We help businesses accept payments online.

auPAY is currently the leading digital payment app with the largest number of members in the industry. It has over 30 million users, and 5 million registered merchants and has already processed over 50 trillion yen worth of transactions across all of its services by the end of 2023.

Learn why you can’t ignore this convenient and trending payment method when in Japan.

What is auPAY?

Launched in 2019 by KDDI Corporation (the largest mobile service provider in Japan), auPAY is a mobile payment service (also called a digital wallet) that enables financial transactions directly from a smartphone via the “auPAY” app. Utilizing a unique barcode or QR code, users can conveniently access funds from their preloaded “auPAY balance” to complete safe and secure cashless transactions.

At the moment, not only customers of KDDI’s mobile networks “au”, “UQ” and “povo” may enjoy the many benefits of using this digital wallet. Anyone who registers for an “auID” can use most of its services.

(Image from auPAY homepage)

By linking their credit/debit card, bank account or au/UQ/povo billing information to the app through their unique auID, users can purchase goods and services at any participating online or offline store. Users can also accumulate and use Ponta points directly within the app.

auPAY payments can be made at physical stores in a wide range of genres such as convenience stores, supermarkets, shopping centers, restaurants, drugstores and hotels. It can also be linked to several other apps, such as food delivery, gaming or booking apps.

Unfortunately, the app is only available in Japanese, although non-Japanese residents who are registered auID users can use the app freely. Luckily, Chinese visitors can link their AliPay and WeChatPay accounts to the auPAY app as well.

Features

The auPAY app has tons of integrated features. It can be quite overwhelming, but after getting accustomed to it, one can discover many useful services. I will introduce only the top 7 most used features below:

QR Code/Barcode Payments for Offline Stores

The customer presents their unique QR code or Barcode at any participating store and the transaction is instant.

Ponta Points

The user either links their existing Ponta card or creates a new one via the auPAY app. The points can be accumulated during payments and campaigns and can be used as partial or complete payment, with 1 point being equivalent to 1 yen.

“Pay later” service called “Kantan Kessai”

Users of KDDI services (au/UQ/povo) can opt to charge their au balance by adding the payment to their end-of-the-month au/UQ/povo mobile bill. ”Kantan Kessai”, translated as “Easy Payment”, functions much like a loan, with caps depending on each person’s credit history and credibility.

Home Utilities Payment

Users can now quickly and effortlessly pay their home bills, such as electricity, gas or internet, directly through the auPAY app, just by scanning the barcode on their bill.

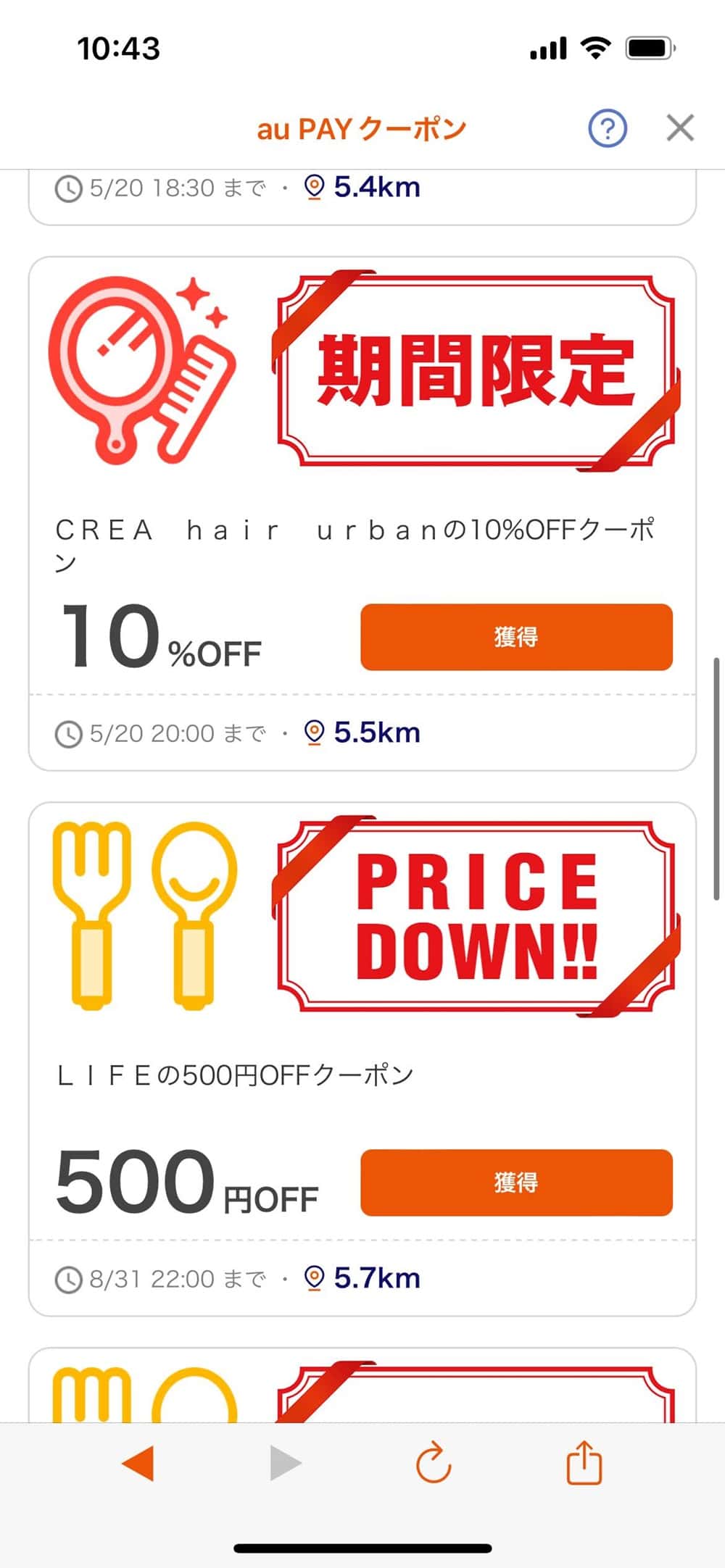

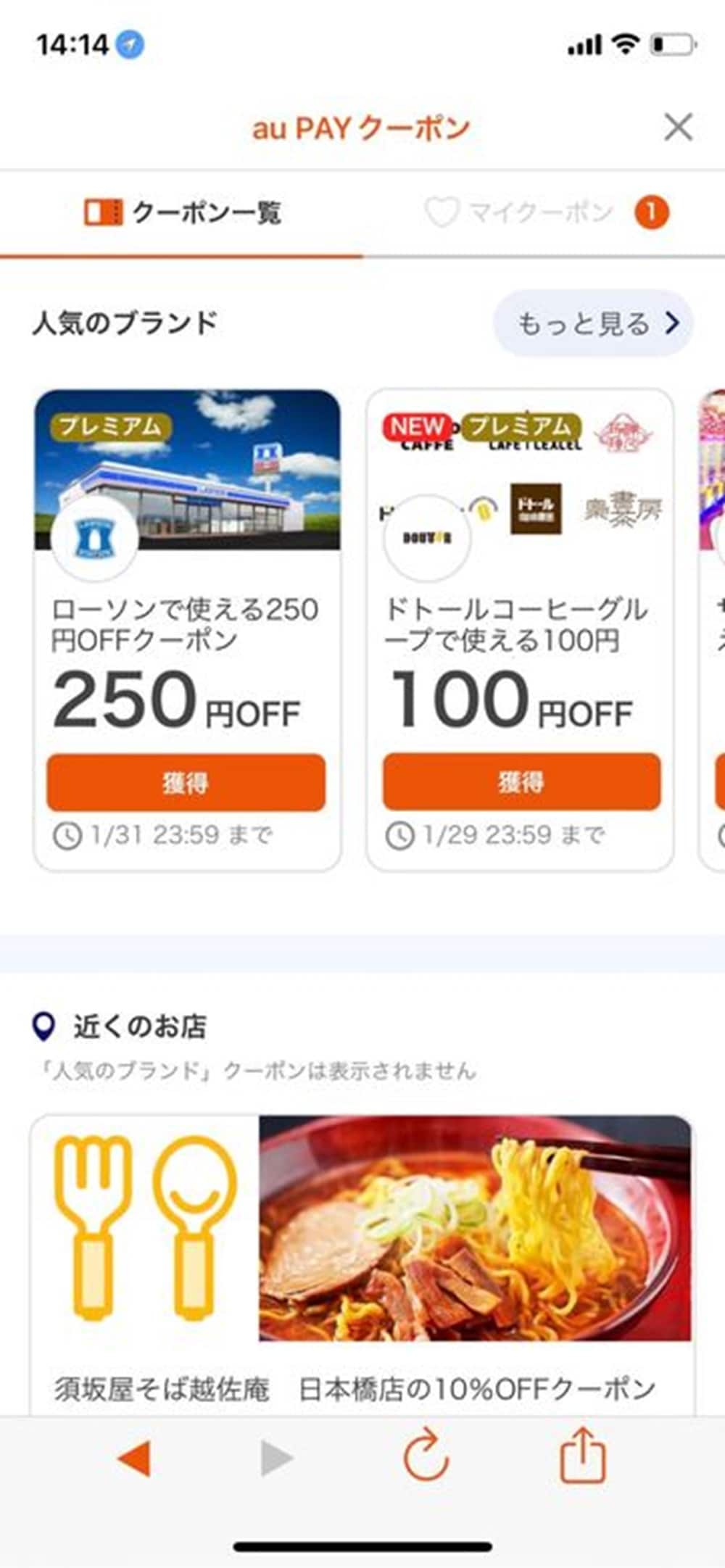

Coupons and Discounts

The auPAY app contains a series of exclusive coupons and campaigns that offer discounts or extra points for paying at registered large chain stores. Some examples of coupons are: monthly 250 yen coupon at any Lawson convenience store, 10% off at participating local beauty salons, 500 yen off at local supermarkets.

Online store “auPAY Market”

auPAY has its own online store that sells everything from food to daily necessities. The user can pay with their auPAY wallet, Ponta points or their “Kantan Kessai” pay-later service.

NISA Investments

Japan’s now very famous tax-free investment scheme called NISA can be accessed via the auPAY app, with zero experience in investing. The customer can use either their auPAY wallet or their Ponta points to invest in small-scale NISA bonds. It works similar to a retirement plan, or a 401K, except you can extract money whenever you want.

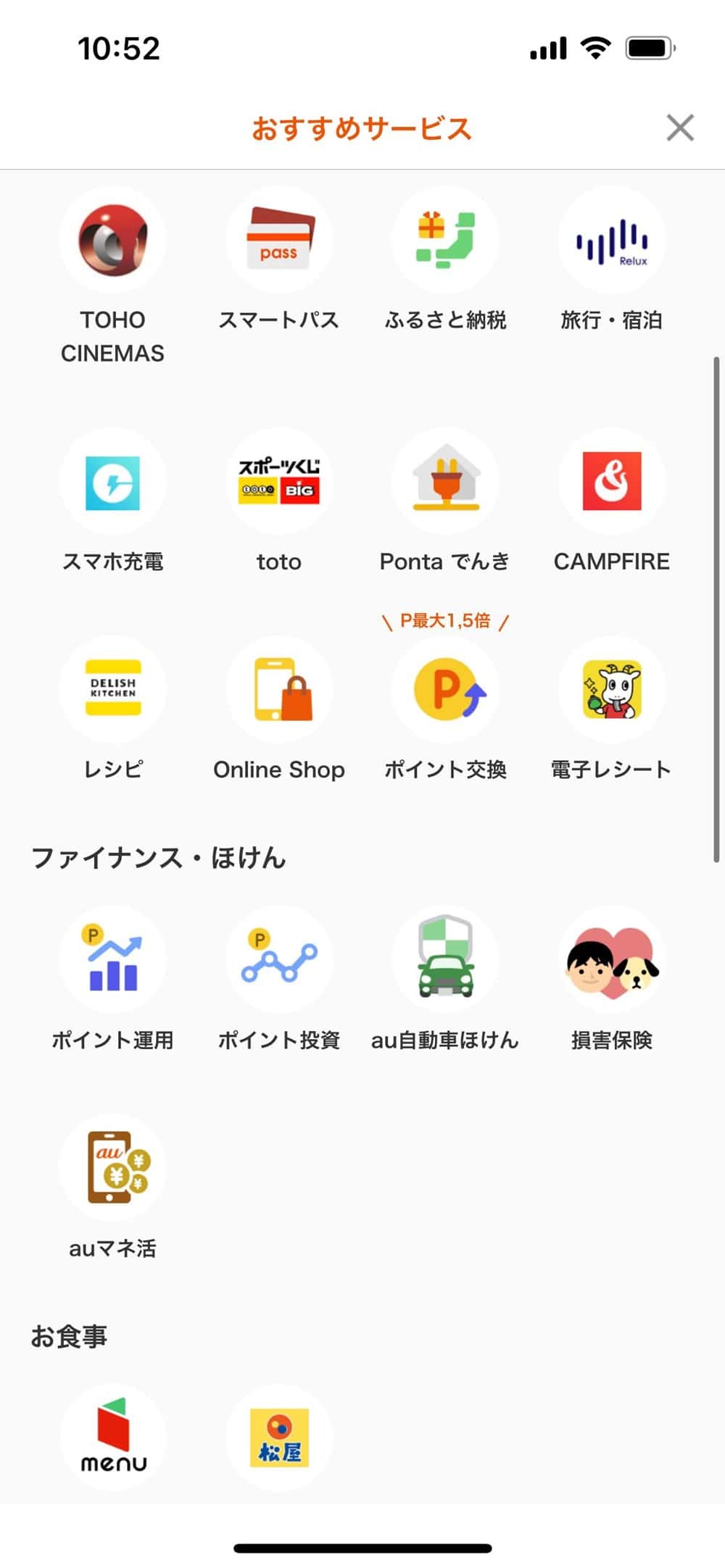

Other mentionable features

While not as commonly used, there are also plenty of other features worth mentioning: digital IC card, sending and receiving money, a personal finance organization service, a food delivery service “Menu”, traveling and hotel bookings, cinema tickets, recipes, donations, automobile insurance and entertainment. All can be accessed and paid directly via the auPAY application.

In addition, the auPAY app also contains 2 optional services that can be useful for heavy auPAY users: a designated auPAY bank account called “au Jibun Bank” and an auPAY credit card.

And not to forget, for iPhone users, the auPAY payment method can be added to the iPhone’s own digital wallet, Apple Pay.

How auPAY Works

For Offline (Physical) Stores:

Step 1 – Check if the store accepts auPAY payments

Step 2 – Let the store clerk know you choose auPAY as your payment method

Step 3 – Display the Barcode or Scan the QR Code

Depending on the store, there are 2 possible scenarios:

Scenario 1 – The store clerk scans the customer’s barcode.

Scenario 2 – The customer scans the store’s QR code, enters the price to be paid, and shows it to the store clerk

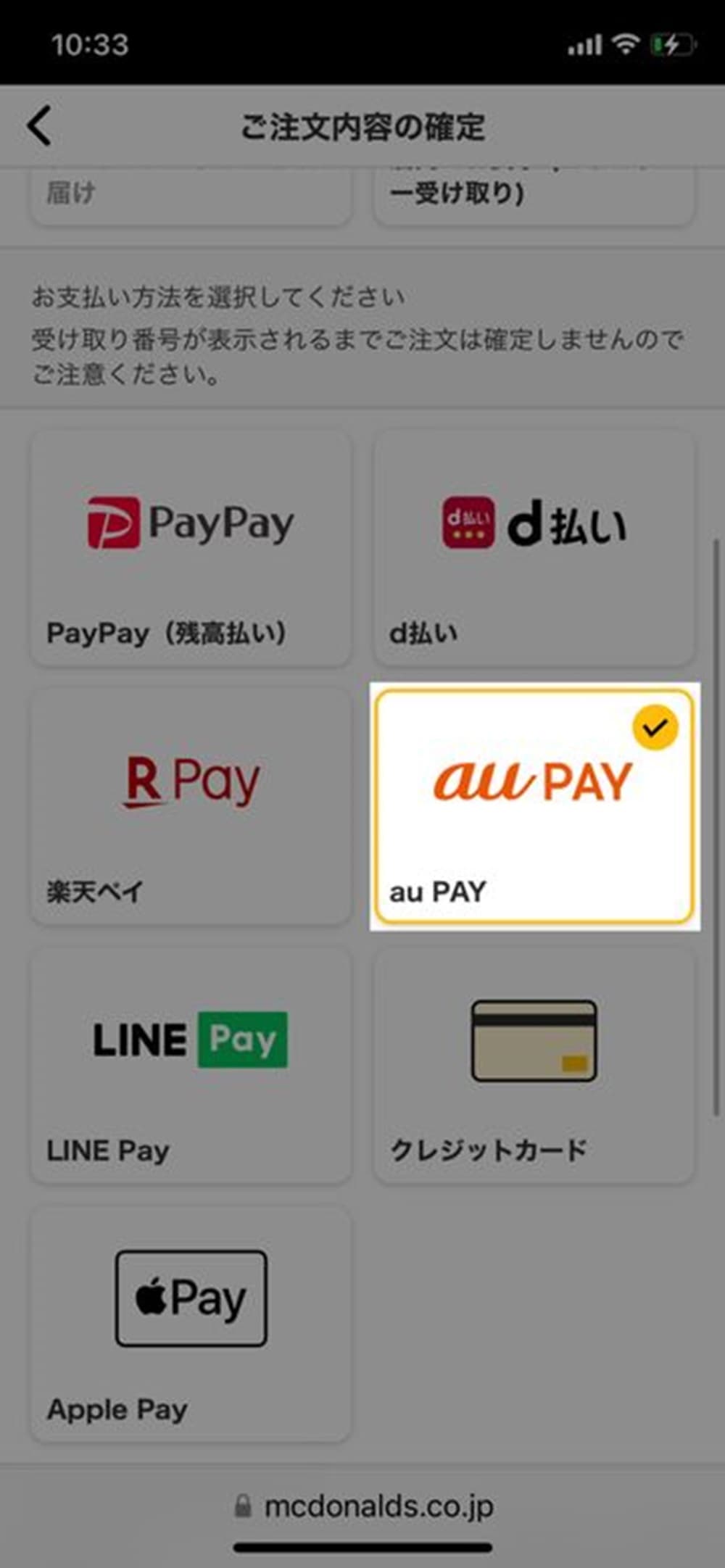

For Online Stores:

Step 1 – Check if the online merchant offers auPAY as one of their payment methods. Once selected, a QR code will appear on the screen.

Step 2 – Scan the QR code with the mobile phone that has the auPAY app installed.

Step 3 – Check to see if the price matches and click on the “Pay” button.

Step 4 – Check the payment confirmation screen. If there is not enough money in the au balance, charge it and try again.

How to Start Using auPAY

Step 1 - Register For an auID

Acquire an “auID” by registering your personal information on the id.auone.jp website

Step 2 - Install auPAY App

Download and install the “auPAY” app from your local Google Play Store (for Android) or Apple Store (for iPhone). Only available within Japan.

Step 3 - Register Your auID

Register your unique auID in the app.

For KDDI (au/UQ/povo) users, make sure you use the same auID and mobile phone that uses the KDDI network SIM card. Turn off your wifi (this step is crucial).

Step 4 - Charge Your auBalance

Once the auID is registered, it’s time to charge the app’s digital wallet, also called “au balance”,

Step 5 - Enjoy The Many Benefits

Now you’re ready to start exploring the many ways you can conveniently use the auPAY app.

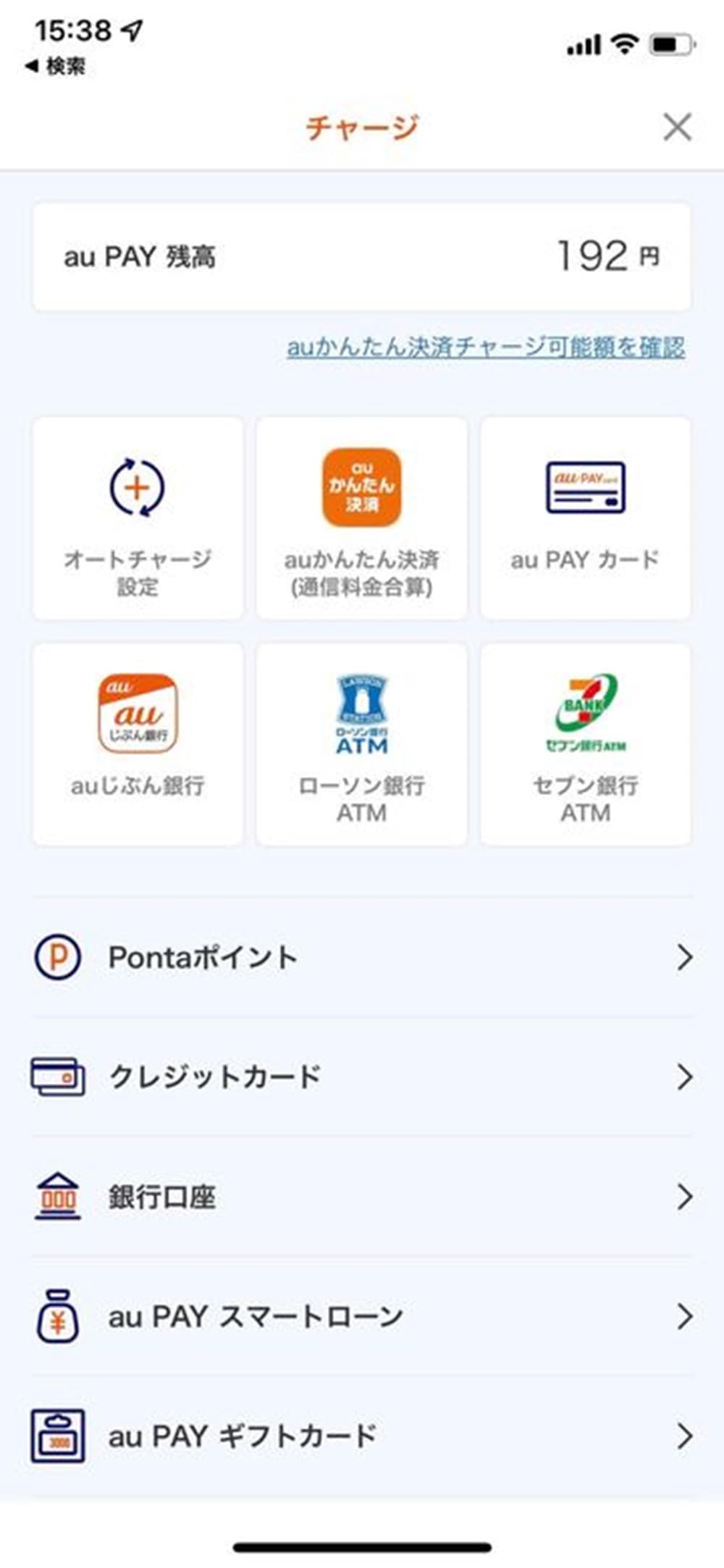

How to Charge Your auPAY Balance

There are 6 major ways to fund (or charge) your au balance, explained below, in order in which they appear in the app:

1. auPAY Credit Card

As mentioned before, you can register for an auPAY credit card. It works just like any other credit card and depends a lot on your credit score and credibility. You can select “auto-pay” and the app will automatically charge your account using the auPAY credit card.

2. au Jibun Bank

auPAY has its own designated bank called “au Jibun Bank” where you can open an account, just like you would do for any other bank. You get a cash card that you can charge at any ATM. The app extracts money directly from the account.

3. Lawson ATM

A convenient way to charge is at your local convenience store. Lawson is the main partner for auPAY, so the process is very simple and fast. You go to the convenience store’s ATM, scan a QR code, select the amount to charge, add the money to the ATM and voila! Your au balance is now ready to be used. The benefit is getting extra Ponta points for charging at Lawson.

4. Seven Eleven ATM

The Seven Eleven ATM charge works in the same way, except you don’t get the same Ponta benefits as Lawson.

5. Credit Card

Probably the fastest way to charge is to use your existing credit card. All you have to do is link it to the app and you’re all set. You can also select auto-pay and the app will automatically charge using your registered credit card.

6. Bank Account

Last but not least, you can charge your balance by connecting your existing bank account(s) to the app. The process is a little longer, since you have to enter your account details and then take the extra step to confirm with the bank. This may require installing your bank’s own security app. But once connected, you can charge your au balance within seconds.

Benefits of Using au PAY for Customers

1. Fast and Secure Cashless Transactions at Physical Stores

When in a hurry, you can just take out your phone, scan the code and you’re out the door before you know it. Once set up, even charging only takes up to 10 seconds to complete. It’s quick and you don’t have to worry about security.

2. Convenient For Everyone With a Mobile Phone

auPAY is available in a wide range of stores such as convenience stores, supermarkets, department stores, drugstores, home appliances stores and hotels, so shopping is very convenient. And you don’t even have to be a KDDI customer to claim the benefits.

3. Ponta Points

For each transaction, you can accumulate Ponta points, including paying your bills or ordering food delivery. You can use those points for purchases, either entirely, or partially, by combining both points and your au balance.

4. Coupons and Discounts

You get a generous selection of discounts, coupons, special campaigns, cashbacks and extra points. And who doesn’t like freebies?

5. The Convenience Goes Beyond Just Payments

The auPAY app has several other services that can make your life easier. From food delivery to entertainment, from paying bills to getting loans, from managing your finances to investing.

It’s honestly a waste to not use the whole range of benefits that one little app can bring.

Why eCommerce Merchants Should Consider auPAY

1. High Number of Users (Expected to Grow Even More)

Introducing auPAY as a payment method in stores is likely to attract more customers and boost sales, given its large user base. With approximately 32.4 million members as of May 2023, auPAY ranks among the top QR code payment services according to a survey by MMD Institute. Since June 2019, it has been available at select stores alongside Rakuten Pay, expanding its reach further.

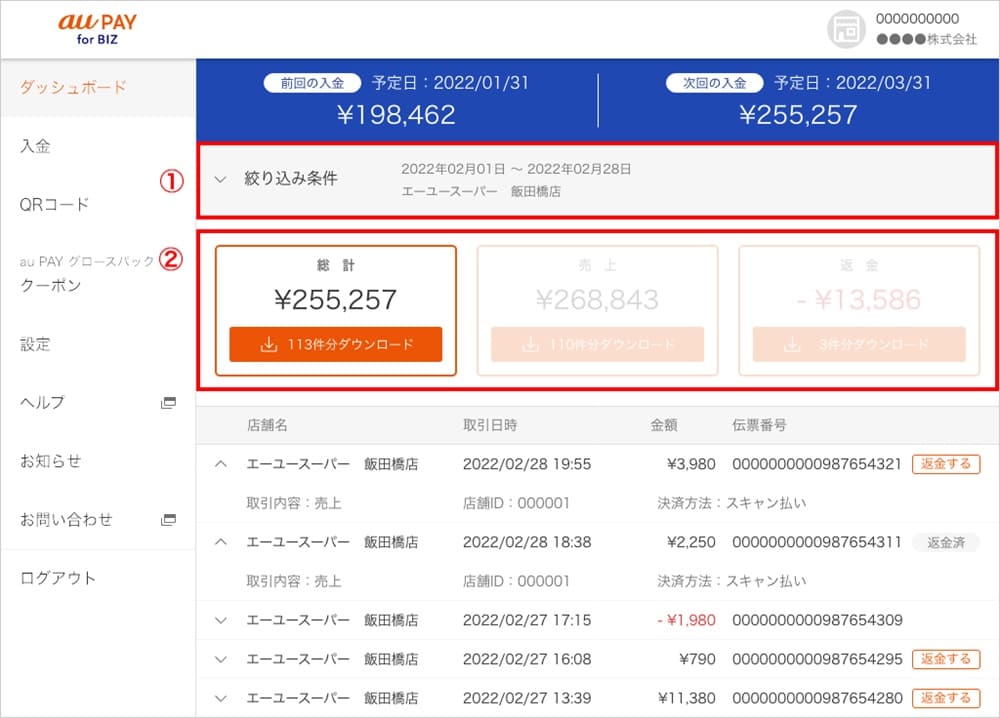

2. Easily Keep Track of Transactions

Merchants can conveniently track their trading history using the “auPAY for BIZ” app. This data provides insights into payment frequency and peak days/ hours. This information lets merchants strategize promotional activities targeted towards auPAY users during high-traffic periods.

Moreover, in cases of accidental settlements, merchants can initiate refunds directly from the store app. By accessing the transaction records on the homepage and selecting the “refund” option, merchants can effortlessly complete the refund process.

3. Ponta Points and Discounts Motivate Customers

Ongoing campaigns, such as the Ponta points, discounts and large-scale promotions, are continuously drawing in new users, including non-au subscribers. Leveraging the substantial user base of auPAY is expected to drive increased foot traffic and sales for stores.

Integrating au PAY with Your Online Store

auPAY offers seamless QR code payments via smartphone, eliminating the need for additional equipment. Implementation is effortless, typically requiring only a QR code displayed at the store or on a stand. The application process is straightforward and can result in activation within 1 to 10 days.

Here’s how to apply:

Step 1 - Application

Fill out a provisional application form on the auPAY website, providing necessary details such as the business name, contact information, etc. Then, follow the instructions received via email to complete the application process, which will undergo review by KDDI Co., Ltd.

Step 2 - Review Results

Upon completion of the review, you’ll receive an email notification regarding the review outcome. Follow the instructions in the email, typically titled “【Important】auPAY Request for Setup to Begin Use” to register your account on the management site.

Step 3 - Deployment Tools

After registering your account, you’ll receive the auPAY deployment tools within approximately a week. These tools include promotional materials like stickers and the auPAY Kanban Start Guide. This enables you to immediately start using auPAY by displaying the QR code sticker at your store or installing a QR code stand.

For businesses interested in integrating auPAY with their e-commerce platforms, such as Shopify, the process is simplified by utilizing payment agencies like KOMOJU. Through this service, businesses can introduce auPAY to their online stores with zero initial or fixed costs.

Conclusion

auPAY emerges as a pivotal player in Japan’s digital payment landscape, boasting an extensive user base and widespread merchant adoption. With its user-friendly interface, diverse features, and seamless integration options, auPAY presents an attractive opportunity for both consumers and businesses alike.

As the digital payment ecosystem continues to evolve, auPAY remains at the forefront, offering convenience, security, and innovative solutions for financial transactions. Whether you’re a local resident, a tourist, or an eCommerce entrepreneur, embracing auPAY opens doors to a world of cashless convenience and rewards. As Japan’s digital economy flourishes, auPAY stands ready to empower individuals and businesses on their journey towards a cashless future.

FAQs

auPAY is a mobile payment service or digital wallet that enables financial transactions directly from a smartphone via the “auPAY” app. It allows users to make purchases at participating online or offline stores, pay bills, accumulate and use Ponta points, and access various other services such as NISA investments, food delivery, and entertainment.

Yes, non-Japanese residents who are registered auID users can freely use the auPAY app. Additionally, Chinese visitors can link their AliPay and WeChatPay accounts to the auPAY app, expanding its accessibility to international users.

No, auPAY is not a credit card. It is a mobile payment service or digital wallet provided by KDDI Corporation. It allows users to make transactions directly from their smartphone using funds from their preloaded “auPAY balance” or linked payment methods such as credit/debit cards or bank accounts.

auPAY employs various security measures to ensure safe and secure transactions. These measures may include encryption, authentication processes, and user verification methods. Additionally, users can monitor their transaction history and initiate refunds for accidental payments directly from the app.

auPAY is primarily targeted towards the Japanese market and requires registration through a Japanese auID, it may not be directly applicable for online purchases outside of Japan.

We help businesses accept payments online.