We help businesses accept payments online.

Docomo Barai, otherwise known as dBarai or d Payment, is a digital payment solution developed by NTT Docomo, one of Japan’s leading telecommunications companies. The dBarai app provides users with a convenient and secure method for online and offline transactions, enabling payments at shops and stores with their smartphones.

The dBarai app is a popular digital payment option in Japan, and its user base has been growing yearly. In fiscal year 2022, dBarai boasted over 50 million users—an increase from 43.75 million users in the previous fiscal year. As a product of NTT Docomo, dBarai is highly favored among NTT users, who can benefit from point accumulation and access to the Docomo network.

While not as widely accessible or English-friendly as some other apps, dBarai remains a viable choice for any e-commerce business looking to tap into Japan’s market.

What is dBarai?

D Barai is a smartphone payment app and digital wallet introduced by Docomo in April 2018. “dBarai (払い)” translates to “d Payment.” Thus, both terms are used interchangeably. However, “d Payment” should not be confused with “Docomo Pay,” an entirely different service.

The key difference between “Docomo Pay” (formerly Docomo Mobile Pay) and “d Payment” is accessibility. “Docomo Pay” is an online payment service exclusively available to NTT Docomo customers, allowing them to charge online purchases to their monthly mobile phone bill.

However, “d Payment” extends its usability to anyone with a “d account,” regardless of their contract status with NTT Docomo. In other words, while Docomo Pay requires a contractual relationship with NTT Docomo, d Payment is open to a wider audience, including those without such a contract.

The dBarai app allows users to use features like top-up, remittance, mobile ordering, bill payment, message functions for receiving coupons from member stores, d Point investment, and even money loans. Moreover, since September 2020, both “d Payment” and “Merpay,” another popular payment app in Japan, can be used with a single QR code, streamlining business transactions and potentially increasing sales from Merpay users.

Based on data as of March 2023 disclosed by NTT Docomo in April 2023, the user count was 51.99 million by the end of March 2023, achieved within five years. Currently, there are approximately 4.79 million locations where “d Payment” and “d Points” are accepted, with this number rapidly expanding.

Online shoppers can use d Payment on various platforms, from general shopping sites like Amazon to flea market platforms like Mercari and fashion and home electronics sites. For a full list, click here (Japanese).

How Does dBarai Work?

When using d Payment, there are three payment methods available:

- Store Scan Method (Stores Only)

- User Scan Method (Store/Online Shop)

- Online Payment

Store Scan Method (Stores Only)

The consumer launches the dPay app, displays the barcode or QR code, and the store reads the information. Stores must prepare POS registers, tablets, or dedicated terminals capable of reading barcodes and QR codes.

To use d points, the consumer taps the “Use d points” button under the barcode and then presents it to the store.

User Scan Method (Store/Online Shop)

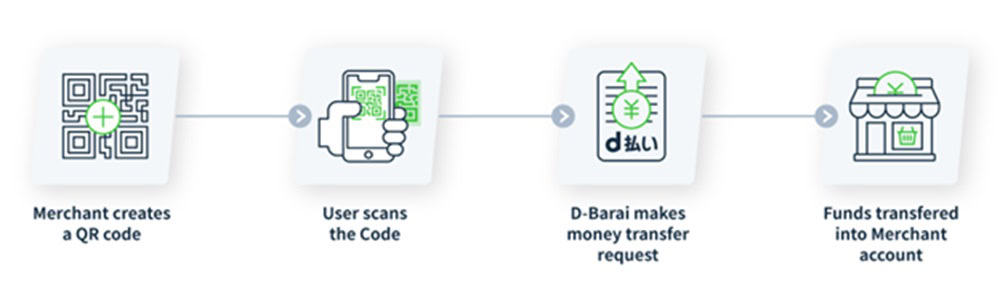

The user activates the camera by clicking the “read” button on the d Payment app and makes a payment by reading the QR code installed at the store or displayed on the online shop.

When paying at a store, start the camera by clicking “Read” on the home screen of the d Payment app, scan the QR code installed at the store, and then enter the payment amount. Stores must install a QR code to be sent as a starter kit after applying for d Payment.

Online Payment

When making online purchases, users usually encounter two payment methods. If a QR code is available on the screen, the user can scan and launch the dBarai app. For those with a Docomo mobile phone line, completing the transaction only requires inputting a 4-digit password. Non-Docomo users, on the other hand, can make payments by logging into their d account.

The flow for making an online purchase with d Barai is as follows:

- Proceed to the payment method confirmation screen.

- Users can enter the points they wish to use (if applicable).

- Confirm the details.

- Enter the four-digit password and accept the terms.

- Press the purchase button to complete the payment.

- A payment number will be displayed.

- After completing the procedure, the user will receive an email with the receipt details.

How to Make a Payment with dBarai

There are four payment methods integrated with dBarai. Users can select any of the following:

- d Card

- Mobile Phone Charges

- dBarai Balance

- Credit Card

d Card

Users can utilize their registered d Card, Docomo’s proprietary credit card, as the preferred payment method within the app. This option gives them various benefits, such as reward points, discounts, cashback offers, and more.

Credit Card

Users can use credit cards from:

- VISA

- Mastercard

- American Express

- JCB logos.

However, some credit and prepaid cards outside Japan may not be accepted.

Mobile Phone Bill

Users can opt to pay with their monthly cell phone bill. With this payment method, the final settlement is added to the user’s mobile phone bill, and they can pay it as they normally would (through automatic withdrawal, convenience store payment, etc.). This method is exclusively available to Docomo users.

Dbarai Balance

Users have the option to pay directly from their Dbarai balance. It’s important to note that Dbarai treats funds as “prepaid” for unverified accounts. Once users complete identity verification, the funds are considered “cash.” At that point, users can register their bank account on the d Payment app and perform actions like charging, making balance transfers, and withdrawing balances.

Benefits of Using dBarai for Customers

Customers have several advantages when using dBarai for their digital payments, including:

- No Credit Card Needed

- Double Points

- 24/7 Security

No Credit Card Needed

Even consumers without a credit card can use dBarai. They can load cash into their dBarai balance from their bank account or a Seven Bank ATM. Docomo users can also combine payments with their monthly mobile phone bill.

Double d Points

Users can maximize their rewards by earning double Points. By inking their d Point Card, they can earn 1 point for every 200 yen spent. Using the d Point Card also earns 1 point for every 200 yen. Thus, if they set the payment method to d Card, they receive 1 point for every 200 yen spent, totaling 3 points.

24/7 Security

The dBarai app offers robust security measures for consumer confidence. These include authentication through Docomo line, personal authentication via 3D Secure, 24/7 fraud monitoring, and compensation in case of unauthorized use.

Why eCommerce Merchants Should Consider dBarai

Introducing d Payment at your store brings several benefits:

- Attract dBarai Users

- Attract Merpay Users

- Utilize d Points

Attract dBarai Customers

By tapping into the approximately 96 million d Point Club members (as of 2023), you can draw in more customers and potentially increase sales. The dBarai payment app’s built-in messaging feature allows stores to send coupons and special offers, attracting customers to visit and make purchases.

Attract Merpay Users

Since dBarai and Merpay share QR codes, they are used interchangeably, and introducing dBarai can help attract Merpay users. With approximately 23 million monthly Mercari users, integrating dBarai can potentially bring in more customers from Mercari and drive sales. Moreover, a common QR code simplifies payment fees, deposit cycles, and sales management.

Utilize d Points

According to Docomo (Japanese), d points increase sales, with 60% of dBarai users utilizing d Points for purchases and 15% of payments made using d Points. Offering point redemption campaigns and earning double points for using d Payment can further incentivize customers.

Cons Merchants Should Consider Before Implementing dBarai

There are a few cons merchant stores should consider before implementing dBarai, such as:

- Only Available in Japanese

- Competitive Landscape

- Security Risks

Only Available in Japanese

dBarai is exclusively available in Japanese, which may pose a barrier for non-Japanese-speaking customers, limiting accessibility and adoption rates. However, a payment service such as KOMOJU can be beneficial as it guides the merchant through setup, document filing, and execution. Through KOMOJU, merchant stores can integrate several online payment options in Japan, such as PayPay and convenience store payment.

Competitive Landscape

Merchants should consider language, culture, and the competitive landscape to understand how dBarai compares to other payment options. While dBarai currently holds a modest three percent of Japan’s digital wallet market, competitors like Line Pay (38%) and PayPay (7%) are more dominant, per Boku’s 2021 Mobile Wallets Report. However, merchants can address this by utilizing payment agents like KOMOJU, which can help integrate multiple payment methods.

Security Risks

There was a fraud case involving dBarai. In February 2024, a food store manager was arrested for fraudulent use of dBarai, allegedly making transactions totaling an estimated 20 million yen and obtaining personal information from 200 foreign residents, as reported by Sankei. While dBarai has implemented a monitoring system to detect fraudulent activity around the clock, and NTT Docomo compensates for the full damages, merchants should prioritize security measures and keep up-to-date fraud prevention strategies to protect their businesses and customers.

Example Businesses That Use dBarai

Below are some examples of businesses in Japan that offer dBarai as a payment method and improved sales (per the dBarai corporate site).

- United Arrows (Fashion)

- Asahi Shimbun (News)

- Sample Department Store (Retail)

United Arrows (Fashion)

United Arrows (Japanese) is a clothing brand in Japan. The online store offers styling tips and recommended items. Introducing dBarai streamlined checkout and allowed users to earn d Points. Campaigns and publicity efforts boosted awareness among new demographics. Weekend campaigns were especially successful, taking advantage of increased payment activity.

Asahi Shimbun (News)

Asahi Shimbun is a 24/7 news site delivering information nationwide. It combines the familiarity of a print page with the convenience of digital technology through paid membership registration. While the main customer base is middle-class, discounts are available for job hunters, attracting younger subscribers.

Introducing dBarai as an alternative option helped secure contracts, especially among those uncomfortable with credit cards. Additionally, combining payments with mobile phone charges has made it more accessible to young people without credit cards. To inform customers about dBarai, Asahi Shimbun sent targeted email newsletters to Docomo users, resulting in significant new acquisitions.

Sample Department Store (Retail)

Sample Department Store is one of Japan’s largest sampling platforms, boasting around 2.4 million members, predominantly women in their 30s and 40s. Its primary service offers products for a nominal fee, allowing users to experience various items at a fraction of the market price, from beverages to household goods.

Sample Department Store has attracted numerous new customers through targeted campaigns and incentives via dBarai. A promotional campaign in October 2017, offering 500,000 points exclusively to first-time dBarai users, resulted in a surge of new customers trying paid samples for the first time. This initiative improved the appeal of d Points and fostered greater customer loyalty.

Integrating dBarai with Your Online Store

To integrate dBarai into your store’s payment options, follow this flow:

- Apply On ThedBarai Website

- Receive Screening Results

- Receive Starter Kit

Apply On The dBarai Website

Complete the dBarai application form on the member store application page. Provide basic information about the person in charge and finish the application in 5 to 10 minutes.

For swift online d payment applications, consider using KOMOJU, which fully supports d Payment’s Shopify integration. With the anticipated rise in online smartphone payments, introducing d-payment payments to your e-commerce site could be advantageous.

Receive Screening Results

You should expect to receive the screening results via email within two days. If any application details are missing, you’ll be prompted to provide them via email. Merpay Co., Ltd. will send screening results, so ensure your email settings allow receipt of such communications.

Receive Starter Kit

Upon approval, you’ll receive a starter kit containing a guide, posters, and stickers for your store. These stickers, including the QR code, can be affixed to the designated mount for installation. Once installation preparations are complete, you can begin accepting payments via d Payment.

Summary

dBarai is a promising digital payment solution in Japan, offering convenience, security, and a growing user base. Despite its Japanese exclusivity and potential language barriers for non-Japanese-speaking customers, the benefits of integrating dBarai into stores are substantial.

Moreover, with assistance from payment agents like KOMOJU, merchants can easily overcome these challenges and tap into Japan’s lucrative market. As online smartphone payments continue to rise, integrating dBarai opens doors to increased sales opportunities and improved customer engagement.

FAQs

Here are some frequently asked questions about dBarai:

No, dBarai is exclusively available in Japan.

Yes, foreigners can use dBarai with a valid “d account.” However, the app and its services are predominantly Japanese, which may pose a language barrier for non-Japanese speakers.

Yes, dBarai is open to anyone with a “d account,” regardless of their contract status with NTT Docomo.

The dBarai app accepts various payment methods, including d card, mobile phone charges, dBarai balance, and credit cards.

The dBarai app offers robust security measures, including authentication through Docomo line, personal authentication via 3D Secure, and 24/7 fraud monitoring.

Yes, dBarai can be used for online purchases on various platforms, from general shopping sites like Amazon to flea market platforms like Mercari.

We help businesses accept payments online.