We help businesses accept payments online.

The way we handle financial transactions continues to undergo profound transformations. Among the innovative solutions driving this change is LINE Pay, a smartphone wallet service offered by LY Corporation, the parent company of the popular LINE application. With its array of features ranging from QR code payments to prepaid cards, LINE Pay not only streamlines payments but also prioritizes security and accessibility for users worldwide. Let’s explore how LINE Pay revolutionizes the payment experience, empowering both consumers and merchants alike with its integrated and versatile platform.

What is LINE Pay?

LINE Pay is a smartphone wallet service offered by the Japanese company LY Corporation. It integrates with the LINE application and its adjacent services. It includes various functions including QR code payments at partner stores, money transfers between friends, and the utilization of LINE prepaid cards. This versatile platform operates in every country that supports the LINE application.

A Short History of LINE Pay

Beginning (2014)

LINE Pay was launched by LINE Corporation in 2014, initially in Japan, as a mobile payment service integrated into the LINE messaging app. It allowed users to make peer-to-peer transfers, pay bills, and make purchases through their smartphones.

Development and Expansion (2015-2017)

Following its successful debut in Japan, LINE Pay embarked on a journey of rapid expansion both domestically and internationally, introducing features like QR code payments, prepaid cards, and loyalty programs. It expanded into other Asian markets through partnerships with local businesses and financial institutions.

Maturation and Diversification (2018-present)

LINE Pay began focusing on maturing its platform and diversifying its range of services to cater to evolving consumer preferences and market demands. The platform put effort into enhancing security with biometric authentication and diversified its offerings with additional financial services.

In recent years, LINE Pay has embraced emerging technologies such as blockchain and artificial intelligence to further innovate its services and stay ahead of the curve in the competitive fintech landscape, constantly targeting new markets globally.

Features

To access LINE Pay’s features, users must first register for a LINE account on their smartphones.

Payment at Partnering Merchants

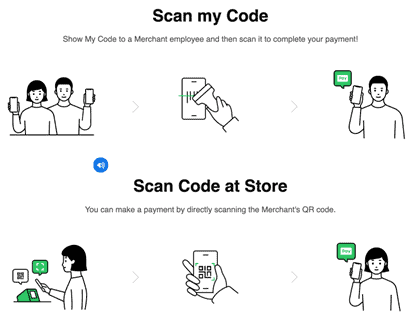

QR and Barcode Payment

Upon opening the LINE Pay app, users are presented with a barcode and QR code, either of which can be scanned by merchants to complete transactions. Prior to payment, users must ensure that their digital wallet, referred to as ‘My Balance’, is sufficiently funded.

Scanning a Merchant’s QR Code

Alternatively, users can make payments by scanning the QR code provided by the merchant. LINE Pay has also partnered with PayPay, allowing users to complete purchases by scanning PayPay codes.

Tap to Pay With a Prepaid Card

LINE Pay offers its own prepaid card powered by VISA, enabling offline payments via the one-tap function of Apple Pay (for Apple users) or Google Wallet (for Android users). Registering the card to the digital wallet is a straightforward process, only requiring the user to connect their LINE Pay account.

Services For Merchants

Physical stores, such as convenience stores, restaurants, or supermarkets, can select from 3 payment methods for their customers:

1. Payment through a QR Code displayed on a panel

Establish the payment QR code for effortless customer transactions via smartphone scanning, eliminating the need for extra equipment or app installations. Upon successful application review, you can commence usage promptly.

Please be aware that the possibility of signing up as a merchant and available payment services may vary depending on each country’s Privacy Policy for merchant operations. Applying to become a LINE Pay Merchant involves a review process. Failure to meet the criteria may result in application rejection.

2. Scanning a QR code from a mountable terminal

Once installed at your shop, simply activate the terminal and input the desired amount to finalize the payment! Your customers can effortlessly scan the displayed amount to make payments without manual entry.

Please note that eligibility and available services may vary based on each country’s merchant privacy policies. Applying to become a LINE Pay Merchant involves a review process, and meeting the criteria is crucial to approval.

3. Scanning the customer’s QR code using an app POS

This app offers both payment services and sales promotion features. Upon approval of your application, you can instantly utilize it alongside the QR code. Please note that merchant sign-ups and payment services may vary based on each country’s privacy policies.

Sending and Receiving Money From Friends

Users can easily send and receive money from friends registered on their LINE account, requiring only sufficient funds in their LINE digital wallet.

Paying Bills

Users can access a variety of coupons for both online and offline stores, including popular services like UberEats, Big Camera, and Hulu.

Coupons

LINE offers a wide variety of coupons to common online and offline stores, including UberEats, Big Camera, and Hulu.

Point Cards

LINE Pay supports the storage of point cards from local merchants and chain stores, offering a convenient accumulation of rewards.

Loans

Users with excellent credit scores can apply for loans of up to 500,000 yen, with the process typically completed in just 10 minutes, contingent upon the results of a background check.

LINE Points

Every payment made through LINE Pay earns users LINE points, which can be redeemed within the LINE app for services such as stickers, games, and gifts.

How LINE Pay Works

Charging The LINE account “My Balance”

- Open the LINE Pay app.

- Under the 2 codes, navigate towards the section titled “My balance Add money.”

Click on the Add Money button.

- Select the desired charging method, which includes direct bank transfers, ATM deposits at convenience stores (7/11, Lawson, or Family Mart), loan options, or automated deposits from bank accounts.

And voilà, you now have digital money in your LINE Pay’s balance!

Paying Offline (at Physical Stores)

> The customer scans a code at the store

OR

> The store clerk scans the customer’s code

Paying Online (at Digital Stores)

For online purchases, users select the LINE Pay payment method and proceed to pay through the LINE Pay app.

How is LINE Pay Different From Its Competitors

LINE Pay stands out among digital payment platforms due to its seamless integration with the LINE messaging app, offering a range of features that cater to diverse user needs. Unlike many competing platforms, LINE Pay distinguishes itself with its emphasis on security, implementing robust measures such as biometric authentication to safeguard user accounts and transactions. This commitment to security reassures users and fosters trust in the platform, especially in regions where digital payment fraud is a major concern.

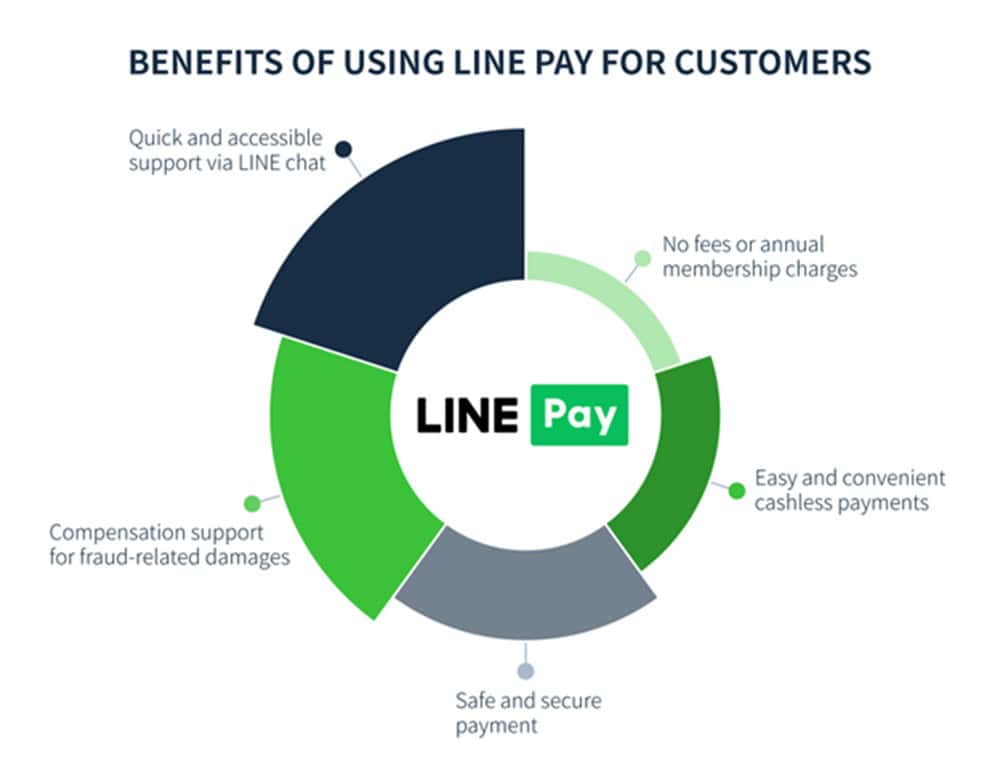

Benefits of Using LINE Pay for Customers

1. No fees or annual membership charges

You can experience the convenience of LINE Pay without incurring any registration or usage fees. LINE Pay ensures a cost-effective payment solution for all of its users.

2. Easy and convenient cashless payments

Financial transactions can be simplified by effortlessly replenishing the digital wallet directly from the user’s bank account or by going to a nearby convenience store. Charging is done only using QR codes or barcodes, offering a headache-free and accessible payment experience.

3. Safe and secure payment

LINE Pay offers peace of mind thanks to its robust security measures, including face ID or Fingerprint ID authentication for every payment, ensuring the protection of the user’s sensitive financial information. LINE also provides peer-to-peer encryption between users during digital money transactions.

4. Compensation support for fraud-related damages

Users can rest assured knowing that LINE Pay provides comprehensive coverage for damages resulting from third-party fraud during transactions, including remittances, payments, and withdrawals. LINE Pay is committed to help provide financial protection to users.

5. Quick and accessible support via LINE chat

In case of confusion, errors or problems, users are able to receive immediate assistance directly on their LINE app through chat, ensuring prompt resolution of any issues or queries related to LINE Pay’s service. It thus offers users with convenient and reliable customer support.

Why eCommerce Merchants Should Consider LINE Pay

1. Easy and quick setup

Anyone can streamline the process of becoming a merchant by leveraging their existing LINE account. It eliminates the need for complex registration procedures, and allows for swift integration into the LINE Pay ecosystem, expediting each product entry into the digital marketplace.

2. Increased shop visits

The user has the benefit of driving traffic to their online store by leveraging LINE Pay’s various promotional campaigns and rewards. Enticing users with incentives to explore products and services, it ultimately boosts customer engagement and conversion rates.

3. Simple and secure payments

The user experience can be further enhanced by integrating LINE Pay’s secure payment features into your POS systems and online platforms. It provides customers with a fast, reliable, and secure payment solution, thereby instilling confidence and trust in the brand.

Integrating LINE Pay with Your Online Store

For sole proprietorships

If you are a sole proprietor, one of the following personal documents are required:

(1) Business certificate:

- National tax/local tax receipt or tax payment certificate

- A copy of the personal business opening notification form (stamped with the tax office reception stamp)

- A copy of the final tax return (stamped with the tax office reception stamp)

- A copy of the blue tax return approval application form (stamped with the tax office reception stamp)

- A copy of the declaration form for starting a personal business (stamped with the reception stamp of the prefectural tax office/municipal office)

(2) Identity verification documents (any of the following):

- Driving license

- Health insurance card

(3) Business license if payment is made at a store

OR

Business license if a business license has been obtained for opening a business

(4) For online payments, please provide product/service explanation materials: Product/service explanation materials (if there are materials other than the application URL information)

For corporations

For corporations, the following documents are required:

- Registered copy (certificate of all historical matters) – Issued within six months

- Business license if payment is made at a store

OR

Business license if a business license has been obtained for opening a business

- For online payments, please provide product/service explanation materials: Product/service explanation materials (if there are materials other than the application URL information)

Integrating Online Payments

There are 2 ways to integrate online payments within LINE Pay: (1) Develop your own connection and apply, and (2) Apply through an affiliated partner.

(1) How to develop and use your own connection

To develop and use your own connection, follow the following 3 steps:

- Check the LINE Pay API guide

- Apply for LINE Pay

- Connection development and operation start.

First, let’s prepare the specifications required for connection development. We provide a sandbox environment, so we will integrate and test LINE Pay in the sandbox. For specifications such as how to apply for an account in Sandbox and the test flow, please refer to “LINE Pay Sandbox”.

Next, apply to become a member store from “LINE Pay Member Store Application”. There are required documents for application, so please prepare them in advance by referring to the information explained in the previous chapter.

Once the review is complete, refer to the materials and carry out the necessary development for connectivity. Additionally, once the review is complete, you will be able to use the “Member Store My Page”. After logging in, check the “Channel ID and Channel Secret Key” required for connection, and if you can set them, you are done.

(2) How to use it via an affiliated partner

There are 2 ways to use our services via our affiliated partners.

Start operation in the following 3 step:

<In case of payment via payment agency>

- Contact the payment agency

- Apply via payment agency

- Start of operation

In the case of a payment agency, first contact the payment agency if you would like to use LINE Pay. Be sure to check the installation costs and fees as well.

Next, apply for LINE Pay via your payment agency and undergo a review.

Once the review is complete, the payment agency will provide you with a dedicated management screen, and you can begin operation.

<If via cart operator>

- Inquire from the cart operator’s website

- Apply for LINE Pay

- Start of operation

If you are a cart operator, please check the introduction method and fees on the cart operator’s website before making an inquiry.

The method for applying for LINE Pay also differs depending on the cart operator, so be sure to check.

Once the review is complete, connect to LINE Pay from the cart operator’s management screen.

If you are considering implementing LINE Pay via a payment agency, please contact KOMOJU. By using KOMOJU, you can quickly and easily start making online payments without having to enter into a separate contract with LINE Pay. There are no initial fees or monthly fees.

Summary

LINE Pay offers a user-friendly and secure platform for both consumers and merchants, facilitating seamless online and offline transactions.

As a user, LINE Pay can be easily and safely used by anyone with a LINE account to make purchases both online and offline.

As a merchant, by introducing LINE Pay for online payments, one can effectively utilize LINE to sell products and create a shopping experience that meets user needs.

FAQs

Foreigners with a LINE account from a country where LINE is permitted can access LINE Pay. However, countries like China, Indonesia, Thailand, and Russia have restricted some LINE operations.

No, neither a credit card nor a debit card are required for LINE Pay. Users can fund their accounts directly from their bank or through a convenience store’s ATM.

No, individuals can become LINE merchants by registering as sole proprietors at their local tax office.

Yes, LINE Pay can be used offline, but users must ensure they have sufficient funds in their account before making a transaction. They can either register a prepaid card for payments via Apple Pay or Google Wallet, or add money at a convenience store ATM.

Yes, if your friend’s LINE account is registered with a Japanese phone number, you can send and receive money internationally. However, transactions are not possible if both accounts are registered in different countries or using phone numbers from different countries.

Conclusion

In a nutshell, LINE Pay adds to the digital payments option list by offering a seamless and secure platform. With features like QR code payments, peer-to-peer transfers, and prepaid cards, it caters to diverse user needs. Its emphasis on security and user engagement makes it a trusted choice for consumers and merchants alike, driving adoption and fostering loyalty. LINE Pay represents the future of digital payments, combining technology, convenience, and user experience to reshape how we transact in the modern world.

We help businesses accept payments online.