Read the latest whitepaper about an essential Japanese local payment method, Konbini Payments.

We help businesses accept payments online.

Branching into cross-border eCommerce is a fantastic way to reach a wider audience and grow your business beyond local limitations.

Japan eCommerce is an ideal opportunity:

- It has a strong broadband Network Infrastructure and Mobile infrastructure

- It also has top-notch logistics and local delivery systems (Takyubin)

However, opening your door to a new market doesn’t guarantee success, especially in a country where daily needs and desires differ greatly from what you commonly encounter in the West.

We’ll explain what it takes to succeed in selling online to Japan, what you can expect from this market in the future, and why it’s a good moment to expand to this country.

Japan eCommerce Market Overview

Market Size

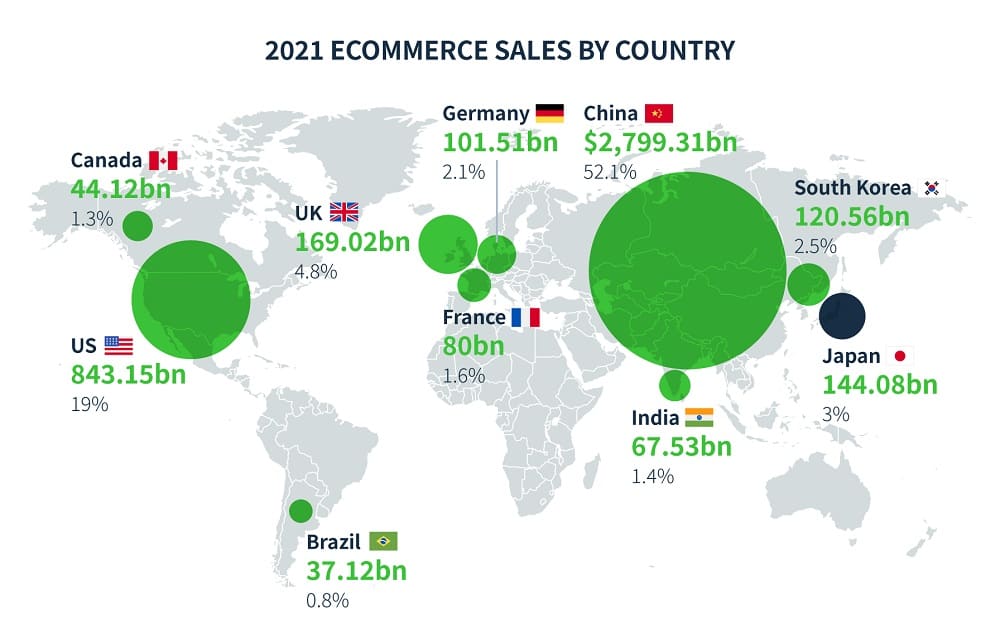

Japan is currently the 4th largest eCommerce market in the world, right after China’s eCommerce market , the US, and the UK.

In 2021, it was worth $144,08 billion and it’s expected to reach $225,00 billion by 2027.

The biggest shares go to eCommerce malls like Rakuten and Amazon which operate fully online, and online retail stores which combine an online and offline presence and host multiple brands.

Japan’s current market size is impressive, but its stable growth rate is even better.

Growth Rate

On trend with the rest of the world, Japan eCommerce grew during the pandemic.

Japan faced lockdowns where restaurants and stores were forced to shut down. Even when some shops reopened, the Japanese populace followed public authorities and recommendations and didn’t leave the house.

During this time, eCommerce continued to grow at the expense of brick-and-mortar businesses.

Japan has maintained this growth pace for the years since, whereas some other markets like the UK have been contracting after the lockdown peak.

At this rate, Japan eCommerce is set to overtake the UK and become the 3rd largest eCommerce market in the world.

Demographics

The population of Japan reached 123,294,513 people in 2023, making up 1.53% of the global population. The population is declining year over year.

Japan’s population skews to an older demographic. The median age is 49 years, and as much as 93.5% of the population is urban.

Japanese people live in small homes and spend hours on the commute each day. As a result, they use their phones disproportionately more than Western users for all their needs – from finding entertainment to making expensive purchases.

Almost 70% of Japanese people in their 10s-40s rely only on their smartphones when shopping online, and this trend is on the rise even among seniors.

Here’s a snapshot of this country’s eCommerce activity:

- 81.6% searched online for a product or service

- 85.0% visited an online retail site or store on any device

- 48.4% used a shopping app on a mobile phone or a tablet

- 73.7% purchased a product online

- 32.1% purchased a product online in the past month

Popular Product Category

Japanese consumers shop for these categories the most:

- Fashion products

- Consumer electronics

- Phones and accessories

- Baby products

- Laptops and gadgets

- Cosmetics

- Gaming

- Furniture

- Health and beauty

- Home and office equipment

When it comes to the product categories that bring in the most revenue in Japan eCommerce, here they are ranked by the total amounts spent in 2021:

Product category | Spend in billions |

1. Travel, mobility, and accommodation | $31.06 |

2. Food and personal care | $25.77 |

3. Fashion and beauty | $23.93 |

4. Toys, DIY, and hobbies | $19.73 |

5. Electronics and physical media | $18.90 |

6. Furniture and appliances | $16.32 |

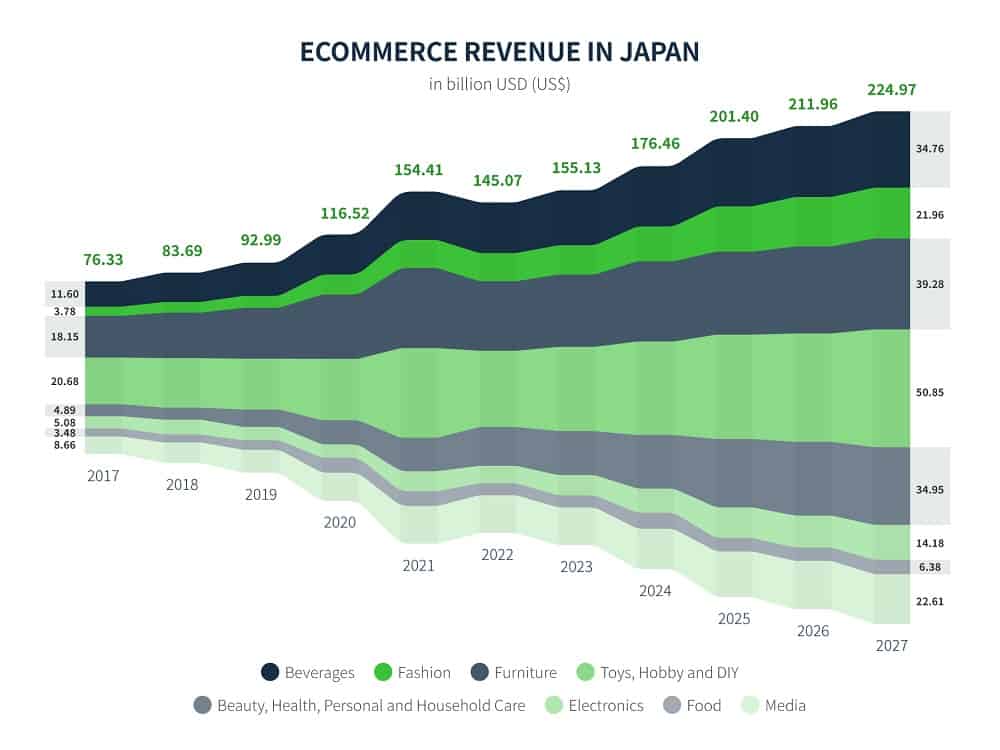

Now let’s look at the big picture. This is where things are headed today and up until 2027:

As you can see, it’s a good moment to set up shop in Japan. The next question is, where do you go?

Top eCommerce Websites in Japan

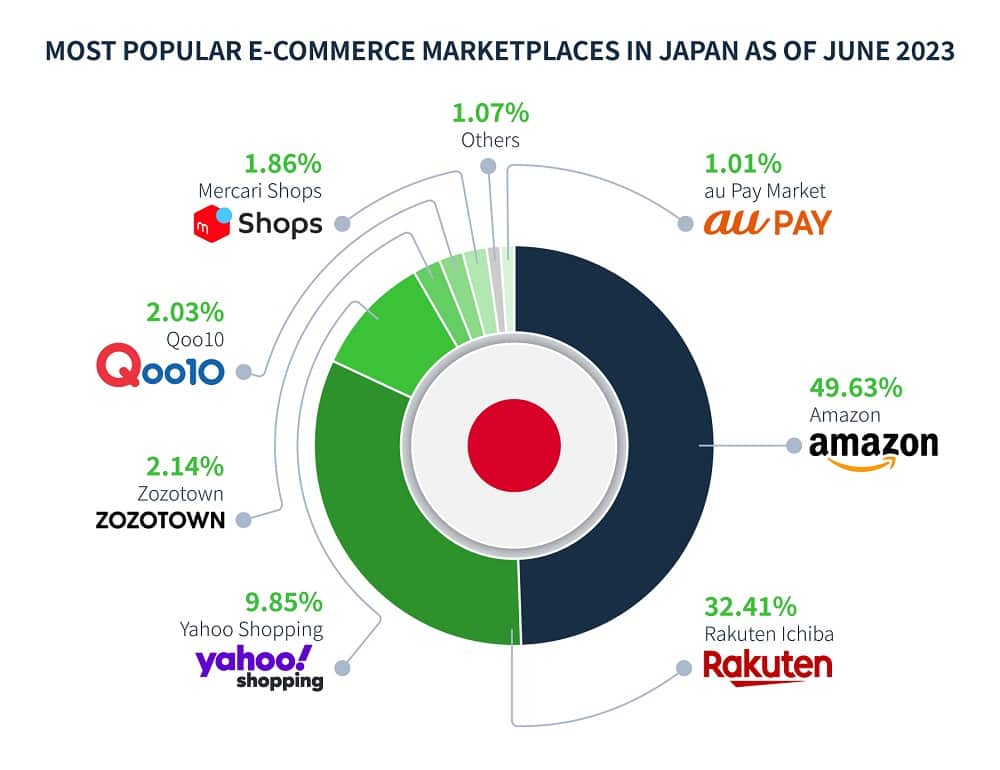

Brand websites and consumer-to-consumer platforms get some traction in Japan, but the vast majority of Japan eCommerce world is split between Amazon Japan (49.6%) and Rakuten (32.4%).

We’ll explain how they work and include other notable eCommerce marketplaces you can join or take inspiration from.

Amazon Japan

Amazon Japan is the most popular online marketplace according to 47.5% of consumers in Japan (tied with Rakuten with only a 0.2% difference).

The store interface is completely in Japanese, however, English machine translation is available for English users.

The store contains a mix of items found in Western Amazon stores as well as items unique to the Japanese market. Well-known features like Amazon Prime, Amazon Video, Music, Kindle, and Audible are available in Japan.

Amazon has been around since 1995 and became a global eCommerce giant by the end of the decade.

It’s important to note that just because it’s Amazon doesn’t mean it’s identical. Amazon Japan has distinct differences that reflect the audience it needs to attract.

For example, the top best sellers from Amazon US include eco-friendly laundry detergent and fish oil supplements, which pander to the West’s fascination with organic, green products.

In comparison, Amazon Japan’s best-selling products include soaps and cosmetics, as well as luxury umbrellas, a product that the Japanese take much more seriously than the West.

Rakuten

Rakuten is a large and centralized Japanese platform known for its gamification system which Japanese consumers love.

It was founded by Hiroshi Mikitani in 1997 and since its launch has branched off into many lines of business such as Rakuten Travel, Rakuten Farm, and Rakuten Fashion.

It rewards you with points for using various services such as credit cards, banking, investing, mobile carrier, insurance, travel booking (accommodation & flights), or online shopping on the platform.

Additionally, Rakuten has Super Point or Sale days when any shopping can earn you 16 times the points of a normal day.

You spend your points not only within the platform, but also within the Rakuten ecosystem which extends to 700,000 offline partners including convenience stores, restaurants, and supermarkets.

This level of integration in Japan helps Rakuten keep customers engaged and loyal.

With 68% of locals using Rakuten points, this is the most used point service in Japan for shopping and the reason why Rakuten is so popular.

It’s been gradually losing market share to Amazon Japan over the past years, now holding 32% versus Amazon’s 49%, as we mentioned above.

However, Rakuten is determined to remain relevant and has been increasing its presence throughout Asia, with concentrated efforts to penetrate the South Korean eCommerce market .

Yahoo!

Yahoo! includes “Yahoo! Auctions Japan” and “Yahoo! Shopping Japan,” which recently integrated with PayPay Mall, another beloved Japanese platform.

Yahoo! Auctions Japan is the largest online auction and flea market that customers love because of the variety of goods they can find – some of which are unavailable on other platforms.

Yahoo! Shopping Japan is one of the top ten largest eCommerce websites in the world. It offers a wide selection of products, such as:

- Office supplies

- Furniture and home appliances

- Clothes and jewelry

- Toys

- Electronics

- Health and beauty products

- Food

ZozoTown

While offline retail brands suffered losses due to limited working hours during the pandemic, ZozoTown capitalized on the heightened online shopping demand.

Many brands started relying on this platform for two reasons:

- They didn’t have an established website of their own

- They didn’t have enough traffic so sales were low

ZozoTown now houses a wide selection of retail brands alongside selling its own brand of custom-fit Zozo clothes.

They also have a marketing strategy revolving around “ZOZOWEEK” events that use TV commercials in May, September, and November to keep consumers’ attention.

au PAY Market (Previously: Wowma)

au PAY Market is an online marketplace owned by parent company KDDI, which owns AU Mobile, one of the country’s top mobile operators.

Mobile consumers receive marketing content, such as texts about new products and offers on the marketplace, which guarantees lots of traffic and sales.

au PAY Market’s catalog includes home equipment, cosmetics, apparel, restaurant reservations, and personal care services.

DMM

DMM sells digital products like online games, ebooks, and DVDs. It’s an important Japan eCommerce market for certain niches like video rentals (IIRC).

Founded in 1999, DMM has since expanded to include:

- Solar panel services

- 3D printing

- Online English education services

- Charity auctions

DMM.com Security, its subsidiary company, provides forex services to individual investors.

Kakaku.com

Not as big of an eCommerce mall overall, Kakaku.com provides specifications, price comparisons, and product reviews on a variety of products including apparel, appliances, computers, smartphones, internet providers, and insurance.

It’s an important platform in Japan because it helps shoppers make informed buying decisions and save money.

Aside from Kakaku.com, the company runs several websites with user-generated information and reviews in various industries, including:

- Tabelog.com – Restaurants

- 4travel.jp – Travel

- Bushikaku.net – Buses and bus tours

- Photohito.com – Photo sharing

- Sumaity.com – Residential real estate

- Eiga.com – Movies and showtimes

Qoo10 Japan

Qoo10 is a Singaporean eCommerce platform that sells to the Southeast Asian region via localized online marketplaces.

One of these marketplaces, Qoo10 Japan, is now owned by eBay.

It sells a variety of products including e-tickets, books, clothing, home equipment, and more.

Qoo10’s brand recognition isn’t high compared to others on this list, but the company is trying to change that through a marketing campaign focused on TV commercials.

Mercari

Mercari is a Japanese peer-to-peer platform that allows people to buy items from people who no longer need them.

It was founded in 2013 and quickly became a consumer favorite.

To understand why, you first need to understand the concept of Japanese convenience stores, or “konbini.” These stores can be found at virtually any corner in Japan and they’re very popular with consumers.

They carry a wide selection of items, from groceries to daily necessities and even clothes, and most of them are open 24/7.

Looping back to Mercari, this platform is genius because it allows sellers to send products anonymously from local convenience stores – in other words, straight from a local, familiar shop.

Mercari has expanded to the US and the UK due to its success in Japan.

Case Studies of Companies Successfully Expanding to Japan Online Market

1. iRobot uses feedback from Japan to achieve worldwide success

iRobot was the first foreign company to receive funding from Japan’s Ministry of International Trade and Industry and their product first found success in Japan.

In their early days, the company found Japanese consumers to be a tough crowd with particularly high standards for quality, according to iRobot’s CEO, Colin Angle.

Customers would send the product back due to a small scratch on the packaging and expect perfection from their purchase.

This feedback helped shape the Roomba as consumers know and love it today.

When Japanese consumers approved of iRobot’s products, they truly meant it – it became such a central part of their homes that some companies started labeling their furniture as Roomba-friendly.

After this type of validation in Japan, iRobot knew they would pass with flying colors worldwide.

2. iHerb grabs attention through affiliate marketing

iHerb sells all-natural food, vitamins, and makeup, all-around a good product match for the Japanese audience.

However, Japanese consumers don’t trust new brands easily. They needed an introduction to get there faster.

The company partnered up with Ellie Ames, a beloved Japanese influencer in the same niche as their products. Ellie already had a health-conscious audience with over 130,000 subscribers, and her iHerb unboxing video gained 18,000 views on YouTube.

This and other affiliate marketing initiatives helped put iHerb in front of their ideal audience and made their launch in Japan a success.

3. IKEA customizes offerings to solve local problems

IKEA, a popular Swedish furniture store, didn’t have a successful initial launch in Japan in 1974.

Even though furniture and DIY are both popular in Japan, IKEA didn’t realize how different Japan was from its usual market. It didn’t research the country enough to understand what this audience needs.

Once this company took the time to study the Japanese market, things changed for the better.

IKEA realized that the densely populated, largely urban demographic appreciates furniture that maximizes functionality while taking up very little space.

IKEA made a series of changes and relaunched in 2006 with new and improved offerings that matched Japanese style and tiny homes.

It prioritized 7,500 items from its global range that were suitable for Japanese home standards and also included a few items that were specifically modified for Japan.

Tips to Succeed in Online Selling in Japan

1. Localize your offering to meet the country’s preferences

Adapt to local preferences and expectations, starting with the basics:

- Have a version of your website in Japanese

- Provide customer service in Japanese and during hours that suit the locals

- Offer payment options that locals commonly use

In Asia-Pacific, 60% of people are paying using digital wallets, which is higher than in any other region.

Offering digital wallets not only caters to local preferences, it also minimizes security risks which is an important consumer consideration when trying new brands.

Other than that, Japanese consumers often turn to the convenience store payment option. This allows consumers to pay in cash at the nearest convenience store.

Using a good payment services provider is an easy way to unlock local payment options for your chosen countries without complicating your life in the process.

2. Mold around the market, not the other way around

What sells in America won’t necessarily sell in Japan.

Spend some time researching the ways this market differs from the West to find lucrative opportunities and increase your chances of success.

Non-Japanese, particularly Western, brands have found success in localizing their offerings.

Brands like KitKat have launched their products in Japan-favorite flavors like matcha and red bean. This creates exclusive options that you can’t buy anywhere else and has made KitKat stand on its own in Japan, not just as a British offering.

Here are some general examples of how you can apply that thinking to your business:

- Japan houses are small, the average size house for a family of 4 is 105 square meters (1127 square feet). “Space” has a lot of value.

- People in Japan sit on the floor a lot, so keeping it clean is a priority, as seen by Roomba’s success.

- Japanese are used to long commutes and taking mass transit. The average commute time in Tokyo is over 1 hour. As such, Japanese people spend more time using mobile devices.

- Japan has a strong gaming culture you can cater to with exclusive games in their language.

- Their banks are falling behind on digitization, leaving the door open for fintech brands

- Like Western culture, Japanese people value their health. However, they may value certain types of products as “healthy” that might not be considered the same in the West.

- Japan is a fashion mecca with unique traditional styles and diverse streetwear fashion, which is a good opportunity for retail brands.

Remember: IKEA wasn’t met with immediate success by coming to Japan with a cookie-cutter offering. They succeeded by figuring out what the Japanese wanted and selling them exactly that.

Research the trends, subcultures, holidays, popular artists and events, shopping habits, and sought-after product categories and specifications.

This strategy takes more research at the start and a keen eye for monitoring Japanese trends, but it leads you down a steady path to success.

3. Build brand awareness

Where do you start marketing in Japan? It doesn’t always work the same way as marketing does in the US.

For instance, Japanese people start their search for products on Google, just like most people in the West do. This means it’s smart to explore SEO and PPC in Japan.

However, social media is a different story.

If you go to a business conference and people ask you for your LinkedIn profile, that would be a tell-tale sign you’re not in Japan.

The Japanese use Facebook as a business platform, which is an important note for B2B brands trying to establish an online presence.

The most popular social media site by far is LINE, followed by Twitter and Instagram. Consider heightening your presence there to integrate your company into your audience’s daily lives.

Knowing which channels to use and how to present yourself to gain trust is crucial. That’s an easier job when you have sturdy footing to start. That leads us to our next point.

4. Prioritize the mobile experience

If you launch a B2C eCommerce site, chances are a majority of your visitors will access it via a mobile device.

Compared to their Western counterparts, Japanese consumers are comfortable making large purchases from their mobile phones. The mobile purchase/checkout experience needs to be well-optimized and tested.

5. Collaborate with local partners

Carefully selecting and collaborating with local partners can do wonders for your company.

Here are some reasons why local partners are valuable assets to any business expanding to Japan eCommerce:

- They can offer customer service in Japanese

- Keep you in the loop on the customs and trends

- Make you aware of applicable laws and regulations such as the electrical product regulations by JET

- Connect you to the key industry players

- Help with the logistics

This goes for marketing as well.

Finding an influencer or credible partner in your niche can put you on the map and cast a positive light on your business right off the bat, just like it did for iHerb.

6. Support popular payment methods in Japan

Besides credit cards, Japanese users use Convenience store payments, COD, and a long list of individual payment services.

The more services your eCommerce site supports, the more revenue you can get. KOMOJU can help with that..

Win Big in Japan eCommerce

Crossing borders in eCommerce might be outside of your comfort zone – it’s hard enough to understand and predict the behavior of your own market.

But don’t let that stop you. In reality, going global has never been easier.

With a healthy economy, the 4th most valuable market, and a solid growth rate, Japan eCommerce is a rich avenue to explore.

You only need to do two things:

- Find a way to localize your offering to Japan

- Select the right partners to guide you and handle the logistics

Sign up for KOMOJU to bridge payment gaps and access the global market.

If you’re ready to open your door to Japanese consumers, read about Japan’s local payment methods on our blog next.

We help businesses accept payments online.