We help businesses accept payments online.

Large eCommerce markets like China are probably on your radar already. But growing eCommerce markets shouldn’t be underestimated.

They tend to be less saturated and full of opportunities.

When it comes to growth, Southeast Asia eCommerce is outpacing the rest of the world.

Five Southeast Asian countries are currently among the world’s top 10 fastest-growing eCommerce markets, shaping Southeast Asia into a promising opportunity for cross-border eCommerce.

In this blog, we’ll cover the important considerations focusing on the six most attractive markets in the region. This should help you decide whether Southeast Asia eCommerce is right for your business.

Southeast Asia eCommerce Market Overview

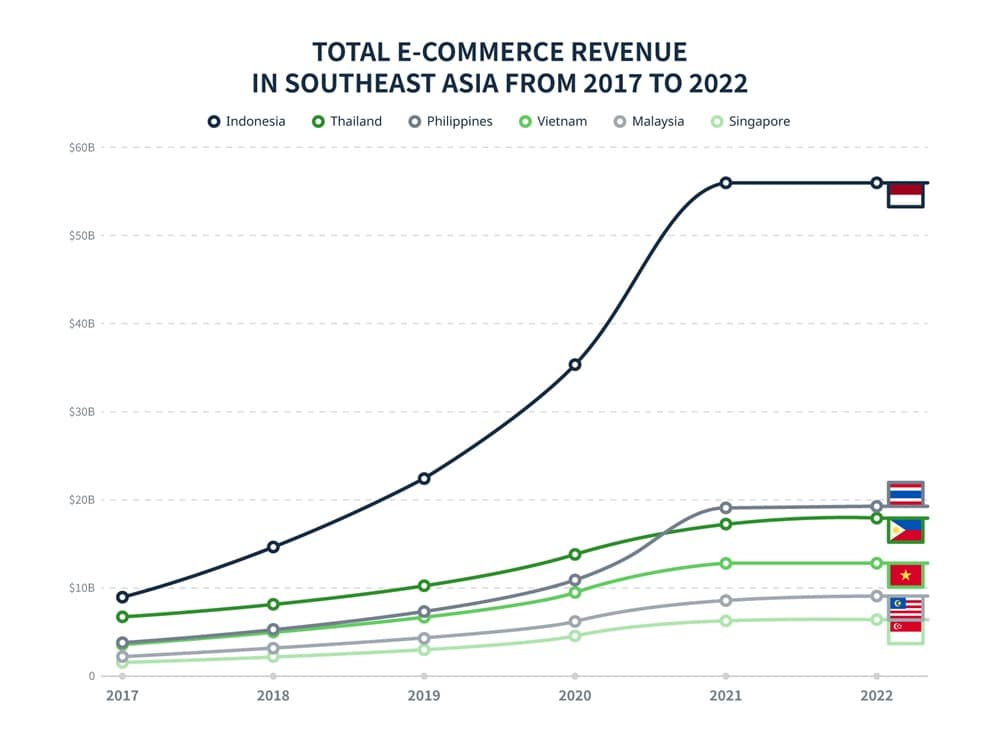

Market Size

Southeast Asia eCommerce is an early-stage market with a 22% year-on-year growth. This is one of the most rapid growth rates in the world. It’s expected to continue expanding at a 17% growth rate in certain areas over the next five years.

Cross-border eCommerce specifically registered a compound growth rate of 5.7% in Southeast Asia.

The value of Southeast Asia eCommerce amounted to $28 billion in 2023.

Below is the breakdown of eCommerce revenue by individual Southeast Asian country:

Demographics

The current population of Southeast Asia counts over 689 million people, or 8.6% of the total world population. The median age in the region is 30 years old.

Here are some key facts about this demographic:

- The upper middle class is booming; the rising disposable income leads to a higher consumption per capita rate

- Population growth is high – estimated at 23 million more working people by 2030

- The population is young and digitally connected. Half of the population is under 30 years old, and the oldest median average in the region is 42 years in Singapore

- Mobile and internet penetration are increasing steadily with many new internet users each month since 2020

- Southeast Asians spend above-average time on the internet and on social media each day, especially in the Philippines

- Consumers go online for product discovery and evaluation (and prefer video form) even if they end up buying offline

- 84% of consumers have tried new apps since the pandemic, and the average number of channels grew from 8 to 15 within a year

- There’s demand for high-quality but affordable goods, and desire to compare the same product from different sellers

- Customers have shifted online for daily essentials – 45% have increased online grocery shopping during the pandemic

- Higher adoption of new technology, especially in Indonesia, the Philippines, and Vietnam – 7 out of 10 respondents tried a metaverse-related tech

- Higher adoption of digital wallets, cryptocurrency, and non-fungible tokens than most other markets

Local governments are investing in infrastructure installments and Southeast Asia eCommerce regulation. There’s a steady stream of foreign investments helping propel the market further.

In 2022, 82% of survey respondents in Southeast Asia reported shopping online in the past year, and that number is forecasted to reach 88% by 2027.

Southeast Asia eCommerce Market by Country

Indonesia

- Growth rate: 20%

- Popular product categories: clothing, shoes, cosmetics and body care, bags and accessories, electronics and household appliances, and health products

- Popular online marketplaces: Tokopedia, Shopee, Chinese JingDong, and Lazada

Indonesian eCommerce is the fourth fastest-growing market in the world and the most populated nation in Southeast Asia.

The country recorded around 56 billion US dollars of eCommerce revenue in 2021, the highest revenue in the entire Southeast Asia region.

Indonesia is projected to account for 42% of the Southeast Asia eCommerce market by 2030 due to a growing middle class and increasing internet penetration. Experts predict the country will generate around 160 billion US dollars in online retail sales.

It’s important to note that cross-border eCommerce in Indonesia is going through some changes.

In response to TikTok’s plan to invest in Indonesian eCommerce by selling products in-app, the government issued new regulations banning social media selling as of October this year to help local businesses compete.

TikTok agreed to comply with the new rules. Sellers must now acquire a specialized license and use a separate app for their e-commerce.

Overseas vendors were already banned from selling products below $100 to Indonesia earlier this year. Additionally, Shopee and Lazada no longer offer cross-border selling services for Indonesia.

With all these changes, it’s critical to have an expert review all relevant local regulations. Then you can determine the best course of action before you expand to Indonesia online.

Vietnam

- Growth rate:12.5%

- Popular product categories: clothes, shoes, cosmetics, and electronics

- Popular online marketplaces: Shopee, TikTok Shop, Lazada

Vietnam’s $16.4 billion eCommerce market has been steadily expanding with an increasing number of people shopping online.

Alongside this shift, Vietnam’s digital payments sector has been on the rise. Although cash is still preferred, consumers are turning to cashless payment options to make online shopping even more convenient.

Vietnam has standard eCommerce regulations that apply to all businesses selling to the Vietnamese market, including overseas vendors. This year, the government announced two new laws which will take effect from July 2024. These laws aim to better define and moderate all eCommerce activity in the country, including cross-border eCommerce.

Thailand

- Growth rate: 16%

- Popular product categories: fashion, beauty and personal care

- Popular online marketplaces: Shopee and Lazada

Thailand’s eCommerce market value is projected to reach 900 billion Thai baht by the end of 2023 (roughly $25.4 billion).

Interestingly, the most popular perk of online shopping in Thailand next to ease of payment is the possibility of returns. Returns weren’t a commonly offered option in the country until recent years when international brands like Zara and Uniqlo normalized it.

This nation mostly relies on eCommerce marketplaces for online shopping, but social commerce holds a close second place.

The newest eCommerce regulations in Thailand are mostly concerned with data confidentiality and security, content moderation, and accountability for digital platform operators.

Besides that, you can find other applicable rules and laws for Thailand here. It’s best to have a legal professional with local experience by your side to ensure compliance.

Malaysia

- Growth rate: 18%

- Popular product categories: Electronics, fashion, beauty products, and groceries

- Popular online marketplaces: Shopee, PG Mall and Lazada

The gross merchandise value of the Malaysian market amounted to $13 billion in 2023 and it’s expected to keep increasing in the following years.

The Malaysian government currently doesn’t have very strict requirements for B2C cross-border eCommerce, but there are some general guidelines you should implement. Many Malaysian platforms permit international sellers, offering a fast and easy entry into the market.

Singapore

- Growth rate: 12.23%

- Popular product categories: groceries, fashion, and accessories

- Popular online marketplaces: Shopee, Lazada, Amazon

Singapore is a smaller market (valued at 5.21 billion in 2022) with great potential due to high internet, smartphone, and social media penetration. It’s projected to reach $9.09 billion by 2027.

Singaporean consumers are some of the most affluent in Southeast Asia, and the country registers the highest basket size ($67.40).

Another advantage unique to Singapore is its favorable geographic location along the cross-roads of the East-West trade, ideal for cross-border eCommerce. This is one of the reasons the country is home to the highest number of unicorns in the region, such as Shopee, Grab, Carousell, Lazada, and Ninja Van.

There are no specific regulations in the country that govern eCommerce to date. However, as a vendor, you should get professional advice about your specific product categories if you sell to Singapore.

The Philippines

- Growth rate: 24.1%

- Popular product categories: clothing and fashion accessories, personal hygiene items, groceries, cosmetics, household cleaning products

- Popular online marketplaces: Shopee, Lazada, eBay (C2C)

The Philippines have relatively low eCommerce engagement and one of the lowest internet penetration rates. Interestingly, Filipinos hold the world record for the longest time spent online with 10.23 hours each day.

No wonder the Philippines are the fastest-growing eCommerce market in the world (24.1% in 2023).

The market value amounted to $15 billion in 2022. According to forecasts, it will reach 60 billion by 2030.

The biggest challenge online shoppers face in the Philippines is the risk of scams and hackers. eCommerce policies in the country are focused on limiting security threats and protecting consumers’ rights.

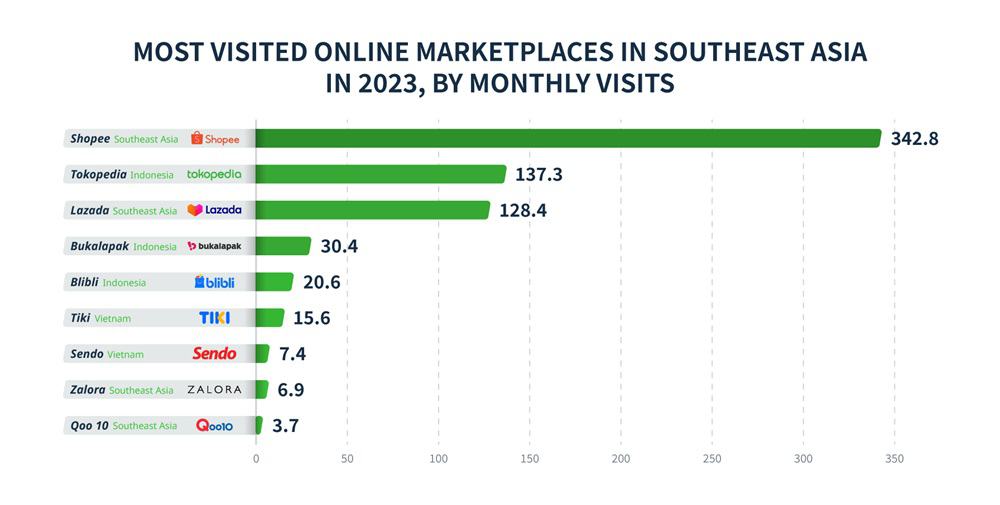

Top eCommerce Websites in Southeast Asia

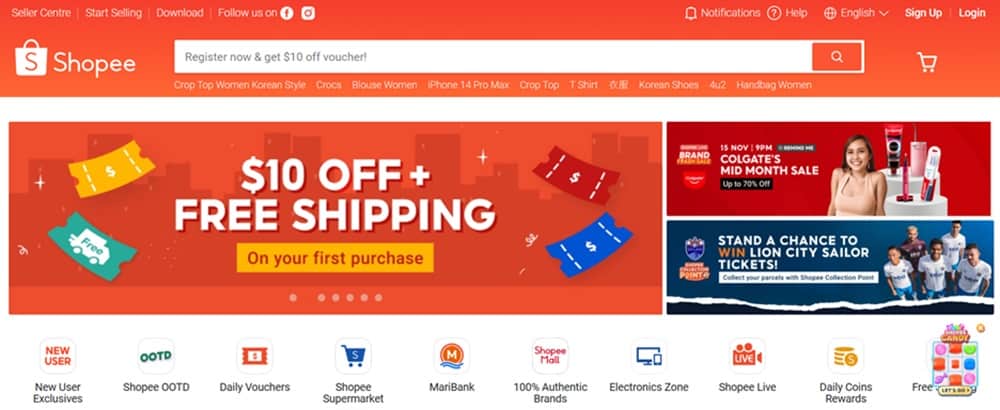

1. Shopee

Singapore-founded Shopee is the biggest player across all of Southeast Asia eCommerce with 342.8 million website visits per month. It was launched in 2015 as a subsidiary of Sea Limited.

Shopee earned around $1.8 billion in Gross Merchandise Value in the first year of its launch and rapidly established a presence in Southeast Asia.

This marketplace offers a wide range of products, similar to Amazon, and leads in mobile commerce along with Lazada and Tokopedia.

The product categories sold on Shopee include perfumes, clothes, electronics, and other everyday household items from global brand names and lesser-known small businesses.

These are the rare product categories that are forbidden on Shopee:

- Alcoholic beverages

- Tattoo needles

- Orthodontic items such as braces

- Military, government, and police uniforms

Shopee supports a couple of major delivery services alongside its own Shopee Express for consumer convenience. It also offers multiple payment options: credit/debit cards, Shopee Pay, PayNow, and GoPay.

Aside from Southeast Asia, Shopee operates in Taiwan, Brazil, Chile, Columbia, and a few other countries.

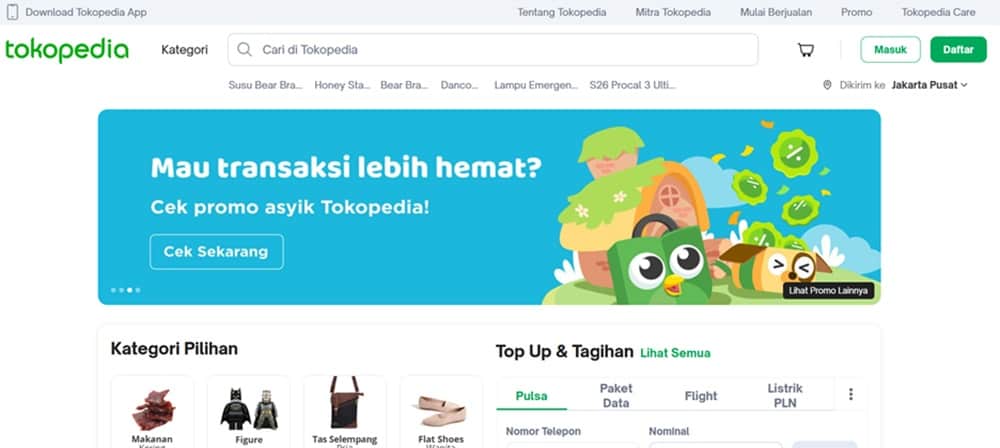

2. Tokopedia

With an estimated yearly GMV of $14-15 billion, Tokopedia is Indonesia’s second most popular eCommerce site, and the third biggest Southeast Asia eCommerce marketplace overall.

It was founded in 2009 in Indonesia by William Tanuwijaya. His vision was to create a marketplace for street vendors scattered across the country’s 17,000 islands and democratize digital commerce.

As such, the platform was initially intended for C2C selling but supports the B2C model as well.

Tokopedia currently hosts roughly 12 million vendors and has 137.3 monthly visits. It sells products across 25 popular categories, such as food and beverages and fashion, but also digital products like tickets and bill payments.

The company works with 13 logistics and fulfillment providers to guarantee same-day delivery across Indonesia.

As of last year, Tokopedia expanded its payment method offerings to include GoPayLater Cicil, a buy-now-pay-later installment solution that has since become a consumer favorite.

Tokopedia has been a subsidiary of GoTo since 2021.

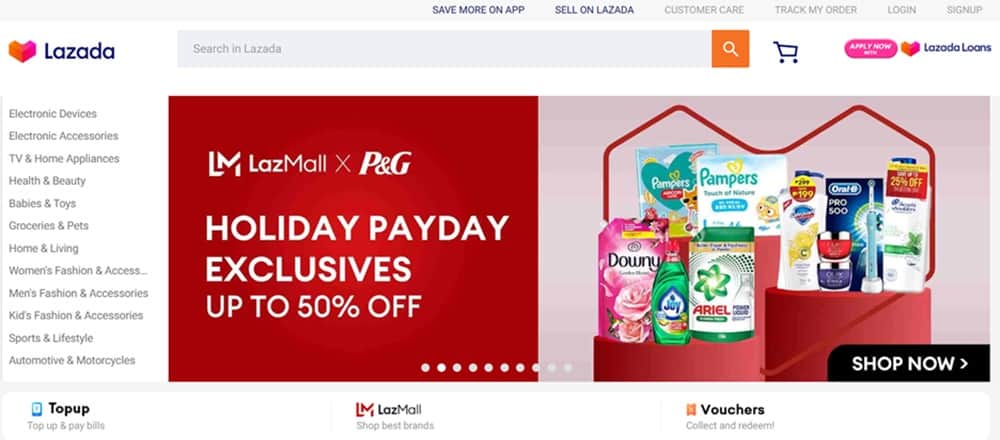

3. Lazada

Founded in 2012 by Maximilian Bittner in Singapore, Lazada was once the largest eCommerce marketplace in Southeast Asia. It’s now the runner-up behind Shopee in almost every Southeast Asia country by website visits (128.4 million per month compared to Shopee’s 342.8 million).

However, Lazada is still the top Southeast Asia eCommerce marketplace by revenue, generating around $1.5 billion in annual sales.

Lazada is the regional flagship of the Chinese Alibaba Group and is backed by its first-class, end-to-end logistics infrastructure, reportedly the best in the region.

It is home to over 155,000 international and local merchants.

The current best-selling products on Lazada include:

- Mother and child products

- Household items

- Clothes

- Beauty products

- Sports equipment

- Weight loss products

- Phone accessories

- Food and groceries

Lazada doesn’t allow selling fake or second-hand products, telecommunication devices, or products larger than 300cm.

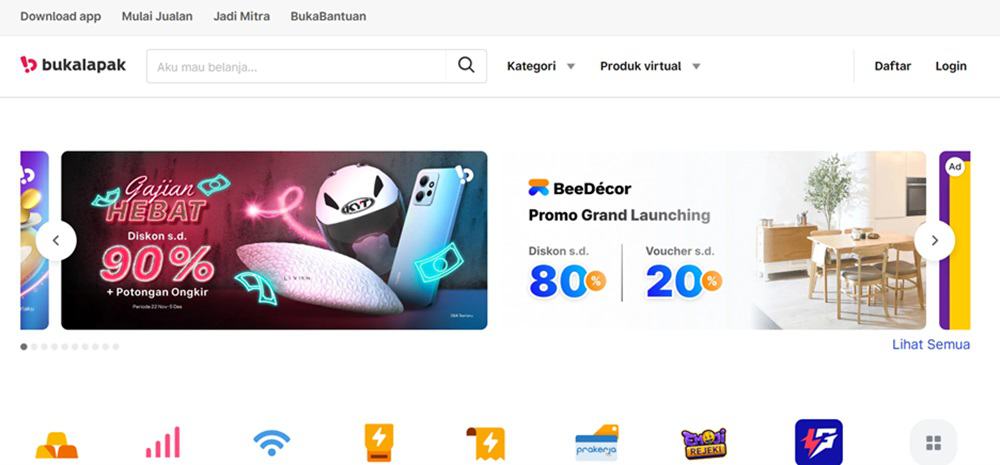

4. Bukalapak

Bukalapak is an Indonesian eCommerce company founded in 2010. Its founder, Achmad Zaky, created it to facilitate online commerce for millions of family businesses known as “warungs” – roadside stands or kiosks at the heart of every Indonesian neighborhood across the country.

This is an open market where people can sell a variety of items, from electronics to clothes and toiletries, at no cost.

The marketplace only charges platform fees for Super Sellers on BukaMall and sellers who have successfully completed more than 100 transactions.

In 2019, Bukalapak launched BukaGlobal, connecting Indonesian sellers to buyers from around the globe.

However, like other Indonesian platforms, Bukalapak doesn’t allow international sellers access to the Indonesian market due to the new, strict government rules for cross-border eCommerce.

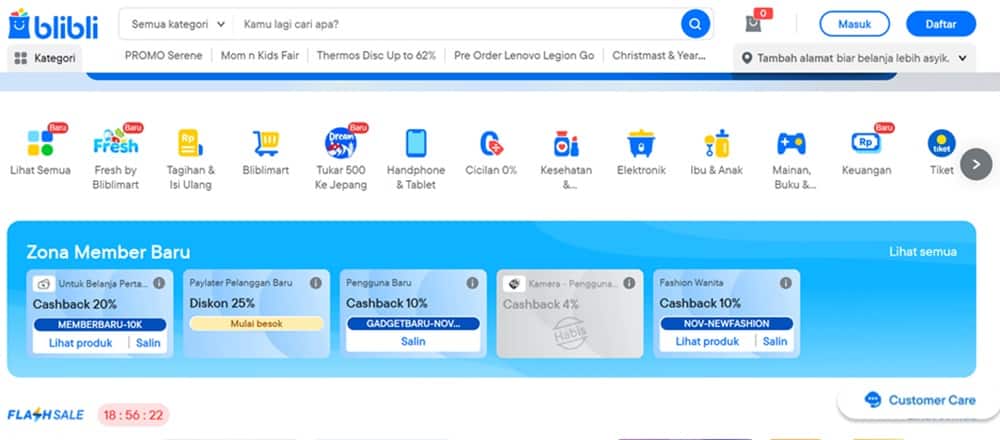

5. Blibli

Blibli is a platform by Indonesians, for Indonesians with 20.6 million visits per month.

The platform has a fully in-house logistics system that guarantees delivery within two days.

It was also the first Indonesian site to offer video streaming in 2019, mainly on-demand sports streaming and eCommerce integrations.

The product categories on Blibli include clothes, gadgets, makeup, home decoration, food and travel vouchers, and more.

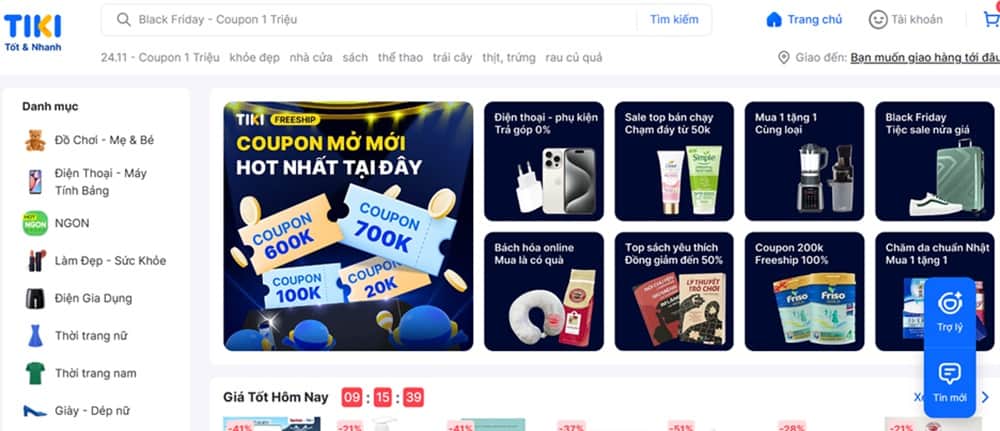

6. Tiki

Tiki is a Vietnamese site founded in 2010 to sell English language books. It has since expanded significantly, reaching 15.6 million monthly visits in 2023.

Tiki still focuses mainly on domestic eCommerce. It sells products from local brands, and has a great reputation with Vietnamese customers who love its two-hour express delivery service called TikiNOW.

However, the platformalso offers a cross-border seller program that connects international sellers with a designated third-party logistics partner. The partner handles shipping to the customers in Vietnam.

7. Sendo

Another locally-focused Vietnamese marketplace, Sendo is fairly popular with a monthly traffic of 7.4 million.

The company was launched in 2012 as a subsidiary of the software conglomerate FPT Corporation.

It’s a rounded eCommerce platform that connects buyers and sellers across the country and sells products from popular categories such as home essentials, fashion, and electronics.

Sendo has an open marketplace as well as SenMall, a more regulated space for vetted branded products with a guarantee of authenticity.

8. Zalora

Zalora is the only single-category-focused eCommerce website on the list.

It’s a fashion and beauty destination with headquarters in Singapore and Malaysia, founded by the Global Fashion Group in 2012.

It also has a presence in Indonesia, Brunei, the Philippines, Taiwan, and Hong Kong.

Zalora has around 6.9 million website visits per month in 2023 and over 3 million active customers. It is a retailer and an online marketplace that offers products from international and local sellers. The platform’s main target audience is fashion enthusiasts, ages 16-44.

As a global marketplace, Zalora has a solid logistics system to support cross-border eCommerce. Their unique International Dropshipping service is perfect for brands that want to expand to Southeast Asia via a single eCommerce-enabled platform.

9. Qoo10

Qoo10 is a Singaporean company launched in 2010. It was a joint venture between eBay and the founder of South Korea’s GMarket. It is now an independent company everywhere except in Japan, where it’s owned by eBay.

Apart from Singapore, Qoo10 has localized marketplaces in Malaysia, Indonesia, mainland China, and Hong Kong and receives 3.7 million website visits per month.

Qoo10 offers easy entry into Southeast Asia eCommerce to international sellers.

Customers shop for all kinds of products on this marketplace, from fashion and watches to computer games and automotive items.

Below are the categories which Qoo10 prohibits:

- Used and second-hand products

- Animals and wildlife items

- Alcoholic beverages

- Narcotics and steroids

- Slot machines

Case Studies of Companies Successfully Expanding to Southeast Asia Online

1. White Magic

White Magic is an eco-friendly brand that specializes in cleaning products. In 2017, the company decided to enter Singapore eCommerce and picked Lazada as its online platform and partner.

Lazada worked closely with White Magic, providing guidance, business tools via the Lazada Seller Center, comprehensive analytics, and other resources. This meant that White Magic didn’t have to figure out individual logistical aspects on their own.

The platform already ensured they could manage their inventory, optimize listings, and drive traffic to their shop.

Thanks to all those resources and their participation in Lazada’s numerous promotional campaigns, White Magic established its name as a reputable eco-friendly brand in Singapore.

2. Colgate

Oral hygiene brand Colgate partnered with Shopee and launched an exclusive product collection on Shopee’s Super Brand Day. The collection was aimed at Southeast Asia’s younger audience, with the goal of engaging them and driving sales.

Their marketing strategy involved several tactics, including:

- In-app ads as well as Google ads with Shopee

- Colorful onsite banners within the platform to draw attention to Colgate’s special offers, such as time-limited deals and vouchers

- A personality quiz that determines which brush fits your personality, as a creative way to engage the younger audience

- Livestream on Shopee Live to meet the video evaluation demand

- Free tote bags for orders that surpassed the minimum spend limit

This comprehensive strategy resulted in a 62x increase in sales and 24x increase in new shop followers for Colgate.

Tips to Succeed in Selling to Southeast Asia Online

1. Focus on localization

Knowing the holidays, customs, and other drivers of shopping behaviors of your target audience should be standard procedure regardless of the country.

Additionally, it’s particularly important in emerging markets like Southeast Asia to meet your customers where they are currently.

This might require some out-of-the-box thinking to bridge the gaps between the market’s future potential and current reality.

Here’s an example. Despite increasing internet penetration, some people in Indonesia still don’t have internet. Even offline businesses have issues reaching all the consumers across 17,000 islands in the country. For online stores, the hurdle might seem insurmountable.

A possible solution for online stores is to create close partnerships with various small shops around the country. Their strategic geographic position would unlock the consumer base that’s not yet present online.

Bukalapak found success using this exact strategy to reach the entire Indonesian consumer base.

2. Target the platforms locals use

Southeast Asian countries spend a lot of time online. In the Philippines, where over 10 hours per day on the internet is normal, four hours on average are spent on social media.

That doesn’t mean companies can market just anywhere online and the Philippines will positively respond, or even notice it. Neither will the rest of Southeast Asia.

To ensure your message reaches its intended recipients, focus on the platforms your target audience uses.

3. Offer localized payment options

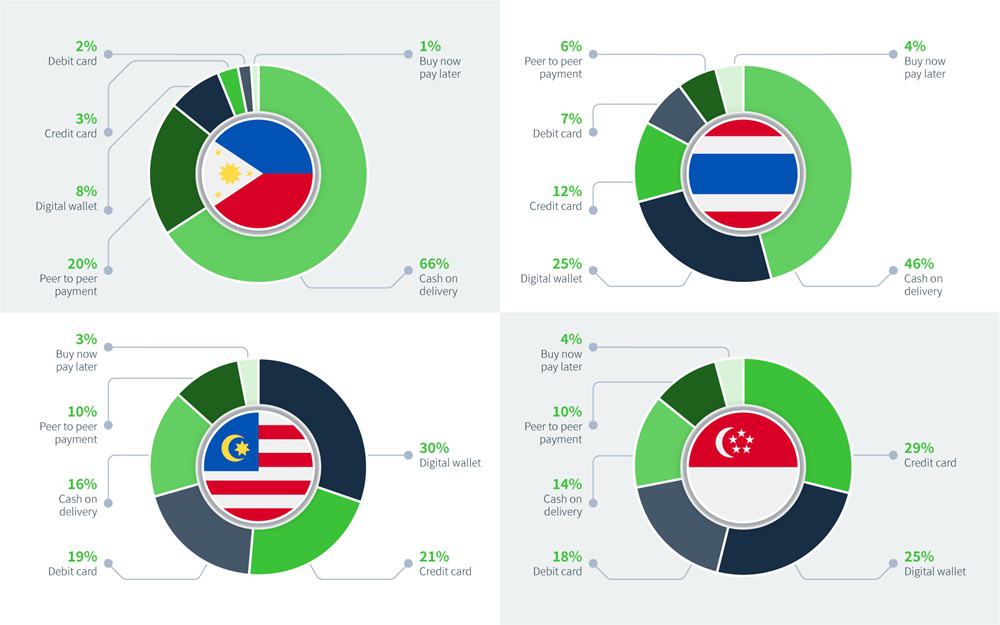

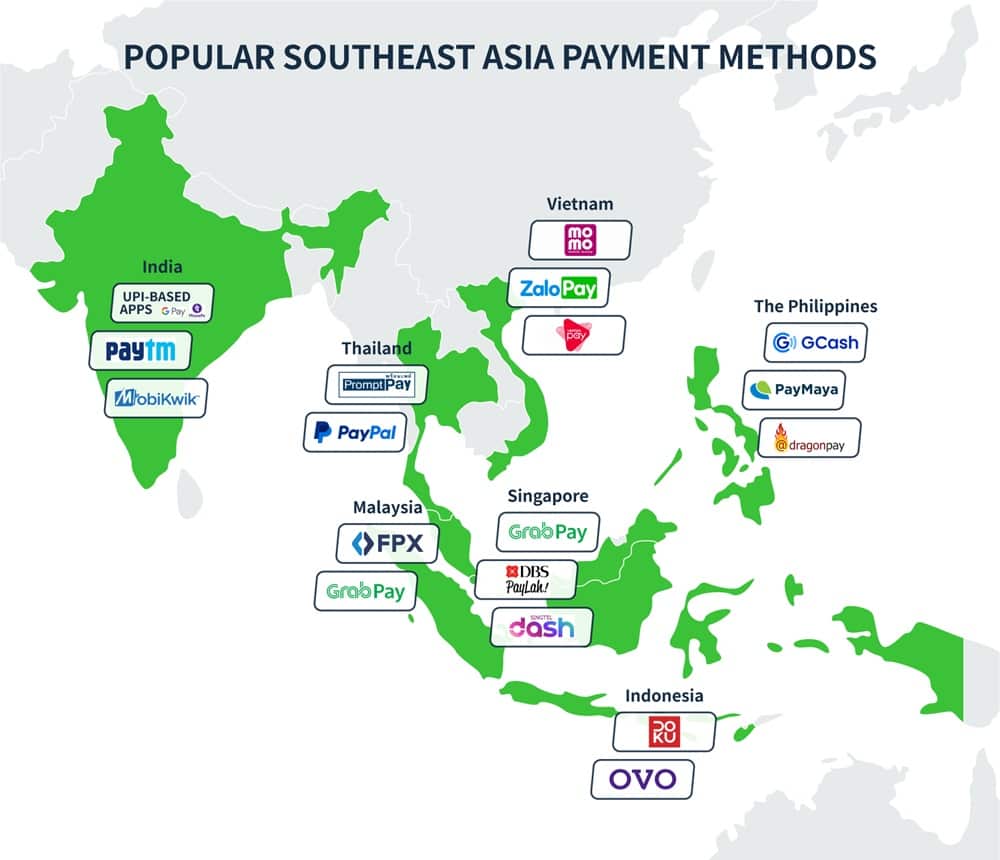

Looking at the pie charts below, you can see that Southeast Asia payment methods vary greatly by country.

While Filipinos prefer paying by cash on delivery, digital wallets are starting to soar in popularity in the Philippines. In contrast, cards and digital wallets are already the norm in Singapore and Malaysia.

Here’s an overview of the most popular payment methods across Southeast Asia:

Expanding to Southeast Asia eCommerce is a tall order if you don’t provide local payment options.

Since there are a lot of them, a payment service provider like KOMOJU can help you integrate all the important payment channels without having to manage them individually.

Summary

Southeast Asia eCommerce is an emerging market full of opportunities. Consumers in this region are increasingly coming online to find a wider range of options and shop for daily essentials.

To find success in this market, you need to provide a variety of payment options that Southeast Asian consumers already use and expect. Contact KOMOJU if you’d like help with that.

We help businesses accept payments online.