We help businesses accept payments online.

After successfully establishing your brand locally, it is time to expand your business in a new, exciting direction with more room for growth.

Cross-border eCommerce is one of the most logical and lucrative next steps, assuming you pick the right market and develop a localization strategy.

When it comes to Europe, the majority of online spending (72%) comes from the top 6 countries we’ll focus on today: the UK, Germany, France, Italy, Spain, and the Netherlands.

In this blog, we’ll tell you what to expect from Europe eCommerce, provide some real-life expansion examples for inspiration, and help you succeed in this part of the world.

Europe eCommerce Market Overview

Market Size

The European eCommerce market is valued at $599.39 billion in 2023 and is expected to reach $880.70 billion by 2028 at an 8% growth rate.

Western Europe is a well-developed and large market that drives the most revenue, but other parts of the continent have their advantages.

For instance, Southern Europe has some of the fastest-growing eCommerce markets in the entire region in Italy and Spain. Consumers from these two countries are increasingly shopping from foreign brands.

Northern countries are characterized by high digital literacy, internet penetration, and purchasing power, making them another good candidate for eCommerce.

Overall, although it’s the third largest market after China and the US, Europe is less saturated and still has room for growth.

Demographics

The population of Europe is 742,007,219 people, making 9.32% of the total world population as of December 2023. The median age in the region is currently 42.2 years old and rising.

Below are some things that define the current European consumer and influence their shopping habits:

- 90% of Europeans use mobile phones

- 90% have internet access, higher than the global average

- In the European Union, 7 out of 10 internet users shopped online in 2021, most notably consumers from the Netherlands (94%), Denmark (92%) and Sweden (89%)

- By 2025, 1% of Europeans will turn to eCommerce as their primary purchase method

- Two-thirds of European consumers express concerns about inflation. They plan to spend less on non-essential categories and shop from lower-price retailers

- Generation Z has the highest intent to splurge and treat themselves with non-essential products

- Half of European consumers, particularly from France and Germany, prioritize health and environmental factors when making a purchase. These include sustainable sourcing, recyclability, fair-trade practices, and the absence of artificial ingredients

Here are the differences between subregions of Europe when it comes to internet and online shopping penetration:

Europe eCommerce Market by Country

United Kingdom

- Growth rate: 4.4%

- Popular product categories: Groceries, fashion, fresh food and beverages, books, movies, music and games, consumer electronics, personal care items, DIY and garden

- Popular online marketplaces: Amazon, Sainsbury’s, Tesco, Argos, John Lewis, eBay, Next, Ocado, Etsy

The UK is the largest eCommerce market in Europe and the third largest globally behind China and the US. The population of the UK is 68 million people, out of which 60 million are eCommerce users in 2023. Further, 99% of British people have the internet.

Consumers from the UK are avid smartphone users and prefer to shop from their phones. Mobile and contactless payments are also gaining in popularity.

Interestingly, one of the main reasons for online shopping in the UK is the ability to pay via cash on delivery, as cited by 96% of study respondents.

When it comes to shipping, free delivery isn’t crucial in this country. Customers deem the sustainability factor to be more important. However, the sustainability of the product itself is considered more relevant than the delivery method.

France

- Growth rate: 7.49%

- Popular product categories: clothing and shoes, accommodation, food, personal care, video games, furniture and appliances, hobby

- Popular online marketplaces: Amazon, Aliexpress, Cdiscount, eBay, Zara, Zalando

93% of the population in France has internet access, and 83% of people have shopped online.

In recent years, France rolled out new VAT and other eCommerce regulations to replace the outdated ones from 2000. The goal is to protect consumer rights and create a fair market for everyone.

The country is putting more effort into sustainability which is increasingly important to consumers. There has been a massive shift in consumers’ attitudes about second-hand products as half of French people have bought second-hand within the past 12 months.

Similarly, renting items is becoming more popular for special occasions. Renting a bridesmaid dress eliminates the need to buy an item that will be discarded after one use and the need to manufacture a new one.

Germany

- Growth rate: 4.5%

- Popular product categories: Clothing and shoes, consumer electronics, books and ebooks, food, hobby and leisure, furniture, personal care

- Popular online marketplaces: Amazon, eBay, Otto, Zalando, Mediamarkt, Ikea, Temu

Germany is the second-largest European eCommerce market.

Similarly to France, 93% of the German population are internet users, and 82% are online shoppers. Germany’s B2C sales generated 84.5 billion euros (around $92.748 billion) revenue in 2022. The figure is set to continue its steady growth over the following years.

German consumers are becoming increasingly concerned with sustainability, transparency, ethical production, and employee rights.

Spain

- Growth rate: 14.7%

- Popular product categories: Electronics, hobby and leisure, fashion, personal care, furniture, groceries, DIY

- Popular online marketplaces: Amazon, El Corte Ingles, Shein, Apple, Mediamarkt, Carrefour, Mercadona, Zalando

Spain is one of the fastest-growing markets in Europe and one of the biggest South European markets. It’s one of Europe’s leading markets for fashion, electronics, and media segments.

Spain’s market size is expected to reach $29,443.4 million by the end of 2023.

96% of people in Spain have internet access, and 73% are online shoppers. Their biggest incentives for shopping online are the diversity of products, better prices, viewing other people’s opinions, and convenience.

As mobile commerce is growing, Spanish customers are increasingly opting for mobile payments and buy now pay later (BNPL).

Italy

- Growth rate: 17.5%

- Popular product categories: Electronics, hobby and leisure, fashion, DIY, personal care, groceries

- Popular online marketplaces: Amazon, Apple, Zalando, Shein, Aliexpress, Esselungaacasa, Uniero, Mediaworld, Ikea

Another fast-growing market alongside Spain, Italy is growing thanks to the government’s investments in infrastructure to support it.

85% of the population has internet access. Out of them, 62% have bought goods or services online at some point, and the number of online shoppers is higher each year.

Italians love to shop from foreign companies. Chinese retailers like Shein are particularly trendy, followed by those from Germany and the UK. This makes Italy an attractive proposition for cross-border eCommerce.

Netherlands

- Growth rate: 5.3%

- Popular product categories: Electronics, fashion, groceries, hobby, DIY, furniture and homeware, personal care

- Popular online marketplaces: com, Coolblue.nl, Albert Heijn, Wehkamp.nl

The Netherlands eCommerce market is worth $23,936.0 million in 2023. It’s expected to grow by 5.3% annually and amount to $29,438.4 million by 2027.

This is a developed eCommerce market due to the country’s well-established internet structure. The internet penetration rate is 96%.

The Netherlands is the only EU country that legally requires online stores to allow consumers the option to pay at least 50% later.

Consumers are showing interest in sustainable delivery options, and online stores and carriers are increasingly meeting that demand. This trend increases the importance of transparency: how much carbon dioxide is emitted during transportation, are packaging materials recyclable, and so on.

Denmark

- Growth rate: 6.6%

- Popular product categories: Hobby and leisure, electronics, fashion, furniture, care products, DIY, groceries

- Popular online marketplaces: Zalando, Apple, Elgiganten, Microsoft, Amazon, H&M, Bilka, Harald Nyborg

Denmark’s market size in 2023 is valued at $17,026.9 million. Experts predict the market revenue will reach $22,014 million by 2027.

98% of the population is online, and 91% have bought goods or services online in 2021. Smartphones are on the rise, too. In fact, mobile payment has become so popular in Denmark that MobilePay and Apple Pay are now outranking debit and credit cards.

International transactions make up almost a quarter of total eCommerce transactions in the country. This makes Denmark a promising candidate for cross-border eCommerce.

Top European Online Marketplaces

Below are the websites that European consumers visit and shop on the most.

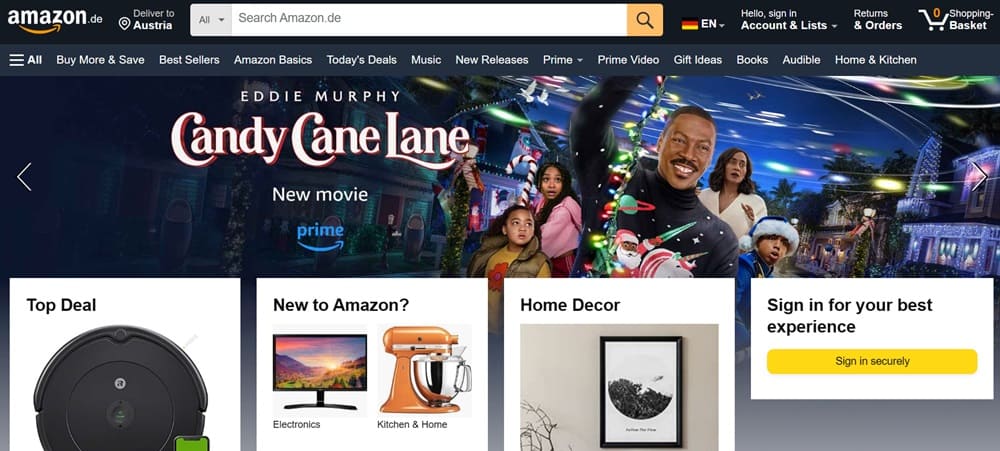

1. Amazon

By far the biggest share of Europe’s eCommerce goes to Amazon. Amazon was founded by Jeff Bezos in 1994.

This year, the platform has been visited by 1.3 billion people from Europe each month.

Amazon has localized websites in Germany, the UK, France, and Spain to name a few. According to data from 2020, Amazon’s European marketplace sells 2700+ products per minute.

Over 86,000 third-party vendors are active on the marketplace and generate $100,000+ in sales.

Amazon has items from all major categories and a vast range of brands. This leads many consumers to skip the Google search and look for desired products directly on Amazon.

Amazon’s tools and logistics like the European Fulfillment Network, Multi-Country Inventory (MCI), and Pan-European Fulfillment By Amazon give sellers easy access to customers across Europe and beyond.

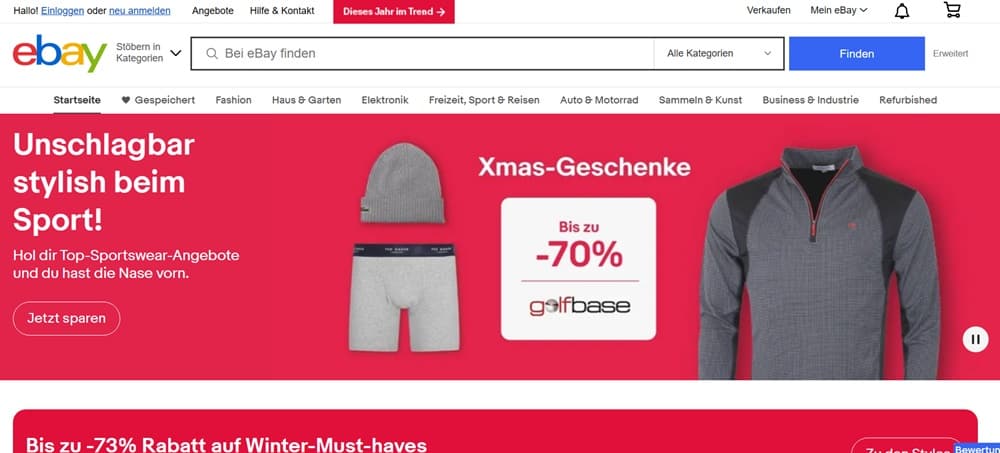

2. eBay

Founded in 1995 by Pierre Omidyar in California, eBay has evolved from a C2C auction site to a comprehensive marketplace.

In the company’s own words, “eBay means 147 million active buyers, 17 million sellers, and 190 markets worldwide.”

eBay is Europe’s second most-visited eCommerce marketplace with 474 million monthly visits. The majority of this traffic is from the UK, Germany, Italy, and Spain, but eBay reaches all corners of Europe.

Like Amazon, it’s another great option to get instant access to a large consumer audience.

Some popular product categories on this platform are clothing and accessories, health products, electronics, phones and chargers, and pet supplies.

3. Allegro

Allegro was founded by Kara Jorvig in 1999 in Poland, and to this day its focus is on national sales. This is obvious from the fact that it’s only available in Polish.

Nevertheless, Allegro ships to other European countries, including Austria, Bulgaria, Cyprus, Belgium, Croatia, Czech Republic, Estonia, and Denmark.

In fact, despite its apparent lack of internationalization, it’s still one of the largest European marketplaces, visited by 185 million people each month. Allegro generates revenue from more than 22 million customers each year.

Allegro’s product categories include fashion, home and garden, automotive, toys, electronics, health and beauty items.

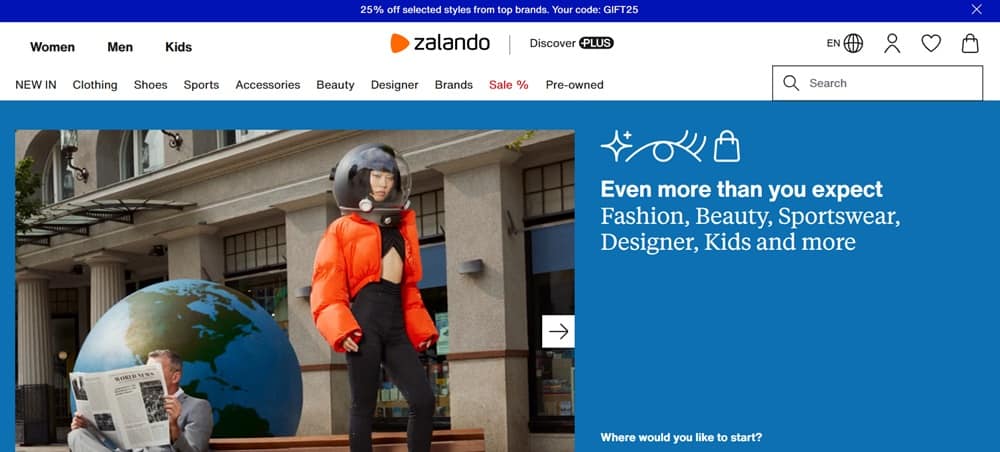

4. Zalando

Zalando is a German-based marketplace that sells clothing and shoes. It was founded in Berlin in 2008 by David Schneider and Robert Gentz. Originally, Zalando was a regular fashion retailer like H&M, selling its name products. It opened its marketplace to other brands in 2013.

Zalando is popular across Italy, Spain, France, and other parts of Europe. It is the number one fashion marketplace in the Netherlands, Poland, and Germany.

The platform is open to international vendors selling via its Partner Program, under two conditions:

- They must have an established online presence and an active Instagram account

- They must offer free shipping and a 100-day return period

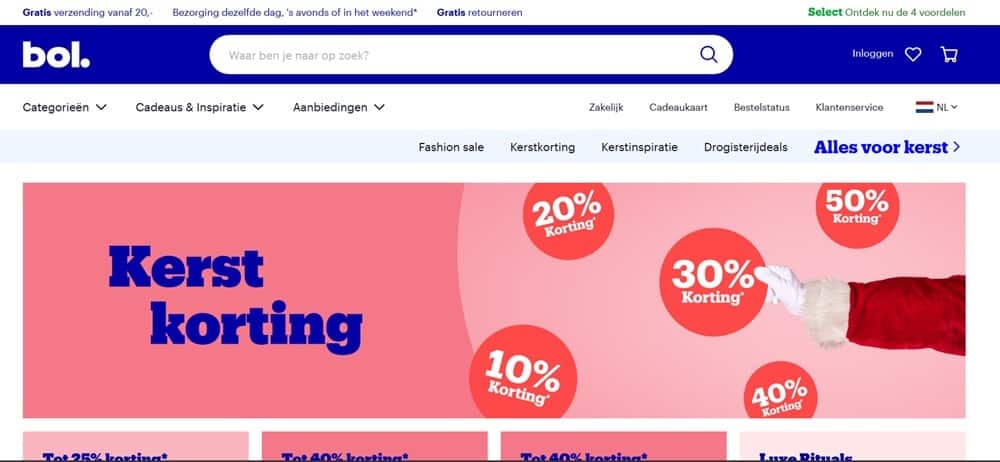

5. Bol.com

Bol.com is the number 1 online marketplace in the Netherlands, also prominent in Belgium. The Netherlands is a rare example where domestic companies dominate the eCommerce scene compared to global giants such as Amazon.

Bol.com belongs to the local food retail group Ahold Delhaize. It was founded in 1999 and launched its online marketplace in 2011.

Since Bol.com was quick to fill local demand before Amazon reached the country, Amazon and other online marketplaces haven’t been able to overtake this platform’s position.

Bol.com has 97 million monthly visits on average from the Netherlands alone. The company reported a net sales value of 5.5 billion euros (roughly $5.9 billion) in 2022.

The products sold on the platform include baby items, toys, health and lifestyle, sports, electronics, books, accessories, and jewelry.

Vendors can get started on the platform without paying any listing fees after being vetted with a questionnaire. However, Bol.com charges a commission for each sold product.

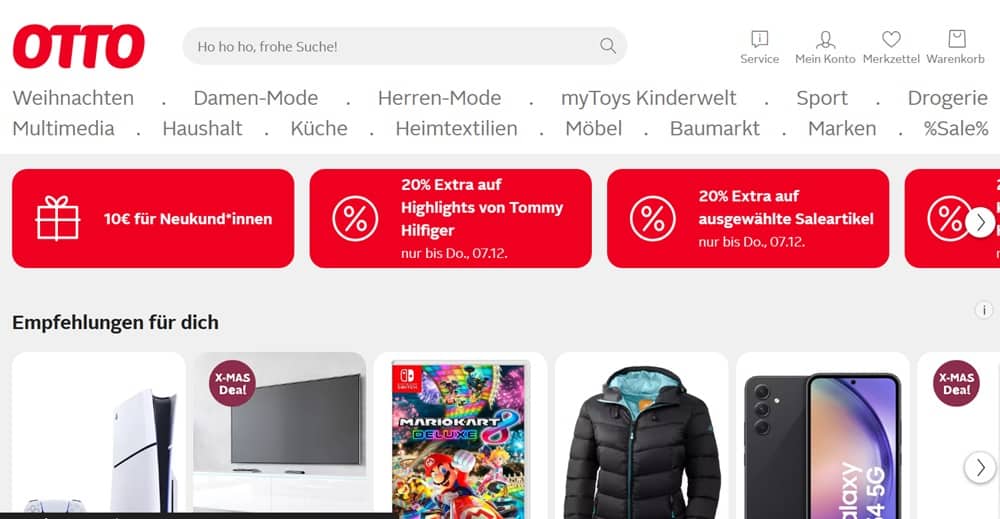

6. OTTO

Otto is German-based and one of the world’s largest eCommerce companies. In the fiscal year 2022/2023, it reached 4.5 billion euros (roughly $4.872 billion) in revenue.

It was founded in 1949 and specializes in home goods, fashion, sports, technology, garden, and DIY categories.

Otto focuses on German consumers. Therefore, international partners can only sell on the platform if they fulfill its criteria, such as:

- Having a German legal entity or company, and a German VAT identification number

- Providing German-speaking customer service

- Shipping from a German warehouse

- Following the minimum requirements for products

Besides Germany, Otto is available in Austria, Switzerland, the Netherlands, the UK, and Japan.

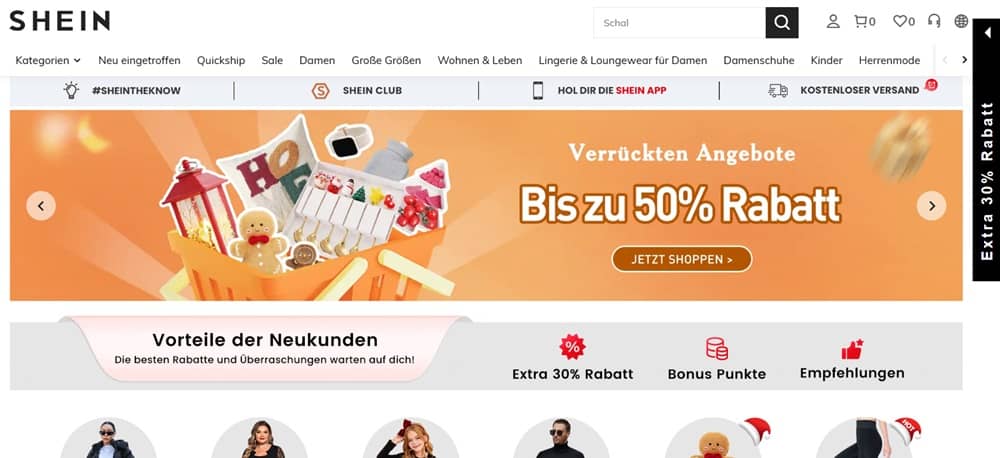

7. Shein

Shein is a fast fashion retailer company founded in 2008 by Chris Xu in China, originally named ZZKKO. It’s currently headquartered in Singapore.

The platform initially specialized in wedding dresses.

It later switched its focus on affordable clothes from a wide range of styles for men, women, and children. It now also sells accessories, makeup, homeware, cleaning products, and decor items and ships to more than 150 countries all over the globe.

Currently, Shein is the largest fashion retailer in the world with a $22.7 billion revenue in 2022 alone.

Shein is especially popular with Generation Z because it churns out thousands of new arrivals each day, jumps on the latest fashion trends, and always has deals and coupons available.

The company implements an in-app point engagement system that rewards customers for leaving reviews and comments by further reducing the cost of their future purchases.

Shein is one of the most visited online shopping websites in Europe. Its shares in this region are the highest in Spain (11.8%), Italy, and France (both 10.7%).

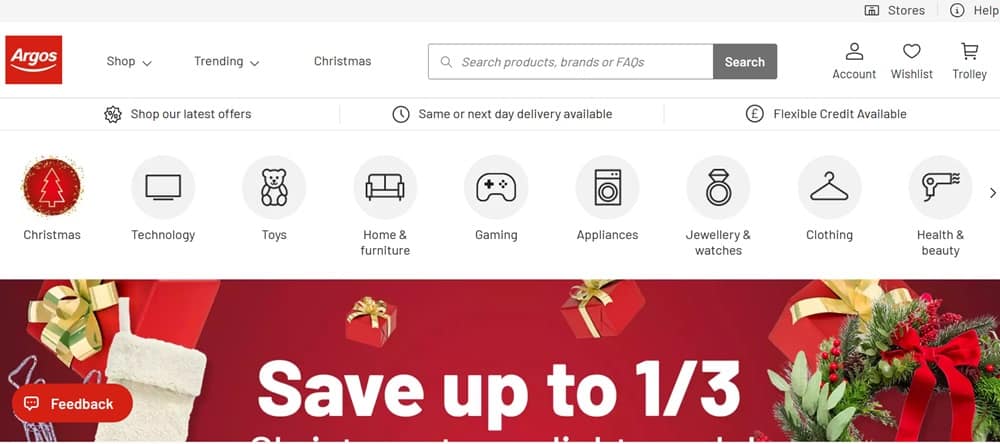

8. Argos

Argos was founded in 1972. Today it’s the third most prominent eCommerce website in the UK.

It’s owned by Sainsbury’s and works with Sainsbury’s Nectar card, the largest loyalty card system in the UK.

Argos fulfills most orders within a day because an estimated 96% of their customers live within 10 miles of a store.

Although it was once available in other European countries, Argos currently doesn’t ship internationally. It’s focused solely on its UK consumer base who value the convenience of same-day delivery and the special deals via collecting Nectar points.

Foreign businesses can become suppliers on the platform. However, the registration and approval process is a bit more complicated compared to becoming a seller on Amazon or eBay.

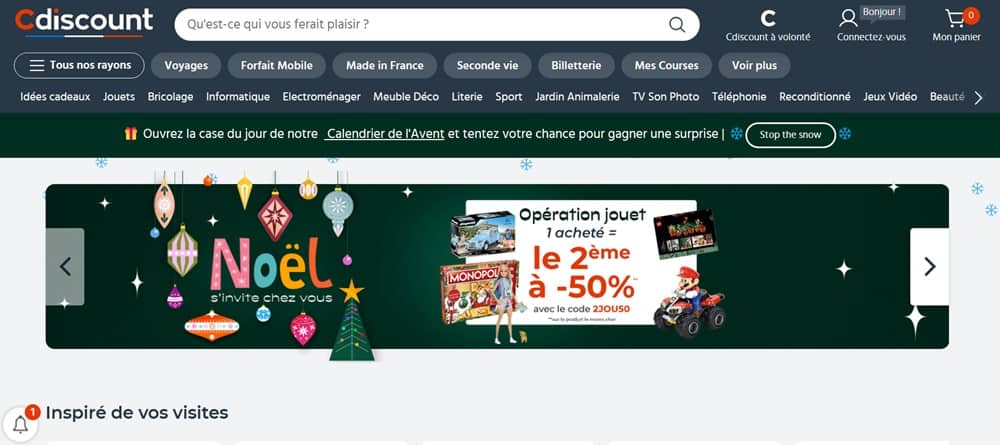

9. Cdiscount

The French discount retailer Cdiscount was founded by the Charle brothers in 1998.

Since 2018 it has expanded to Belgium, Germany, Spain, Italy, and Luxembourg, and its cross-border presence is steadily growing each year.

Cdiscount’s biggest selling point is its low prices. People can find deals even for expensive brands such as Apple or Gucci.

The platform sells new and used products across 40 different categories, including home appliances, hygiene and beauty products, clothing, technology, and more.

The most popular category is hobby and leisure.

In 2021, the platform reached 193 million euros ($208 million) in revenue.

Companies can join Cdiscount’s Partner Program. The only requirements are customer service in French, and registering with the French Register of Companies.

10. ASOS

One of the largest online-only fashion retailers on the globe and the leading apparel website in the UK.

The company was founded in 2000 in London. It sells women’s and men’s clothing, accessories, and shoes from its own and other brands. Thousands of new products are available each week to attract the platform’s target audience of young adults.

As of 2018, ASOS also has a mobile app.

The most interesting feature there is image-based search. Users can upload an image of clothing into this search and immediately receive similar or matching products from the platform’s stock.

The majority of customers now shop from ASOS via mobile.

In April 2023 alone, ASOS was visited 79 million times. Most of the traffic comes from the UK, but ASOS also has websites in the US, Europe, and Australia, and ships to over 140 countries worldwide.

Case Studies of Companies Successfully Expanding to Europe eCommerce

1 DrGL

DrGL is a Singaporean premium skincare brand. It was known for its innovative, high-quality products in its local market, but it didn’t have an established international presence before going to Europe.

The company’s goal was to expand to Germany, Italy, and the UK, and they partnered with Codedesign to help them navigate this process.

Codedesign ran comprehensive market research to uncover skincare trends in each target market. They also did competitor analysis to see where DrGL fits into the market.

DrGL then opened a store on Amazon’s international platform to reach millions of potential customers in the same place.

These are the tactics they used to succeed on Amazon:

- Amazon SEO to make the brand discoverable via Google

- Google Ads to drive customers to DrGL’s Amazon page

- Amazon PPC advertising to target the right consumers at the right time and benefit from Amazon’s algorithm

- Product description optimization to reflect key insights about the audience and benefits of DrGL skincare

- Encouraging customer reviews as social proof for future customers

- Email engagement campaign to keep customers up to date with new arrivals and skincare tips

The strategy was a success. DrGL established its brand name in all three target markets, built an engaged community, and saw a 700% increase in international sales.

2 Lululemon

Canadian athletic apparel brand Lululemon partnered with Zalando to break into the European eCommerce market.

Lululemon had physical stores in the UK, France, and Germany, where the locals showed increasing interest in an active lifestyle.

The partnership with Zalando was the logical next step. It allowed Lululemon to expand its reach before establishing a physical presence in other European countries.

Selling via the platform opened the door to millions of new customers from a total of 12 European countries, continuing the brand’s global growth.

Tips to Succeed in Selling in Europe

1. Carefully consider your partners

If you look at the European marketplaces we listed above, it’s clear that each website has certain assets to offer. The question is, what do you need?

If you’re targeting the UK specifically, selling on Argos alongside other marketplaces makes sense.

But if you want to focus all your attention on one marketplace, or have multiple interest groups in Europe, Amazon and eBay make better candidates.

Here are some ways good partners can give you a helping hand:

- With insights based on their local experience and expertise

- By helping you create a solid, efficient expansion plan that saves you money in the future

- By giving you access to an established, engaged audience and opportunities to gain their trust

- With logistics infrastructure to support your business

- With knowledge of local regulations to help you stay compliant

2. Take advantage of the similarities and differences between markets

Initially, you may want to expand to just one European country based on your target audience, product fit, or perhaps convenience.

Those are good starting points, but think further ahead: what can this decision mean for you later? Is there an option that will provide you easier access to other European eCommerce markets in the future?

One example of a contributing factor here is language. Imagine you decided to sell in Austria first and go to France next. You’d have to set up a localized website version and customer support for each country in their respective languages.

In contrast, if you started with Austria and proceeded to other German-speaking countries like Germany or Switzerland, you would extract more value from your language-based localization without spending more money.

Studying the differences and similarities between various markets helps to fine-tune your approach, elevate your chances of success, and map out the most efficient way to achieve it.

Here are some other examples you can use:

- Weather – your customers in Barcelona and in Copenhagen don’t experience winter the same way. If you are selling clothes to locations with contrasting climates, strategically pick what to offer where, especially for marketplaces that charge for each listing

- Delivery – see which services work across multiple countries, or which marketplaces ship to multiple countries on your expansion list for convenience and fast delivery

- Preferred payment options – if you want to avoid juggling too many payment methods, see which ones are shared between countries. PayPal is one of the safe bets in Europe

3. Accommodate local payment preferences

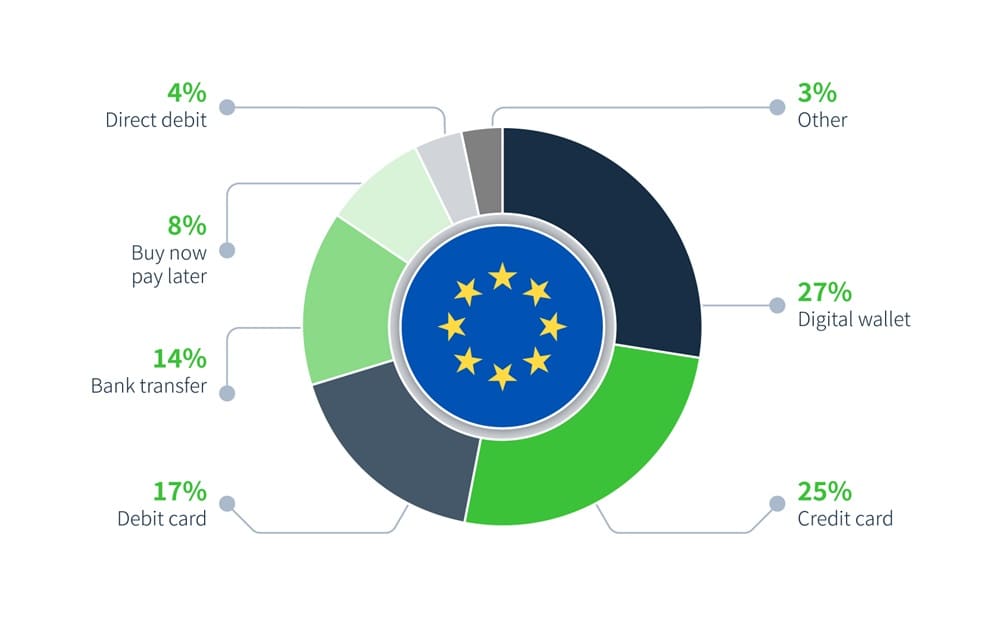

Here’s the breakdown of the most popular payment methods in Europe:

As a whole, Europe favors debit and credit cards, and digital wallets such as PayPal. However, it’s important to know the differences between the nations.

The Netherlands prefers their local iDEAL payments for online shopping. British consumers use a variety of mobile solutions like Apple Pay, Google Pay, and Samsung Pay, as well as Open Banking.

Italians also like keeping their payment options open.

Here are some reasons why payment localization is essential for business:

- It’s convenient and removes an obstacle in your customers’ journey

- Enforces the idea that the product is meant for them

- Shows that what matters to the customers, matters to you

- Provides price clarity, which removes unpleasant surprises at the checkout and aids in customers’ decision-making process

Most European eCommerce marketplaces accommodate multiple payment options. To do the same on your website, you can use a payment service that integrates a variety of European payment methods all in one place.

Summary On Europe eCommerce

With increasing internet and mobile penetration and a consumer base used to buying from foreign brands, Europe eCommerce is worth consideration.

You can pick individual countries to target based on your product fit and logistical solutions. Certain locations like Germany can give you a geographical advantage and make your way further into Europe easier.

Wherever you go, remember to localize. Contact KOMOJU to get all the local payment options sorted without adding more work to your plate.

We help businesses accept payments online.