We help businesses accept payments online.

With WebMoney, customers can enjoy the convenience of making purchases without divulging personal information, making it an appealing choice for younger customers or those without credit cards.

KOMOJU simplifies entering the Japanese market. Incorporating WebMoney into your eCommerce store with KOMOJU is a hassle-free experience for you and your customers. With WebMoney’s emphasis on user privacy and KOMOJU’s expertise in global payment solutions, you can navigate the complexities of the Japanese market.

WebMoney is a popular prepaid alternative payment method in Japan. It provides versatile payment options from online shopping websites and gaming portals to social networking sites, blogs, and community forums.

One of WebMoney’s key features is its emphasis on user privacy. Unlike many other payment methods, it requires little to no registration and offers high anonymity. This makes it particularly appealing to younger customers and individuals without credit cards.

This article introduces eCommerce businesses to the advantages and disadvantages of integrating WebMoney as a payment option through KOMOJU, a global payment gateway for merchants in Japan and beyond.

What is Webmoney?

WebMoney, developed by WebMoney Corporation in 1998 and issued by au Payment Co., Ltd., quickly gained popularity as a prepaid payment option in Japan. Initially introduced as an alternative to credit cards for online transactions, a partnership with MasterCard marked its expansion into the prepaid card market in 2014.

WebMoney issues prepaid tickets, prepaid cards, and gift cards. These come with a 16-digit alphanumeric code that can be used to make payments at online and offline merchants that accept WebMoney payments. WebMoney is accepted on most major platforms in Japan, including Google Play, Amazon, Yahoo Japan, Rakuten, and others.

Prepaid tickets and gift cards are usable as long as currency remains. Users can check their balance through the WebMoney website or WebMoney Wallet app. Prepaid Cards can be recharged or topped up as needed via convenience stores, credit cards, and some banks.

In Japan’s prepaid electronic money market, WebMoney faces competition from BitCash and other services like NET CASH and JCB Prepaid. However, WebMoney dominates a significant portion of the prepaid market. According to WebMoney’s official website, the total amount of user payments has surpassed ¥300 billion.

Types of WebMoney

WebMoney offers various options tailored to different needs. There are five types of WebMoney:

- Sheets (Tickets)

- WebMoney Gift Cards

- WebMoney Prepaid Cards

- au PAY Prepaid Card

- Exclusive Member Cards

Sheet (Ticket) Type

The sheet type, also known as tickets or vouchers, is issued at terminals installed in convenience stores. It features a 16-digit alphanumeric code and can be purchased in fixed amounts of ¥1,000, ¥2,000, ¥3,000, ¥5,000, and ¥10,000.

To purchase WebMoney tickets, users visit a terminal at a convenience store, locate a WebMoney application ticket, and complete the transaction at the register. Upon payment, users receive a 16-digit serial number with no expiration date.

Once issued, the prepaid number cannot be reloaded or reused after its balance is depleted. Each transaction will be deducted from the balance until it reaches zero. After the balance is depleted, the prepaid number cannot be used again.

WebMoney Gift

Like Amazon Gift cards and Google Play cards, WebMoney Gift cards are available at convenience stores and other outlets. They come in two types: the custom type, which allows customers to freely specify the purchase amount, and the fixed type, which has a predetermined amount.

WebMoney Prepaid Card

The WebMoney Prepaid Card is issued via the WebMoney Wallet app (SMS authentication required). There are two types of WebMoney prepaid cards:

WebMoney Prepaid Card: This rechargeable prepaid card can be used multiple times. It is supported by Mastercard and can be used at any physical or online store accepting Mastercard. There is no spending limit as long as money is on the card. This card requires identity verification for issuance, but there is no age limit for application, although minors need parental consent.

WebMoney Prepaid Card Lite: This prepaid card does not require identity verification and has a Mastercard limit of ¥100,000 per month. The user name on this card is “Webmoney User.” The Webmoney Lite card should work where Mastercard is accepted, but users may face restrictions.

au PAY Prepaid Card

With the au PAY Prepaid Card, users can earn one point for every ¥200 spent on shopping. These points can be used at Mastercard and WebMoney member stores. This option is appealing to users who often collect and use au points.

Exclusive Card Type for Member Stores

These WebMoney cards are limited to exclusive websites, primarily for game and music websites.

How WebMoney Works

Online payments with WebMoney are made by entering the 16-digit serial number at checkout. If the balance on a ticket or gift card isn’t sufficient to cover the payment, users can enter additional serial numbers to cover the remaining amount. If a prepaid card has insufficient funds, it must be topped up.

Web Money Wallet App

The WebMoney Wallet app is directly linked to the user’s WebMoney Prepaid Card or WebMoney Prepaid Card Lite. Although it previously served as a digital wallet for conveniently transferring unused balances from WebMoney tickets, this service was discontinued in 2020.

However, the app still offers a convenient feature allowing customers to scan QR codes at checkout for quick and easy payments.

The WebMoney Wallet app allows users to:

- Apply for a prepaid card and manage card details.

- Track spending history and check balance.

- Charge via ATMs and credit cards.

- Scan QR codes for payments and transfers.

- Transfer money between cards and withdraw cash.

- Temporarily lock the card, set a PIN, or request a reissue.

How to Make a Payment with WebMoney

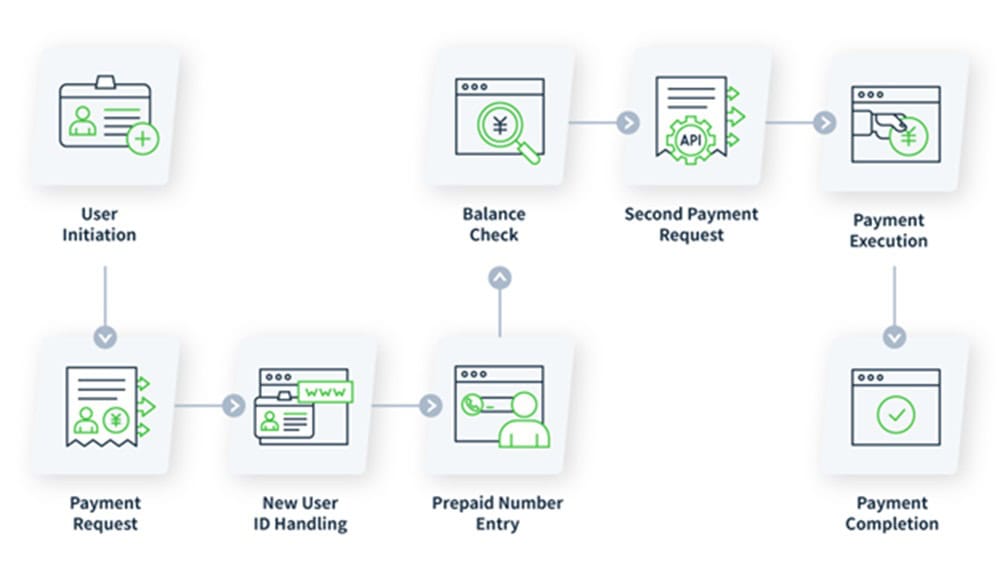

Here’s an explanation of the WebMoney payment flow for eCommerce transactions:

- User Initiation: When a user selects WebMoney as the payment method and clicks the purchase button, the merchant store’s system generates a unique user ID for the user and registers it within the store’s system.

- Payment Request: The merchant store’s system sends KOMOJU a payment request, including the user ID and the payment amount, to facilitate the transaction with WebMoney.

- New User ID Handling: If the user ID is new, WebMoney’s system returns a URL for the prepaid number input screen, and the merchant’s store redirects the user to this URL.

- Prepaid Number Entry: The user enters their prepaid number and user ID on the input screen. These details are linked and registered in WebMoney’s system.

- Balance Check: WebMoney checks if the balance on the prepaid number meets the requested payment amount. If the balance is sufficient, the user is redirected to a URL specified by the merchant.

- Second Payment Request: The merchant store’s system makes another payment request to WebMoney’s API via KOMOJU, continuing the transaction process.

- Payment Execution: WebMoney verifies the prepaid number linked to the user ID in its system, processes the payment, and returns a successful completion result.

- Payment Completion: Once the payment is processed, KOMOJU communicates the completion status to the merchant store’s system, redirecting the user to a payment completion screen.

For future transactions, WebMoney checks the stored user ID and prepaid number for subsequent payments or transactions. If the balance is sufficient, WebMoney returns a successful completion result. If the balance is insufficient, the user is redirected to the prepaid number input screen to enter a new “prepaid number”. The process then follows steps 4 through 8.

How to Make a Payment with WebMoney Wallet App

When paying with the WebMoney Wallet app:

- Select WebMoney as the payment method at the checkout.

- Launch the “WebMoney Wallet App” on your smartphone.

- Tap the barcode icon in the upper right corner of the screen for the card to be used.

- Use the app to scan the QR code displayed on the PC screen.

- If there is a sufficient balance, the payment will be automatically confirmed.

Benefits of Using WebMoney for Customers

For people who value privacy or do now own credit cards, WebMoney may be a preferred online payment method.

No Credit Card Required

WebMoney simplifies online payments, making them a breeze even for people without a credit card (E.g., teenagers). Unlike credit card applications, there’s no complex screening process for obtaining tickets and gift cards. Even acquiring the prepaid card lite only requires SMS verification.

High Anonymity

Because users do not need to submit personal information, WebMoney offers robust privacy and anonymity. This is particularly attractive to users who prioritize safeguarding their personal information.

Convenient Purchase Locations

WebMoney tickets and gift cards are conveniently stocked in convenience stores, electronic stores, supermarkets, and drug stores. This widespread availability ensures easy access, allowing users to purchase them whenever necessary.

Benefits of Using WebMoney for Merchants

Integrating WebMoney as a payment option offers merchants advantages worth exploring.

Potential Sales Growth

As a prepaid payment method, WebMoney appeals to people without credit cards or who are weary of information sharing. Offering WebMoney as an alternative payment method on your site could reach new demographics.

One of WebMoney’s notable features is its accessibility to users of all ages. With minimal identity verification requirements, except for the WebMoney PrePaid Card by MasterCard, it can be easily obtained, even by junior high school students.

Reduced Risk of Payment Non-Receipt

Since WebMoney operates as a prepayment system, payments are made in advance, mitigating the risk of non-received payments. This assures merchants that funds are available and secured before providing goods or services. Unlike credit cards, where there is a non-receipt risk due to customer bank balance issues or transaction errors, prepayment systems like WebMoney offer merchants a more secure payment process.

Considerations

There are some things to consider before using WebMoney as a consumer:

- No Deferred Payments: With WebMoney, users must pre-charge or pre-purchase, meaning they can’t pay later. This may result in unused points.

- Limited Usage of Tickets: Webmoney tickets can only be used at WebMoney member stores, limiting utility.

- Risk of Erased Numbers: WebMoney cards can easily be erased, especially if they are torn or wet. Careful management is necessary.

- Phishing Risks: Users are vulnerable to phishing scams. Protecting serial codes is crucial, as anyone with the code can use it.

Integrating Webmoney with Your Online Store

Integrating WebMoney directly by signing a contract with au Payment Co., Ltd. requires liaising directly with the au sales team. This method demands a solid understanding of Japanese language, culture, and business practices. Moreover, au Payment Co., Ltd. only accepts contracts with corporate customers.

However, utilizing KOMOJU simplifies the process. The KOMOJU platform seamlessly incorporates WebMoney and other popular payment options in Japan, such as PayPay and Konbini Payment. Their team assists in overcoming language barriers and guides you through the integration process, making it hassle-free.

Note that au Payment Co., Ltd. will not allow WebMoney on:

- Adult sites

- Dating sites

- Gambling sites

- RMT-related sites

- Sites that infringe copyright, etc.

Summary

WebMoney, a popular prepaid payment method in Japan, allows for versatile payment options across various platforms. Integrating WebMoney with your online store can offer several benefits. Notably, it emphasizes user privacy, requiring minimal registration and offering high anonymity, which appeals to customers who value safeguarding personal information.

The benefits of using WebMoney for customers include having no credit card requirement, high anonymity, and convenient purchase locations, making it accessible to a broader demographic, including teenagers and those without credit cards. For merchants, integrating WebMoney can potentially lead to increased sales, reaching new customer segments, and reduced risks of non-receipt payments due to its prepayment system.

To introduce WebMoney, KOMOJU simplifies the process, integrating WebMoney and many other payment options into your store while assisting with language barriers. Once set up, KOMOJU handles the payment collection, allowing merchants to focus on their business.

FAQ

No, WebMoney is currently only available in Japanese. Limited support or translations might be available in other languages, but the platform’s primary language is Japanese. However, KOMOJU will guide merchants through the application process.

The digital wallet service associated with WebMoney was discontinued in 2020. However, the WebMoney Wallet app is an extension of the WebMoney Prepaid Card rather than a standalone digital wallet. Users can make QR payments via the app and manage their prepaid card details, top-up points, and cash withdrawals.

WebMoney implements various security measures to protect user accounts and transactions, especially for the WebMoney Prepaid Card. However, users should remain vigilant against phishing scams, as individuals with access to the serial code can exploit it. Users must protect their serial codes and be cautious when sharing them to prevent unauthorized use.WebMoney can typically be used wherever MasterCard is accepted. However, as it is based in Japan, you may encounter restrictions on international stores.

We help businesses accept payments online.