We help businesses accept payments online.

Japan’s eCommerce market is expected to reach $190.53 billion in 2025, making it one of the most lucrative digital economies in the world. To succeed in this market, businesses must offer fast, secure, and localized payment options that align with consumer preferences.

Japanese shoppers expect a frictionless checkout experience, and their payment preferences are diverse. While credit cards account for 63% of online transactions, many consumers also rely on convenience store payments (Konbini pay), bank transfers, and mobile payments like PayPay and Rakuten Pay. A rigid or incomplete payment strategy can lead to failed transactions, cart abandonment, and lost revenue, especially in a market where shoppers are less likely to retry a failed payment and switch to a competitor.

But how can you tell what’s working and what’s costing you sales? Are certain payment methods leading to more abandoned carts? Are failed transactions stopping customers from completing their purchases?

This is where payment analytics comes in. KOMOJU provides real-time insights into transaction success rates, payment trends, and fraud detection for payments processed by KOMOJU. By leveraging this data, merchants can pinpoint weak spots in their payment process, streamline checkout, and capture more completed transactions—without losing customers to avoidable failures.

What Is Payment Analytics?

Payment analytics uses data-driven tools to track and analyze transaction trends, helping businesses optimize payment processes, reduce failures, detect fraud, and enhance the customer experience.

Traditionally, businesses relied on manual financial reports and spreadsheets to assess payment performance—an approach that is time-consuming and prone to errors. Modern payment analytics tools automate this process, collecting real-time data from payment gateways, merchant dashboards, and financial platforms.

Some payment service processors, like KOMOJU, offer integrated analytics, enabling businesses to track transaction data, including payment method trends and failure rates, within their dashboards. By leveraging these tools, merchants gain actionable insights to refine payment strategies, optimize checkout experiences, and increase transaction success rates.

How Payment Analytics Works

Payment analytics track and analyze transaction data to uncover information such as which payment methods customers prefer and where revenue is lost. Instead of relying on guesswork, businesses can use this data to identify trends, prevent fraud, and improve approval rates in real time.

For example, if a business notices an increase in declined payments due to expired cards, it can send automated renewal reminders before customers’ payment details become invalid. If a high number of transactions are failing due to bank rejections, companies can test alternative payment routes or adjust retry settings to increase success rates.

Beyond payment failures, analytics can also detect unusual spending patterns that signal fraud. Visa’s AI-driven fraud detection identified 54% of fraudulent transactions that previously bypassed security filters. Similarly, Worldpay and Capital One reduced false positive declines by 40% by integrating machine learning and real-time data sharing, striking a balance between security and transaction approvals.

Subscription-based businesses also rely on payment analytics to track recurring payment failures. For example, a streaming service that notices a spike in failed auto-renewals due to insufficient funds can implement grace periods or delayed retries to give customers time to add funds before their subscription is canceled.

Ultimately, payment analytics use AI-driven tools to track transaction data, identify failed payments, reduce lost revenue, and improve the checkout experience.

Key Metrics in Payment Analytics

There are numerous metrics a business can track with the right payment analytics tool. Including:

- Transaction Approval Rate: Track the percentage of successful payments to identify issues and optimize payment flows.

- Payment Method Preferences: Track which payment options customers use most (credit cards, Konbini, digital wallets) to tailor offerings to their preferences.

- Chargebacks & Fraud Detection: Monitor chargebacks and fraudulent transactions to detect patterns, reduce losses, and strengthen security measures.

- Cart Abandonment Rate: Measure how often customers abandon their carts. A high rate may indicate friction in the process or missing payment options.

- Payment Decline Reasons: Identify why transactions fail (e.g., insufficient funds, expired cards, fraud flags) to lower decline rates and improve approval rates.

- Average Transaction Value (ATV): Track the average spend per transaction to assess customer behavior and adjust pricing or promotions.

- Refund & Dispute Rate: Measure the frequency of refunds and disputes to uncover potential product issues, unclear policies, or fraud risks.

- Recurring Payment Success Rate: Monitor subscription renewal success to improve retention and billing strategies.

- Settlement Time: Track how long it takes for funds to be processed and deposited.

- Cross-Border Payment Success Rate: Measure the success rate of international transactions to optimize payment routing and reduce failures in different markets.

Why Payment Analytics Matter in Japan

Japan’s eCommerce market presents unique challenges due to its diverse payment landscape and consumer habits. Credit cards dominate, but many consumers still prefer cash-based methods like Konbini payments and bank transfers. Digital wallets like PayPay and Rakuten Pay are growing and are supported by government cashless initiatives. Prepaid cards also serve a niche, especially among minors, for digital purchases. With these varied preferences, businesses need data-driven insights to optimize their payment options and checkout experience.

A key challenge is cart abandonment due to limited payment choices. Recent data from 2024 suggest that two in every three desktop shopping carts are abandoned. Japanese consumers expect their preferred methods, and if one isn’t available, they are more likely to abandon the purchase than switch methods. Konbini payments add another layer of complexity, as many customers select this option but fail to complete the transaction. Payment analytics helps businesses track these drop-offs, send reminders, and recover lost revenue.

Beyond checkout optimization, payment analytics helps balance fraud prevention with approval rates. Strict fraud filters can lead to false declines, frustrating customers and cutting into sales. By analyzing transaction data, businesses can adjust fraud settings to reduce declines while maintaining security.

For international merchants entering Japan, tracking cross-border payment failures helps identify and fix issues with currency conversions, fraud checks, or payment gateways.

Common Challenges Without Payment Analytics in Japan

Without payment analytics, businesses in Japan face several issues that can lead to lost sales, poor customer experience, and operational inefficiencies. Given the country’s diverse payment preferences and low tolerance for transaction failures, tracking payment data is essential for maintaining smooth operations.

High Cart Abandonment Rates

Japanese shoppers expect familiar and preferred payment methods at checkout. If an option isn’t available, they are more likely to abandon their purchase rather than switch methods. Konbini payments introduce additional risk, as many customers select this method but fail to complete the payment before expiration. According to PYMNTS.com, merchants in the Asia-Pacific (APAC) region who fail to offer localized payment options experience a 60% or higher loss in sales due to cart abandonment.

Low Retry Rates on Failed Transactions

Japanese consumers are less likely to retry a failed payment than in other markets. One study found that 25% of shoppers in Japan would abandon their purchase if their preferred payment method wasn’t available, while only 48.7% would try an alternative. Moreover, with one of the highest cart abandonment rates globally, at 89%, failed transactions are a major contributor to lost sales.

Without analytics, businesses lack visibility into why payments fail, whether due to expired cards, insufficient funds, or fraud triggers. This makes it difficult to identify patterns and optimize retry strategies. Since payment preferences strongly influence purchasing decisions, failing to analyze transaction failures can lead to permanent customer loss and reduced conversion rates.

Missed Opportunities

Digital wallets like PayPay and Rakuten Pay are expanding rapidly in Japan, but adoption varies by age group, region, and industry. The Japanese mobile payments market was valued at $173 billion in 2023 and is projected to reach $1,463 billion by 2031.

However, Japan remains a fragmented market where multiple payment methods coexist, making it critical for businesses to track which payment options their customers prefer to optimize checkout experiences. Payment apps like Rakuten Pay are expected to see a 33% increase in users in 2025 compared to 2020, and PayPay accounts for nearly half of QR code payments in Japan.

Without analytics, businesses lack the visibility needed to track these shifting preferences, making it harder to prioritize the right payment options. Thus, companies can identify which methods resonate with their audience and adjust their offerings.

Inefficient Fraud Prevention

In 2024, fraud cases rose by 24.6% year-over-year in Japan, totaling 57,324 incidents, with damages reaching ¥307.5 billion—an 89.1% increase. Special fraud cases also saw a 10.2% rise, disproportionately affecting elderly individuals, who made up nearly 80% of victims.

With fraud on the rise, strict payment security measures are more important than ever. However, overly aggressive fraud filters can lead to false declines, rejecting legitimate transactions and frustrating customers.

Without payment analytics, businesses struggle to differentiate between real fraud and false positives, leading to unnecessary revenue loss and customer dissatisfaction. Analyzing fraud patterns allows businesses to fine-tune their fraud detection settings, reducing risk while maintaining a seamless payment experience.

Cross-Border Payment Challenges

Many Japanese eCommerce businesses sell internationally, but cross-border transactions often face higher failure rates due to currency conversions, fraud screening, and gateway issues. A lack of information on sales destinations has been identified as one of the biggest challenges for Japanese eCommerce businesses, making it harder to optimize payment strategies for different regions.

Moreover, strict financial regulations and compliance requirements, such as Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols, add further complexity to cross-border payments (Renub Research).

Without payment analytics, businesses struggle to pinpoint why international payments fail, whether due to regulatory blocks, incorrect payment routing, or high decline rates from foreign banks. By tracking transaction data and failure patterns, businesses can adjust fraud settings, optimize payment routing, and ensure compliance with international regulations.

How KOMOJU Supports Merchants with Analytics

Real-Time Payment Insights

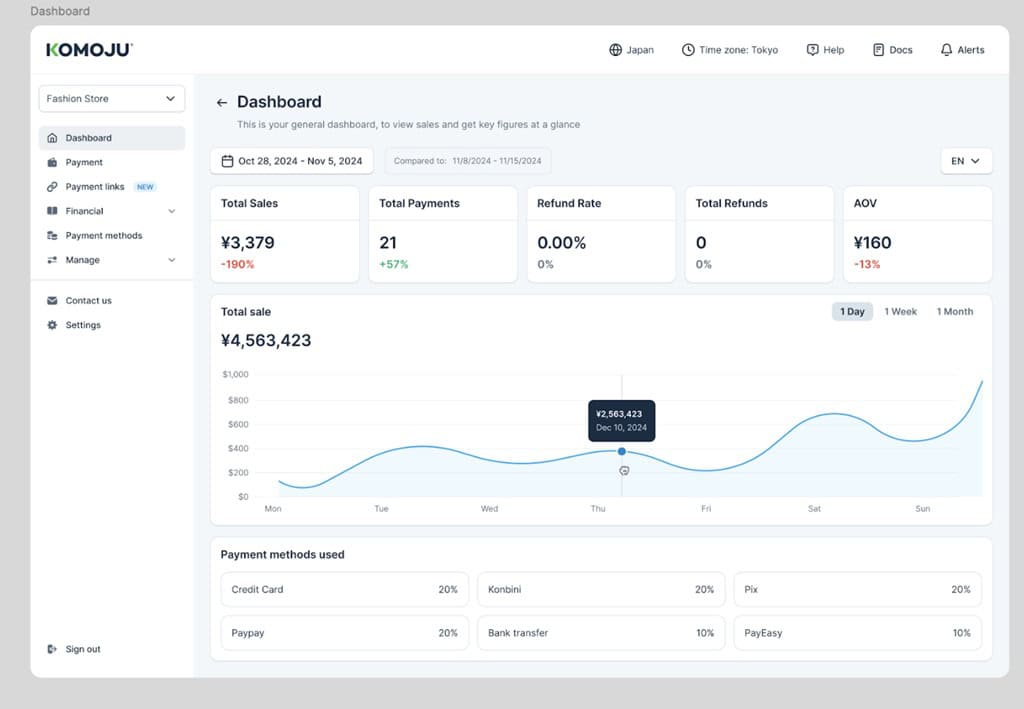

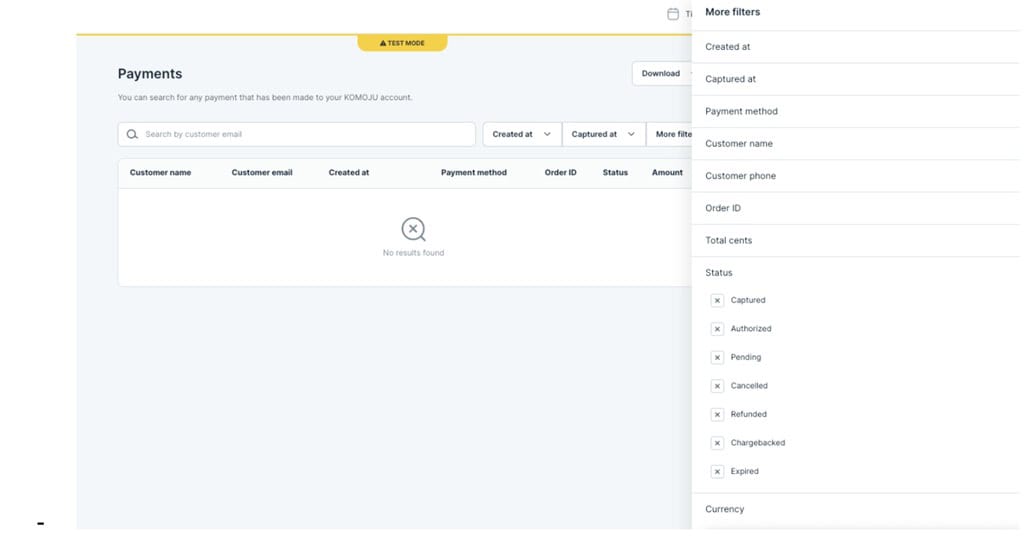

Once a payment is processed, the transaction details are immediately updated and displayed in real-time on the KOMOJU Dashboard.

Preferred Payment Methods

KOMOJU’s homepage offers a simple yet comprehensive visual breakdown of the percentage of total sales for each payment method, helping you identify your store’s most popular options.

Easy Integration

Once you sign up for KOMOJU, the KOMOJU Dashboard is immediately available. To get started, simply follow three easy steps. Onboarding is seamless for solutions like Shopify, Wix, Salesforce Commerce Cloud, and other popular eCommerce platforms.

Summary

Japan’s eCommerce market is projected to reach $190.53 billion in 2025, but businesses lose significant revenue due to payment failures and abandoned transactions. Payment analytics helps merchants track approval rates, identify why transactions fail, and adjust their checkout process to reduce drop-offs. In Japan, where consumers are less likely to retry a failed payment, understanding these patterns is critical.

By analyzing payment data, businesses can see which payment methods lead to the most completed transactions, detect fraud risks without blocking legitimate purchases, and optimize cross-border payments. Without this data, merchants risk losing customers to preventable failures.

KOMOJU offers merchants real-time insights into transaction trends, helping businesses fix issues before they impact revenue. With tools to track failures, fraud, and customer behavior, KOMOJU helps merchants improve payment success rates in the Japanese market.

FAQ

Below are frequently asked questions about payment analytics in Japan.

Japanese consumers prefer a mix of payment options—credit cards, konbini payments, bank transfers, mobile billing, and digital wallets—and failing to offer the right options can lead to lost sales. Moreover, businesses risk permanently losing customers if transactions don’t go smoothly.

Payment analytics helps track which methods customers use, identify why payments fail, and optimize checkout to reduce friction. It also improves fraud detection without increasing false declines, ensuring more transactions are approved while keeping security intact.

Payment failures in Japan occur for various reasons, including fraud prevention measures, insufficient funds, and authentication issues. Some of the most common reasons for payment failures include:

- Bank or Card Issuer Declines Due to Suspected Fraud: Strict fraud filters may block legitimate transactions, especially for high-value or international purchases.

- Insufficient Funds: Payments are immediately declined if the user’s balance is too low or their credit card limit has been reached.

- 3D Secure Authentication Failures: Some transactions require verification via SMS or a banking app, and if this step is missed, the payment is declined.

- Issues with International Payments: Some Japanese credit and debit cards aren’t enabled for international use by default, requiring manual activation.

- Slow Adoption: Japan’s shift to digital payments has been slow among the elderly, with only 13% using mobile payments monthly due to trust issues and complex interfaces. This lack of familiarity leads to higher payment failures, often from data entry errors and authentication issues.

Cart abandonment in Japan happens due to limited payment options, checkout friction, and failed transactions. Many shoppers prefer specific methods, abandoning their purchase if their preferred option isn’t available. Failed transactions from expired cards or fraud triggers also lead to lost sales, as Japanese consumers are less likely to retry a declined payment.

Businesses can reduce abandonment by offering:

- Offering the Right Payment Methods: Providing popular options like credit cards, konbini payments, and mobile wallets to match customer preferences.

- Simplifying Checkout: Reducing form fields, enabling guest checkout, and using auto-fill for faster transactions.

- Tracking and Fixing Payment Failures: Identifying common decline reasons and optimizing retry strategies.

- Optimizing for Mobile Payments: Ensuring a fast, mobile-friendly checkout that supports mobile payments.

- Minimizing False Declines: Adjusting fraud settings to prevent blocking legitimate transactions.

- Recovering Abandoned Carts: Sending automated reminders or incentives to encourage purchase completion.

- Using Payment Analytics: Tracking transaction trends and abandonment patterns to refine checkout.

Payment analytics help businesses understand customer behavior and streamline operations. By studying payment trends, businesses can see which payment methods customers prefer, adjust pricing based on demand, and cut unnecessary transaction costs. These adjustments lead to higher revenue and a better customer experience.

Possible benefits of payment analytics include:

- Pricing Strategies: Adjust prices dynamically based on demand patterns to maximize revenue.

- Personalized Marketing: Tailor promotions to individual customer preferences identified through their payment behaviors.

- Identify Fraudulent Activities: Detect unusual transaction patterns to prevent fraud and reduce chargebacks.

- Customer Retention: Recognize loyal customers and offer targeted incentives to encourage repeat business.

- Improve Cash Flow Management: Analyze payment cycles to better forecast revenues and manage operational expenses.

We help businesses accept payments online.