We help businesses accept payments online.

Japan is considered the heart of video gaming—the birthplace of Nintendo, Sony, and thousands of studios that shape global tastes. It is also the world’s third-largest video-gaming market, on track to generate $24.7 billion USD in 2025. Behind that headline figure are about 55.5 million video gamers in Japan, meaning, the average player will spend hundreds of dollars annually on in-game downloads, micro‑transactions, downloadable game content, and associated purchases.

But video games in Japan extend far beyond consoles and handhelds. Nearly four in five, or about 78.6%, of Japanese people now own a smartphone, and mobile gaming plays a massive role in the market. Surveys suggest that half of smartphone users in Japan play video games on their devices, and they lead the world for in-game purchases per capita, spending about 50% more than next ranked South Korea and the USA.

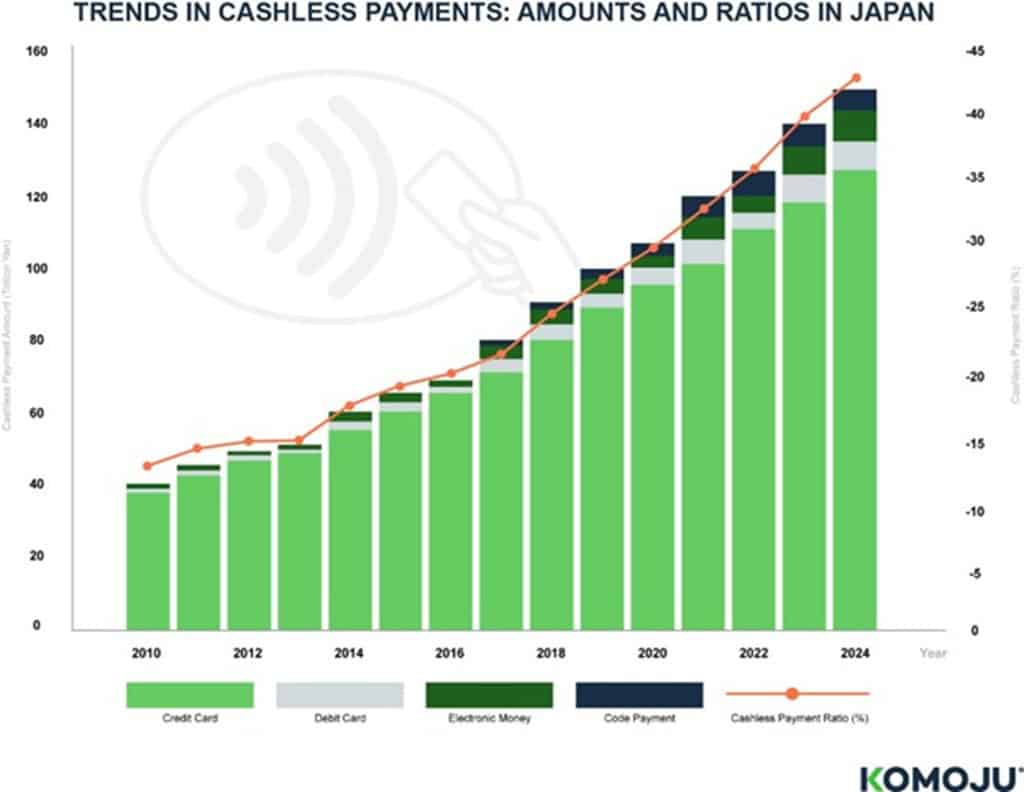

As mobile access grows, so does digital spending. A Ministry of Economy, Trade and Industry study showed that by 2024, 42.% of all consumer spending in Japan was cashless, surpassing the government’s 40% target a full year ahead. Electronic money and QR-code payments* have rapidly grown to 15% of all cashless transactions, and the government now considers payment apps as essential to Japan’s “Cashless Vision” strategy.

As with the broader economy, Japan’s video game economy is racing toward a cashless future, and local payment preferences are evolving just as quickly. This article explores the trends shaping how players pay in 2025 and beyond, from mobile wallets to the continued relevance of convenience store payments (Konbini payments) and prepaid cards. For online businesses, understanding how players pay is key to succeeding in Japan’s digital market.

KOMOJU is a payment gateway that enables businesses to accept multiple payment methods, allowing businesses to seamlessly integrate Japan’s most trusted local payment methods. As the video game industry grows, sellers equipped with the right tools will be best positioned to convert players into loyal customers.

Payment Trends in Japan’s Video Game Market

As Japan continues its digital transformation, the way players pay is also rapidly evolving. Mobile-first behaviors, regulatory changes, and evolving consumer expectations are reshaping checkout preferences, especially for the younger generation. Here are seven trends shaping payment behaviours in 2025 and beyond.

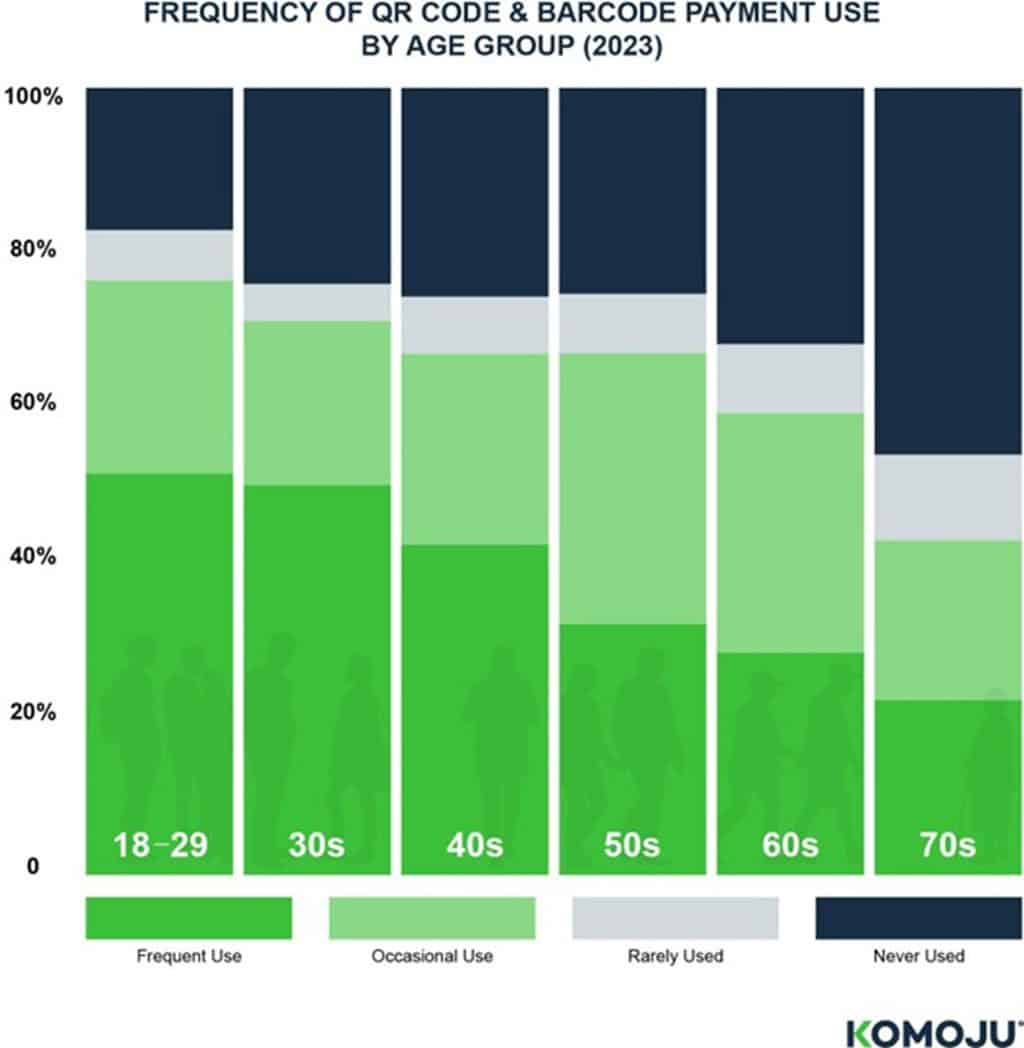

Mobile Wallets Overtake Credit Cards for Players Under 30

While cashless payments are growing steadily across Japan’s economy, credit cards are slowly losing their dominance. At the same time, digital wallets—especially QR-code-based services* like PayPay—are on the rise. In 2023, QR payments* were used frequently by nearly 50% of all people in the 18–40 age group, and a record 68% of the population reported using a QR wallet*. As highlighted by recent NIRA research, QR payments* are already the top choice among younger demographics and are steadily gaining traction across all age groups.

Japan has long been at the forefront of in-app mobile game payments, but regulatory changes in 2024 (see Trend 4 below) have paved the way for digital wallets to gain ground. PayPay, as the nation’s leading digital wallet, has quickly established itself as the top choice among male video gamers in their teens and twenties and female video gamers up to their 50s. On the other hand, credit cards were preferred only by men over 30 and women over 60.

Rejecting mobile wallet payment options risks alienating mobile-first, under-30 players, a group that drives a significant share of microtransaction revenue. Consider the spending data:

- Japanese players of university age spend an average of ¥7,787 (about $52 USD) per month on in-game content.

- While teenagers, 15–19) spend an average of ¥2,649 (about $17.50 USD) a month.

These players should not be overlooked, especially considering the unfulfilled potential in this market segment that has had consistent year-on-year growth.

To effectively reach and convert this core audience, offering mobile and QR-code payments is no longer optional—it is essential.

PayPay Is Becoming the Default Checkout Experience

Building on this trend toward mobile payments, it’s important to note just how widespread PayPay has become. It is practically part of Japan’s financial infrastructure. As of mid-2025, PayPay has more than 70 million users and processed more than 7.46 billion transactions in 2024, making it Japan’s most-used cashless payment service. That accounts for roughly one in every five cashless payments nationwide, with use cases spanning online stores, mobile apps, restaurants, public transport, vending machines, and more.

PayPay’s dominance is reinforced by how deeply embedded it is in Japan’s digital economy:

- It comes pre-installed on SoftBank and Y!mobile smartphones.

- It offers integrated reward points and rotating cashback campaigns that encourage regular use.

- It supports everything from peer-to-peer payments to bill payments, event tickets, and online shopping.

In the video game space, PayPay regularly appears in promotions on platforms like Yahoo! Shopping, Amazon Japan, and DMM. Game codes, in-game currency, and memberships are often eligible for extra points or cashback if paid via PayPay. This has conditioned younger consumers to prefer PayPay when spending online. In fact, PayPay accounts for nearly half of all QR-code transactions.

For online business the implications are clear: integrating PayPay directly boosts conversions by tapping into a trusted, incentivized behavior loop. Failing to support PayPay can signal that your store is incomplete or unreliable to Japanese users. Familiarity and trust at checkout are deciding factors, especially in competitive product categories like digital content and mobile games.

BNPL Services For Big Purchases

Buy Now, Pay Later (BNPL) services like Paidy are seeing increased adoption across the Japanese economy, including digital content. Once used mostly for physical goods or fashion, BNPL is now being used to buy new hardware, video game subscriptions, and high-value in-game purchases, giving younger players a way to manage spending without a credit card.

According to Research and Markets, Japan’s BNPL market is projected to reach $20.1 billion USD in 2025 and grow to over $58 billion USD by 2030. This shift is especially relevant for players in their 20s, who make frequent in-game purchases but often have limited access to credit. BNPL is also compatible with Konbini payments, allowing users to settle balances in cash, which is a perfect match for Japan’s hybrid digital/cash habits.

BNPL can turn hesitation into action. In a market where younger players prefer flexible, no-commitment payment options, BNPL meets that need without requiring a credit card. It helps remove the most significant barrier to higher-value digital purchases—timing—ensuring purchases happen when customers want them, not when their budget allows.

Developers Gain Freedom with External Payments

In late 2024, Japan passed the Smartphone Software Competition Promotion Act, a landmark regulation that prohibits companies like Apple and Google from forcing developers to use their in-app payment systems exclusively.

For publishers and developers, this is an opportunity to:

- Avoid high platform commission fees

- Offer players more competitive pricing

- Use local, trusted, and more familiar payment options.

Under the new law, developers can now redirect users to external payment pages, where purchases can be completed via PayPay, Konbini, or other local methods, without paying platform commission fees.

While launching through major platforms can be a smart way to gain visibility, external checkout options give you complete control over pricing, promotions, and user experience. You set the terms, manage your margins, and deliver a payment flow designed for Japanese players.

Japan’s Next-Gen Payment Vision

Japan is showcasing biometric face-recognition payments at Expo 2025 in Osaka. The system allows visitors to pay hands-free after registering their facial data and funding source in the event’s digital wallet. More than a novelty, this real-world use case is part of a nation-wide initiative to modernize the country’s retail payment systems and reduce reliance on cash and physical cards. The expo itself is a testing ground for a potential rollout of a digital currency in Japan.

The Japanese government is also testing the feasibility of a central bank digital currency (CBDC). While no formal decision has been made, the Bank of Japan is actively working with private firms through a CBDC Forum and continues to study practical use cases for a potential digital yen.

Together, these initiatives signal where Japan’s payment infrastructure is heading: faster, more secure, and less device-dependent methods of authentication and settlement. Payment expectations are shifting quickly, and businesses face a stark choice: modernize checkout experiences now, or risk obsolescence in Japan’s hyper-competitive digital marketplace.

Konbini Payments Remain a Valuable Checkout Option

Even as Japan shifts toward mobile wallets and QR-code payments, Konbini (convenience store) payments remain widely used, especially for younger users, privacy-conscious customers, and those without credit cards. There are over 58,000 convenience stores across Japan, which means Konbini payments offer unmatched accessibility for digital purchases.

In the video game space, this method is still heavily used for purchasing in-game content, particularly among teens and students who may not have access to other forms of payment. According to Forbes Japan, Konbini payments account for 18% of Japan’s nearly $167 billion USD in annual B2C eCommerce payment volume.

Even major platforms like Nintendo, PlayStation, and DMM continue to support Konbini checkout, and shoppers in Japan expect it to be available. Merchants who skip a Konbini payment option risk losing sales at checkout, while those who offer it gain broader reach.

Prepaid Cards Still Matter, Especially for Younger Video Gamers

Likewise, prepaid payment remains a key part of Japan’s digital economy, especially in relation to video games. According to a report by Spherical Insights, Japan’s prepaid card market is valued at $105.63 billion USD and is expected to grow at a CAGR of 19.4% through 2032. This payment category includes physical and digital cards, gift cards, and top-up systems commonly used for game platforms and in-app content.

Younger users, particularly teens, use prepaid cards to purchase content that typically requires a credit card. Branded prepaid cards for popular platforms like Fortnite, Nintendo, Steam, and Roblox are widely available at convenience stores across Japan. Some mobile wallet services, including PayPay and Rakuten Pay, also support prepaid balances, offering users the ability to combine cashless convenience with spending limits.

For merchants, supporting prepaid transactions can increase sales among younger or unbanked users, specifically during holidays, gift seasons, or campaign promotions—when demand for prepaid solutions spike.

How Steam Localized its Way to Success in Japan

Steam is the world’s largest PC gaming platform, and has quickly become the dominant PC-gaming platform in Japan. As the domestic PC game market surged from ¥82.2 billion in 2019 to over ¥236 billion in 2023, Steam’s Japanese user base grew in parallel—up 60% since 2019, and by 2025 has reached 1.6 million users. Significantly, PC gaming is also the fastest growing segment in Japan’s video gaming market.

This success did not happen by chance, but through strategic localization. Since 2012, Steam’s parent company Valve has partnered with Degica’s payment service provider KOMOJU to tailor the platform for Japanese video gamers. By resolving key friction points—like English-only interfaces, foreign currency pricing, and limited payment options—Steam was able to transform itself from a niche importer to a mainstream platform in a booming PC gaming economy which is steadily increasing its share of Japan’s video game market.

A big part of that success came at checkout. KOMOJU enabled Steam to offer trusted, localized payment methods including Japan-issued credit cards, PayPay, Konbini, and even Steam prepaid cards. This allowed Japanese users to shop in yen using familiar options—removing barriers and boosting adoption. Steam’s transformation demonstrates a fundamental truth: the right payment infrastructure doesn’t just support transactions—it unlocks entire markets.

Summary

Japan remains one of the most lucrative video game markets in the world, with more than 55 million players and a projected $24.7 billion USD in revenue for 2025. But the real challenge is in how players pay. Smartphone adoption is nearly universal, and cashless payments now account for over 42% of all consumer spending. Although credit cards are still the dominant cashless payment option, QR-code wallets like PayPay are outpacing credit cards among younger users. Meanwhile, Konbini payments and prepaid cards continue to serve as a vital bridge between Japan’s strong cash culture and its increasingly digital economy.

New legislation (like the Smartphone Software Competition Promotion Act) is also creating opportunities. Developers can direct users to external checkout pages, bypassing Apple, Google, or other platform fees entirely, and offer more payment methods. Likewise, younger video gamers are becoming more selective, favoring flexible, mobile-first payments that align with how they already shop, ride transit, and shop online.

KOMOJU helps digital sellers stay ahead by offering seamless access to over 20 of Japan’s most trusted payment options through one streamlined API. More than a payment processor, KOMOJU has been instrumental in scaling platforms like Steam in Japan, breaking down barriers like foreign pricing, language gaps, and limited payment support. That same infrastructure is available to any video game publisher or eCommerce business ready to localize, convert, and grow in Japan’s digital-first video game economy.

Ready to make the most of Japan’s dynamic online video game market? Partner with KOMOJU for fast, flexible, and fully localized payment solutions.

*QR Code is a registered trademark of DENSO WAVE INCORPORATED in Japan and in other countries.

We help businesses accept payments online.