We help businesses accept payments online.

Japan’s digital payment landscape is growing rapidly, with more platforms integrating Buy Now Pay Later (BNPL) services.

This payment option enables customers to make purchases with the flexibility of deferred payment and the appeal of zero interest rates. Moreover, BNPL presents significant advantages for e-commerce stores, expanding their customer base to cash users and non-credit card holders and potentially increasing sales.

This payment option is a more straightforward payment strategy that is especially popular with Japan’s younger demographics, who are looking for new, more straightforward payment plans beyond credit cards.

This article will review the current trends surrounding BNPL and why merchants entering the Japanese market should consider integrating it as a store payment option.

What is Buy Now Pay Later (BNPL)?

BNPL, or “Buy Now, Pay Later,” is a payment method that enables consumers to make purchases and defer payment until later, often in manageable installment plans (bi-weekly, monthly, etc.) without accruing interest or with low interest rates.

For example, a consumer wants to buy a new smartphone priced at ¥99,000 but prefers not to pay the full amount upfront. With a BNPL service, they can pay for the phone in three equal monthly installments of ¥33,333 each, making it more financially feasible. While the basic idea of BNPL isn’t new, implementing specialized BNPL services represents a recent innovation in payment methods pioneered by fintech companies.

BNPL, in theory, makes purchases more manageable, resembling how a credit card operates without fees or constraints such as spending limits, annual fees, and strict approval processes. BNPL services circumvent the inconvenience and interest fees associated with credit card usage. Instead, BNPL service providers generate revenue through fees charged to the merchant, relatively low interest rates (if any), or late fees imposed on the consumer.

According to Global Data, BNPL transactions totaled $120 billion globally in 2021, and this figure is projected to soar to $576 billion by 2026. Some consumer preferences have also shifted, with BNPL services and apps becoming the preferred payment method over credit cards.

BNPL spending is particularly higher with younger demographics and those with lower credit scores. Per Experian, part of the shift is that consumers view BNPL as a budgeting or cash flow management tool rather than a form of credit.

The same trend is also evident in Japan. Data from a Merpay Co., Ltd. survey conducted in 2021 indicates a higher usage in BNPL usage among younger demographics:

- 6% of consumers in their 20s

- 8% of consumers in their 30s

- 0% of consumers in their 40s

- 9% of consumers in their 50s

In 2022, the BNPL market in Japan was estimated to be worth ¥1.26 trillion, and it is expected to grow to ¥2.45 trillion in 2027. In a November 2023 survey, approximately 14 percent of Japanese respondents reported using BNPL services, marking an increase from 11 percent from 2022.

Japan’s BNPL market gained much attention in September 2021 when PayPal Holdings Inc. announced its acquisition of the BNPL service Paidy for US$2.7 billion (then over 300 billion yen). This move by PayPal demonstrated its confidence in Paidy and, by extension, BNPL, allowing the company to retain its brand and be managed by its original team.

These trends highlight the increasing favorability of BNPL, especially among younger consumers, which is influencing Japan’s payment landscape. This underscores the importance of merchants entering the Japanese market and integrating BNPL as a payment option to appeal to new customers, potentially boosting sales and customer satisfaction.

How Does BNPL Work?

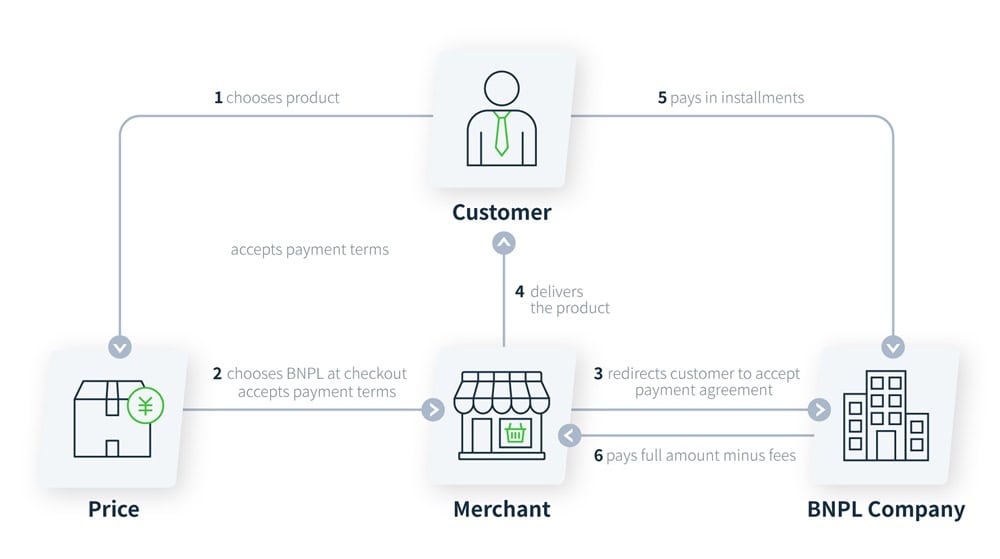

The BNPL payment flow is typically as follows:

- The consumer selects BNPL at checkout.

- A BNPL service (such as Paidy) confirms the transaction.

- Once approved, the BNPL service pays the full amount to the store.

- The store ships the product.

- The consumer pays the BNPL service (likely in installments).

When a consumer opts for Buy Now, Pay Later (BNPL), the BNPL service reviews the transaction details. After approval, the BNPL service pays the merchant store the full amount, and the product is shipped.

However, introducing BNPL services to a store in Japan may be difficult due to regulations, language barriers, and market knowledge—especially if you are a foreign business person operating in Japan. A payment service provider such as KOMOJU can offer multilingual support and facilitate smoother integration of BNPL and other payment options in Japan so you can focus on growing your business confidently.

After purchase, customers must make payments to the BNPL provider, usually through a mobile app. Payments are commonly made via automatic bank withdrawals or credit cards, but cash payments at convenience store ATMs, banks, or post offices are also accepted.

The merchant store covers the initial fee, and after the process is finished, the BNPL service sends its invoice to the user for payment. This means there’s no direct money exchange between the store and the consumer.

Types of BNPL Loans

In Japan, there are typically three main types of BNPL loans:

- Installment payments

- Point-of-sale (POS) loans

- Deferred payments (with a grace period)

Installment Payments

You pay for your purchase in multiple fixed payments over a set period, such as three monthly payments. Any installment plan over two months will typically require more verification in Japan.

Point-of-sale (POS) Loans

POS loans allow you to finance your purchase directly at checkout and pay it off in regular installments over a longer period, often with interest or fees, making them suitable for higher-priced items.

Deferred Payments (with a Grace Period)

You can delay your payment for a certain period without incurring interest, giving you extra time to pay off the purchase without immediate financial pressure. Typically, these are to delay the payment until the next month, at which point you pay off the entire amount in one payment. These are usually the easiest to qualify for—often, you only need an address, email, or phone number.

Pros & Cons of BNPL

Let’s explore the pros and cons to help you decide whether to add BNPL as a payment option in your Japanese store.

Pros for Merchants

- New sales opportunities

- Attracts cash-paying customers

- Decreased cart abandonment

- Customer trust

Introducing BNPL can open up new sales opportunities by extending payment options. Some customers hesitate to buy higher priced items if limited to lump-sum payments or credit cards, but BNPL offers them free or low-interest installment plans. Additionally, since BNPL accommodates non-credit card holders, implementing it can attract customers who prefer paying by cash—especially in a cash-dominant society like Japan.

BNPL also helps decrease cart abandonment rates, particularly for expensive items. Shoppers who may have abandoned carts due to cost concerns can proceed knowing they have the convenience of paying over time. Also, by allowing manageable installments, customers are more inclined to include higher-value items in their basket and add more items.

Furthermore, as BNPL gains popularity, offering this payment option can give your store a competitive edge or build customer trust. It shows that you understand consumer preferences and are willing to provide flexible payment options and ship a product that has, technically, not been paid for (even though you have been paid in total).

Cons for Merchants

- Security

- Unknown regulations

- Japanese ability

While convenient, BNPL does pose certain risks. Its less stringent identity verification process than traditional credit cards can lead to unauthorized use, fraud, and default. Unlike credit cards, which typically require thorough screening or a credit check, BNPL often lacks such stringent checks, making it easier for individuals to exploit.

However, it’s important to note that BNPL services assume merchant liability. Thus, there is arguably more reason for merchants to take advantage of BNPL services. Moreover, BNPL services use various security measures such as Paidy’s Transport Layer Security (TLS) encryption, 24-hour monitoring, and identity verification such as a driver’s license or My Number Card.

Since BNPL is still relatively new in Japan, there have yet to be specific laws governing it, although it’s a direction already happening in the West. Currently, BNPL falls under some of Japan’s Installment Sales Act, but specific regulations and stricter screening are possibly on the table.

It’s also important to acknowledge that most, if not all, BNPL services in Japan are only available in Japanese. Even Paidy, a popular BNPL provider, offers limited explanations in English. In light of this, a payment service like KOMOJU, which offers multiple payment methods, including BNPL, to be integrated into an eCommerce store, bypasses the language barrier.

Pros for Consumers

- Convenience

- Split Payments

- Easy Approval

In a 2021 survey by CR Research involving 2,005 online consumers with an average age of 37, several reasons emerged for preferring BNPL payment options. Among these, respondents cited the easier payment process (45%), greater flexibility (44%) and lower interest rates (36%). Additionally, the simplicity of the approval process (33%) and the prevalence of maxed-out credit cards (33%) were contributing factors. The absence of interest charges (22%) and the limited availability of credit cards (22%) further underscored the appeal of BNPL among consumers.

Credit card ownership in Japan is over 70 percent, but usage is low, especially among younger demographics that don’t want to incur fees or bother with clunky installment arrangements. Most BNPLs provide a straightforward payment structure and a user-friendly experience.

Customers value BNPL because they can order the product and “worry” about the payment later—for example, after payday. This flexibility is preferable if they’re low on funds or spending on a budget. Moreover, customers can pay in installments or in full, providing flexibility to manage their budget. Opting for split payments reduces the initial cost and allows for easier financial management. Alternatively, customers can pay the full amount at a later, more convenient date. In either case, the merchant receives the full payment.

Getting approved for BNPL is much easier than getting approved for a credit card. Credit screening is typically not even necessary. Customers can use a BNPL app immediately by simply providing their email address and phone number. And because there’s no requirement to provide address or credit card details, it’s ideal for those hesitant to share personal information when shopping online.

Finally, paying after receiving the product offers some customers security for purchases.

Cons for Consumers

- Overspending

- Limits

- Late Payments

While it ultimately depends on the consumer’s mindset, there’s a chance of overspending or exceeding your budget, similar to credit card usage. BNPL can lead to spending beyond your means, potentially causing financial strain or debt buildup. However, BNPL services typically have a monthly limit of ¥55,000 in Japan.

Despite the spending cap, BNPL’s ease of use may encourage users to create multiple accounts with different BNPL services and accumulate excessive debt.

Consistently missing deadlines or making late payments can prompt BNPL providers to lower your credit limit. If you’re deemed a high risk for defaulting due to financial instability or a history of missed payments, BNPL providers may suspend the service completely.

Popular BNPL Providers

Below are some of the most popular BNPL services in Japan.

Paidy

Paidy, a prominent BNPL service in Japan, was acquired by PayPal in 2021, consolidating its market presence. Users can split payments into 3, 6, or 12 installments without additional fees.

It is used on 700,000 e-commerce platforms, including Amazon, DMM, and Shein. The BNPL service also launched Paidy Plus, which applies stricter verification procedures, enabling higher-value purchases such as those at Apple Retail Stores and the Apple Online Store. Merchants enjoy a 100% sales proceeds guarantee and zero liability for unpaid amounts.

Klarna

Klarna is a Swedish fintech company that offers BNPL services for online shoppers. It operates in Japan and is tailored for the Japanese market. While Klarna is less dominant in Japan than in other regions, it has expanded its presence by partnering with local retailers and e-commerce platforms. Through these partnerships, Klarna enables Japanese consumers to enjoy flexible payment options when shopping online, contributing to the growth of the BNPL market in Japan.

Atkara

Atkara is a deferred payment service by GMO Payment Service and Sumitomo Mitsui Card. Users can pay the full amount the following month, spread payments over 3 to 36 installments, or even pay immediately without waiting for the next billing cycle.

Atone

Net Protections Co.’s Atone offers two payment options: “Next Month Deferred Payment,” which allows registration with a mobile phone number and password, and “Instant Deferred Payment,” with a mobile phone number, email address and SMS authentication. These options aim to boost user purchase completion rates.

PayPay Deferred Payment

Launched in February 2022, it was designed to sync PayPay Card and the PayPay app, one of Japan’s most used payment apps. By connecting the PayPay Card to the PayPay app, users can pay the total amount spent in the following month without needing to preload funds beforehand.

Famipay

FamiPay, a FamilyMart app offered by FamilyMart Digital One Co., Ltd., allows users to load their cards with cash at a Family Mart convenience store, credit card or bank account, or “FamiPay Next Month Payment.”

FamiPay Next Month Payment lets users settle all FamiPay transactions made in the current month in one go the following month. Users can pay via direct debit or at any FamilyMart convenience store.

Users can choose options such as “Automatic Revolving,” which maintains a consistent monthly payment; “Skip Payment,” which defers the entire payment; and “Installment,” which splits the payment into specified installments.

Merpay Smart Payment

Merpay is a feature integrated within the Mercari app, tapping into Mercari’s extensive user base of around 23 million. Its introduction offers a valuable opportunity to engage Mercari users.

Merpay is hassle-free. Customers can swiftly complete transactions by scanning a QR code with their smartphones. Additionally, Merpay integrates with d Payment, extending accessibility to Docomo users (as of March 2024). While identity verification is required within the app, the setup process is quick, taking as little as 30 seconds

The Future of BNPL

The future of BNPL in Japan promises significant growth, mirroring global trends. Projections indicate that the global BNPL market could soar to $20.4 billion by 2028, with an annual gross merchandise volume (GMV) surpassing $1 trillion by 2025. A recent investment round in Klarna (Swedish BNPL), led by SoftBank’s Vision Fund 2, exemplifies Japan’s keen interest and investment in the BNPL sector, solidifying its potential within the country’s financial landscape.

According to ResearchAndMarkets.com, BNPL payments in Japan are poised for exponential growth, with an annual growth rate forecasted at 41.7%. This projection sets the stage for a significant valuation leap to US$21.35 billion in 2024, with a compound annual growth rate (CAGR) of 28.2% by 2029.

These figures highlight the potential and rapid expansion of the BNPL market in Japan and how it might shape the future of the country’s payment landscape.

Summary

With Buy Now Pay Later (BNPL) services that allow for deferred or installment payments without interest rates gaining popularity with consumers—especially younger demographics, substantially benefits e-commerce stores by expanding customer bases and reducing cart abandonment.

As Japan’s BNPL market projects significant growth, foreign merchants may face regulatory challenges when entering this space. Payment service providers like KOMOJU offer multilingual support and seamless integration into Japanese eCommerce stores, helping businesses capitalize on this trend effectively by ensuring consumer satisfaction.

We help businesses accept payments online.