We help businesses accept payments online.

Japan has a long history of adopting Western traditions and reshaping them to align with local culture and market behavior. Some holidays may seem familiar, but they’re often celebrated in very different ways. Valentine’s Day is an example of a Western tradition that has been adapted into a unique Japanese event.

In Japan, Valentine’s Day isn’t just about romance—it’s driven largely by seasonal shopping trends. It’s no longer a one-day event, but a two-part cycle that runs through February and March and influences how people spend.

For businesses in Japan, understanding Valentine’s Day also means understanding wider consumer behavior and seasonal buying habits, helping them maximize sales opportunities.

What Is Valentine’s Day in Japan?

Like in many parts of the world, Valentine’s Day in Japan falls on February 14th. Visually, the season looks familiar: stores are decorated in red and pink, and chocolate is displayed as the main seasonal product.

However, the gifting process is reversed. In Western countries, couples usually exchange gifts. In contrast, in Japan, women take the lead, giving gifts to the men in their lives. This includes romantic partners, colleagues, friends, or family members.

This exchange does not end on February 14th. One month later, on March 14th, Japan celebrates White Day, when men are expected to return the favor by giving gifts to those who gave them chocolates. In many cases, these return gifts are higher in value, reinforcing the expectation of reciprocity.

Chocolate remains the main gift, but men’s fashion accessories, small luxury goods, and branded items have also become popular choices. To better understand these unique customs, it’s important to go back to how it all started.

History of Valentine’s Day in Japan

Valentine’s Day was introduced to Japan in the early 20th century through Western influence and international trade. Its modern form took shape after World War II, when Japanese confectionery companies began promoting chocolate as a Valentine’s gift.

In these early marketing campaigns, the Western custom was reinterpreted. Valentine’s Day became a day when women express their feelings by giving chocolates to men. This messaging aligned well with kokuhaku, the act of confessing romantic feelings.

Over time, Valentine’s Day became one of the most important commercial events of the year. Chocolate companies began generating a significant share of their annual sales during February.. The holiday has evolved and diversified over time. However, its basic structure has remained the same: women give gifts in February, and men return them on White Day in March.

Types of Valentine’s Chocolates in Japan

In Japan, Valentine’s Day chocolates are not given casually. Gift-giving is categorized, and the type of chocolate reflects the relationship between the giver and the recipient. Understanding these categories enables businesses to plan their product ranges, pricing, and packaging more effectively.

Below are the main types of Valentine’s chocolates in Japan. Each category carries a distinct cultural meaning and presents different commercial opportunities.

Table 1: Types of Valentine’s Chocolates in Japan

| Type of Chocolate | Given to | Cultural Meaning | Price | Sales Angle |

| Honmei-choco (本命チョコ) | “True feeling” chocolate for a romantic partner or special person. | 💲💲💲 | Premium pricing, limited editions, luxury packaging. | |

| Jibun-choco (自分チョコ) | |

Self-reward chocolate purchased for personal enjoyment. | 💲💲💲 | D2C opportunities, online sales, indulgent positioning. |

| Giri-choco (義理チョコ) | |

Obligation chocolate for coworkers, bosses, or acquaintances. | 💲💲 | Bulk sales, corporate-friendly pricing, multi-pack options. |

| Tomo-choco (友チョコ) | |

Chocolate that is exchanged between friends, often among women. | 💲💲 | Shareable sets, visually appealing packaging, mid-range pricing. |

| Gyaku-choco (逆チョコ) | |

“Reverse chocolate,” given by men to women. | 💲💲 | Niche positioning, brand storytelling, and early White Day crossover. |

These product categories reflect a broader set of consumer behaviors that shape Valentine’s season in Japan. Valentine’s Day in Japan follows a two-step gifting culture. Understanding the history and distinct chocolate categories helps explain consumer expectations. It also highlights how Valentine’s season creates multiple purchase moments and an extended sales cycle, allowing businesses to drive higher revenue and plan more effective, long-term sales strategies in advance.

What is White Day in Japan?

Unlike Valentine’s Day, which was imported into Japan by the confectionery industry, White Day was invented entirely within Japan. Valentine’s Day was successful in driving demand by positioning women as the primary buyers of chocolate. Almost immediately, the industry identified a structural imbalance: men were receiving gifts without a clear process to reciprocate.

White Day originated in the 1970s when a Japanese confectionery campaign encouraged men to give return gifts (initially marshmallows) as a “reverse Valentine’s Day.” Over time, this practice became normalized. Reciprocation was reinforced by sanbai gaeshi (triple the return). This created an expectation that White Day gifts should be worth more than what was received on Valentine’s Day. This informal rule continues to influence consumer behavior, encouraging higher-value purchases.

For businesses, Valentine’s and White Day form a single extended purchasing cycle rather than two separate holidays. Valentine’s Day creates demand; White Day converts it through reciprocity, functioning as Phase Two of the Valentine’s funnel.

How Consumers Shop for Valentine’s Day in Japan

Media use, shopping habits, and payment methods are changing. As a result, social media and more diverse gifting motivations are reshaping how Japanese people shop for Valentine’s Day.

Modern Shopping Habits: Social Media and Payment Preferences

- For younger consumers in Japan, social media functions almost like a search engine. Teens and shoppers in their 20s rely heavily on Instagram and TikTok to discover Valentine’s gift ideas, seasonal trends, and limited-edition products.

- Recent consumer research shows that around half of consumers who use social media to gather Valentine’s gift ideas go on to purchase and gift products they saw there.

- Many consumers now discover products on social media and buy them on their phones. When familiar local payment methods are not readily available, they are more likely to abandon the purchase.

- Cart abandonment also occurs when checkout requires too many steps, especially compared to one-click or link-based payment experiences.

- Gen Z and many millennials do not regularly use credit cards and instead rely on prepaid balances, mobile wallets, QR payments, and tap-to-pay systems.

Where Consumers Shop: Online vs Offline Purchase Trends

Channel preferences

Where people shop has shifted in recent years. While department stores used to be the most common locations for buying chocolate, consumers are now shopping more at supermarkets and convenience stores. This change is driven by convenience, accessibility, and price sensitivity.

Omnichannel shopping behavior

Valentine’s shopping in Japan is increasingly becoming omnichannel. Consumers are moving between online discovery and offline purchasing. Social media is used for product research, while physical stores remain key purchase points.

Payment preferences

This hybrid behavior requires payment systems that function smoothly across channels. Tap-to-pay enables faster in-store checkout during peak congestion, reducing friction at the moment of purchase.

Payment Service Providers such as KOMOJU support local payment methods across both online and offline environments. This allows brands to convert interest into revenue regardless of where the transaction occurs.

Chocolate as the Core Purchase Driver

Chocolate remains the main driver of Valentine’s Day purchases in Japan. Market surveys consistently show that it is the most popular gift across romantic and social occasions.

Also, according to The Japan Times, many consumers buy Valentine’s chocolate as a gift for themselves. This change has increased demand for higher-quality, premium chocolates, making Valentine’s chocolate both a symbolic gift and a seasonal treat.

Homemade Valentine’s Chocolates and the Rise of Baking Purchases

In Japan, Valentine’s Day isn’t just about buying chocolates—it’s also about making them. Homemade chocolates give people a more personal way to take part in the season and create extra demand beyond ready-made gifts.

These chocolates aren’t a separate category but are mainly made for honmei-choco (romantic partners) and tomo-choco (friends), where effort and thoughtfulness matter. People often make them not to save money, but because they enjoy the process. Many see chocolate-making as relaxing and satisfying, almost like a form of self-care.

As a result, Valentine’s spending goes beyond chocolates to include baking ingredients, molds, decorations, and packaging. Brands that offer simple, attractive, and easy-to-use products can benefit from this short but highly active seasonal window.

Demand for Limited-Edition and Seasonal Products

Limited-edition and seasonal products play a major role in Valentine’s Day purchasing behavior. Consumers actively look for limited or exclusive items, which strongly encourages purchases.

Seasonal flavors, Valentine’s-only packaging, and collaboration products help brands stand out in a crowded market while justifying premium pricing.

Luxury Valentine’s Gifts

Beyond chocolate, luxury and premium gifts have become increasingly relevant during Valentine’s season. Accessories, fragrances, beauty products, and small leather goods are commonly purchased for romantic partners or as self-reward items.

Valentine’s season offers businesses an opportunity to position premium products as lasting keepsakes, not just consumables.

Greeting Cards and Small Add-On Gifts

Greeting and note cards are becoming popular Valentine’s Day add-ons, driven by emotional, low-cost purchases.

- Shopify Japan reports 300%+ year-over-year growth in online card sales for Valentine’s Day 2025.

- Cards increase average order value while completing the gifting experience at minimal cost.

How Businesses Can Effectively Leverage Valentine’s Day in Japan

After understanding how Japanese consumers discover, buy, and gift during Valentine’s season, the next step is turning those insights into action.

Launch Limited-Edition Products

Valentine’s is a highly competitive retail period, especially in the chocolate and gifting categories. Limited editions help products stand out and justify higher price points.

- Release Valentine’s-only flavors, colors, packaging, or bundles

- Limit availability to the Valentine’s–White Day window

- Use scarcity messaging to encourage earlier purchases

Leverage Social Media

Social platforms are where discovery starts, especially for younger consumers. The buying journey should feel seamless from inspiration to checkout.

- Treat social media as the top of the sales funnel, not just for awareness

- Link directly to mobile-optimized product pages

- Ensure checkout flows work smoothly for social traffic

- Utilize Payment Links on social media to reduce checkout friction for customized Valentine’s items (Links can easily be shared in DMs, SNS, and emails.)

Run Valentine’s-Specific Campaigns

Generic promotions get lost during the season. Clear seasonal framing helps customers decide faster.

- Create Valentine’s and White Day–specific campaigns

- Use countdowns, early-bird offers, and curated gift guides

- Add “return gift” messaging to extend the sales cycle

Use Emotion-Driven Storytelling

Products perform better when tied to social meaning, not abstract romance.

- Frame products around gratitude, thoughtfulness, obligation, or self-reward

- Match messaging to different gifting contexts (partner, friend, self)

- Keep storytelling culturally grounded and practical

Create In-Store Events (Tap-to-Pay Integration)

Busy seasonal stores risk losing sales at checkout if payment feels slow or inconvenient. In-store events such as tastings, pop-ups, and Valentine’s displays increase foot traffic but also create congestion at the register. To keep transactions moving during peak periods, businesses should:

- Prepare for higher checkout volume

- Offer fast, familiar payment options such as tap-to-pay and local mobile wallets

- Reduce barriers at the point of purchase

Payment platforms like KOMOJU support these locally preferred payment methods, helping merchants process in-store transactions smoothly during seasonal peaks.

Offer Free Gift Wrapping and Customization

Presentation matters, especially for last-minute or obligation-driven purchases.

- Provide gift wrapping or message cards

- Offer light customization where possible

- Reduce hesitation by making gifts “ready to give”

Prepare Multiple Payment Methods

Customers are more likely to abandon purchases if their preferred payment option isn’t available.

- Support credit cards, mobile wallets, and local Japanese payment methods

- Optimize checkout for mobile and social-driven traffic

Reduce Cart Abandonment with the Right Payment Setup

Payment friction is a major driver of cart abandonment during peak seasons, particularly as more consumers move from social media directly to mobile checkout.

Payment Service Providesuch as KOMOJU help businesses capture this mobile-first demand by supporting a wide range of locally preferred payment methods. Key actions include:

- Simplifying checkout and minimizing required steps

- Offering familiar, locally trusted payment options

- Using a unified payment platform to manage multiple payment methods efficiently

To succeed during Valentine’s season in Japan, businesses should offer limited seasonal products and use culturally relevant messaging. Making checkout simple and supporting local payment methods helps brands drive sales on Valentine’s Day and extend them into White Day.

Popular Payment Methods in Japan

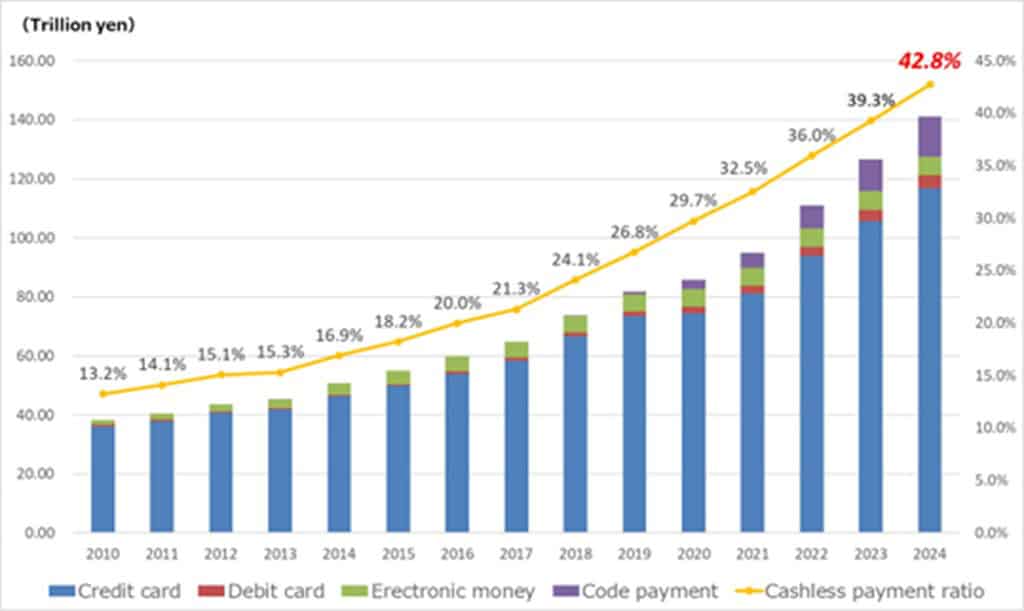

Japanese consumers use a wide range of payment methods, and preferences vary by age, channel, and purchase context. Cashless payments in Japan are continuing to grow. In 2024, they accounted for 42.8% of all payments, totaling 141.0 trillion yen, highlighting a clear shift away from cash. Code payments alone made up nearly 10% (13.5 trillion yen) of all cashless transactions.

Source: Ministry of Economy, Trade and Industry (METI), “Cashless Payment Ratio in 2024,”

Payment Method Category | Examples | Features |

Credit & Debit Cards | Visa, Mastercard, JCB, American Express | Widely used, especially for higher-value purchases and among older consumers. Essential for eCommerce, department stores, premium, and pre-ordered gifts. |

Digital Wallets & QR Payments | PayPay, Rakuten Pay, Merpay, au PAY | Common among younger and mobile-first shoppers. |

Konbini Payments | 7-Eleven, Lawson, FamilyMart | Pay-at-convenience-store options. Useful for some online orders, but less common for time-sensitive gifting. |

Bank Transfers | Pay-easy, traditional bank transfer | More relevant for utilities or subscriptions than Valentine’s purchases. |

Buy Now, Pay Later (BNPL) | Paidy | Can support higher-value gifts by reducing upfront payment friction. |

Why Local Payment Options Matter—and How KOMOJU Helps

When a preferred payment method is not available, customers are more likely to abandon their cart, even if purchase intent is high.

Japan has a wide range of preferred payment methods. By supporting them all through a single service, KOMOJU reduces checkout friction and helps businesses capture more completed purchases across both online and in-store channels.

This allows businesses to:

- Offer familiar payment options to a wider range of customers

- Reduce cart abandonment caused by limited checkout choices

- Support both online and in-store transactions without added complexity

Summary | Turning Valentine’s Demand into Completed Sales in Japan

Valentine’s Day in Japan is a structured, two-stage sales cycle that runs from February through White Day in March. With clearly defined gifting roles and social expectations, consumer behavior follows predictable patterns that businesses can plan for and scale.

What is different about Valentine’s season in Japan:

- Gifting is led by women on February 14, with reciprocation expected on White Day

- Chocolate gifting is categorized by relationship, driving multiple purchases per customer

- The season extends beyond one day, creating repeat purchase opportunities

What drives revenue during the season:

- Limited-edition and seasonal products that are easy to choose

- Social media–led discovery that moves quickly to purchase

- Small add-ons like gift wrapping and cards that increase order value

What often blocks conversion:

- Friction at checkout, especially on mobile or during busy in-store periods

- Missing or unfamiliar payment methods that cause hesitation or abandonment

How KOMOJU helps close the gap: KOMOJU supports a wide range of locally preferred Japanese payment methods, both online and in-store, through a single payment platform. By removing payment friction, businesses can convert seasonal interest into completed purchases, reduce cart abandonment, and capture more value across both Valentine’s Day and White Day.

With the right product strategy and a smooth payment experience, Valentine’s Day in Japan becomes a reliable, two-phase revenue cycle, not a one-day sales rush.

We help businesses accept payments online.