We help businesses accept payments online.

As of 2024, nearly 43% of Japan’s payments were cashless, exceeding the country’s 2018 goal to become a 40% cashless society by 2025. While cash is still traditionally used, especially among older generations, digital payments are now a central part of daily life.

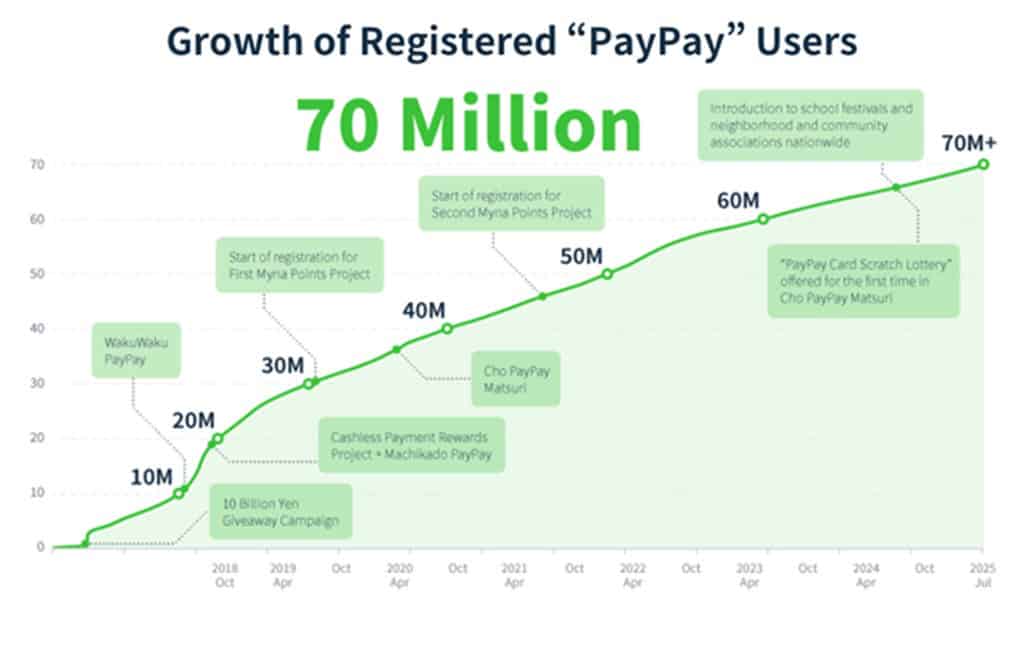

This transformation was driven by government initiatives and the rise of digital wallets. Today, two-thirds of Japan’s population and over 70 million registered users use PayPay.

For WooCommerce merchants expanding into Japan, integrating PayPay is more than just adding another payment option; it is also a powerful marketing strategy to connect with local customers. In this guide, we’ll explain how to set up WooCommerce PayPay integration, its key benefits, and how you can start accepting PayPay payments quickly through KOMOJU.

Features of WooCommerce

WooCommerce is an open-source platform that allows merchants to build, manage, and grow their own eCommerce stores. It supports selling a wide range of products, offering built-in and third-party tools for store management, marketing, and analytics.

As a WordPress plugin, WooCommerce provides a flexible foundation for creating fully customized online shops. It allows store owners to smoothly integrate key features like payment systems, coupons, and other tools tailored to their business needs.

While setup and customization may require some technical knowledge, WooCommerce remains an excellent choice for businesses that want a fully original eCommerce website.

WooCommerce's key features include:

Open-Source and Flexible

WooCommerce is fully open-source, meaning its code is free to use and modify. It also has extensive themes that businesses can choose from, giving them complete control to design a unique look and feel for their store.

WordPress Integration

As a WordPress plugin, setup is straightforward, seamlessly adding eCommerce functionality to existing or new websites.

Customizable Storefront

WooCommerce allows businesses to shape every detail of their online store, from product pages to checkout, ensuring the customer journey feels seamless, branded, and uniquely theirs.

Inventory Management

It helps businesses to track inventory stock levels, hold stock after an order is canceled, receive notifications for low and out-of-stock items, and more.

Product Management

This feature allows owners to easily add, manage, and categorize products, including variations, digital downloads, and subscription-based services.

Built-in and Secure Payment Processing

It allows merchants to offer flexible and secure payment options, including major credit cards, bank transfers, and cash on delivery. It can also integrate with popular gateways such as Stripe, PayPal, WooPayments, Square, Amazon Pay, Apple Pay, and Google Pay, as well as region-specific options like PayPay, JCB, Konbini, and Pay-Easy.

Marketing and Analytical Tools

Monitors your store’s performance with an analytics dashboard that provides sales data, and has built-in or add-on tools for SEO, email marketing, and social shopping.

Mobile Management

Manage your store from a mobile app to update products, view analytics, and process orders on the go.

Scalability and Growth

The platform is built to handle increasing traffic and complexity as your store grows.

What is PayPay?

PayPay is a mobile payment app that allows users to make instant payments, transfer money, and earn rewards, directly from their smartphones. Users can pay effortlessly by scanning QR codes or tapping within the app.

PayPay: One of Japan's Most Popular Payment Methods

With over 70 million registered users as of 2025, PayPay is one of Japan’s most popular payment methods and allows users to make transactions both online and in-store across a wide range of categories.

Target Audience for PayPay

PayPay has a large user base. This includes millennials, working-age adults, and increasingly younger users, making it an essential payment method for merchants looking to reach a broad range of consumers in Japan. Its convenience, ease of use, and security features are highly valued and appealing to Japanese users.

How PayPay works when making online payments

During checkout, customers can select PayPay as their preferred payment method. If the customer accesses the online store using a smartphone, the PayPay app automatically opens for payment processing and sends payment confirmation to the merchant.

Key Features of PayPay

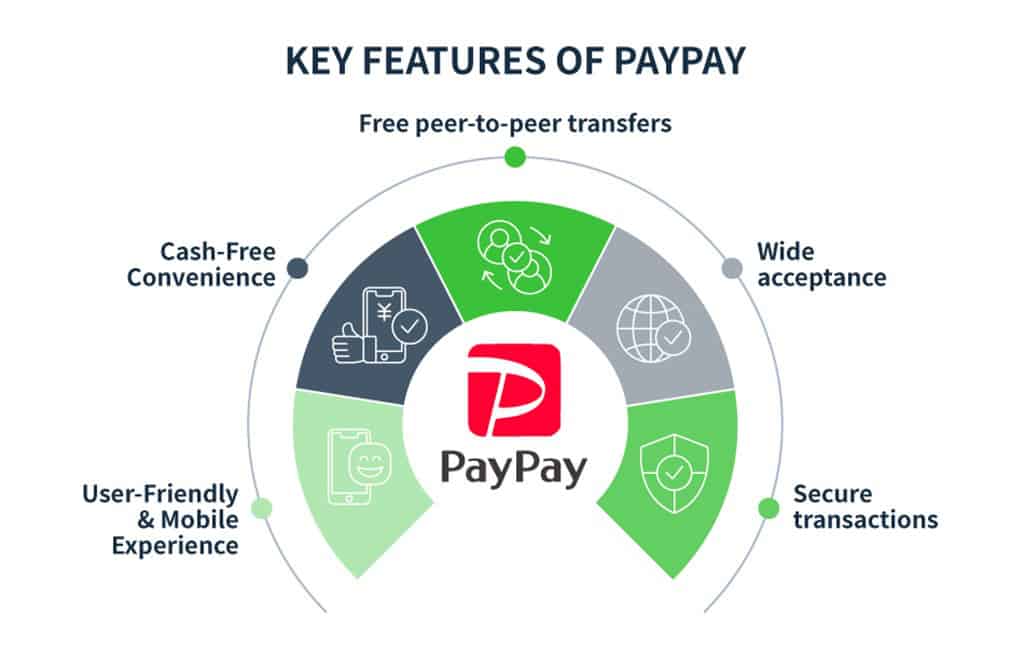

User-Friendly and Mobile Experience:

PayPay is a digital wallet that’s quick to set up and easy to use. Payments are processed instantly by scanning a merchant’s QR code or displaying one for others to scan.

Rewards and Loyalty System:

Users can earn PayPay Points with every purchase, which is usually 0.5–1.5% cashback, and up to 20% during special campaigns. It is an integrated loyalty ecosystem where points never expire and can be used for future purchases.

Cash-Free Convenience:

A key feature of PayPay is that it eliminates the hassle of cash. In Japan, small coins like 1-yen and 5-yen accumulate quickly and can weigh down wallets. With PayPay, payments are cashless, ideal for anyone who’d rather tap and go than worry about exact change.

Free Peer-to-Peer Transfers:

PayPay is a popular tool for splitting bills, reimbursing friends, and handling casual business payments, allowing users to instantly send or receive money at no cost.

In Japan, bank-to-bank transfers often incur fees, so many people prefer using PayPay for free, convenient transfers. For example, when friends go out for dinner, one person usually pays the full bill, and allows others to reimburse them using PayPay. This convenience makes the service particularly appealing to Japanese users. It also removes the awkwardness of asking the server to split the bill.

Wide acceptance:

PayPay is widely accepted by millions of stores, restaurants, and eCommerce platforms across Japan. PayPay is welcomed by not only major retailers, but small stores too, making it a trusted, familiar payment option in Japan.

Secure transactions:

PayPay uses bank-level encryption, advanced fraud detection, and two-factor authentication, ensuring safe, reliable digital payments that are fully compliant with Japanese financial regulations.

Benefits of WooCommerce PayPay Integration

Integrating PayPay with WooCommerce allows businesses to offer a secure, user-friendly payment method. This helps to increase revenue opportunities in Japan by expanding sales channels and reaching new customer segments.

Benefits Include:

Attract PayPay users

PayPay is widely used in Japan, and is integrated into daily life from paying for utilities to splitting dinner bills in groups. It is viewed as a familiar and secure payment method, which attracts a wide base of customers and increases the likelihood of purchasing.

Capture Younger Customers Who Don’t Own Credit Cards

PayPay is especially appealing to younger consumers under the age of 18 who cannot yet be approved for credit cards. Minors with parental consent can use PayPay either by linking to a bank account or topping up at an ATM. It is also convenient for people who avoid credit cards due to concerns about information leaks during card payments.

Reduced Cart Abandonment

Cart abandonment occurs when a customer adds items to an online shopping cart but leaves the website without completing their purchase. In Japan, the cart abandonment rate is 89%, higher than the global average. Payment friction is a major reason shoppers abandon their carts. PayPay helps to minimize this by offering a simple, fast, and seamless checkout experience, reducing transaction times and enhancing customer satisfaction.

How to Integrate PayPay into WooCommerce

For businesses expanding to Japan, the WooCommerce PayPay plugin provides a fast, compliant, and localized way to accept payments. There are two main options for merchants: 1.) using a plugin directly in WordPress or 2.) integrating via a payment gateway plugin like KOMOJU. Below is an overview of each method and its key features.

Using the WooCommerce PayPay Online Payment Plugin

One option is to add the WooCommerce PayPay Online Payment Plugin to WordPress. To do this, first create an account with “PayPay for Developers” and apply to become an online merchant with PayPay. Once approved, you’ll receive an authentication key. Then set an API key, whitelist your IP addresses, and install the plugin. This method is ideal for merchants with development resources who want to customize their payment flow according to specific requirements.

Integrating WooCommerce Using a Plugin Provided by a Payment Gateway

A quick and easy way to integrate PayPay is to use a WooCommerce plugin provided by a payment gateway.

The KOMOJU Payments plugin from KOMOJU allows you to implement multiple payment methods at the same time. This includes PayPay, convenience store payments, bank transfers, credit cards, Pay-easy, and carrier payments. Payment management is also completed in one place. Setup work is kept to a minimum, so you can start using it immediately after passing the screening. This offers a practical integration option for businesses with limited development resources.

How to Integrate PayPay into WooCommerce Using KOMOJU

This is the basic process for installing the official plugin provided by KOMOJU.

1.) Create a WooCommerce Account

2.) Create a KOMOJU Account and Apply for Approval

You can create a KOMOJU account and apply for approval online. Immediately after registering your account, you will have access to the test mode, but to gain access to the production environment (LIVE mode), you will need to apply to KOMOJU and wait for approval.

3.) Install the KOMOJU Payments Plugin

1. Download the plugin file from this link (File name: komoju-woocommerce-master.zip).

2. Upload and install the downloaded file from the WordPress plugin screen.

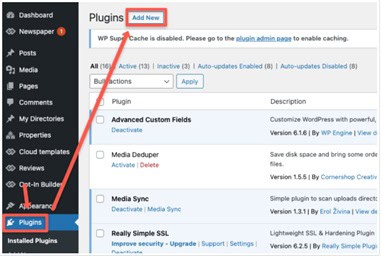

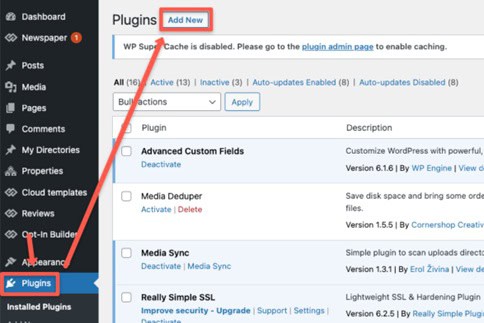

3. Log in to the WordPress administration panel ⇒ Click on ‘Plugins’ ⇒ and then click ’Add New’

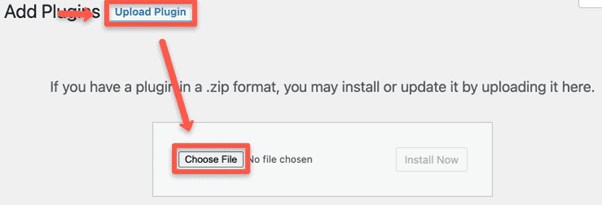

4. Click on ’Upload Plug-in’ ⇒ and then click ‘Choose File’.

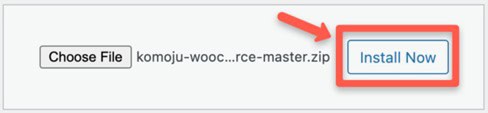

5. Select the downloaded file and click ‘Install Now’.

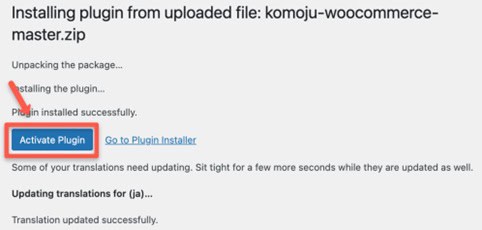

6. Click on ‘Activate Plugin’

7. Click ‘Plugins’ again, and if the KOMOJU Payments plugin and the deactivate link is displayed, you have successfully installed KOMOJU.

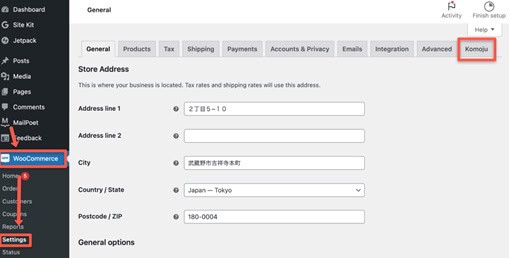

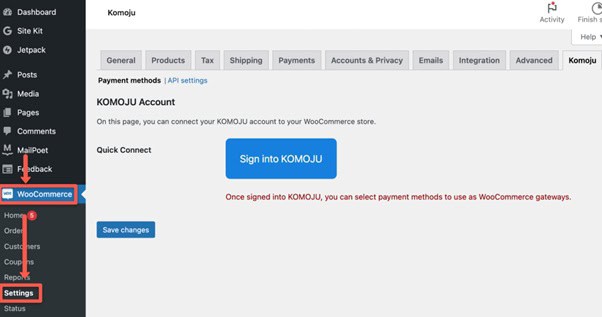

8. You can also check KOMOJU from the WooCommerce settings page.

Setting Up Collaboration with KOMOJU (authentication)

Open the “WooCommerce” → “Settings” → “KOMOJU” tab and click “Sign into KOMOJU.” Log in to KOMOJU from the login screen that appears, select your account and usage mode (TEST or LIVE), and your secret key and webhook will be automatically set, completing the integration between WooCommerce and KOMOJU.

Activating PayPay Payments

Return to the “WooCommerce” → “Settings” → “KOMOJU” tab, check PayPay or any other payment method you want to use, and click “Save Changes.”

Enable “Komoju – PayPay” in the “Payment” tab and click “Save Changes” to display PayPay as an available payment method on the site.

This completes the setup. The only thing left is to check that it works properly with a test order. If there are no problems, you can move on to production operation. For detailed installation instructions, please see the KOMOJU.

Cost and Time Required to Implement PayPay on WooCommerce

Merchants can choose to integrate PayPay directly into WooCommerce or through a payment gateway like KOMOJU.

Here are some factors to consider:

- How quickly you want the funds deposited.

- The fees (which will affect profits)

- The customer checkout experience

Whether you are opening a new store or expanding your payment options, KOMOJU allows you to begin accepting PayPay fast, without any initial or monthly fees. The table below outlines the cost, setup time, and deposit cycles for implementing PayPay with KOMOJU Payments.

Summary|Integrating PayPay with WooCommerce to Reach More Customers

Expanding your business in Japan is easy with PayPay integration for your WooCommerce store. This fast, secure, and mobile-friendly payment option helps you connect with 70 million potential customers.

Integrating PayPay makes fast checkout effortless. It streamlines the process, gives shoppers built-in rewards, and offers them a payment method they already trust—all proven to reduce cart abandonment and strengthen long-term customer loyalty.

With the Payment plugin, merchants can quickly set up PayPay, manage reconciliation and settlements, and expand their reach in Japan’s growing eCommerce market.

Unlock the power of effortless payments with PayPay, Japan’s most popular smartphone-based payment service. Let your customers pay securely from their PayPay wallet, earn rewards, and enjoy a smooth, mobile-friendly checkout experience.

We help businesses accept payments online.