We help businesses accept payments online.

A rapidly growing trend in Japan’s market is smartphone payments. PayPay is the country’s largest and most popular payment app and digital wallet. A survey conducted in April 2023 indicated that PayPay is the most widely used cashless payment service in Japan, with around 49% of consumers in Japan utilizing it.

PayPay generates revenue from financial services, value-added services for merchants and payment services. Within four and a half years of its launch in 2018, PayPay achieved a gross merchandise value (GMV) of ¥10 trillion. Today, PayPay has become an essential digital payment option for businesses looking to enter the Japanese market.

This article explains how PayPay functions and guides businesses in maximizing its potential.

What is PayPay?

(Image from PayPay homepage)

PayPay, provided by PayPay Co., Ltd., is Japan’s leading smartphone payment service. Established in 2018, PayPay Corporation is a joint venture owned by LY Corporation, a collaboration between SoftBank Group and Yahoo Japan under Z Holdings.

According to a survey by the Statistics Bureau of the Ministry of Internal Affairs and Communications as of December 2023, PayPay boasts a substantial user base of approximately 61 million or one in every two smartphone users in Japan. According to PayPay-Inside-Out, the PayPay app has been adopted by over 3.66 million merchant locations in Japan as of 2022.

PayPay’s simple payment process requires users to scan a QR code, eliminating the need for physical cash exchanges. Users can link their bank accounts and add funds to their PayPay account. When purchasing, users simply scan a QR code or have the cashier scan a barcode on their smartphone.

Users can use PayPay to make various utility bill payments and fund transfers. A notable advantage of PayPay is its collaboration with other cashless payment services in Asian markets, like Alipay and Kakao Pay, which widens its reach and potential customer base.

The platform also supports digital coupons and stamp cards, incentivizing business loyalty programs and encouraging repeat customers. Notably, businesses can introduce PayPay into their operations at zero cost, making it a cost-effective option for those exploring mobile payment solutions.

How PayPay Works

Merchants usually display a sticker or sign indicating they accept PayPay payments. Two primary payment methods are available for PayPay:

- QR Scan

- Barcode Scan

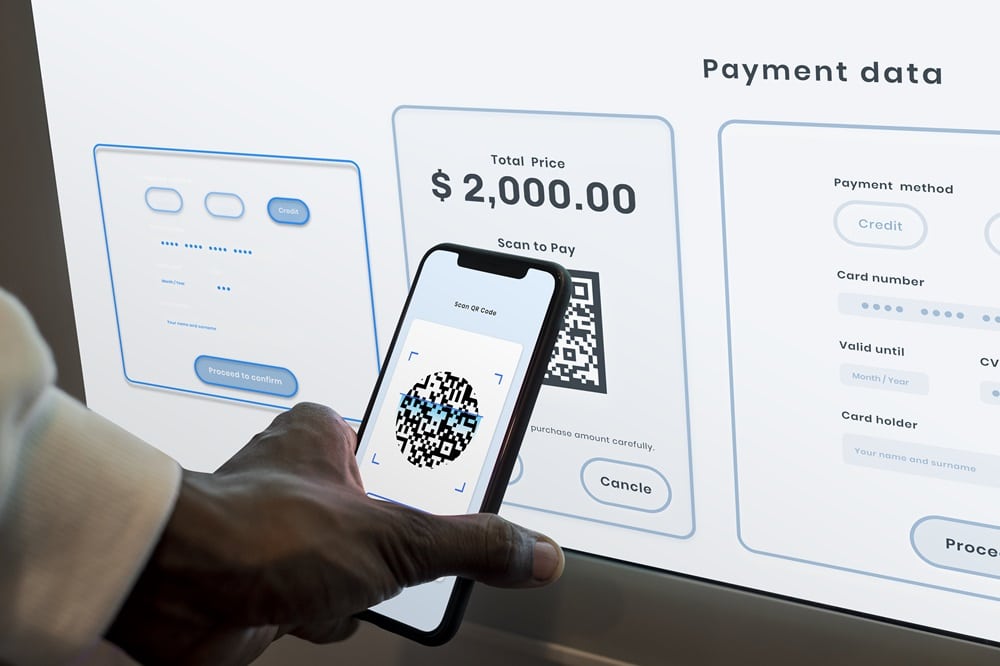

Paying via QR code

To use the QR code method, locate the QR code options within the PayPay app and scan the QR code provided by the store. Upon scanning, the store’s name will appear, prompting the user to enter the desired amount manually. This method does not necessitate a dedicated terminal at the store’s front.

Paying via barcode

The default payment option is barcode payment, which requires the store to have a dedicated terminal. To use this method, open your PayPay app and display the barcode. Present the barcode to the cashier, who will scan it. The funds will be deducted from your PayPay balance, bank account or PayPay card upon scanning.

How PayPay Works Online

PayPay can also be used online as a payment option for an e-commerce store.

Checkout on a phone

During checkout, customers can select PayPay as their preferred payment method. If the customer accesses the online store using a smartphone, the PayPay app automatically opens for payment processing and sends payment confirmation to the merchant.

Checkout on a desktop

The checkout page generates a QR code if the customer uses a desktop. The customer scans this QR code using the PayPay app on their phone. After scanning, the customer completes the payment within the app, and the app sends a payment confirmation to the merchant.

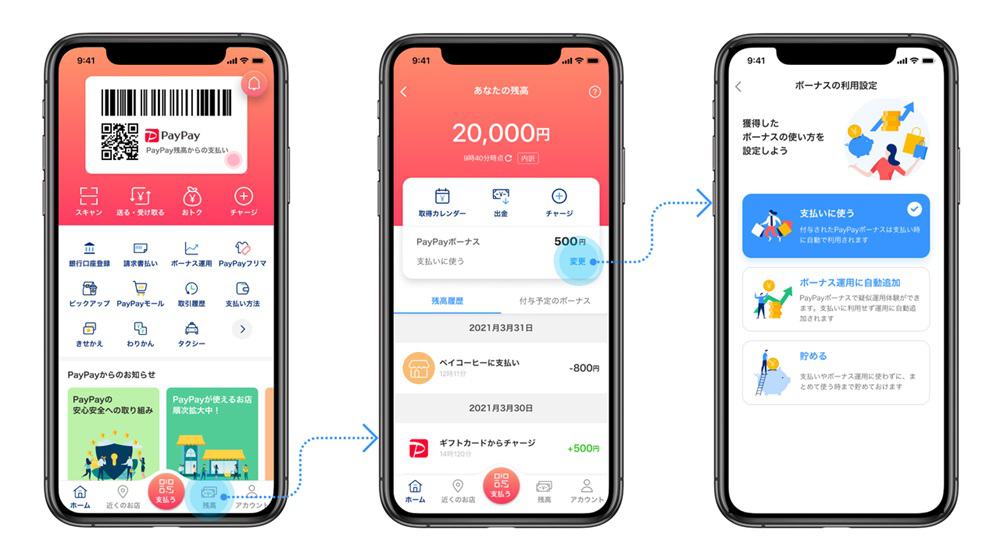

How users charge their PayPay balance

To charge their PayPay balance, users can use any of the following:

- A linked bank account

- A linked credit card

- A linked PayPay card

- Cash (via ATMs inside convenience stores such as 7-Eleven)

- Sales proceeds from Yahoo! Flea Market and Yahoo! Auction

- Softbank/Y!Mobile combined payment

Users do not incur fees when adding funds to their PayPay account. However, for SoftBank/Y!Mobile combined payments, a 2.5% fee (tax included) is charged on the amount starting from the second transaction within the same month.

Why Consumers Choose PayPay

Several benefits for users have made PayPay a popular digital payment option in Japan.

Coupons and Points

PayPay offers valuable coupons monthly. Once earned, these coupons are automatically applied during payments. Users can save money while shopping with these coupons. These are accessed via the coupon icon on the home screen.

Every transaction using PayPay accumulates PayPay points based on the payment amount, providing additional benefits to users. These saved points can then be used at stores that accept PayPay. PayPay points do not have an expiry date, allowing users to use them whenever they prefer without any rush.

Easy Payment

PayPay simplifies payments by enabling users to scan a store’s QR code with their smartphone, eliminating the need for cash or waiting for change. This is particularly significant in a predominantly cash-based society, such as Japan, making transactions faster and more convenient for everyone involved.

Wide Acceptance

PayPay is accepted at numerous stores, and this list continues to grow. Users can find a variety of establishments that accept PayPay, including but not limited to:

- Grocery stores

- Restaurants and cafes

- Clothing and retail stores

- Electronics stores

- Convenience stores

PayPay is even used to settle utility bills. This feature lets users scan utility or tax bills and pay them directly from their phone—even without setting up regular bank transfers or visiting convenience stores (konbini payment).

Benefits of introducing PayPay to your store

Implementing PayPay as a payment option on your e-commerce site offers numerous advantages.

Easy Implementation

PayPay offers a hassle-free implementation process without requiring dedicated terminals. Unlike some services from other companies that require dedicated terminals, PayPay can be set up using just a smartphone or computer.

Increased Customer Appeal

With a high usage rate and the potential to attract more customers, it’s easy to see why PayPay is a popular payment option in Japan. Its widespread adoption, with nearly one in two people using the service, reflects its strong demand. The versatility of PayPay, usable in physical stores and online, makes it accessible even to customers unfamiliar with registering credit card details online.

PayPay also supports overseas cashless payments, expanding its usability. Users can opt for cashless payments in countries like Taiwan through the user scan method or use an integrated payment app such as Alipay to access cashless transactions in Hong Kong, Thailand, Malaysia, the Philippines, and more.

Comprehensive Support and Security

PayPay provides comprehensive support, including pre-installation assistance and ongoing support over the phone. Advanced technology should prevent unauthorized use, complemented by a dedicated staff monitoring system. In case of damage due to malicious transactions, PayPay offers a compensation system.

Customer Engagement

Businesses can leverage PayPay to issue customized coupons and stamp cards, boosting customer engagement. PayPay coupons can target specific user groups, like first-time or repeat customers, with customizable usage limits and spending thresholds. The PayPay Stamp Card is managed on smartphones and streamlines loyalty programs for businesses and customers.

Store Promotion

While advertising fees are common for promoting stores, PayPay offers a cost-effective alternative by allowing store information to be distributed through its app. Promotional content such as events, campaigns, and business hours can be shared, effectively branding and promoting your store to a wider audience at a lower cost.

Things to consider before implementing PayPay

There are some points stores should consider before integrating PayPay as a payment option on their e-commerce platform.

Initial Cost

There is no initial cost to start using PayPay. The user scan method, which does not require a dedicated terminal, eliminates any equipment costs for the store.

Demographics

Japan still heavily relies on cash transactions. Older generations are particularly slower to adopt or understand digital transactions, including downloading and using the PayPay app. PayPay Inside-Out says the older generation “isn’t comfortable” with the tech. Therefore, consider your target audience and whether PayPay would apply to them.

Nevertheless, according to the most recent data from the Engagement Lab, PayPay has nearly 70% usage across all age brackets among payment applications in Japan.

Regular Security Practices

While PayPay has security measures, business operators can take additional steps. In 2020, PayPay’s server fell victim to a hacking attack operating in Brazil, and its user base’s personal and financial information was compromised. The company acknowledged that configuration flaws led to unauthorized access to information.

That said, KOMOJU recommends store operators:

- Change passwords regularly, especially for sites where you check sales data, and ensure passwords are complex.

- Avoid using free Wi-Fi to mitigate risks of external attacks.

PayPay Installation Procedure

PayPay can be implemented by individual e-commerce owners or businesses via PayPay’s store introduction page However, this process is currently only offered in Japanese. Therefore, for those without proficiency in Japanese, it is advisable to utilize a service like KOMOJU. KOMOJU will assist in the setup process in the merchant’s native language for a smoother and more user-friendly experience when adding PayPay as a payment option for their store.

Merchant stores should prepare to submit the following:

- Identification Document:

- For Corporations:

- Driver’s License

- Residence Card or Passport

- Personal Number Card (My Number Card)

- Health Insurance Cards

- For Sole Proprietorships:

- Driver’s License

- Residence Card or Passport

- Personal Number Card (My Number Card)

- Health Insurance Cards

- Address Confirmation Documents (if using Passport)

- Account Information for Receiving Sales Proceeds

- Corporate Number (for Corporations)

- Store Photos:

- Interior Photo (1)

- Exterior Photo (1)

- Permits and Licenses (if applicable)

After successful screening, PayPay will deliver a kit with instructions on how to complete the setup procedure.

PayPay Installation procedure for online store

While PayPay is commonly associated with brick-and-mortar stores, its online payment method is gaining popularity. To implement PayPay for online payments:

Apply directly

You can apply directly from PayPay’s store introduction page.

Use a platform with PayPay already implemented

Some e-commerce platforms, such as Shopify, offer easy integration with PayPay, making deployment a simple click away.

Use KOMOJU

Utilize KOMOJU for a hassle-free introduction to multiple payment methods, including PayPay, LINE Pay, Merpay, d Payment, au PAY, Rakuten Pay, and more.

With KOMOJU, you can manage all these payment options from a single account without worrying about fixed costs such as initial or monthly fees. KOMOJU also provides assistance with Japanese language support, installation issues, and other related concerns, ensuring a seamless integration process for your business.

Summary

This article discusses the advantages of integrating PayPay as a payment option on your e-commerce site.

Integrating PayPay can help address payment method needs more effectively and improve your customer attraction rate. While transaction fees are involved, the benefits outweigh these costs in most cases.

KOMOJU offers comprehensive online payment processing services.

Along with PayPay, you can introduce multiple payment methods simultaneously, such as smartphone payments, credit card payments, and convenience store payments. Moreover, KOMOJU supports a global range of payment methods, not limited to Japan.

Expanding your range of payment options can help broaden your customer base. Use KOMOJU’s services to explore various payment methods, including PayPay, to strengthen your business capabilities.

FAQs

Here are some common questions and answers you might have about PayPay.

PayPay is a mobile payment service that allows users to make various transactions using their smartphones by scanning a barcode or QR code. It is used for payments at physical stores, online shopping, bill payments, money transfers to other users, and more. PayPay essentially digitizes the payment process, making it convenient for users to make purchases.

Yes, foreigners can use PayPay in Japan, but they must have a valid residence status or visa and may need to provide identification documents. It’s worth noting that foreigners can open a PayPay account even if they do not have a bank account in Japan. They can conveniently charge their account balance using ATMs available in convenience stores.

As of 2023, PayPay has incorporated several foreign digital payment apps, such as Alipay from Mainland China and Kakao Pay from South Korea. This integration allows visitors from 11 countries and regions to make cashless payments in Japan using PayPay’s QR codes.

PayPay currently supports:

- NAVER Pay (South Korea)

- Toss (South Korea)

- OCBC Digital (Singapore)

- Changi Pay (Singapore)

- MyPB (Malaysia)

- Tinaba (Italy)

- Mpay (Macau)

- Hipay (Mongolia)

- JKO PAY (Taiwan)

- SUN Wallet (Taiwan)

- Alipay (Mainland China)

- Kakao Pay (South Korea)

- AlipayHK (Hong Kong)

- TrueMoney (Thailand)

- Touch ‘n Go eWallet (Malaysia)

- GCash (Philippines)

- HelloMoney by AUB (Philippines)

No, PayPay is not a credit card. It is a digital payment service that allows users to link their bank accounts or PayPay cards to their PayPay accounts to make payments and transactions.

PayPay does not permit users to link outside credit cards to their accounts. Instead, users can only link their bank account or use PayPay’s proprietary PayPay Card.

PayPay is currently only available in Japan. This means that you cannot use PayPay for transactions outside of Japan. PayPay’s functionality and support focus on the Japanese market, including partnerships with local businesses, integration with Japanese financial systems, and adherence to Japanese regulations.

We help businesses accept payments online.