We help businesses accept payments online.

Japan has passed a new law to open up how apps are distributed and paid for on mobile in an effort to bolster competition and innovation in eCommerce. This follows a global trend—Europe and South Korea have set rules to open app markets and payments, while U.S. senators have introduced a bill to push sideloading, third-party app stores, and alternative payments.

The Act on Promotion of Competition for Specified Smartphone Software (Japanese), or “Mobile Software Competition Act,” was passed on June 12, 2024, and will enter full enforcement on December 18, 2025, under guidance from the Japan Fair Trade Commission (JFTC).

Specifically, the act sets new rules for:

- Operating Systems: Access to core features like NFC and biometrics, plus a real default-app choice.

- App Stores: Third-party stores are allowed, alternative billing is permitted, and anti-steering limits are lifted.

- Browsers: Complete browser engines on iOS, enabling faster web apps and robust web checkout.

- Search: Choice screens and fewer self-preferencing advantages, improving discovery outside a single gatekeeper

In plain terms, Apple and Google must allow third-party app stores, let developers use alternative in-app payments, and stop blocking links to outside checkout.

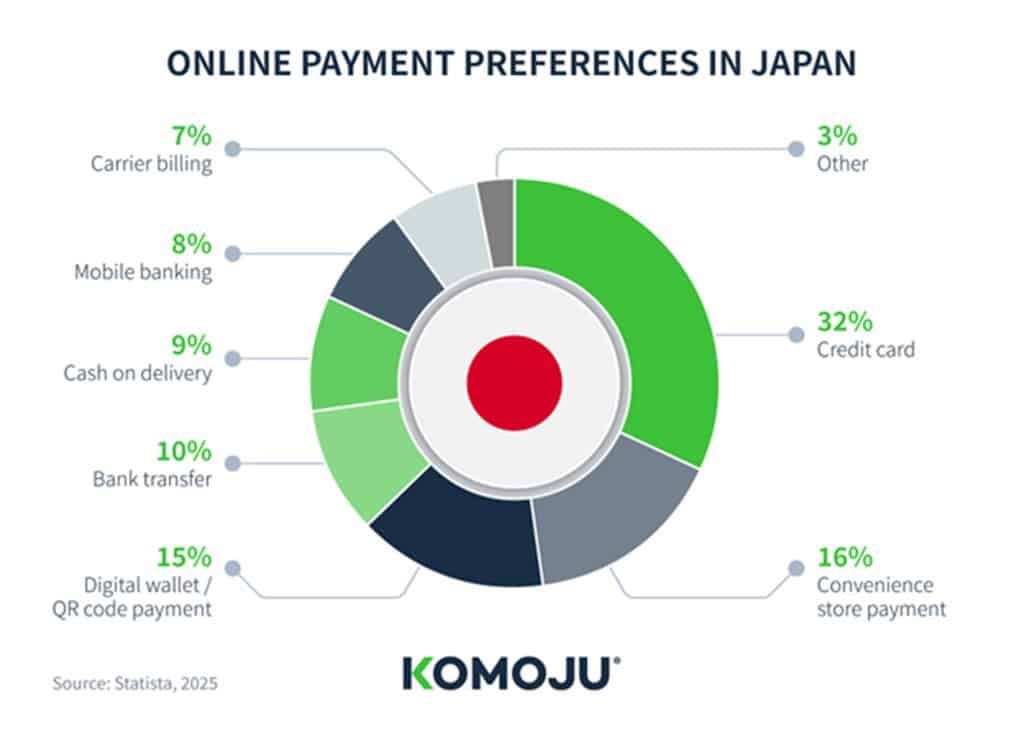

For merchants, this means more control over checkout and payment options, including: credit cards, Konbini payments (convenience store payment), carrier billing, and digital wallets like PayPay. It also means a more straightforward path to better margins and a closer relationship with customers.

This article is for international app developers, SaaS providers, and game studios selling into Japan—as well as merchants that rely on Apple or Google today. It explains what the finalized rules require and how they expand your checkout options. Finally, it shows how KOMOJU enables Japan-first payments quickly—without rebuilding your stack.

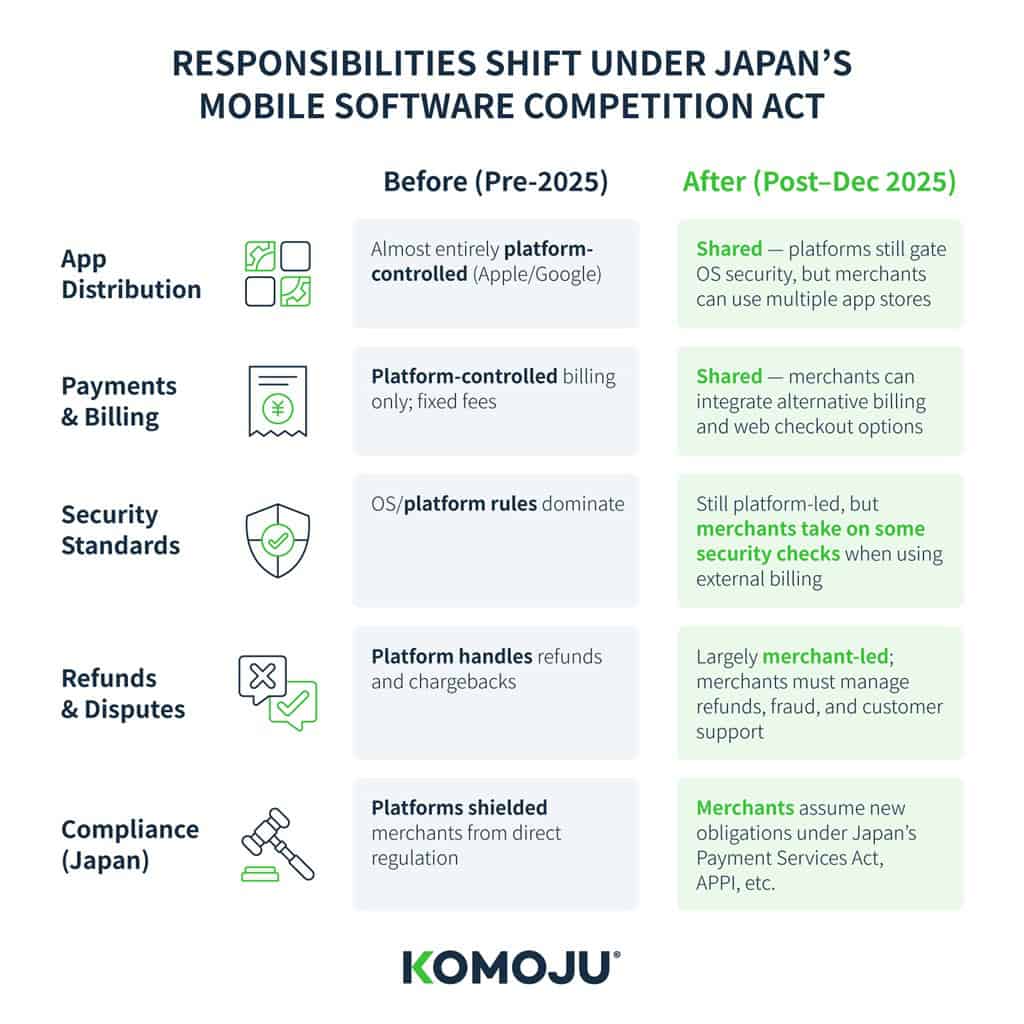

Pre-New Mobile Software Competition Act

Before 2024, the mobile ecosystem in Japan was strictly managed. For example, on iOS, Apple didn’t allow third-party app stores and required apps selling digital content to use Apple’s own billing system (with limited payment options and a hefty fee). Developers were also barred from directing users to pay on the web. Thus, there were no in-app pricing comparisons and no links to outside checkout. iOS browsers were also required to use Apple’s WebKit engine, limiting the capabilities of web apps and web checkout options.

Lawmakers argued the old rules stifled competition by locking distribution and billing to platform systems. Mandatory in-app purchase and anti-steering policies prevented developers from directing users to web checkout.

Of course, this wasn’t only an issue in Japan. Dutch courts, for example, found Apple abused its dominance in the dating-app market by forcing developers to use Apple’s payment system and banning links to alternative payments. Apps in Japan and elsewhere faced the same restrictions.

Because reaching mobile users meant going through the App Store or Google Play, merchants had limited control over pricing (to offset platform fees) and over which payment methods were offered. Users who wanted to buy in-app were confined to the platform’s payment rails; if their preferred method wasn’t available—or the total cost felt too high—they often abandoned the cart. The merchant paid higher store fees on the purchases that did go through and lost the direct customer relationship (including first-party data and billing control).

What’s Changing in 2025

If you sell apps, video games, or digital goods in Japan, the Mobile Software Competition Act will change how you release, set prices, and collect payments.

In your upcoming releases plan to:

- Publish in more than one app store

- Expanded scope for merchants to introduce cross-app promotions and package offers

- Offer additional payment methods and a clear link to pay on your website when it’s better value or easier.

- Re-test your iOS web checkout as fuller-featured browsers roll out.

- Prepare for set-up screens that let users choose their default search engine and browser, which could alter how they discover you.

Third-Party Stores Are Allowed

In Japan, large platforms can no longer force users to download apps only through their own stores. The JFTC names Apple (iOS, App Store, Safari), iTunes K.K., and Google (Android, Play, Chrome, Search) specifically. That means iPhone and Android users in Japan must be able to use alternative app stores, creating new ways for developers to reach customers beyond the App Store and Google Play.

On iOS, Apple must permit independent app stores and cannot block them with overbearing rules, hidden settings, or extra fees. Developers may also use alternative in-app payments and include clear links and price information for web checkout.

Apple can set reasonable security standards, but it can’t undermine them by adding obstacles (like extra fees that cancel out the benefit, or approval steps that make outside payments unusable).

Combined with the requirement to allow non-WebKit browser engines, iPhone in Japan is shifting from one store and one billing path to multiple routes, so you can offer local methods and a web checkout when it delivers a better price or user experience.

Alternative Billing and Web Checkout

Until now, Apple and Google required most digital goods sold in apps to go through their own billing systems, taking a 15–30% cut and limiting payment options. Developers were also barred from telling users about cheaper or more familiar ways to pay on the web.

In 2021, the JFTC investigated Apple’s “anti-steering” rules and concluded they could violate the Antimonopoly Act. In a narrow response, Apple simply let “reader apps” such as Netflix and Kindle include a single link to external sign-up and payment pages. It didn’t apply to video games or most digital goods, leaving large parts of the market still locked into in-app billing.

The new law closes this gap. Developers can now integrate alternative billing for payment methods that people in Japan prefer. Apple and Google may still set basic safety standards, but they can’t penalize or block outside options.

Full Browsers on iOS

For years, every browser on iPhone and iPad, from Chrome to Firefox, was forced to use Apple’s WebKit engine. That meant no matter what users downloaded, it behaved like Safari underneath. This limited performance and blocked developers from offering full Progressive Web Apps (PWAs), which could have supported web-based subscriptions or checkout alternatives. Japan’s new law ends this restriction.

Apple must now allow browsers with their own engines, such as Google’s Blink (Chrome) or Mozilla’s Gecko (Firefox), and cannot add technical or financial barriers that make them unusable.

This change means web checkout and subscriptions on iOS will no longer be second-class experiences. Faster, more capable browsers improve PWA performance, letting you offer payment flows outside the App Store that are smoother, cheaper, and more aligned with how Japanese consumers already pay online.

Default Browsers and Search Engines

Until now, Apple and Google have decided the order in which apps appear in their app store fronts. On iPhones, Safari was always the browser that opened links. On Android, Google Search and Chrome were pre-set and difficult to change. That gave their own services a built-in advantage, while competing apps struggled to be discovered.

Under the Mobile Software Competition Act, users must be given a clear and easy way to choose their own default browser and search engine when setting up a device. The JFTC guidelines also restrict self-preferencing, i.e., platforms can’t unfairly push their own apps to the top of results, delay approvals for rivals, or use data from the OS or app store to tilt the field in their favor.

This means fairer conditions for visibility and user acquisition in Japan. If more people switch away from the built-in defaults, your app or service has a better chance to be found, compared on merit, and retained.

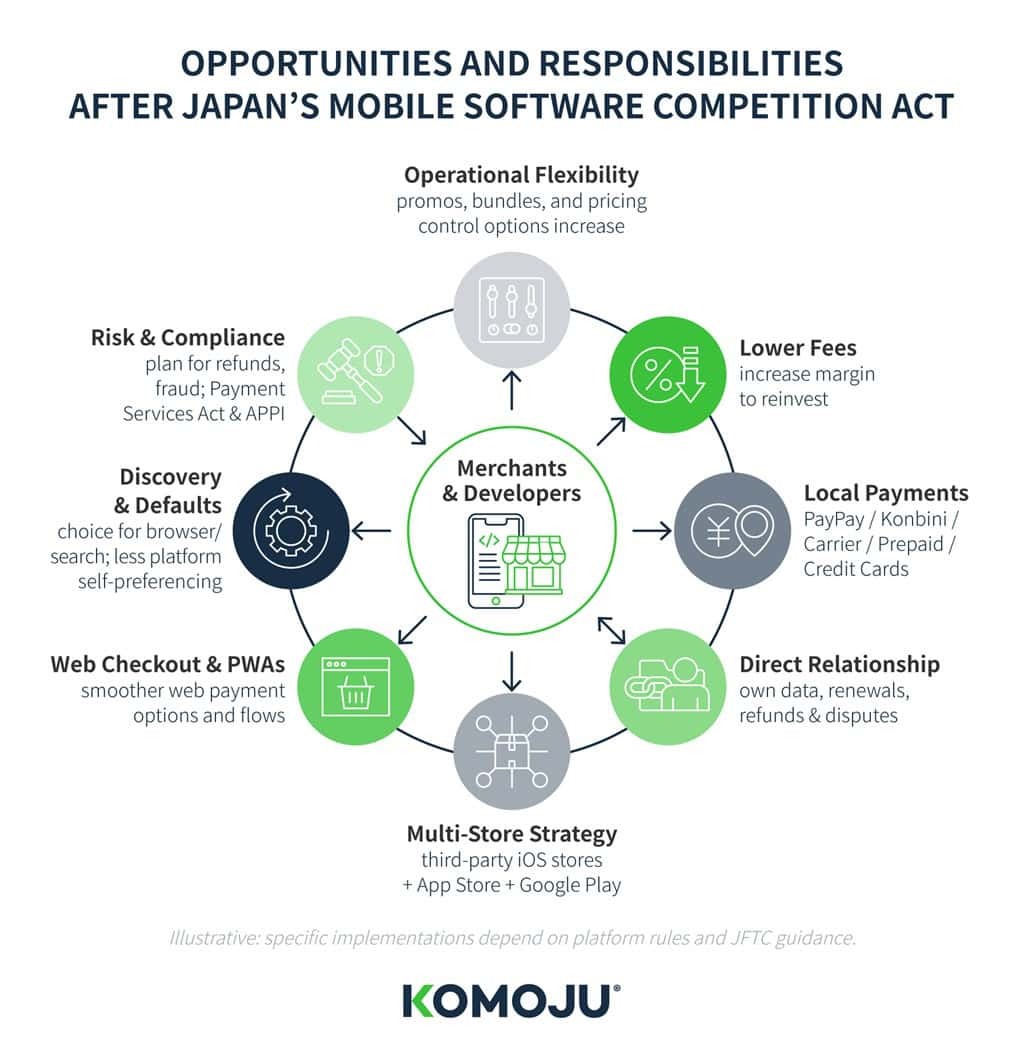

New Opportunities

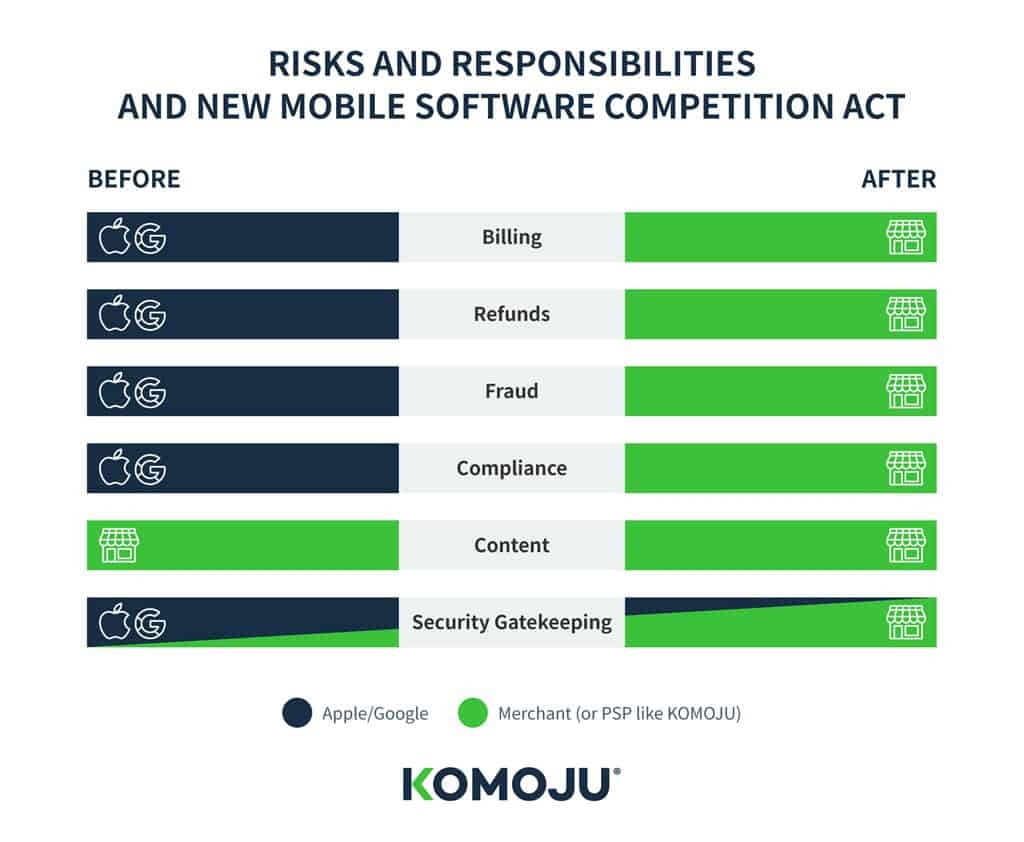

Japan’s Mobile Software Competition Act shifts responsibilities that Apple and Google used to handle behind the scenes—billing, refunds, security checks—onto developers and publishers themselves. That makes this a double-edged change: more room to experiment, but also more work to keep payments smooth and compliant.

Let’s take a look at some of the possibilities that have opened up in Japan.

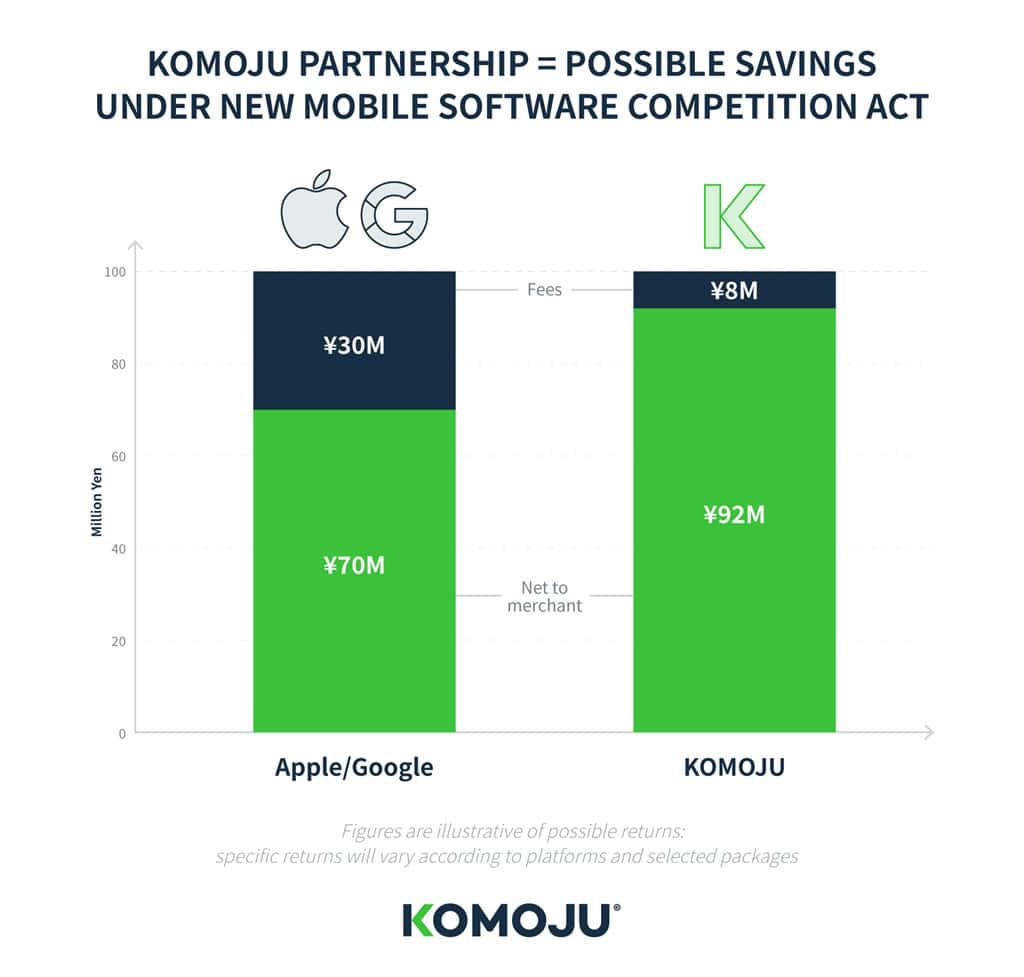

Lower Fees, More Margin

Developers can now bypass the 15–30% platform commission by routing transactions through their own billing or partner with a Payment Services Provider like KOMOJU, which supports Japan-first payments methods. In a 2025 survey, nearly 70% of Japan’s top-grossing games had already built web payment portals to avoid app store fees. For a popular title with millions in revenue, even a few percentage points in saved commission can translate into significant reinvestment for marketing or content.

Local Payment Methods

Credit cards are still the dominant cashless payment method for digital goods in Japan, but that may not be the case for much longer. Digital wallets like PayPay are rapidly becoming more widespread, driven by younger, digitally savvy users and are bolstered by broader government initiatives promoting cashless payments. PayPay currently has over 70 million users in Japan, which accounts for more than one in every two people in Japan.

This increasing diversification of payment methods is especially important for video game publishers and in-app services. Many players are too young to hold credit cards or simply prefer not to use them online. Under the new rules, those users can pay through cash at convenience stores, use carrier billing (adding charges to their phone bill), or even use prepaid cards.

These options were previously blocked inside App Store billing but can now be offered directly or via web checkout. Merchants who integrate them will capture more users who either cannot—or choose not to—pay by card.

Better Customer Relationships

Alternative billing lets merchants own more of the payment data. That means knowing who subscribed and managing renewals directly. Done right, this improves retention because the merchant—not Apple or Google—manages the customer relationship.

Moreover, under the old rules, developers would often redirect customers with billing problems to Apple or Google support, since the platforms processed the payments. This limited visibility into the transaction and could frustrate users who wanted a direct resolution. With alternative billing, merchants (or their payment partner) now handle refunds and disputes themselves, giving them more control over the customer relationship and the ability to resolve issues faster.

Third-Party Stores

With third-party app stores allowed, publishers can list their apps in multiple storefronts. That reduces the risk of any single platform decision (like a sudden policy change) and gives flexibility in running promotions or bundles outside Apple’s rules.

Developers can plan for multi-store builds and operations, managing separate listings, app updates, and QA across each store. Even a small presence outside the App Store and Google Play can capture incremental reach at lower effective fees.

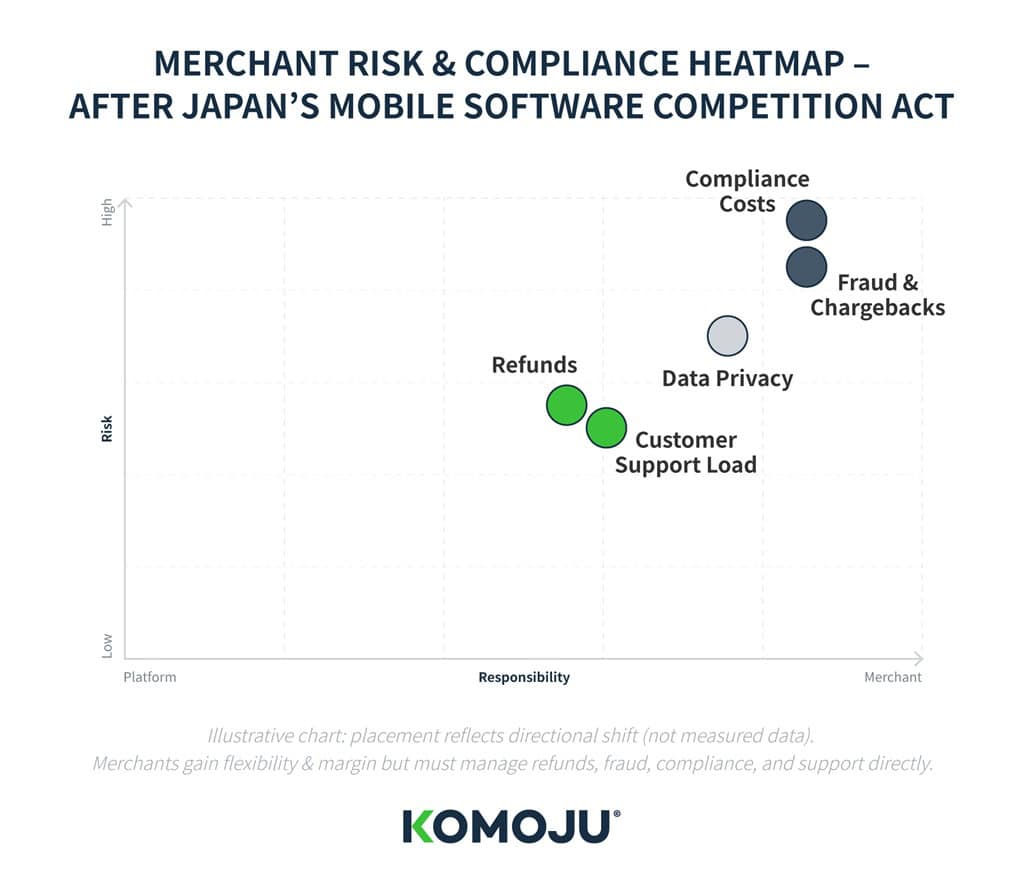

Risks and Trade-Offs

Greater flexibility also brings greater responsibility. As you move beyond a single platform’s billing and distribution, you assume direct accountability. Planning for these areas up front is necessary to realize the benefits of Japan’s new rules.

Refunds and Fraud

Merchants now take on refund and fraud responsibilities that Apple and Google once handled. Under the old model, users with payment issues were directed to platform support, which limited transparency but spared developers from direct liability.

Apple, in particular, was often criticized for being overly generous with refunds, which left developers to bear the cost of fraudulent claims.

Now, merchants must create refund processes that are fair, legally compliant, and resistant to abuse. That means having clear refund terms in Japanese, monitoring transactions for suspicious activity, and ensuring problems can be resolved quickly to avoid complaints being escalated.

Compliance Costs

Running your own billing in Japan brings absolute regulatory obligations. Payments fall under the Payment Services Act, which governs refund rights, receipt issuance, and, in some cases, reporting of prepaid balances.

For video games or SaaS platforms that issue in-app currency, unspent balances may be considered as “prepaid payment instruments,” which require registration or reporting with Japan’s Financial Services Agency. Payment data is also regulated under the Act on the Protection of Personal Information (APPI). Mishandling personal data or transferring it across borders without safeguards risks enforcement and penalties.

International companies cannot assume Japan is lenient—regulators actively enforce consumer and data protection rules, so compliance planning is essential.

User Flow

Apple and Google may still be permitted to insert security prompts when users leave their in-app payment systems. In Europe, Apple already requires a screen telling customers they are “transacting with the developer, not Apple” before continuing with external billing, and Japan’s law allows similar safeguards. If checkout flows add extra steps, conversion rates may fall.

Merchants must design web and app payment experiences that reassure Japanese users and emphasize trusted payment methods. Local testing and careful UX design will help limit drop-off even when extra warnings are present.

Technical Overhead

Supporting multiple app stores and payment providers introduces operational challenges. Each store has its own submission rules and approval timelines, which can delay updates.

Purchases made in one storefront must be recognized across others, requiring a unified account system and reliable purchase records. Monitoring app quality across fragmented builds, ensuring entitlements carry over, and running QA on each version all add to the workload. For smaller teams, especially, the added complexity can stretch engineering and support resources.

Financial Risk and Pricing

By avoiding Apple and Google’s commissions, merchants reduce fees, but assume new financial risks. Chargebacks, fraud-related losses, and fluctuating transaction fees across different payment methods now fall on the merchant. Settlement schedules also differ between payment providers, which may create cash flow pressure. Merchants need to reassess their pricing models, factoring in not only the lower commissions but also the variability of fees and payout timelines across providers.

Reputation and Support Load

In Japan, billing disputes and delayed refunds can quickly escalate into reputational problems. A customer who cannot get a clear answer on a payment issue may turn to the Consumer Affairs Agency or leave negative reviews on the App Store and Google Play.

Reviews carry real weight in Japan’s digital culture. Consumers routinely consult comparison and review platforms before buying, and ratings materially influence discovery and sales.

Now, merchants will be the first point of contact for complaints. Thus, customer support must be prepared to handle inquiries in Japanese, respond quickly, and provide clear explanations of billing policies. Proactive communication—such as publishing transparent FAQs—can reduce escalations and build trust.

How KOMOJU Mitigates These Risks

Many of these potential downsides of Japan’s new smartphone payment law can be offloaded to a provider like KOMOJU. As a licensed Payment Service Provider, KOMOJU takes care of essential compliance tasks for merchant’s, including licenses, fund deposits, and regulatory reporting.

In effect, app developers who integrate KOMOJU operate under its regulatory umbrella and remain fully compliant with Japanese law without incurring extra administrative burdens.

That said, merchants still share responsibility for basic security practices such as safeguarding contact details.KOMOJU also minimizes technical hurdles by providing a unified payments platform. A single integration grants merchants access to a wide range of popular Japanese payment methods, without needing separate contracts or custom builds for each.

Summary

Japan’s Act on Promotion of Competition for Specified Smartphone Software opens the mobile stack across Apple and Google: third-party app stores are permitted (beyond the App Store and Google Play), apps can use alternative payments and link to web checkout, complete (non-WebKit) browsers can run on iOS, and users can choose their default browser and search (not just Safari/Chrome or Google Search).

For merchants, this breaks the one-store-one-payment model. You can reduce fees, offer Japan-native options (Konbini payment, PayPay, carrier billing, prepaid cards) alongside credit cards, and take firmer control of pricing, refunds, and retention. You should see more completed checkouts with familiar local methods, smoother website purchases as full-featured browsers arrive on iOS, and broader discovery on Android as default search and browser choice and alternative billing take hold.

With KOMOJU, one integration adds Japan-specific payment methods, local refund paths (including Konbini payment), risk controls tuned to domestic compliance, and reporting aligned to Japanese laws—so you capture the upside without rebuilding your payments stack.

Contact KOMOJU to find out more about how to increase Japanese, South Korean and other region’s alternative payment methods to your apps.

We help businesses accept payments online.