We help businesses accept payments online.

Credit cards have become a cornerstone of South Korea’s economy, with many Koreans relying on them for daily transactions, from grocery shopping to dining out and even paying for utilities. According to surveys, around 57 percent of South Koreans prefer using credit cards over other payment options, making it the most popular payment method in the country.

While international credit cards like Visa and Mastercard are widely accepted in South Korea, locals often prefer local credit cards due to regional benefits, acceptance at local businesses, and better integration with Korean mobile payment systems.

For businesses looking to tap into the market, KOMOJU offers businesses in South Korea a simple way to integrate credit cards as a payment method.

As a payment gateway, KOMOJU supports local credit cards, digital wallets, and carrier billing explicitly tailored to the South Korean market. With KOMOJU, businesses can easily accept local credit cards, making it a viable choice for eCommerce businesses that want to cater to local consumers.

In this article, we’ll explore South Korea’s local credit card landscape, the major players in the market, and how businesses can leverage both KOMOJU and local credit cards for success.

What Are Local Credit Cards?

Local credit cards are issued by banks, credit card companies, and other financial service providers in a specific country and are primarily designed for use within that country. These cards often support local currency transactions and align with the financial regulations and banking practices of the issuing country.

In South Korea, local credit cards are predominantly used for payments within the country and may not be accepted for international transactions. Cards issued by prominent financial institutions such as Samsung, Lotte, Hyundai, Hana, BC, NH, Shinhan, and KB often pair with Korean merchants, mobile payment apps like Naver Pay and Kakao Pay, and local point-of-sale (POS) terminals.

Although they can be used for a wide range of transactions, from retail purchases to utility payments, their primary focus is on serving local businesses and consumers. They offer localized features such as loyalty rewards, cashback on local spending, and integration with Korea-specific services like public transportation or telecom bill payments.

Local vs. International Credit Cards in South Korea

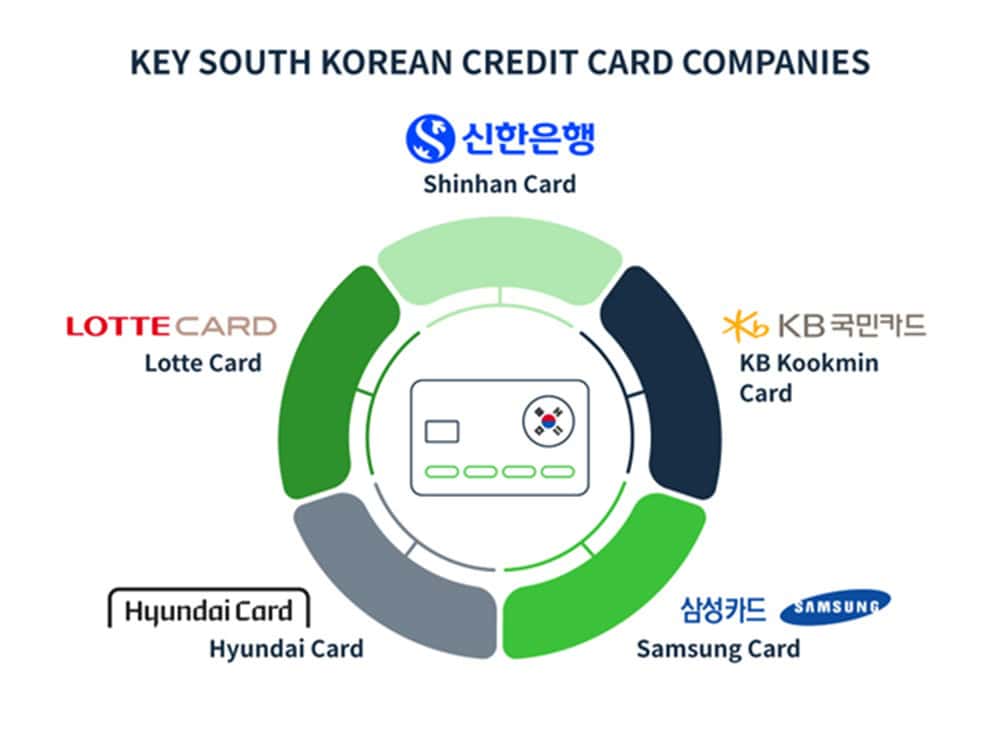

In 2023, around 130 million credit cards were issued in South Korea, showing the strong role they play in daily transactions. Local issuers like Shinhan Card, Samsung Card, and KB Kookmin Card dominate the market, with Shinhan holding nearly 22% of the market share.

While local credit cards are the preferred choice for many due to their localized benefits, they may also be more accessible for residents, particularly younger consumers, than international cards.

Many local credit card issuers offer products for younger people, such as student or cards (i.e., cards that people with little to no credit can apply for). These cards come with lower credit limits and more lenient approval criteria, making it easier for young applicants, even those with part-time jobs or lower income levels, to qualify and begin building their credit history.

In contrast, international cards often require stricter approval criteria, such as higher income thresholds and established creditworthiness, making local cards a more practical and attainable option for younger consumers.

Another factor could be online shopping. According to a 2023 internet usage survey in South Korea, 75% of respondents reported using their credit cards for online purchases. In the same survey, consumers spent an average of 187,000 won per month (approximately USD$140) on online shopping, showing just how important credit cards are for online transactions in South Korea.

How Do Local Credit Cards Work in South Korea?

Local credit cards in South Korea work similarly to international credit cards but are specifically fashioned to the needs and preferences of local consumers. Local cards are issued by Korean banks and financial institutions and are integrated with the country’s financial systems, including mobile payment apps like KakaoPay, Naver Pay, and Toss.

When making purchases with local credit cards, transactions are processed in South Korean won (KRW). The cards can be used both for offline transactions at physical stores and online purchases on eCommerce platforms within the country.

In South Korea, local credit cardholders can also typically choose between a one-time lump-sum payment or installment payments when making purchases. This option, known as bunhal (분할, meaning “split”), allows users to spread the cost over several months or even longer for larger purchases. Depending on the card issuer and merchant, these installments can be interest-free or may include interest charges.

Credit card bills will list charges under two categories: 일시불 (ilsibul, one-time charges) and 할부 (installments). The bill will show the number of installments remaining.

You can pay the total amount owed by the due date using various methods:

- Online Banking: Transfer funds directly from your bank account to your credit card issuer’s account via your bank’s online portal or app.

- Mobile Banking Apps: Use your credit card issuer’s mobile app or other banking apps that support credit card payments.

- ATM Payments: Some ATMs allow direct credit card bill payments.

- In-Person: Pay at a bank branch.

Why Are Local Credit Cards Important in South Korea?

Local cards in South Korea are preferred for several reasons, such as:

- Cultural Preference: South Koreans might prefer local credit cards because they trust or are familiar with local financial institutions. These cards provide familiar rewards and services that align with their spending habits.

- Widespread Acceptance: Nearly all merchants in South Korea accept local credit cards, both online and offline. They are integrated with local digital payment systems like Naver Pay and Kakao Pay, making them convenient for everyday transactions.

- Multiple Card Ownership: The average South Korean holds several credit cards, often using a mix of international and local ones. While international cards are typically reserved for travel and cross-border transactions, local cards are preferred for local purchases due to their loyalty rewards, cashback programs, and other benefits that cater specifically to local merchants and services.

- Installment Payment: Local credit cards in South Korea allow consumers to split large purchases into monthly installments. While this feature exists elsewhere, it’s widely used in South Korea, especially for expensive items, offering a convenient way to manage payments.

Key South Korean Credit Card Companies

Here are some of the major Local credit cards in South Korea.

Shinhan Card

Shinhan Card (신한카드), owned by Shinhan Financial Group, is one of the largest credit card issuers in South Korea and the most popular, controlling about 22% of the market. There is a range of cards tailored to various consumer needs, such as travel, dining, and shopping.

While it’s a popular choice for local consumers, the Shinhan Card is often considered more challenging for foreigners to obtain due to stricter application criteria. However, in 2024, Shinhan Card announced plans to develop new card products specifically designed for foreigners, aiming to make its services more accessible to non-Korean residents and visitors.

KB Kookmin Card

Kookmin Card (KB card, KB국민카드) is a credit card company under KB Financial Group that offers a range of credit and check cards. KB’s credit cards are typically more accessible but often require a minimum amount of spending for rewards.

For example, spending less than 10,000 KRW at a convenience store may not qualify for cash back or points on some cards. However, certain cards like the and Liiv Mate 체크카드 offer rewards for small transactions.

Samsung Card

Samsung card (삼성카드) is part of the Samsung Group. It offers a variety of co-branded cards with partners like SKT and KT and major retailers like E-mart and Shinsegae. However, it’s known to have strict qualification requirements for foreign residents.

Samsung Card offers a range of credit and check cards with cashback and point rewards. Some cost-effective rewards include the Samsung iD EV Credit Card, which offers substantial savings for electric vehicle owners.

Hyundai Card

Hyundai card (현대카드), part of Hyundai Motor Group, is a major credit card provider in South Korea, known for its unique M Points rewards program.

These points can be used at partner retailers but only cover 20-30% of the purchase price. Some options allow you to redeem them for gift cards at a reduced value. Hyundai Card is also popular with foreigners living in South Korea, and its mobile app is available in English for international users.

Lotte Card

Lotte Card (롯데카드), part of the Lotte Group, offers credit cards that also function as L.Point membership cards. These cards allow users to earn L.Point rewards at L.Point-affiliated stores without needing a separate membership card.

Lotte cards can also be used to recharge Cashbee cards for public transport. Lotte Card offers various co-branded cards and special rewards, particularly for shoppers at Lotte-owned stores like Lotte Mart and Lotte Department Store.

Advantages & Disadvantages of Using Local Credit Cards

Local credit cards are a key payment method for many South Koreans, offering advantages that cater to the country’s consumer habits. Integrating Local credit card payments into your eCommerce platform can raise customer satisfaction and expand your reach within the South Korean market.

Advantages

- Installment Payments: South Korean consumers often take advantage of installment payment options available through local credit cards. By offering this feature on your site, you can make big-ticket items more accessible to buyers, increasing the likelihood of larger purchases. This is particularly useful for businesses selling electronics, luxury items, or higher-value goods.

- Localized Rewards: South Korean credit cards frequently offer rewards that appeal to local shopping habits, such as discounts at popular restaurants, Korean-only online stores, or travel rebates. By accepting Local credit cards, you align your business with these rewards programs, adding another layer of appeal to local customers who actively seek to maximize their card benefits.

- Mobile Payment Integration: Local credit cards have become integrated with popular Korean mobile payment apps like KakaoPay, Naver Pay, and Toss. Enabling these payment methods on your platform simplifies the transaction process and increases the likelihood that South Korean consumers will choose your products. Mobile payments are popular in the country, and having this capability is essential for capturing a broader audience.

Disadvantages

- Limited International Use: While Local credit cards are popular for local transactions, they may not be accepted for purchases outside of South Korea. If your business serves international customers in South Korea, it’s important to offer additional payment methods alongside Local credit cards to ensure a seamless shopping experience for all users.

- Strict Qualification Criteria for Foreigners: Foreign residents in South Korea may face more stringent requirements when applying for Local credit cards. As a business owner, you may want to consider offering alternative payment methods for this demographic, such as global credit cards or digital wallets, to ensure inclusivity and convenience.

- Spending Caps: South Korean cards apply a credit limit on a per-person basis rather than per card. For instance, if your credit limit is five million won, applying for a second credit card won’t increase your overall limit. This can be a disadvantage for those seeking to expand their purchasing power across multiple cards.

Summary

With 57% of Koreans preferring credit cards for their purchases, businesses aiming to enter the South Korean market should understand both the benefits and limitations of these cards.

Local credit cards offer several advantages, such as high integration with popular local payment systems like Naver Pay and Kakao Pay, attractive loyalty rewards, flexible installment payment options, and lower transaction fees compared to international cards. However, there are also drawbacks to consider, including limited international usage, the potential for higher interest rates, annual fees, and spending limits.

For eCommerce businesses, using KOMOJU to support local credit card and mobile wallet transactions provides a practical solution for engaging with South Korea’s tech-savvy audience while maintaining focus on business objectives.

Ready to integrate South Korean Local credit cards?

Find out South Korean Local credit cards’ processing fees on the Korean local credit cards payment method page. If Korean local credit cards are the right payment method to offer your customers, sign up on KOMOJU to offer your customers a secure and convenient payment option!

If you’re unsure if Korean local credit cards are the right payment method for your eCommerce site, why not talk to our payments experts to learn more about South Korean payment methods?

FAQs

Below are some frequently asked questions about Local credit cards in South Korea.

Yes, but the process may vary depending on the issuing bank and the applicant’s residency status. Typically, foreign residents need to meet certain criteria, such as having a valid Alien Registration Card (ARC), proof of stable income, and a local address. Some banks may also require a Korean bank account and/or a Korean co-signer. Some issuers, such as Shinhan Bank, are considered to have exceptionally stricter criteria regarding foreigners.

Local cards often offer region-specific loyalty rewards, discounts, and promotional offers. They also offer flexible installment payment options.

Yes, Local credit cards are widely accepted online in South Korea. While Visa and Mastercard are also widely accepted, some online shopping platforms exclusively accept credit cards issued in South Korea.

Local credit cards in South Korea generally offer strong security features, often on par with international cards. They also typically use secure online payment authentication—so much so that it could be considered tedious. Korean websites can be extra strict due to the specific security programs that need to be installed.

We help businesses accept payments online.