We help businesses accept payments online.

Online stores constantly struggle to prevent eCommerce fraud, a challenge that has only grown in complexity. The surge in online shopping during the COVID-19 pandemic, coupled with the rise of more advanced cross-border cybercrime tactics, has made fraud prevention even more critical.

By 2027, global eCommerce fraud is projected to surpass $343 billion, with North America expected to account for 42% of the fraudulent transaction volume. In Japan, losses from internet fraud reached approximately 77.2 billion yen in 2023. Businesses are dealing with issues like customers abusing discount systems or fraudulently disputing transactions, as well as hackers taking control of accounts.

To combat these threats, companies can implement robust fraud prevention strategies, safeguarding their profits, earning customer trust, and staying compliant with relevant regulations. Emerging technologies such as artificial intelligence and tokenization are providing fresh opportunities for effective fraud mitigation.

What Is eCommerce Fraud?

Also known as payment fraud, eCommerce fraud occurs when criminals use the internet to steal customers personal information, like credit card details, to make fraudulent gains at the expense of online businesses, or use illicit means to cheat businesses, such as exploiting refund policies or engaging in chargeback fraud. Scammers constantly devise new tricks, but many rely on tried-and-true methods.

These scams target online retailers, aiming to go unnoticed while damaging the business’s profits. Contrary to the image of a skilled hacker using backdoor channels, the reality is much simpler—fraudsters typically use everyday devices like computers, tablets, or phones to carry out their scams through online stores.

Scammers can easily buy stolen credit card details from the dark web, and the anonymity of online fraud makes it even more tempting. Since they can operate from pretty much anywhere with internet access, it’s hard to catch them. To make things even more complicated, law enforcement often doesn’t prioritize eCommerce fraud, and with these crimes crossing borders, tracking down these criminals, let alone prosecuting them, is nigh impossible.

Understanding eCommerce Fraud

Online fraud is an increasingly dangerous threat for businesses, affecting operations, profits, and even client relations. Many types of fraud disrupt business operations, including “friendly fraud,” where consumers abuse policies to procure products free of charge or at a discount. Thus, businesses have to set aside valuable time, money, and manpower to resolve conflicts, suffer chargebacks, and supervise the aftermath.

In 2024, businesses around the world are expected to lose about $48 billion to fraud each year. And it’s not just the value of the fraudulent transactions that businesses lose. For every $100 in fraud, companies end up losing an average of $207 once you factor in chargebacks, shipping, and processing fees. These added costs chip away at profit margins, leaving less money for important things like growth, innovation, and keeping loyal customers. As fraud drains resources, businesses are finding that more and more of their revenue is being spent just on fighting fraud instead of investing in their future.

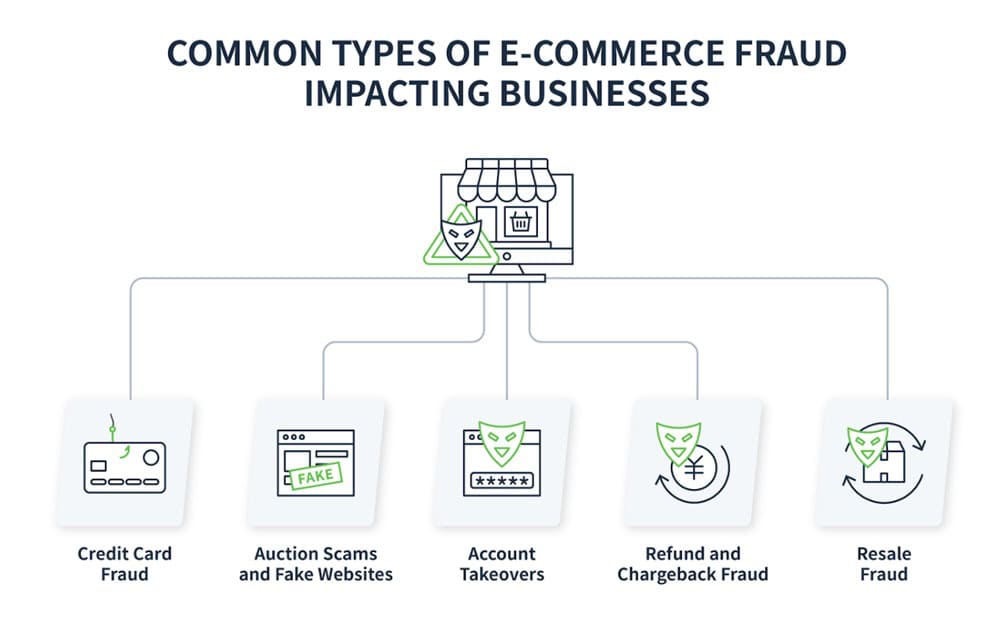

Common Types of eCommerce Fraud Impacting Businesses

Credit Card Fraud

Credit card fraud occurs when cybercriminals use stolen card details to make unauthorized purchases, which can lead to chargebacks and inventory loss. In 2023, the total losses from credit card fraud in Japan reached a staggering 54 billion yen, with nearly 93.3% of that—around 50.47 billion yen—coming from card theft.

How It Works: The fraudsters typically get credit card information by hacking, phishing, or skimming. With stolen details, they make purchases online, and the actual cardholder disputes the charges, hence, the chargeback to the business.

How To Prevent It: Businesses should use secure payment systems with fraud detection tools. Adding extra security like 3D Secure can require customers to confirm their identity during checkout. Monitoring transactions for unusual activity, like sudden large orders or multiple purchases from the same IP address, is also key. Educating customers on protecting their information, like avoiding phishing scams and using strong passwords, adds another layer of defense.

Account Takeovers

Account takeover (ATO) fraud happens when hackers gain access to customer accounts and make fraudulent orders. This can affect customer trust, as consumers expect their personal information to be secure. Negative reviews, public complaints, and frustrated customers are just some of the consequences a company may face, along with financial losses from reimbursements.

According to the fraud prevention platform Sift, ATO fraud increased by 131% in the latter half of 2022, and it’s especially prevalent during peak shopping periods like Black Friday and “Cyber Monday.”

How It Works: Fraudsters typically obtain login details through phishing, where they impersonate the customer or a trusted entity to trick the victim into revealing credentials, or through credential stuffing, where they use stolen username-password combinations from data breaches to gain unauthorized access to multiple accounts. Once they get access to an account, they can make fraudulent purchases, change account settings, or steal personal information.

How To Prevent It: To prevent account takeovers, businesses should encourage strong, unique passwords and offer two-factor authentication. They should also monitor accounts for unusual logins or activity and add CAPTCHA to login pages to stop automated attacks.

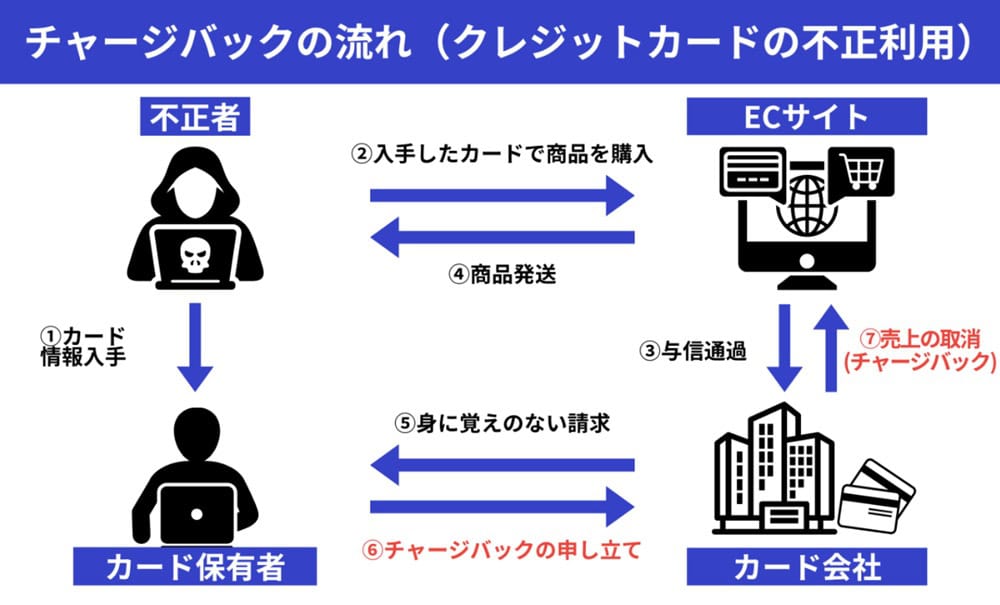

Refund and Chargeback Fraud

Also known as “friendly fraud,” refund and chargeback fraud occurs when customers falsely claim they didn’t receive their purchase or return used items to get unauthorized refunds. Though consumers rather than criminal groups carry this out, it remains one of the most damaging fraud types for eCommerce businesses. In 2024, the projected global chargeback cost for merchants was $54.5 billion.

In Japan, the most common type of eCommerce fraud is chargeback fraud, according to Kakko Co., Ltd., a Japanese company specializing in AI fraud detection.

How It Works: Fraudsters may return stolen goods, claim they never received an item, or dispute valid charges with their bank or credit card provider, resulting in chargebacks.

How To Prevent It: To fight refund and chargeback fraud, businesses should have clear, strict return policies and track shipments with proof of delivery. Screening chargeback requests carefully and using fraud detection tools can also reduce the likelihood of fraud.

Resale Fraud

Resale Fraud occurs when fraudsters use stolen information or unauthorized discounts to buy in-demand items and resell them at a higher price. They often target limited-edition or high-value products.

How It Works: Fraudsters get their hands on stolen credit card details or exploit discount codes to quickly buy up popular items. Once they have them, they resell the products on third-party platforms, hoping to profit from the scarcity by selling at inflated prices.

While this can look like “scalping,” it’s only fraud if the purchase involves illegal methods. However, it can still feel unfair to regular customers, especially when bots are used to snatch up products before anyone else has a chance. This leaves customers frustrated and less likely to return.

How to Prevent It: Businesses should monitor purchasing patterns and look for bulk buys, especially of hot-ticket items. Setting limits on the number of products a single person can buy (especially for in-demand goods) can help. Adding extra layers of customer verification, like multi-factor authentication (MFA), ensures the buyer is legitimate.

Businesses can also “fight fire with fire” using machine learning and fraud detection software to spot unusual activity before it becomes a problem. They can also track and block known resellers to prevent them from taking advantage of the system.

Online Fraud Trends in 2025

As eCommerce evolves, fraudsters are constantly finding new ways to exploit vulnerabilities. Here are some of the latest fraud methods your business needs to be aware of.

Promo Abuse

Fraudsters are increasingly exploiting promotional incentives for personal gain rather than their intended purpose. This growing problem has led to major losses and reportedly cost businesses $89 billioin annually. For example, in 2022, PayPal had to shut down 4.5 million accounts after discovering fraudsters had hacked into their incentive and rewards program. Automated bots and AI-driven scams have made it easier for fraudsters to take advantage of these promotions.

Overpayment Fraud

In overpayment fraud, fraudsters intentionally overpay for an item using fraudulent payment methods and then request a refund for the excess amount. This scam can be hard to detect, as scammers often provide fake receipts and claim the funds are on hold until the refund is processed. Merchants should be cautious of overpayments and verify the authenticity of transactions before issuing any refunds.

Key Technologies for eCommerce Fraud Protection

Below are common tools used to detect and prevent eCommerce fraud.

3D Secure Authentication

3D Secure (3DS) is used during online transactions to verify the cardholder’s identity. When making a purchase, after entering card details, 3D Secure prompts the cardholder to complete an extra verification step, which can include entering a password, an email or phone short message service (SMS), providing a fingerprint, or responding to a notification from their bank. This helps ensure that the person making the transaction is indeed the authorized cardholder.

Tokenization

Tokenization is the process of replacing sensitive payment information, such as a credit card number, with a unique, randomly generated string of characters called a “token.” The tokenized value represents the original data but has no usable value outside the context of the specific transaction or system it was created for. Only the merchant’s system or your device can map the token back to the original payment data.

AI-Powered Fraud Detection

The latest innovations in AI allow smart algorithms to spot suspicious activity in real-time by analyzing transaction data. These systems can learn what normal transactions look like and search for signs that something is off, like large withdrawals or unusual spending patterns. As it collects more data, the AI gets better at detecting fraud, even the more sophisticated types.

One of the biggest benefits of AI fraud detection is its ability to catch suspicious activity immediately. Businesses can act quickly to stop fraud before it becomes a larger problem. AI systems also scale well, meaning they can handle large volumes of transactions without employing more staff.

Purchase History and Behavioral Analysis

Customer analytic tools allow the detection of suspicious or anomalous transactions by analyzing patterns to build a unique behavioral profile for each user. Behavioral analytics takes into consideration transaction types a customer usually makes, the time of day they make purchases, and the devices used. Any deviation from these established patterns, sudden large purchases, or some other unusual transaction type triggers alerts for possible fraud.

For example, if a customer who usually purchases small items on a regular basis suddenly orders something absurdly expensive, that would be a suspicious transaction. Behavioral analysis can also identify changes in the frequency of purchases, location shifts such as logging in from another country, or any other atypical actions that do not fit with the user’s usual behavior. With continuous learning from data, these systems become increasingly accurate, identify sophisticated fraudulent activities, and enable businesses to act swiftly to prevent losses.

Real-Time Monitoring and Alerts

Real-time transaction monitoring tools detect potential fraud as it happens, analyzing transactions instantly to identify suspicious activities. Unlike traditional methods that review transactions in batches, real-time monitoring enables immediate action when red flags appear, such as large or unusually rapid transactions. The system sends an alert, allowing businesses to step in quickly and prevent fraud before it escalates.

Benefits of Implementing Fraud Protection

Reduced Financial Losses

Online businesses are at constant risk of financial ruin from fraud and data breaches. A notable example is Kyushu Railway Company, which experienced a severe data breach that exposed over 3,000 credit card details and nearly 8,000 personal records. The aftermath included costly measures such as credit card reissuance and compensation for affected customers, with response costs averaging around 24 million yen. Financial burden from fraud can push companies to the brink if they don’t have the proper safeguards in place.

However, effective fraud protection can significantly reduce the impact of scams. For instance, YKK AP Inc. responded to fraudulent orders by improving their verification processes and canceling suspicious transactions, which helped to curb potential losses. It is a win-win situation: Safeguard your bottom line and maintain customer trust. With the right precautions, sites can avoid falling victim to fraud and continue operating with confidence in a landscape that’s rife with threats.

Better Customer Trust and Retention

According to a survey by PYMNTS, 82% of eCommerce merchants believe that improving customer satisfaction is a key benefit of updating their anti-fraud measures. A safe transaction environment will help to create customer trust. When people are aware that their payment details and personal information are secure, they are more likely to complete their purchases and return for more. Fraud protection gives a sense of security, reducing anxiety that accompanies online transactions, especially in high-risk sectors such as eCommerce and banking. Trust leads to repeat purchases, reinforces brand loyalty, and promotes long-term customer retention; it is, therefore, an important part of the customer experience.

Improved Operational Efficiency

Automated fraud detection tools simplify business operations by cutting down on the need for manual reviews of suspicious transactions. This boosts both the speed and accuracy of order processing so teams can focus more on genuine customer interactions.

Alloy, a leader in identity verification and fraud prevention, highlights several case studies. Live Oak Bank reduced investigation time by 30% by integrating onboarding and credit underwriting into one platform. Novo Bank cut manual reviews by 50%, doubling customer conversions. Grasshopper Bank secured 800 new clients monthly by streamlining onboarding. These examples show how automated fraud detection improves efficiency and customer satisfaction.

Compliance with Regulations

“Compliance” refers to a business’s adherence to the laws, regulations, and industry standards that govern its operations. In the context of fraud prevention, compliance ensures that companies follow the necessary guidelines, which helps protect them from legal consequences, reputational damage, and financial losses.

Following industry-specific standards—for instance, PCI DSS (Payment Card Industry Data Security Standard) on payment security, GDPR (General Data Protection Regulation) on data protection, and other regional regulations—therefore protects businesses from the consequences of fraud.

A strong compliance framework not only helps companies meet these various regulatory demands but also shows a commitment to transparency and trust, which eventually lowers the chances of expensive breaches.

Competitive Advantage

Consumers expect both convenience and security when shopping online. Offering secure transactions gives businesses a competitive edge, especially online, where trust is earned through social media and reviews.

According to a study by GBG, a global digital identity verification company, 92% of consumers are concerned about fraud and would prefer to choose companies offering secure modes of payment. Businesses that fail to protect their customers risk losing them to competitors who provide safer, more trustworthy transaction processes.

Fraud prevention can also become part of a company’s brand. When businesses use the right security measures, they not only protect themselves from financial losses but also gain customer trust, which leads to increased loyalty and revenue. Customers are more likely to return to businesses they feel are secure, and offering strong fraud protection helps companies stand out in a crowded market, ultimately driving growth and success.

KOMOJU’s Fraud Protection: A Competitive Advantage

KOMOJU is a powerful and user-friendly payment gateway that helps businesses worldwide streamline their payment processing while ensuring secure transactions. Specializing in digital payment solutions, KOMOJU provides merchants with a simple way to accept payments from customers through a variety of methods, including credit cards, bank transfers, mobile payments, and more.

Free Fraud Protection for All Merchants

KOMOJU offers fraud protection as a standard service for all merchants, with no additional or hidden costs. The platform follows PCI-DSS compliance with state-of-the-art fraud protection that enables a business to use fraud detection tools without extra fees.

AI-Powered Risk Analysis

KOMOJU utilizes advanced AI-powered systems to assess risk and generate scores based on multiple factors. This risk analysis helps businesses instantly detect potentially fraudulent activities and take action before any damage is done.

Industry-Standard Tools

KOMOJU prioritizes security, with certifications like Privacy Mark, ISMS/ISO 27001, and PCI DSS compliance. The platform also uses 3D Secure authentication, adding an extra step for customers to verify their identity during checkout, making it harder for fraudsters to succeed. These measures help businesses protect sensitive data for a safer and more secure shopping experience for everyone.

Summary

The rise in eCommerce fraud, especially in the post-COVID-19 era, has placed businesses in jeopardy, with losses globally projected to top $343 billion by 2027. Fraudsters target online retailers through various methods beyond classic credit card theft, and the internet’s anonymity makes tracking these crimes difficult. Fraud can severely harm a company’s reputation and customer trust.

To counter this, innovative fraud prevention tools, such as AI-driven machine learning, are more effective than ever. These tools analyze data in real time, detecting unusual patterns and preventing fraudulent transactions before they occur. Secure payment methods like tokenization and 3D Secure authentication add extra layers of defense, boosting customer confidence.

The need for vigilance remains constant. As fraud tactics evolve, businesses must stay proactive, regularly updating security measures. KOMOJU offers state-of-the-art fraud protection and 3D Secure authentication, helping businesses safeguard their revenue, protect their customers, and ensure peace of mind.

FAQs

Fraud prevention and protection reassures customers that their sensitive information is safe. This leads to stronger customer relationships, increased loyalty, and a better reputation in the long term.

Here are some key tools to prevent eCommerce fraud:

- Tokenization: Replaces sensitive card data with unique identifiers to protect against data breaches.

- 3D Secure: Adds an extra authentication step to verify customer identity during transactions.

- Real-Time Monitoring: Tracks transactions in real-time to spot and stop fraud quickly.

- Behavioral Analytics: Detects unusual activity by analyzing customer behavior patterns.

- AI Risk Analysis: AI tools (Salv Bridge, Swift GPI, Mastercard Consumer Fraud Risk, etc.) can evaluate factors like card details and transaction patterns to identify fraud risks.

The hard truth is businesses must regularly study trends and adapt their security measures. Fraudsters constantly evolve their methods, so updating security protocols and using advanced fraud detection tools is paramount. Regularly reviewing transaction data and implementing machine learning systems to identify new patterns of fraudulent behavior can help businesses stay proactive and protect their bottom line.

Yes, KOMOJU’s fraud protection is ideal for businesses of all sizes, including small businesses. KOMOJU provides free, user-friendly fraud protection tools that allow small businesses to secure their transactions without incurring extra costs.

We help businesses accept payments online.