We help businesses accept payments online.

Japan is a leader in fashion innovation, blending tradition, technology, and craftsmanship. In the past decade, retailers like UNIQLO have taken the lead in refining omni-channel strategies, merging online and offline shopping, to make the customer journey more convenient, engaged, and loyalty-driven.

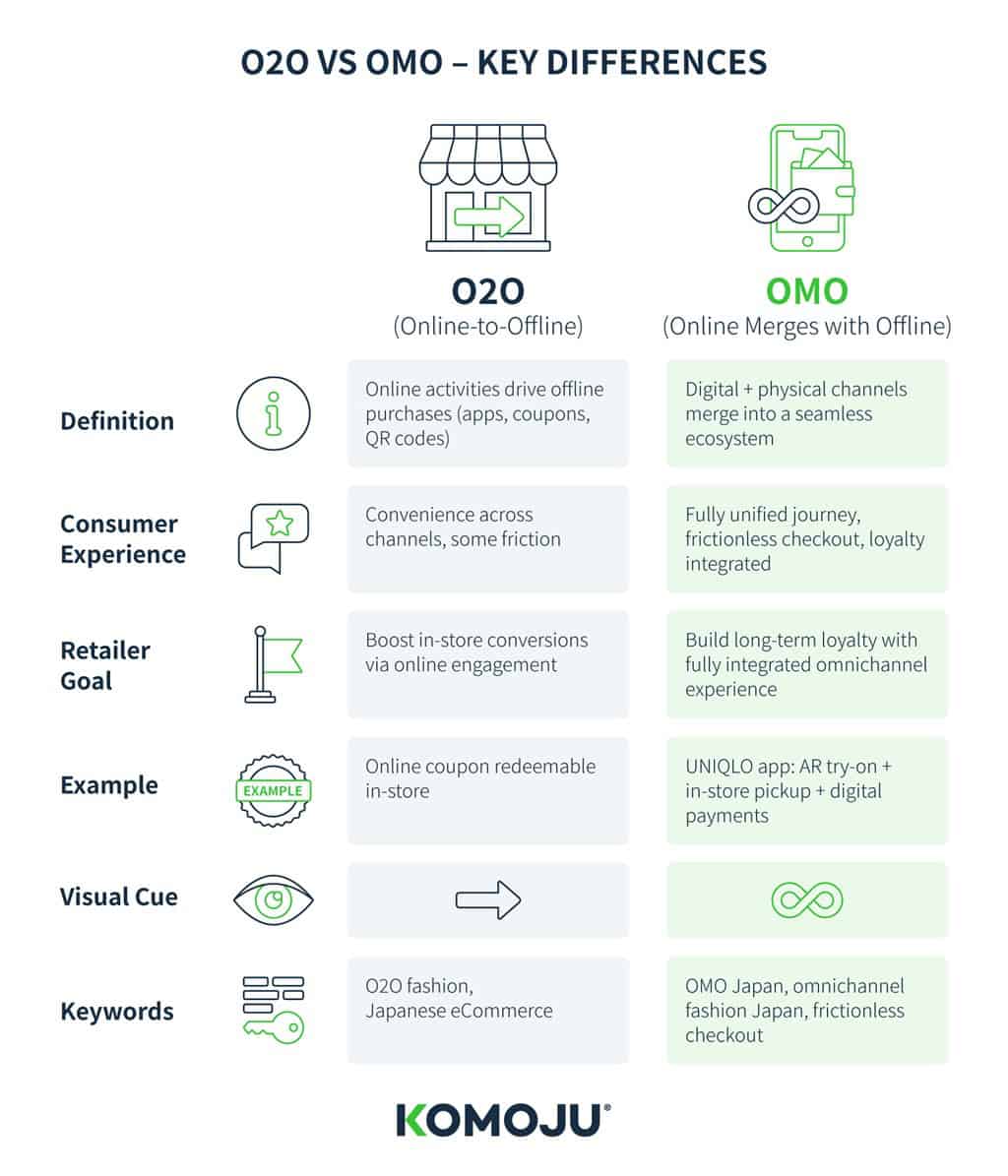

A key part of this evolution is the shift from basic O2O models (online-to-offline) to OMO (online merges with offline). This has resulted in unified digital and in-store experiences that are supported by localized payment options. As Japan’s online fashion market expands, this type of integration is becoming even more important.

According to Coherent Market Insights, in 2025, Japan’s fashion eCommerce market was valued at $32.4 billion USD, and growing rapidly at 15% annually, it is expected to reach $86.2 billion by 2032. This makes Japan an attractive market for international brands; however, entry is not easy. Brands must be able to adapt to local consumer expectations, understand payment habits, and build seamless connections between online and offline experiences.

In this article, we define O2O and OMO, examine how leading Japanese fashion retailers apply these strategies, and why payments are the hidden engine behind frictionless fashion experiences. Through real-life case studies and actionable takeaways, we’ll show how international brands can succeed in Japan’s fashion ecosystem.

Background on Channel Integration in Japan

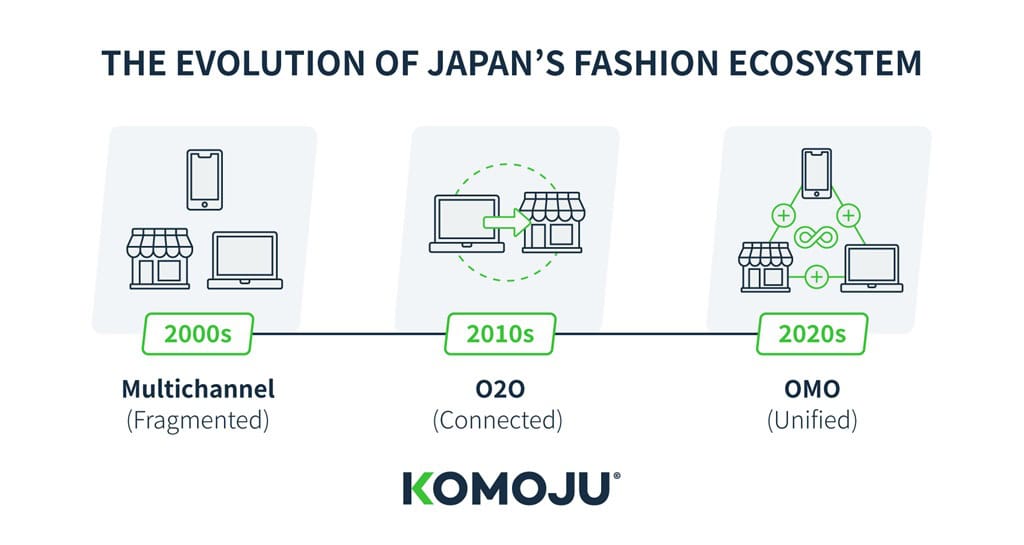

Before diving into Japan’s retail transformation, it’s helpful to understand key channel integration terms and observe how they have evolved. Each stage illustrates the degree at which retailers connect digital and physical channels, and provides insight into the broader evolution of Japan’s fashion ecosystem. While progression varied, the overall timeline reflects a natural evolution driven by technology and global retail trends.

Key Definitions & Evolution

Multichannel

These are brands that have many channels (brick-and-mortar store, website, app, social media). However, each one works separately and does not provide customers with a connected experience.

Evolution: In the early 2000s, retailers typically started with a brick-and-mortar store. With the advent of the internet, many businesses had a basic website, and later on, social media accounts. The shopping experience was fragmented, and customer information, loyalty points, and campaigns didn’t transfer across channels.

Cross-Channel

Some brands connect certain channels without achieving full integration. A common example of this is click-and-collect, which allows customers to pay online and collect their purchase in the store.

Evolution: By the late 2000s, Japanese retailers had started experimenting with connecting online and offline touchpoints. Even though convenience improved a little, integration was still limited.

O2O (Online-to-Offline)

When digital channels (mobile apps, digital coupons, and QR-codes*) are used to bring customers into physical stores, customers can then complete their purchase in person. Brands leverage online traffic and use it as a funnel for offline traffic.

Evolution: By the late 2010s in Japan, retailers like UNIQLO and ZOZOTOWN were using O2O strategies. Mobile apps, loyalty programs, promotions, and digital campaigns helped drive online traffic to physical stores. However, online and in-store experiences were still somewhat separated.

Many global brands remain at this stage today, either due to a lack of technological infrastructure or slow digital adoption. This affects their ability to build stronger customer loyalty, capture data across channels, making it difficult to remain competitive.

OMO (Online Merges with Offline)

At this stage, digital and physical channels are fully integrated into a seamless ecosystem. Customers can browse online, try in-store, pay via mobile, earn loyalty rewards across touchpoints, and their information is seamlessly shared across channels.

Evolution: From the late 2010s, Japan’s top retailers pushed into OMO. Augmented Reality (AR) try-ons, real-time inventory, and mobile payments helped to unify the customer journey. Customers now expect loyalty points, personalization, and frictionless checkout for a fully connected experience.

Consumer Journey in OMO Fashion

As retail evolves from multichannel to O2O and OMO, the consumer journey becomes increasingly seamless. Under OMO, customers remain connected within one ecosystem, receiving a consistent experience across both digital and physical touchpoints.

Key Insight

Even with mobile growth, 52% of eCommerce transactions in 2022 still happened using a PC. This highlights OMO’s ability to bridge gaps across devices and channels, ensuring consumers stay engaged with the brand regardless of where they shop.

Stages of the Consumer Journey

Stage 1: Discovery

In OMO, discovery often begins through connected channels like social media posts, online ads, or personalized app recommendations. Unlike traditional multichannel approaches, these touchpoints are connected, allowing the brand to deliver personalized promotions and style suggestions that drive interest before a store visit.

Stage 2: Research & Engagement

Before visiting the store, with OMO, shoppers can research and plan their purchases online using tools like AI styling tips, AR try-ons, and stock checks, which make it easier for them to compare options.

Stage 3: Store Visit / Try-On

OMO ensures a continuous shopping experience. After researching online, customers then go to the store, where they can check availability, reserve items, and try them on in person.

Stage 4: Purchase & Payment

OMO connects payment across all channels, allowing quick, cashless checkout whether online or in-store. Local payment options like mobile wallets carry loyalty points, promotions, and customer information across channels. This gives shoppers a fast, secure, and convenient experience no matter where they buy.

Stage 5: Post-Purchase

Even after the purchase, OMO keeps customers engaged. Post-purchase customers receive digital receipts, personalized offers, and integrated loyalty programs, keeping them connected across channels and making it easier to repeat their purchases.

Stage 6: Loyalty & Repeat

For loyal customers, OMO provides seamless recognition across all touchpoints. Satisfied customers return, make repeat purchases, and recommend the brand to friends or online communities, creating a full-circle journey that drives lasting value.

Japan Fashion Case Studies: Lessons in OMO Adoption

Market Context & Implications

In Japan, Amazon, Rakuten, and Yahoo combined account for 70% of B2C sales. This highlights the strength of Japan’s eCommerce market and shows how it provides a strong foundation for OMO models. International brands can leverage existing consumer habits, but true differentiation lies in how they implement OMO to deliver unique and memorable experiences.

Japanese fashion retailers have paved the way, blending digital and in-store experiences to increase customer engagement and loyalty. The examples below show how technology and social commerce can support foreign brands entering the Japanese market.

Case Study: Uniqlo – How App Integration Drives OMO Experiences

UNIQLO, a leader in casual and everyday apparel, exemplifies this approach, leveraging its app and in-store technologies to deliver seamless shopping experiences.

The UNIQLO App

The UNIQLO app provides a seamless OMO experience, allowing customers to order online, quickly pick up their items in store, and check stock and sizes. It also offers access to discounts, special promotions, and personalized style recommendations. Additionally, the app uses digital receipts to make returns easier and reduce the use of paper. In-store experiences are enhanced with smart fitting rooms, real-time inventory updates, and streamlined checkout. By connecting online and offline channels, UNIQLO delivers frictionless shopping experiences while building loyalty across both digital and physical platforms.

Case Study: ZOZOTOWN – Data-Driven Personalization

ZOZOTOWN focuses on personalization, utilizing technology and data to deliver customized shopping experiences. For example, shoppers can use the ZOZOSUIT, a 3-D body scanning suit, which is paired with the ZOZOFIT App to provide them with accurate measurements and sizing recommendations.

To enhance engagement, the app also has social commerce features which shoppers use to access reviews, styling tips, and interact with community members.

Data collected through these interactions provides insights that are used to provide product recommendations and precise sizing, helping to improve the overall shopping experience, increase conversions, and reduce returns.

Case Study: MUJI Passport App – Loyalty & Engagement

Japan’s economy is points-driven, and MUJI leverages this by integrating loyalty programs with digital engagement. Through the MUJI Passport, customers can shop anywhere, earn miles, participate in in-store events, earn rewards, and access digital receipts. This creates continuity between mobile and physical touchpoints. This combination of loyalty and convenience strengthens retention and encourages repeat purchases.

In September 2025, it will be rebranded as the MUJI Good program and introduce a redesigned app (renamed to MUJIアプリ or MUJIApp). Under the rebrand, miles will be replaced with points, and there will be added options to support social contribution activities, by donating points to charities or social initiatives.

This rebrand highlights how OMO and loyalty programs are evolving and tying into sustainability—a differentiator in Japan.

The Role of Payments in OMO

Payments are an integral element of OMO, one that is often overlooked but absolutely critical. Even the most beautifully designed UX is meaningless if customers abandon their carts and drop off at checkout. Payments are the invisible engine that keeps OMO running, turning interest into action and action into revenue.

They help to drive conversions, unify the process (by allowing customers to use the same payment method online and in-store), capture valuable customer data (that can be used for personalization and retention), and build trust (so customers feel more confident).

In addition to trust and security, Japanese shoppers value flexibility in payment methods. Each option has its own cultural and practical importance, whether it’s security, convenience, or the ability to shop effortlessly across mobile, desktop, and in-store. International brands that cater to these diverse preferences gain a clear competitive edge by building trust and loyalty. Common payment options include:

Credit & Debit Cards

Credit Cards are a dominant payment method in Japan and are used by most shoppers. In Japan, international credit cards (VISA, Mastercard, American Express) and domestic credit cards (JCB, UnionPay) are both widely used.

Digital Wallets / Mobile Payments

Digital wallets store funds or payment information, enabling convenient online and in-store transactions. Digital wallets in Japan include:

- PayPay: Japan’s largest and most popular payment app and digital wallet.

- Rakuten Pay is a widely used payment app in Japan. It allows users to conduct transactions using their Rakuten ID and mobile phone.

- Apple Pay / Google Pay: Contactless, tap-to-pay solutions for tech-savvy consumers.

Konbini (Convenience Store) Payments

Cash remains the most widely used and accepted payment method in Japan. Konbini (convenience store) payments allow customers to pay for online purchases with cash at local stores such as FamilyMart, 7-Eleven, and Lawson. Because convenience stores are a part of daily life in Japan and cash is so widely used, this is a method that is both familiar and convenient for Japanese shoppers.

Buy Now, Pay Later (BNPL)

Buy Now Pay Later is common both in Japan and the fashion industry. Shoppers have the option to buy now and pay later, either in installments or in full with no interest, and without requiring a credit card.

In Japan, Paidy is the largest BNPL provider, allowing shoppers to break up purchases into three interest-free installments.

Challenges for Global Merchants

eCommerce retailers face the following challenges when entering Japan:

- Understanding Unique Consumer Behaviour: Japanese shoppers have unique preferences when it comes to convenience, service, quality, and brand reputation. Foreign brands must establish trust first.

- Providing Local Payment methods: Japan has a range of diverse payment methods which they expect at checkout.

- Navigating Complex Regulations & Legislation: Legal, technological, and financial regulations can be complex to navigate.

- Language and Cultural Barriers: Being successful in Japan involves more than language translation. Brands must also be aware of cultural nuances that influence consumer behaviour.

- Technical and Operational Difficulties in Integration: It can be challenging to implement different payment systems and ensure data security.

A way to navigate these challenges is to partner with a payment gateway like KOMOJU. KOMOJU offers unified payment integration across online and offline channels, and supports localized payments, allowing brands to focus on delivering frictionless shopping experiences without technical or operational barriers.

Future Outlook & Takeaways

Thanks to its advanced eCommerce infrastructure, high mobile penetration, and innovative digital payment methods, Japan serves as a preview of global OMO retail trends.

Leading retailers have shown how the seamless integration of digital and physical channels can increase loyalty, engagement, and revenue.

As consumers become more tech-savvy and expectations rise, brands entering Japan can gain valuable insights for global expansion.

Key Takeaways for Brands Expanding into Japan:

Integrate Local Payments:

Supporting diverse local payment methods like convenience store (Konbini) payments, mobile wallets, and BNPL through a local payment provider like KOMOJU reduces friction, builds trust, and increases conversions.

Have a Unified Online-Offline Ecosystem:

Connect apps, websites, and physical stores to deliver consistent, personalized experiences.

Prioritize the Consumer Experience at Every Interaction:

Use personalization, AI-driven recommendations, AR try-ons, loyalty programs, and social commerce (reviews, influencers, interactive apps) to drive engagement, repeat purchases, and turn your customers into brand advocates.

Leverage Data & Analytics

Use insights from data to track behavior, optimize inventory, and personalize campaigns, making it easy to scale and repeat OMO strategies

Closing: Payments as the Engine of OMO

As eCommerce evolves and technology advances, online and offline shopping are no longer separate journeys, but merge into one seamless OMO experience. This creates fully integrated, memorable interactions that build loyalty and maximize lifetime customer value. Japanese fashion retailers have shown how OMO strengthens brands, drives engagement, and fuels long-term growth.

Japan’s fashion eCommerce market offers immense opportunities—but success depends on trusted, localized payment solutions, the engine behind OMO integration.

Learn how KOMOJU helps global brands localize payments and deliver frictionless customer experiences in Japan and beyond.

*QR Code is a registered trademark of DENSO WAVE INCORPORATED in Japan and in other countries.

We help businesses accept payments online.