We help businesses accept payments online.

Founded in 2013, Mercari has become a leader in Japan’s C2C online marketplace, connecting 23 million monthly active users with a wide range of products. The Mercari mobile app simplified eCommerce by allowing users to list and buy items directly from their smartphones. Sellers in Japan can ship items anonymously from local convenience stores to ensure privacy.

Since expanding to the U.S. in 2014, Mercari has established itself in the competitive U.S. eCommerce landscape. It has also introduced services like Mercari Shops for personalized online stores and Mercoin for Bitcoin transactions.

Integral to Mercari’s ecosystem is Merpay, a digital wallet service launched in February 2019, serving over 18 million monthly users. Merpay allows customers to use their sales proceeds for Merceri platform purchases, enhancing the shopping experience with features such as payment tracking, early repayment rewards, and easy relisting options for purchased items.

This article explores Merpay’s functionalities and benefits for businesses targeting the Japanese market. It highlights how its integration with the Mercari platform offers a competitive advantage by significantly enhancing the user experience.

What is the Mercari Platform

Mercari provides consumers with a comprehensive platform offering a wide selection of products, competitive pricing, and robust buyer protection measures. It enables a trusted and convenient shopping experience directly from users’ mobile devices, fostering community engagement through seller reviews and ratings.

Features of the Mercari Platform

Wide Variety of Products

Mercari connects consumers with a diverse range of products, from electronics and fashion to home goods and collectibles, offering something for everyone.

Competitive Pricing

Mercari’s marketplace encourages competitive pricing among sellers, allowing consumers to find products at various price points, often lower than traditional retail.

Buyer Protection

Mercari offers buyer protection policies and secure payment options, ensuring consumers’ transactions are safe and reliable, with mechanisms to address issues like lost shipments or misrepresented items.

Community and Reviews

Consumers benefit from the community-driven aspect of Mercari, where they can read seller reviews and ratings, helping them make informed purchasing decisions based on other users’ experiences.

How the Mercari Selling App Works

Mercari provides C2C sellers with a streamlined and user-friendly platform for listing a diverse range of products, setting competitive prices, benefiting from strong seller protection policies, and enhancing credibility through community-driven reviews and ratings.

Create Mercari Account

Sellers begin by creating a Mercari account using email, Google, Facebook, or Apple ID.

Listing Items

Sellers take well-lit photos of items from all angles, including any defects, and provide detailed descriptions. Mercari offers a scanning feature for quick setup, ideal for books and similar items.

Category and Condition

Sellers categorize items accurately and describe their condition, crucial for buyer confidence.

Pricing and Shipping

Vendors set prices and choose shipping methods. Mercari supports shipping via partner convenience stores like Family Mart and major carriers such as Yamato Kuroneko and Japan Post Office.

Payment Process

When a buyer purchases an item, payment is managed through Mercari. Funds are held securely until the buyer confirms receipt and satisfaction, after which sellers receive payment directly into their Mercari account.

Managing Mercari Earnings

After selling an item on Mercari Japan, sellers have two main options for managing their earnings:

- Conversion to Mercari Points: Sellers can convert the money they receive from sales into Mercari points. Each Mercari point is equivalent to ¥1 and can be used within the Mercari app to purchase other items.

- Integration with Merpay: Alternatively, sellers can convert their earnings into Merpay balance. This balance extends beyond Mercari, allowing sellers to make purchases at various merchants and services that accept Merpay.

What is Merpay?

Merpay is a mobile payment service seamlessly integrated with Mercari, Japan’s leading flea market app. It simplifies transactions for users, allowing them to spend their Mercari sales proceeds, charge their balance from a bank account, and use deferred payments within the Mercari app.

Features

Deferred & Flexible Payments with AI Technology

Merpay offers deferred payments by using AI to set individualized usage limits based on users’ historical data.

Can Be Used at Stores All Over Japan

Merpay is widely accepted at convenience stores, restaurants, drug stores, and various other retail locations nationwide. It can also be used at some online stores.

Instant Use of Mercari Sales Proceeds

With Merpay, users can instantly utilize the sales proceeds from Mercari transactions as a payment method. Even without sales proceeds, accounts can be easily topped up from a bank account.

Instant Payment via the Mercari App

All payments can be made using only the Mercari app, which is free to download after you set up a Mercari Account. This allows for quick and easy transactions.

Merpay Smart Money

Launched in August 2021, Merpay Smart Money offers small-sum loans based on Mercari usage history, providing users with appropriate credit and repayment options.

How Merpay Works

Merpay allows users to make purchases through the app, both online and at physical stores, and is accepted in numerous chain and convenience stores across Japan. Customers can use their Mercari sales balance, funds added from their bank accounts, or Buy Now Pay Later (BNPL) options.

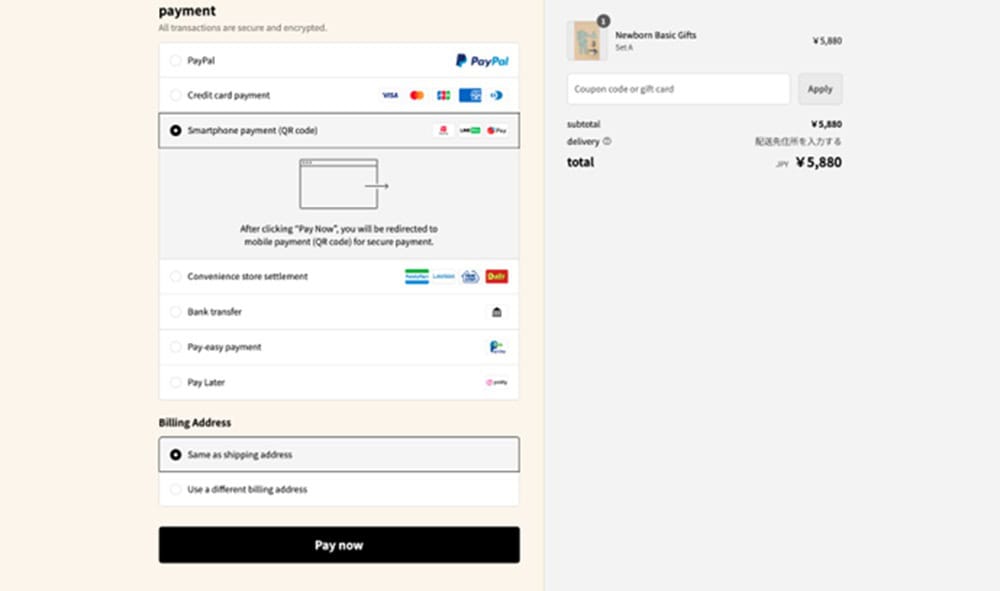

Using Merpay on the EC Site:

For Mercari app users, Merpay provides a convenient payment service for completing purchases on the e-commerce site, whether on a smartphone or PC.

- Select Merpay as Payment Method:

When making a purchase, users should select Merpay as their payment method and proceed to checkout. They can then initiate the transaction by clicking the “Payment with Merpay” button.

2. Payment via Mercari App:

Upon selecting Merpay, the Mercari app will launch and present the payment screen. Users can navigate through the payment process within the app and return to the e-commerce site to finalize the purchase.

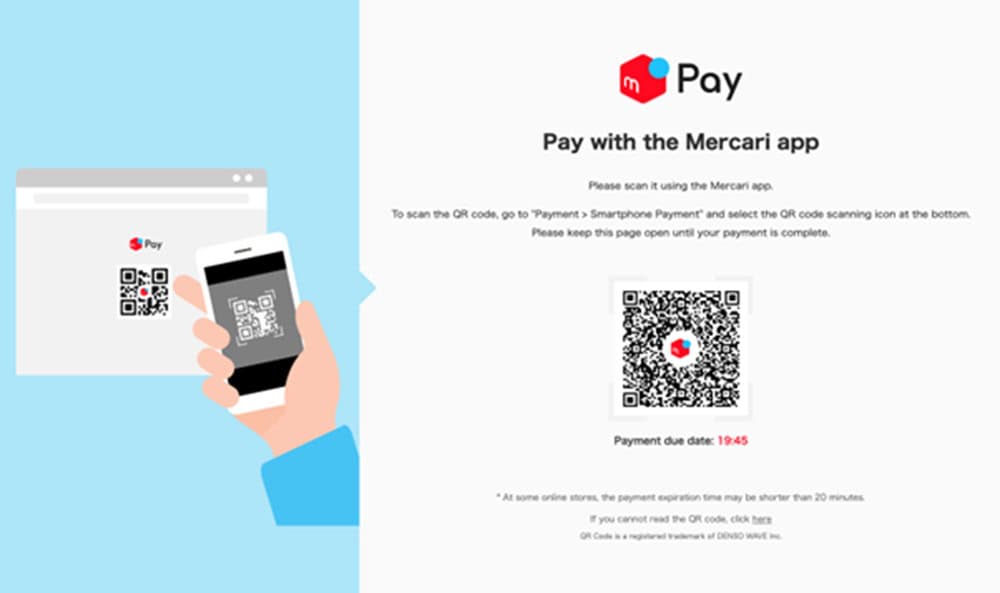

3. QR Code Payment:

Users can open the Mercari app, access the “Merpay” menu, scan the QR code displayed on the e-commerce site, select their preferred payment method, confirm the transaction, and Complete the payment.

Merpay on PC vs Smartphone

For PC Users: | For Smartphone Users: |

1. Display QR Code: – Scan the QR code with the Mercari app, select payment method, and confirm. | 1. Automatic Launch of Mercari App: – Select payment method and confirm. |

2. Complete Payment: – After confirmation, users are directed to the shop site for payment confirmation. | 2. Payment Completion: – After confirmation, users are automatically redirected to the shop site. |

Three Types of Payments with Merpay

- Pay-as-you-go: Ideal for one-time payments, offering flexibility in the payment schedule.

- Recurring (simple): Automatic recurring payments for regular expenses, ensuring timely payments.

- Recurring (fixed/metered): Flexibility in payment amounts with fixed or metered payment options.

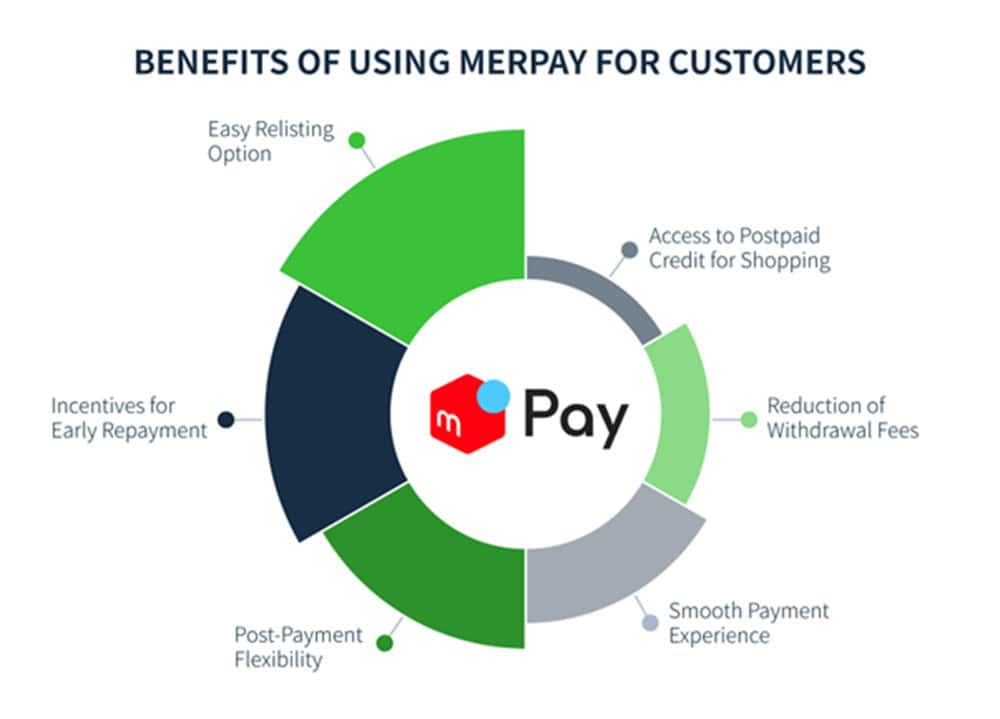

Benefits of Using Merpay for Customers

Merpay is accepted at chain stores and convenience stores, expanding its usability beyond Mercari. Customers can use their Merpay balance for purchases, enhancing shopping convenience and flexibility.

1. Access to Postpaid Credit for Shopping

For loyal Mercari users, particularly sellers, Merpay offers a significant benefit. Sellers can use the proceeds from their sales within the app and also gain access to postpaid credit, enabling them to shop for items they desire without immediate upfront payment.

2. Reduction of Withdrawal Fees

Withdrawing funds directly into a bank account often involves high fees. Using Merpay for transactions allows customers to bypass these fees, offering a cost-effective method for managing funds and making purchases.

3. Smooth Payment Experience

Merpay prevents abandoned baskets by seamlessly transitioning payments from the eCommerce site to the Mercari app. Users can access their Merpay balance within the app, simplifying the process and enabling quick payments, whether on smartphones or at a later time.

4. Post-Payment Flexibility

Users can choose Merpay Smart Payment, allowing them to settle payment amounts on eCommerce sites in a lump sum the following month.

5. Incentives for Early Repayment

Users are rewarded with Mercari points for early repayments, which encourage timely transactions and provide additional value.

6. Easy Relisting Option

Purchased items can be easily listed for resale, promoting a circular economy and maximizing the usefulness of each item, which fosters sustainability and cost-effectiveness.

Why eCommerce Merchants Should Consider Merpay

1. Access to a Large User Base

With 12 million Monthly Active Users (MAU) spending an average of 5.3 hours daily on Mercari, Merpay provides access to a significant customer base. Merchants can capitalize on this existing user pool by accepting Merpay, potentially broadening their customer reach and boosting sales.

2. Increased Consumer Demand

Mercari users generate approximately 500 billion yen per year in sales. By accepting Merpay, merchants can tap into this pool of funds, attracting customers who prefer using their sales balances for purchases. This presents an opportunity for merchants to capitalize on increased consumer demand beyond regular spending habits.

3. Data-Driven Expansion

Merpay utilizes data from the Mercari app to pinpoint high-demand areas for its payment service, facilitating efficient expansion into new markets and prompt adoption by merchants.

Moreover, merchants benefit from the lack of initial fees or fixed costs, making it a cost-effective solution for accepting payments.

4. Seamless Integration

Merpay provides seamless integration with the Mercari platform, simplifying the process for eCommerce merchants to implement and accept payments. With Merpay, merchants can streamline the checkout process for customers, potentially reducing cart abandonment rates and enhancing the overall shopping experience.

5. Potential for Loyalty Programs

Merpay presents an opportunity for merchants to collaborate with Mercari on loyalty programs or promotional campaigns. By giving customers an incentive to use Merpay for purchases, merchants can encourage customer loyalty and drive repeat business over time. This can lead to increased customer retention and long-term profitability for eCommerce merchants.

Integrating Merpay with Your Online Store

By using an eCommerce platform such as Shopify, you can easily introduce Merpay even if you don’t have any programming knowledge.

1. Research integration options

Research various payment gateway providers, such as KOMOJU, that offer integration with Merpay. Look for providers that support eCommerce platforms including Shopify or offer APIs for custom integrations.

2. Choose a compatible provider

Select a payment gateway provider that supports Merpay integration and meets your business needs in terms of features, pricing, and ease of use.

3. Sign up with the provider

Create an account with the chosen payment gateway provider and complete any necessary registration or verification steps.

4. Integrate Merpay

Follow the integration instructions provided by the payment gateway provider to integrate Merpay into your eCommerce site. This may involve installing plugins, adding code snippets, or using APIs, depending on the provider’s requirements.

5. Configure payment settings

Set up Merpay as a payment option within your eCommerce platform’s settings or through the payment gateway provider’s dashboard. Ensure that the payment method is visible and accessible to customers during the checkout process.

6. Test transactions

Conduct test transactions to verify that Merpay payments are processed correctly and that funds are deposited into your account as expected.

7. Launch Merpay

Once testing is successful, officially launch Merpay as a payment option on your eCommerce site and start accepting payments from customers.

8. Monitor performance

Keep track of Merpay transactions and monitor their performance over time. Analyze transaction data to identify trends and optimize your payment strategy accordingly.

By following these steps, merchants can implement Merpay on their eCommerce sites, thereby providing customers with a seamless payment experience while leveraging the benefits of Merpay integration.

Case Study: Attracting New Customers with Merpay

Company Background

NOIN, a major online cosmetics retailer established in 2016, caters to a predominantly young female demographic, offering a wide array of skincare and beauty products.

Introducing Merpay

In 2019, NOIN decided to integrate Merpay into its payment options, recognizing the synergy between Merpay’s user base and its own. With Merpay’s support for deferred payments, a popular choice among NOIN’s customers, the decision was clear.

Impact of Merpay Integration

- New Customer Acquisition: Surprisingly, around 70% of Merpay users at NOIN are first-time customers.

- Increased Spending: Customers using Merpay tend to spend more, with an average transaction amount of approximately 3,800 yen.

- Geographic Reach: Merpay attracts customers from rural areas where access to department stores is limited.

Customer Feedback and Expectations

Feedback from customers has been positive, particularly regarding the convenience of using Merpay for purchases. NOIN hopes to further capitalize on this partnership to enhance customer engagement and sales.

Future Outlook

NOIN plans to leverage collaborative campaigns with Merpay to encourage more customers to adopt the payment method, aiming for sustained sales growth and customer satisfaction.

Conclusion

The introduction of Merpay at NOIN has not only expanded its customer base but also increased average spending per transaction. By leveraging the compatibility between Merpay and NOIN’s offerings, the partnership has unlocked new growth avenues and opportunities for further collaboration.

Summary

Merpay enhances both customer and merchant experiences with seamless payments and access to Mercari’s extensive user base. Integrating Merpay into your online store can significantly enhance the shopping experience and drive sales growth in Japan.

If you want to test out Merpay in a free testing environment, sign up to KOMOJU for free or contact KOMOJU sales team to find out more about Merpay.

FAQs

Here are some frequently asked questions about Merpay

Currently, Merpay is available in Japan and is tailored to its market. There is no indication of its availability outside Japan at the moment.

While primarily designed for Japanese users, Merpay may be accessible to foreigners in Japan, although English support is limited. For non-Japanese speakers, there may be additional resources online to assist them.

Merpay accepts various payment methods, including bank transfers, credit cards, and balance top-ups from the Mercari platform.

Merpay prioritizes transaction security, employing encryption protocols and robust security measures to safeguard user data and financial information, ensuring a secure payment experience for users.

Currently, Merpay is available exclusively in Japan. Therefore, only Mercari users in Japan can use Merpay for transactions within the Mercari platform

We help businesses accept payments online.