We help businesses accept payments online.

Toss Pay is a digital wallet and alternative payment method in South Korea. It is part of the Toss app and Toss ecosystem developed by Viva Republica. As of 2021, Toss boasts over 20 million users and sales revenue of nearly 1.4 trillion KRW. In a country with a population of over 50 million, integrating Toss Pay into your eCommerce site presents a significant opportunity to tap into this vast user base.

KOMOJU, a global payment service, offers the simplest method for integrating Toss Pay and other payment methods in South Korea, including local credit cards and mobile payment options. Using the KOMOJU platform allows you to focus on growing your business while the intricate payments and transfers details are handled by the payments expert..

In this article, we will introduce Toss Pay, its features, and its benefits for both customers and eCommerce store owners.

What is Toss Pay?

Toss Pay is a feature built within the Toss app. With Toss Pay, users can facilitate offline and online transactions. Users can link their bank accounts or credit cards to the app for quick and secure payments. Features include QR code payments, barcode payments, e-wallet functionalities, and mobile top-ups, making Toss Pay a widely adopted and efficient alternative payment method in South Korea.

Over 100,000 merchants across South Korea accept Toss Pay, including major online retailers, bookstores, convenience stores, and supermarkets. Thanks to partnerships with other digital payment apps, Toss Pay touch payments are also accepted internationally in 42 countries, including the US, Japan, Australia, the UK, and Singapore.

Launched in 2015 by Viva Republica, a leading fintech company in South Korea, Toss is their flagship platform. Beyond Toss Pay, the Toss app offers money transfers, loans, stock trading, credit score viewing, investments, and more. Initially created to simplify the cumbersome banking apps in South Korea, Toss Pay quickly gained popularity and evolved into a finance super-app, offering a wide range of services, including:

- Toss Bank: An internet-only bank with over 10 million users offering no-fee foreign currency accounts.

- Toss Securities: An investment platform for trading stocks, ETFs, and other financial instruments.

- Toss Mobile: A mobile virtual network operator (MVNO) launched in 2023. It quickly attracted attention, garnering 150,000 pre-applications.

- Toss Place: A hub for businesses using Toss Pay, providing a centralized platform for managing payments.

As of 2024, the Toss app has over 15 million monthly active users and over 20 million registered users, representing nearly 40% of South Korea’s population. This extensive user base makes it essential for eCommerce stores to integrate Toss Pay to tap into a large and trusted customer segment. Using KOMOJU, stores can easily add Toss Pay and other local payment options, ensuring a seamless and familiar payment experience for South Korean consumers.

How Toss Pay Works

Toss Pay is integrated with the Toss app. Connecting a bank card or account to the Toss app allows users to make payments without repeatedly entering card or account details. This convenient system enables seamless transactions using pre-registered payment methods within the Toss app.

It is important to differentiate between Toss Pay and Toss Bank. Toss Bank does not have a dedicated app but operates within the existing Toss app under the “Toss Bank” menu. To use Toss Bank, users need to install the Toss app, sign up, and open a Toss Bank deposit/withdrawal account, which can be used like any other registered bank account in the Toss app.

Toss payments are made using the card and account registered in the Toss app. However, not all stores support every payment method; some only accept bank payments, while others accept only credit cards. The app will display a message indicating this if a payment method is not supported.

To use Toss Pay, users must first register a payment method within the Toss app:

- Open the Toss app and access Toss Pay.

- Select “My Toss Pay” at the top of the Toss Pay screen.

- Choose a payment method from the “My Toss Pay” menu, log in, and click “Add.”

- Select the type of payment method (card or account) to add and enter the relevant information.

- Complete the registration by agreeing to the terms and conditions for saving the payment method information.

How to Make a Payment with Toss Pay

Payments with Toss Pay can be made both offline and online. Here’s a runthough of each method:

Offline Payments Using Toss Pay

Once a payment method is registered, users can make on-site payments at offline locations through Toss Pay.

- Access Toss Pay from the Toss app and select “On-site Payment” at the top.

- For first-time use, agree to the terms and conditions for on-site payment and register a signature for on-site transactions.

- After setting up, select “On-site Payment” at the top of Toss Pay to display the payment barcode.

- Present the barcode to the cashier, who will scan it to complete the payment.

Users can check payment usage by accessing the Toss Pay on-site payment section and selecting “View Usage” under the barcode.

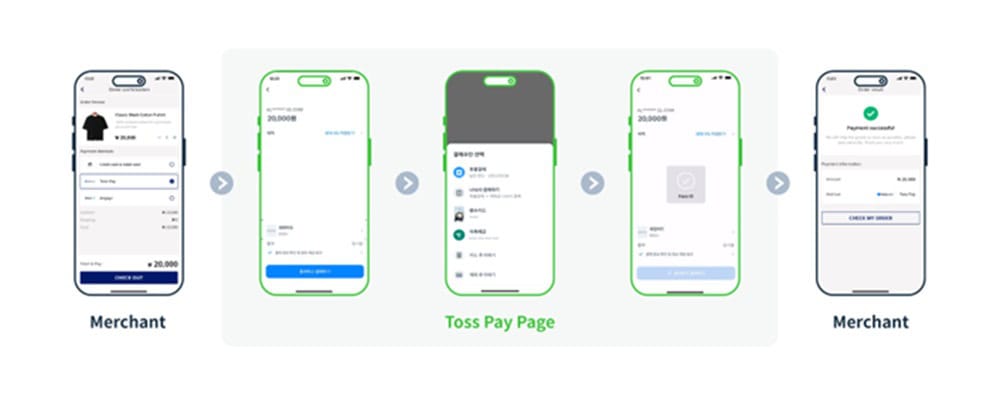

Online Payments Using Toss Pay

For online purchases, users can follow these steps:

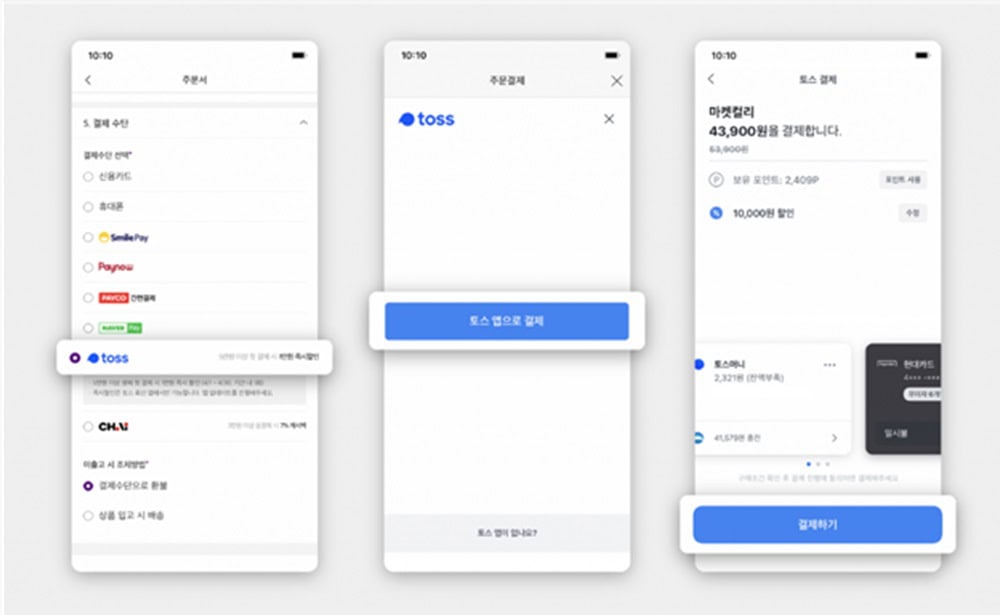

- On the final payment page of the online store, select Toss as the payment method.

- Click “Pay” to proceed to the Toss Pay payment window.

- Agree to all terms and conditions to complete the payment.

When paying on a PC, the process is similar, but with an additional step to connect to the Toss app on a smartphone:

- The user enters their mobile phone number and the first six digits of their date of birth (the first digits of their resident registration number) and selects to pay with the Toss app.

- The user scans the generated QR code with their phone and clicks on the link that appears to connect to the Toss app.

Benefits of Using Toss Pay for Customers

Toss is beneficial to customers in South Korea for several reasons, including:

- All-in-One Convenience

- Finance Management

- Toss Points

- Rewards and Discounts

All-in-One Convenience

The Toss app consolidates various financial services into one platform, including a digital wallet, banking, money transfers, bill payments, loans, insurance, and investments. This centralization makes it incredibly convenient for users to manage all their financial needs without switching between different apps or services. Toss provides an easy-to-navigate interface, making financial transactions simple and quick—provided the user can read Korean. The app is designed to be user-friendly, even for those who may not be tech-savvy.

Finance Management

The Toss app provides significant benefits for tracking personal finances. It automatically categorizes expenses, offers insights into spending habits, and makes budgeting easier. Toss integrates with nearly all South Korean banks, allowing users to link their accounts for a comprehensive overview. Real-time updates on transactions and balances inform users of their financial status, enabling informed decision-making. These features make Toss not only a convenient digital wallet and payment method but also a robust finance app.

Toss Points

Toss Points is the proprietary points system for using the Toss app. It is also a prepaid electronic payment method that accumulates benefits from Toss services. Users can earn points from purchases and various activities such as the “Step Counter” and “This Week’s Mission” in the Benefits tab. One point is worth one won in cash, and users can hold up to two million points. The validity period of Toss Points is five years from the date of accrual.

Toss Points can be used for online Toss Pay payments, brand coupon purchases, and cash withdrawals from the user’s account. Users can use points at the Toss Pay checkout. When a payment with points is refunded, the cash amount will be refunded first, followed by the points.

Points can also be withdrawn to the user’s main account starting from 100 won. While there is typically a 10% fee for withdrawals, Toss Bank provides several free withdrawal vouchers.

Rewards and Discounts

Toss Pay users can benefit from various rewards and discounts, such as specific fuel discounts at gas stations (e.g., 10 to 20 won per liter) and promotions for new users. The app’s partnership with CU convenience stores allows users to earn and redeem membership points for additional savings. Regular collaborations with merchants provide exclusive discounts and offers, adding significant value to everyday transactions.

Why eCommerce Merchants Should Consider Toss Pay

Toss Pay can provide many advantages to online stores, making it a strategic choice for businesses in South Korea

Broad User Adoption

The Toss app is used by a significant portion of South Korea’s population, making it a well-established platform in the market. eCommerce merchants can seamlessly connect with this extensive user base by integrating Toss Pay.

Trust and Familiarity

Toss is a trusted financial payment method in South Korea. By offering Toss Pay, merchants align themselves with a reputable brand, enhancing customer confidence in the payment process. For many users, Toss is the preferred choice for transactions. Providing Toss Pay as a payment option caters to this preference, increasing the likelihood of completed purchases and greater customer engagement with the eCommerce store.

Better Customer Experience

Toss Pay offers a simple and quick payment process, reducing friction during checkout. This ease of use can lead to lower cart abandonment rates and higher customer satisfaction. Additionally, Toss often integrates with loyalty programs, allowing customers to earn rewards or points, further incentivizing them to choose Toss Pay for their purchases. This can enhance the overall shopping experience and encourage repeat business.

Integrating Toss Pay with KOMOJU

Integrating Toss Pay involves applying for a merchant account and submitting a contract inquiry through Toss’s official channels. Once your application is reviewed and approved, Toss will issue you a membership account, allowing you to log in to the membership management system to manage your store’s details. With this account, you can access various management tools to oversee your store’s operations and payment processing through Toss Pay.

However, integrating Toss Pay and applying for the necessary store applications require a strong grasp of the Korean language and familiarity with Korean business culture. Without this knowledge, the application process can be difficult and management troublesome. This is where a payment solution like KOMOJU comes into play.

KOMOJU simplifies the integration process by offering multilingual support including English, streamlining the setup, and allowing you to manage multiple payment methods from a single platform. It provides a wide range of payment options, including Toss Pay, international and local Korean credit cards, mobile payments, and more, along with centralized management and reliable customer support. This makes navigating and managing their payment systems easier for merchants.

Additionally, KOMOJU offers no code solution from easy integration to major EC platforms including Shopify, WooCommerce (WordPress), Salesforce Commerce Cloud to customisable API integration and integration methods in between. Their integration offerings make it easy for international merchants to navigate and add South Korean payment systems to their eCommerce site.

Additionally, KOMOJU offers a no-code solution for easy integration with major eCommerce platforms like Shopify, WooCommerce (WordPress), and Salesforce Commerce Cloud. These options make it simple for international merchants to add South Korean payment methods.

Summary

Toss Pay is a digital wallet and alternative payment method in South Korea, part of the Toss app developed by Viva Republica. With over 20 million users, Toss facilitates offline and online transactions by linking bank accounts or credit cards to the app.

eCommerce stores in South Korea can benefit significantly from integrating Toss Pay, leveraging its broad user base to enhance customer experience and increase sales. KOMOJU, a global payment gateway, offers a straightforward method for integrating Toss Pay and other payment options. KOMOJU handles complex payment processing details, providing multilingual support, centralized management, and reliable customer service, making it easier for merchants to manage multiple payment methods from a single platform.

Ready to integrate Toss Pay?

Find out Toss Pay’s settlement currencies and processing fees on the Toss Pay payment method page. If Toss Pay is the right payment method to offer your customers, sign up on KOMOJU to offer your customers a secure and convenient payment option!

If you’re unsure if Toss Pay is the right payment method for your eCommerce site, why not talk to our payments expert to learn more about Toss Pay and other payment methods?

FAQs

Below are some common questions about Toss and Toss Pay.

The Toss app is an overall financial app developed by Viva Republica. It includes the digital wallet feature Toss Pay and offers various other financial services, such as Toss Bank and Toss Securities.

Users can link their bank accounts, credit cards, and debit cards to Toss Pay.

Yes, foreigners can use Toss Pay. The Toss app requires a domestic phone number and verified ID. Toss Bank allows foreign customers with official identification cards, such as alien and residence registration cards, to open accounts and receive debit cards through a fully digital process. Therefore, foreigners who meet these requirements should be able to use Toss Pay.

TossPay is available outside of Korea through partnerships with other pay apps like AliPay from China’s Alibaba Group. Users can safely log out of the Toss app outside of Korea. However, if the app is deleted, the app must be authenticated domestically. Moreover, the Toss account may be locked if it detects suspicious activity outside Korea.

We help businesses accept payments online.