We help businesses accept payments online.

Japan has made leaps to embrace digital payment methods in a very short time. Thanks to a strong push by the Japanese government, which has implemented incentives and programs to encourage cashless transactions, the country’s cashless payment ratio jumped to 40% in 2023, up from 21% in 2017.

Today, eCommerce merchants in Japan are discovering the benefits of incorporating digital payment options, from prepaid cards to digital wallets. One platform that’s earning attention is WeChat Pay. Initially developed in China, WeChat Pay has become a popular payment option, especially among tourists and Chinese-speaking communities.

With over 1 billion active users globally and a growing presence in Japan, WeChat Pay offers secure and instantaneous transactions, appealing to diverse demographics. This makes adding WeChat Pay as a payment option a smart move for businesses eager to reach customers in Japan, China, and beyond.

In fact, more than 7,000 Japanese companies, from large retailers to small businesses, have embraced WeChat Pay, enjoying increased sales and higher customer satisfaction. In this article, we’ll explore WeChat Pay, why it’s worth considering for your online store, and how to implement it into your operations in Japan.

What is WeChat Pay?

Millions of people, especially in China, now shop, pay their bills, and send money using WeChat Pay, a mobile payment service. Launched by Tencent in 2013 as an extension of its popular social app WeChat, the service now boasts over 1.3 billion active users worldwide. Like Japan’s LINE, WeChat is a huge platform that offers a variety of integrated services, including mobile payments via WeChat Pay, in addition to messaging and social media capabilities.

WeChat Pay makes payments simple, whether you’re sending money to friends and family, shopping online, or making purchases in a physical store. After connecting their bank accounts to WeChat Pay, users can use QR codes to complete transactions. When shopping, customers use the WeChat app to show their unique QR code rather than reaching for cash or a credit card. The payment is processed immediately.

Despite having started in China, WeChat has a growing following in Japan. More than 7,000 companies in Japan already accept the service as a form of payment, and it is currently utilized in 74 countries/regions. WeChat Pay is available in konbini (convenience stores), department stores, and electronics retailers, particularly in places that see Chinese tourists and are accustomed to the app.

Several case studies show businesses that have successfully integrated WeChat Pay into their payment systems and benefit from its widespread use. Furen International School, for instance, took advantage of WeChat Pay’s higher withdrawal limits to process course fees for Chinese students. Rings.tv adopted the platform for the digital concert of the Singapore Chinese Orchestra, ticket sales, and donations. Asian Geographic Magazine made it easier for Greater China competitors to pay for their competition by enabling WeChat Pay.

When WeChat Pay was added as a payment method for tourist passes in Japan, Tokyo Metro saw an increase in revenue, indicating the platform’s potential to increase sales. Last but not least, WeChat Pay continues to gain popularity globally and appeals to a diverse user base, with 48% of users being women and 52% being men.

By offering a smooth, recognizable payment option for the increasing number of Chinese visitors and foreign users, WeChat Pay can help Japanese eCommerce companies draw in both domestic and foreign customers. By providing WeChat Pay, you can maintain your competitiveness in Japan, which makes it simpler for consumers to shop and make payments.

WeChat Pay Features

WeChat Pay offers many features for both local and foreign customers, offering safe, easy, and flexible payment options for both merchants and customers.

- QR Code Payments: Businesses or consumers can create unique QR codes for secure and fast in-person or online payments.

- In-App Payments: Mini Programs and Official Accounts allow seamless payments directly within the WeChat app.

- Cross-Border Payment: Supports multiple currencies, making it ideal for international travelers and global businesses.

- Payment Security: WeChat Pay secures transactions with encryption, real-time monitoring, tokenization, and multi-factor authentication while meeting global security standards.

- Real-Time Notifications: Instant payment confirmations are sent to both customers and merchants.

- Customer Loyalty Incentives: Merchants can add loyalty rewards and promotions to engage customers effectively.

- Global Merchant Support: Operates in over 74 countries and territories, supports 26 currencies, and offers easy merchant registration.

- Analytics: Merchants can analyze sales and customer data to optimize strategies and track preferences.

How WeChat Pay Works

Using WeChat Pay in Japan is simple and convenient, although the registration process differs slightly from that in China.

To begin, your customers will need the WeChat app, which can be downloaded from the Google Play Store or Apple App Store. Once the customers download WeChat app, they can sign up by entering their name, region, and phone number and creating a password. If your customers are outside China, they can register via their mobile number, while those in China will follow the local registration process.

Once they’ve created an account, your customers will access the Money section by tapping the “+” icon within the app. Here, they can enable WeChat Pay. Depending on their preferences, they’ll enter their credit card information or link a Chinese bank account. If using an international credit card, there are certain transaction limits:

- 6,500 RMB (~140,000 yen) per transaction

- 50,000 RMB (~1 million yen) per month

- 65,000 RMB (~1.40 million yen) per year

These limits can be bypassed by linking a Chinese bank account, which allows for higher transaction amounts.

Finally, merchants have access to data analytics tools that provide insights into customer behavior, transaction patterns, and sales performance, which could be used to improve customer engagement and marketing tactics.

Ensuring Data Security and Compliance

WeChat Pay implements strong security measures to safeguard user information and financial transactions. These precautions include real-time monitoring, sophisticated encryption, and adherence to global standards to guarantee safe payments.

WeChat Pay also employs tokenization technology, multi-factor authentication, and user education on security best practices to reduce risks. The platform also maintains a number of security certifications to show its dedication to security and regularly undergoes security assessments to stay ahead of possible threats.

WeChat Pay Security Measures include:

- Multi-layered encryption (AES encryption for data in transit and at rest)

- Real-time monitoring and risk management (AI-powered fraud detection)

- Compliance with National and Global Standards (meets PCI DSS)

- Payment Authentication Protocol (multi-factor authentication, including biometrics)

- Tokenization Technology (replacing sensitive data with unique tokens for transaction safety)

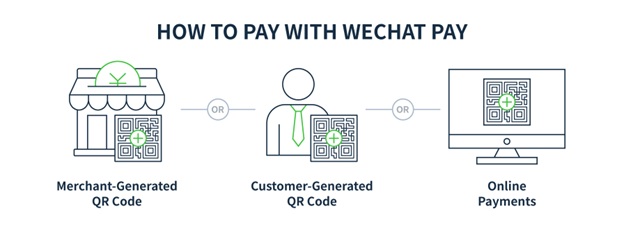

How to Pay with WeChat Pay

Once your customers have set up their WeChat Pay accounts, they can use it to pay at your store with ease. There are two primary ways they can complete payments:

Merchant-Generated QR Code

For physical stores, once your payment terminal is set up to accept WeChat Pay, you’ll generate a QR code that your customers can scan. They’ll use their WeChat app to scan the code, enter any required payment information, and complete the transaction. The customer and your business will receive a notification confirming the successful payment. This process is quick and secure, enhancing the customer experience and making transactions smooth.

Customer-Generated QR Code

Alternatively, you can create a customer-generated QR code. In this case, after your customer enters the price for their items, the system will generate a QR code for them to scan using their WeChat app. They’ll confirm the payment amount, and once the payment is complete, both the customer and your business will receive confirmation.

Online Payments

When shopping online, your customers choose WeChat Pay as their payment option at checkout; your website will generate a QR code that contains all the purchase details. Customers can scan this code with their WeChat app, enter their payment password, and the payment is processed immediately. You’ll receive confirmation of the transaction instantly.

In all of these cases, the transaction is processed in real-time, providing your business with fast and reliable payments. The instant payment notification is sent to both the customer and your business, ensuring that you can proceed with the fulfillment of the order without delay.

Why eCommerce Merchants Should Consider WeChat Pay

eCommerce businesses in Japan should consider accepting WeChat Pay as a form of payment since it has many benefits, especially for those trying to draw in Chinese customers or tourists or for those selling lower-priced goods.

Attract and Engage Chinese Customers

With over 1.3 billion users, WeChat Pay is one of the most widely used payment platforms in China, only behind Alipay in numbers. By accepting WeChat Pay, merchants make their stores more appealing to Chinese customers, increasing the likelihood of visits and purchases. Moreover, WeChat Pay has been integrated with Japan’s LINE Pay since 2019. As a result, many merchants accepting LINE Pay also support WeChat Pay, enabling greater convenience for users.

Boost Sales with Assistance for Small Payments

Small transactions can be handled quickly and effectively with WeChat Pay. Consumers can expedite checkout times by paying by scanning a QR code, eliminating the need for physical wallets. This ease of use promotes impulsive buying and increases total sales.

Increase Client Retention and Return Business

When customers use WeChat Pay, they automatically follow the store’s official WeChat account, allowing merchants to share campaign updates and promotions. This promotes repeat business and raises the possibility of acquiring new clients through word-of-mouth.

Access to Customer Insights

WeChat Pay provides analytics tools that allow merchants to track customer behavior and preferences. These insights can be used to create targeted marketing campaigns, optimize product offerings, and improve the overall shopping experience.

Multi-Platform Flexibility and Integration

WeChat Pay works seamlessly across in-store, online, and mobile platforms, allowing merchants to integrate it with their existing payment systems. This ensures a consistent and efficient payment experience for customers, regardless of how they shop.

Benefits of Using WeChat Pay for Customers

WeChat Pay offers many benefits to your customers. Here are some key advantages:

Seamless Integration into the WeChat Ecosystem

WeChat Pay is built right into the WeChat platform, which is used by a broad audience, especially those aged 25 to 35. With features like messaging, social media, and entertainment all in one app, WeChat makes daily tasks easier. Adding payments to this mix means users can handle everything from chatting with friends to making purchases without switching between apps, making WeChat Pay convenient and efficient.

Convenient for Chinese Residents in Japan

WeChat Pay is a lifeline for Chinese residents in Japan. With its widespread acceptance at many Japanese businesses, users can pay without worrying about carrying cash or converting currencies, making daily life more convenient. Many Chinese residents living in Japan also use WeChat to receive and send money home.

Travel With Confidence

For travelers planning a trip to Japan, the ability to use WeChat Pay is a major plus. Its alignment with the habits and preferences of Chinese tourists makes visiting Japan more appealing and hassle-free. About 2.4 million Chinese tourists traveled to Japan in 2024 which is still far from pre-COVID levels (over 9 million), Japan is working to boost tourism with new tourist visa initiatives. If you are offering digital services or goods targeted at inbound tourists from China but not offering WeChat Pay as a payment option, your business could be negatively impacted.

Campaigns and Rewards

WeChat Pay regularly launches special campaigns that provide its users with exclusive offers, incentives, and discounts. These promotions make shopping and travel more pleasurable and fulfilling and offer added value while encouraging spending.

Breaking Language Barriers to Payments

Users who don’t speak Japanese can easily make payments with WeChat Pay. Thanks to the app’s user-friendly design, transactions can be completed easily, making shopping less frustrating without language barriers.

Integrating WeChat Pay with KOMOJU

Including WeChat Pay in your store is a smart strategy to draw in Chinese clients and grow internationally. However, without the proper assistance, integration can be difficult. A payment platform such as KOMOJU becomes essential in this situation. KOMOJU streamlines the procedure by managing several payment options for a flawless client experience in addition to WeChat Pay integration.

There are technical obstacles, legal requirements, and market regulations to consider when integrating WeChat Pay into your store’s payment system. WeChat Pay requires:

- Business Identity Verification

- Bank Account Setup

- Technical Setup (API integration)

- Compliance with Security Protocols (PCI DSS)

- Merchant Classification (MCC)

- Tax Preparation

- Customer Experience Integration (QR code, in-app payment)

- Customer Support Setup

- Compliance with Market-Specific Regulations

- Multi-Currency Management

While these requirements may seem daunting, KOMOJU handles the heavy lifting, including application processes and ongoing management. KOMOJU makes the setup process faster and less stressful. Thus, you can focus on scaling your business and serving your customers.

Summary

Thanks to government initiatives, Japan has swiftly embraced digital payment methods, increasing the percentage of cashless transactions from 21% in 2017 to 40% in 2023. WeChat Pay, which originated in China but is currently widely used by Chinese-speaking communities and tourists, is one well-liked choice. WeChat Pay, which has more than 1 billion active users globally, is a practical choice for consumers in Japan since it enables safe and instantaneous payment via QR codes.

More than 7,000 companies in Japan, from large retailers to independent shops, now accept WeChat Pay. With practical features like real-time payment notifications, loyalty rewards, and business analytics, WeChat Pay is an excellent choice for businesses looking to attract both domestic and international customers, especially those from China.

Adding WeChat Pay to your eCommerce store can increase sales and provide international customers with a practical way to pay. Let KOMOJU streamline WeChat Pay integration so you can reach customers worldwide with more diverse payment options.

FAQs

While both WeChat Pay and Alipay have advantages, WeChat Pay is better at social integration through WeChat, while Alipay is more eCommerce-oriented. The decision is based on your particular requirements, such as whether you are more interested in online shopping or social payments. AliPay is considered to be stronger for the latter. Both are supported by KOMOJU, which makes it simple for online retailers to select the most suitable payment option for their clients.

No, WeChat Pay is a mobile payment platform that enables transactions within the WeChat app but is not considered a payment gateway.

WeChat Pay uses multi-layer encryption, real-time monitoring, tokenization technology, and compliance with global standards to ensure the safety of transactions and user data.

No, WeChat Pay is not integrated with PayPay. However, it can be linked with PayPal for certain types of transactions.

As of October 28, 2024, WeChat Pay is supported in 74 countries/regions, including places in Asia, Europe, North America, South America, Oceania, and Africa.

We help businesses accept payments online.