We help businesses accept payments online.

Did you know that the global average cart abandonment rate is almost 70%, with countries like Japan having a rate as high as 89%? Abandoned carts represent missed sales opportunities, costing businesses an estimated $18 billion annually.

Businesses face a serious challenge keeping customers engaged until checkout. According to 9% of online shoppers, an underlying cause is the lack of diverse payment options. Local payment methods (LPMs) play an important role in solving this issue by meeting customers’ payment preferences, building trust, and improving conversion rates.

This article will explore how understanding and why local payment methods are important and how partnering with KOMOJU, a global payment gateway, can seamlessly integrate localized payment methods to help you expand your business globally, reduce cart abandonment, and enhance the customer experience.

What is Localization in Payments?

Localization in payments is the process of adapting online payment methods to specific regions’ needs, preferences, and regulations. By offering payment methods that customers trust and are familiar with, businesses can build trust with local customers, create a frictionless checkout experience, and increase conversion rates.

The Importance of Local Payment Methods (LPMs)

LPMs are important for businesses that sell in diverse markets and need to tailor payment methods to local needs, which vary across countries and regions.

Key features include the following:

- Recognized and Trusted: They are usually popular and widely used within specific regions.

- Locally Compliant: Aligned with regional financial regulations.

- Customer-focused: Supportive of local currencies and languages.

By offering LPMs, businesses can provide payment options tailored to regional preferences, such as credit cards, digital wallets, or bank transfers. This also allows them to comply with local regulations.

This approach helps to build trust and simplifies transactions, making them more secure and aligned with local expectations.

Signs Your Business Needs Local Payment Methods

There are clear signs that you may need to implement local payment systems in your eCommerce strategy. Identifying them allows your business to align with customer payment preferences, creates a seamless shopping experience, and drives sales. These signs include:

1. Low Conversion Rates

One of the reasons customers abandon their carts is not seeing their preferred methods at checkout. This is a major challenge as nearly 25% of customers in some regions fail to convert for this reason.

Key Indicators:

- Low conversion rates in new markets

- Not yielding results from cross-border campaigns because checkout isn’t optimized for international shoppers.

- Missing opportunities with organic cross-border traffic due to limited payment options.

Solution:

Expand your payment offerings to offer diverse payment options such as e-wallets and mobile wallets to reduce cart abandonment and increase sales.

2. Low ROI on UX Investments

Investing in UX elements is essential for enhancing the customer experience. However, if these efforts don’t translate into higher conversions, the issue may be in the checkout process —specifically, the lack of diverse payment options.

Key Indicators:

- You have invested in having a mobile-friendly design, responsive interfaces, and simplified checkouts, but users still abandon their carts.

- This decreases the value and return on your UX investments.

Solution: Prioritizing checkout optimization with localized payment methods (LPMs) will help you drive higher conversions, get better business results, and maximize the potential of your UX investments.

3. Underperformance in Specific Channels

Lackluster performance in certain channels may signal a lack of alignment with local payment methods.

Key Indicators:

- You have a product that is performing well in some markets and not selling well in others

- Market research and a competitive analysis show a demand for your offer.

Solution:

- Recognize that different regions have unique payment preferences. Mobile money transactions are popular in Africa, while e-wallets dominate eCommerce in Asia.

- Optimize your checkout experience with LPMs.

- Continuously monitor performance across all channels to identify and address gaps.

Benefits of Supporting Local Payment Methods

The benefits of integrating local payments include having a seamless checkout experience, providing an enhanced user experience, and lowering abandoned carts. Overall these benefits help to support your overall business strategy through the following:

1. Increased Checkout Conversion Rates

Businesses can minimize the effect of lost sales by abandoned carts, by providing local payment methods that customers trust and prefer. According to experts, offering the top three payment methods of a given market or country can boost conversions by up to 30%.

2. Enhanced Customer Trust and Satisfaction

Research shows that 73% of eCommerce consumers prioritize trust, yet over half find it difficult to trust companies. Localizing payment methods reduces the perceived risk of online transactions, increasing confidence through a checkout process that is familiar and trusted.

3. Broader Market Reach and Sales Growth

Integrating localized payment methods allows businesses to expand their reach and increase sales to broader global markets. This can be seen in:

- Increased Transaction Volume:

Localized payment methods connect your business to a larger user base, boosting transaction volume and leading to more completed sales.

- Tailored Payment Solutions for Every Business:

Customized payment solutions can be adapted to businesses of all sizes, ensuring a seamless checkout experience that meets local preferences and drives higher conversion rates.

- Ensuring Compliance and Building Trust:

Localized payment methods help businesses comply with local regulations, further contributing to customer trust and brand reputation in new markets.

- Wider Global Reach:

By accepting diverse payment options, businesses can cater to customers in regions with low credit card usage or unique local preferences. This approach not only broadens the shopping experience but also helps unlock new revenue streams, extending your reach into previously untapped markets.

4. Improved Cross-Border Shopping Experiences

Having diverse payment methods provides seamless transactions across borders and caters to various regions and demographics. This allows international to shoppers to complete their purchases effortlessly, increasing your chances of driving cross-border sales.

Komoju: How We Simplify Payment Localization

Implementing payment localization can seem intimidating, however, when you partner with a payment gateway the process is simplified.

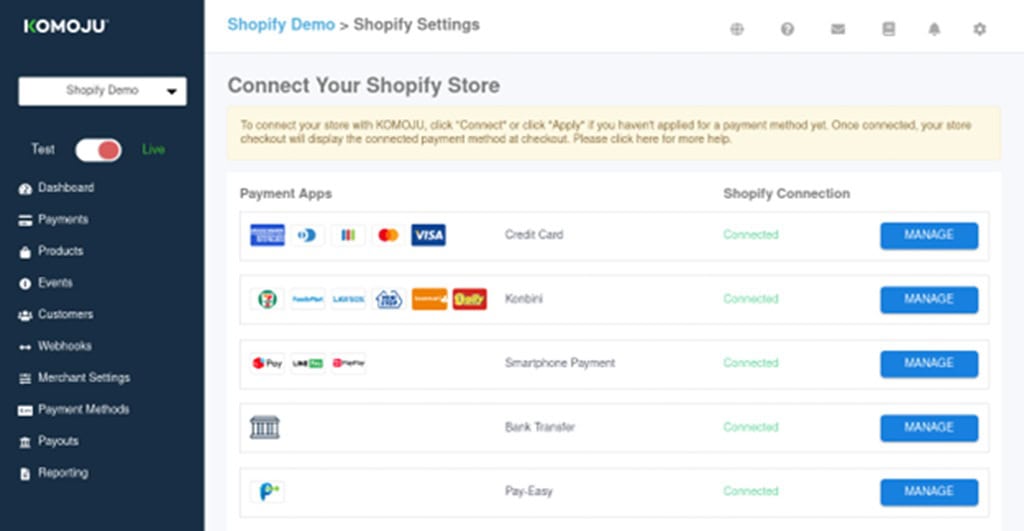

KOMOJU is a payment gateway that has helped over 16,000 businesses accept payments globally. With KOMOJU merchants can adapt easily to diverse markets and grow their business.

Komuju features include:

A simplified pre-built integration process:

KOMOJU has easy-to-use plugins or APIs built for popular eCommerce platforms like Shopify, WooCommerce, and Magento. This removes the need for advanced technical knowledge as the setup is quick and simple.

Comprehensive Payment Support:

Multiple local payment methods are supported, through one integrated solution, including Alipay, WeChat Pay, and PayPal. This simplifies payment management for businesses that target diverse regions.

Ongoing Support:

Businesses don’t have to worry about technical challenges as continuous customer support, including integration, troubleshooting, and compliance is provided.

Security and Compliance:

All transactions are secure with advanced encryption and fraud prevention, while also maintaining compliance with industry regulations like PCI-DSS.

Simplified Payment Management:

Complex aspects like currency conversion, refunds, and chargebacks are also managed by KOMOJU, easing the financial transaction process for businesses and ensuring a smooth experience for both merchants and customers.

Best Practices for Integrating Local Payment Methods

There are a few guidelines for successfully choosing the right local payment methods. Successful implementation includes:

Researching Regional Preferences

Different countries have unique payment habits, and it’s essential to research these preferences based on geography, demographics, and consumer behavior. By utilizing local knowledge and insights, businesses can optimize payment options to suit their target markets and increase their chances of conversion.

Ensuring a Seamless User Experience

Businesses can reduce friction and cart abandonment by offering multiple payment options in a user-friendly, easy-to-navigate checkout system.

Personalized payment options based on customer needs—such as digital wallets for mobile shoppers or By Now Pay Later (BNPL) for those seeking flexible payments—will also ensure a convenient and satisfying payment experience.

Maintaining Data Security and Compliance

Security should never be compromised when integrating alternative payment methods. Payment methods must meet industry standards for security and compliance, including encryption, tokenization, and fraud detection.

Security audits and educating customers on safe online payment practices are essential for maintaining trust and adhering to regulatory requirements.

Partner with Komoju

By partnering with KOMOJU, businesses can seamlessly integrate multiple local payment methods into their online stores. With pre-built integrations, ongoing support, and robust security features, KOMOJU simplifies payment processes and ensures compliance with local regulations, providing merchants and customers with a secure and efficient solution.

Key Markets and Their Preferred Payment Methods

Asia-Pacific (APAC)

In the APAC region, there is diversity where traditional payment methods exist. However, there is a growing preference for convenience and flexibility with a focus on digital-first solutions and mobility.

E-wallets and Mobile Wallets

E-wallets are popular for their convenience, integration with mobile apps, and ability to handle various transactions, including shopping, utilities, and transportation.

Examples: AliPay & We Chat (China), Paytm, GrabPay (Singapore & Malaysia), KakaoPay (Korea)

Buy Now, Pay Later (BNPL)

This is especially in demand by younger consumers who use it for online shopping and purchasing big-ticket items.

Credit and Debit Cards

This varies throughout Asia; for example, Japan relies heavily on them, while Indonesia has lower usage rates.

Examples: Visa, Mastercard, JCB, and UnionPay

Bank Transfers

Bank transfers are popular for large purchases.

Others

Mobile Money, Cryptocurrency, and Cash on Delivery (COD)

North America

In North America, led by the United States and Canada, the payment ecosystem is highly developed and is driven by convenience, innovation, and security.

Digital Wallets

In addition to being popular for online shopping and in-app integration, they are also popular as contactless payment methods.

Examples: PayPal, Apple Pay, Google Pay, Samsung Pay

Others

BNPL, Credit/Debit Cards

Europe

Europe’s payment methods are diverse and vary depending on the country. Consumer preferences favor digital solutions and security.

Digital Wallets

These are used by 44% of European consumers.

Examples: PayPal, Apple Pay, and Google Pay,

Bank Transfers

Direct bank transfers are used widely in Germany and the Netherlands for secure, low-cost transactions. They also enable cross-border euro transactions, which is important for businesses selling in multiple European countries.

Examples: SEPA (Single Euro Payments Area), iDEAL (Netherlands), Sofort/Klarna (Germany).

Buy Now, Pay Later (BNPL)

BNPL is especially popular in the Nordics, Germany, and the UK and is used for eCommerce.

Examples: Klarna, Afterpay, PayPal Credit.

Others

Cash and Cash-Based Vouchers, Credit and Debit Cards

How Komoju Helps Merchants Adapt to Global Payment Needs

KOMOJU helps merchants integrate global payment methods by handling all the details including setup, ensuring local compliance, and providing ongoing support for you and your customers.

Benefits of Using Komoju as a Payment Gateway

Ability to Cater to Diverse Markets

KOMOJU supports a variety of local payment methods in key markets, including Korea, Japan, and China. This allows businesses to across different regions, increasing their reach and potential customer base.

No Need for Advanced Technological Setup

Komoju has pre-built integrations for platforms like Shopify, WooCommerce, and Magento. This allows merchants to quickly start accepting payments without requiring advanced technical expertise.

Compliance Across Regions

Komoju ensures that businesses comply with local and industry regulations like PCI-DSS, making it possible to comply in various regions without hassle.

Simplified Payment Management

Komoju handles complex aspects like currency conversion, refunds, and chargebacks, easing financial processes and providing a smooth experience for merchants and customers.

Safe Payment Environment

KOMOJU offers secure transactions with advanced encryption and fraud prevention, providing merchants and customers with peace of mind knowing that payments are protected.

Partnering with KOMOJU helps businesses focus on expanding globally, by reducing complexity, increasing conversions, and enhancing the customer experience.

Final Words

For eCommerce businesses looking to expand and sell globally, integrating region-specific payment methods can reduce friction, build trust, and enhance the customer experience—ultimately driving successful purchases.

Payment localization is also a key factor in boosting conversion rates, as it addresses the unique needs of diverse customer bases.

By partnering with KOMOJU, you can seamlessly implement localized payment solutions, increase conversions, and position your business for success in international markets. Ready to take the next step? Contact KOMOJU today to transform your payment strategy.

FAQs

Local Payment Methods (LPMs) are payment options that are popular and trusted in specific regions or countries. For example, Alipay is in China, and NAVER is in Korea. They are important because they allow businesses to build trust with local customers, create a frictionless checkout experience, and increase conversion rates.

KOMOJU simplifies payment localization for businesses by providing a single platform to integrate multiple local payment methods. KOMOJU handles all the details, including setup, compliance with local regulations, and providing ongoing technical and customer support.

Customers are more likely to complete a purchase when they see familiar and trusted payment options at checkout. By offering LPMs, businesses can address customers’ concerns, reduce friction in the payment process, and enhance trust, leading to fewer abandoned carts.

KOMOJU ensures all transactions comply with local regulations and industry standards, such as PCI-DSS. This helps businesses maintain trust with customers while simplifying compliance in international markets.

KOMOJU offers pre-built plugins and APIs for platforms like Shopify, WooCommerce, and Magento, enabling quick and seamless integration. The process is designed to be user-friendly, with ongoing support to assist with setup and troubleshooting.

We help businesses accept payments online.