We help businesses accept payments online.

Despite the rapid adoption of digital payment methods in countries like China, South Korea, and Singapore within the Asian region, Japan is comparable to emerging nations such as Vietnam and Thailand. It is surprising to many that, as Japan is a G20 nation and the fourth-largest economy globally, it faces challenges in catching up with its regional counterparts. The juxtaposition of Japan’s often-associated high-tech image might direct merchants to seek alternative payment methods for their online stores. Enter the konbini.

In Japanese, “konbini” is an abbreviated colloquial term for “konbiniensu” or “convenience store” in English. Since the 1980s, these stores have played a significant role in Japan’s economy. As of 2022, more than 56,000 convenience stores were dotted across Japan. The nation’s retail sales surpassed 150 trillion Japanese yen, and convenience stores accounted for nearly eight percent of this, highlighting their economic impact.

Convenience stores are integral to daily life in Japan. They offer a one-stop solution for various needs, such as ready-to-eat meals, groceries, and essential services like ATMs for banking transactions, bill payments, and mobile phone top-ups. They also serve as ticket outlets for events, movies, and transportation services. With additional services such as printing and copying, mini post offices, and the availability of emergency supplies like umbrellas and raincoats, convenience stores have become essential hubs. They serve the needs of individuals in both rural towns and urban cities throughout Japan.

Moreover, convenience stores in Japan offer an offline payment solution, enabling customers without credit or debit cards—or those who prefer cash—to make online purchases. This article will discuss one of Japan’s most popular alternative payment methods: konbini payments.

What is Konbini Payments?

Unlike traditional online payment methods, konbini payments allow customers to complete their transactions in cash at a nearby convenience store (konbini).

As reported by Nikkei Asia in 2022, just 36 percent of consumption in Japan was paid for by cashless payment options. This is much lower than in Western and other Asian countries such as China, Singapore, and South Korea, where cashless payments are over 60 percent.

Despite government efforts, including incentives and funding to encourage a transition to a cashless society, many people in Japan still prefer cash transactions. This is particularly evident among the older demographics, who are slower to embrace digital payment options due to concerns related to learning the tech and safety.

When they do make digital payments, it is usually via a card. In a 2022 survey, credit cards, debit cards, and ATM cash cards were Japan’s primary payment options for online shopping and financial transactions. A notable 75.9 percent of respondents reported utilizing card payments.

However, 36.4 percent of respondents made payments at convenience stores using konbini payment. Per Forbes, konbini payments make up 18% of Japan’s nearly US$167 billion annual online B2C payment volume.

Thus, in Japan, where cash is still king, konbini payments are a bridge that connects online transactions with cash transactions. Adapting to Japan’s preferred payment practices is vital for businesses to succeed in the local market. Offering konbini payment options will enhance accessibility and align with the preferred local payment methods.

The Big Three

Japan’s “big three” convenience stores are 7-Eleven, Family Mart, and Lawson. There are 21,488 7-Eleven stores in Japan, over 30 percent of the chain’s stores worldwide (more than 70,200). Family Mart has 16,370 stores across Japan, and Lawson holds the third spot with 14,000 stores. Although there are smaller chains like MiniStop and Yamazaki, there are very few of these stores compared to the big three. Nevertheless, even these smaller chains offer konbini payments.

While Japanese convenience stores may differ in items and seasonal offerings, the core services, including food, postal services, ATM services, and konbini payments, are nearly identical.

In a survey conducted in February 2023, 7-Eleven was the most favored convenience store among Japanese consumers. Nearly 80 percent of respondents frequently visited 7-Eleven stores, while 62.3 percent and 61.8 percent preferred FamilyMart and Lawson, respectively.

How Konbini Payments Work

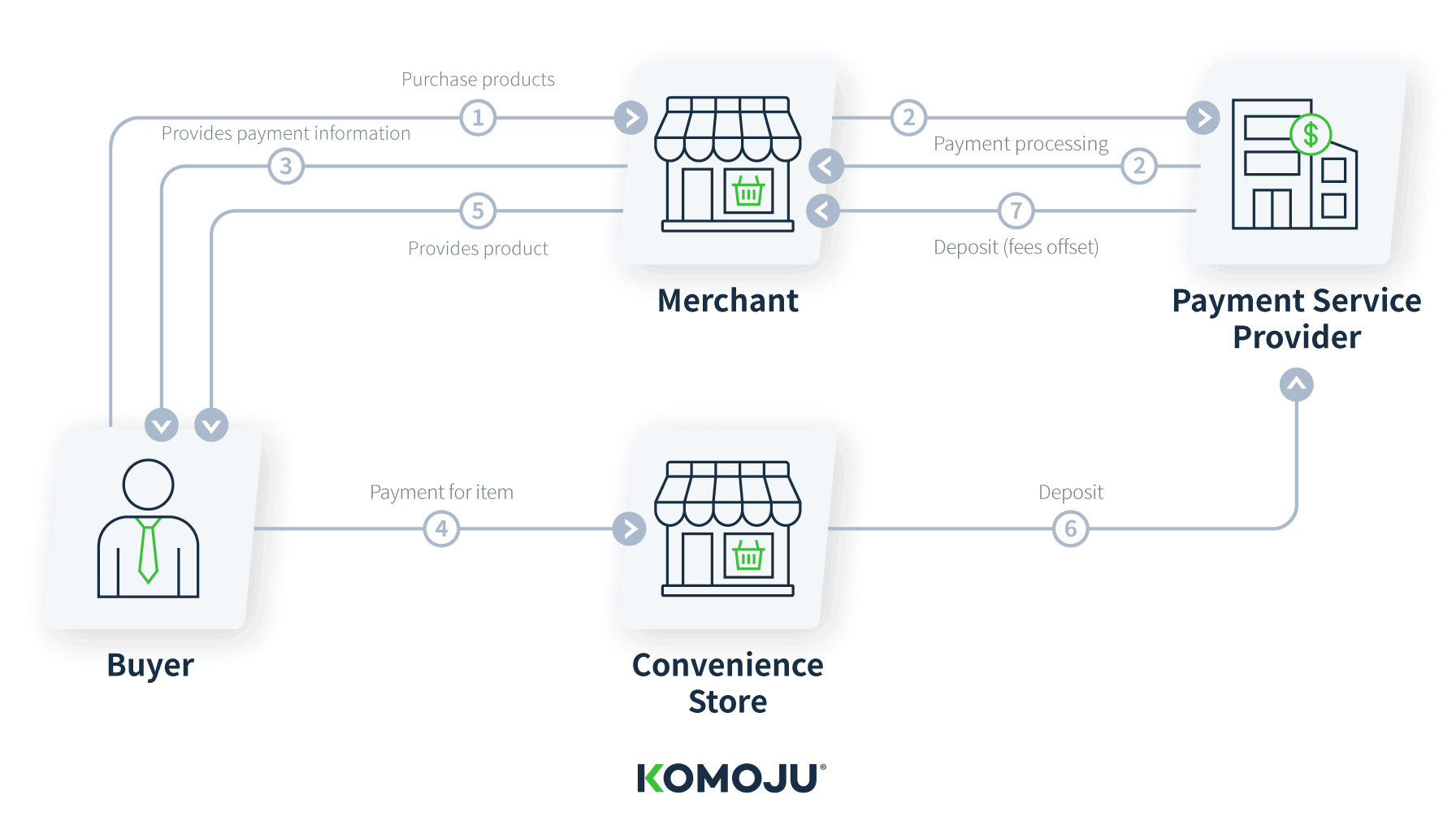

Konbini payments are an alternative option for completing online transactions, appealing to those who prefer cash. Convenience store payments operate by linking various entities through a unified system, including:

- Buyer (Customer)

- E-Commerce Business (Merchant)

- Payment Service Provider (such as KOMOJU)

- Convenience Store

Here’s a simplified explanation of the process:

1. Customer Purchase: The customer buys products and services from the merchant’s store.

2. Payment Transmission: Payment information travels from the merchant’s store to the payment service provider.

3. Notification to Customer: The merchant store sends payment details to the customer.

4. Payment at Convenience Stores: The customer pays at the register or terminal in a convenience store.

5. Order Fulfillment: After payment, the merchant store ships the product to the customer.

6. Funds Transfer: The amount is deposited to the payment service provider.

7. Settlement and Commission: After offsetting the commission fee, sales are transferred from the payment service provider to the merchant store.

When a customer makes a convenience store payment, the payment information is initially sent to the merchant or eCommerce business. This information is relayed to the payment service provider. Following this, the merchant or eCommerce business provides payment details to the customer, who then pays the purchase price at the convenience store.

Once the payment is finalized, the collection company sends a notification of payment completion to the merchant or eCommerce business. Then, the product is shipped, and the payment service provider transfers funds to the merchant.

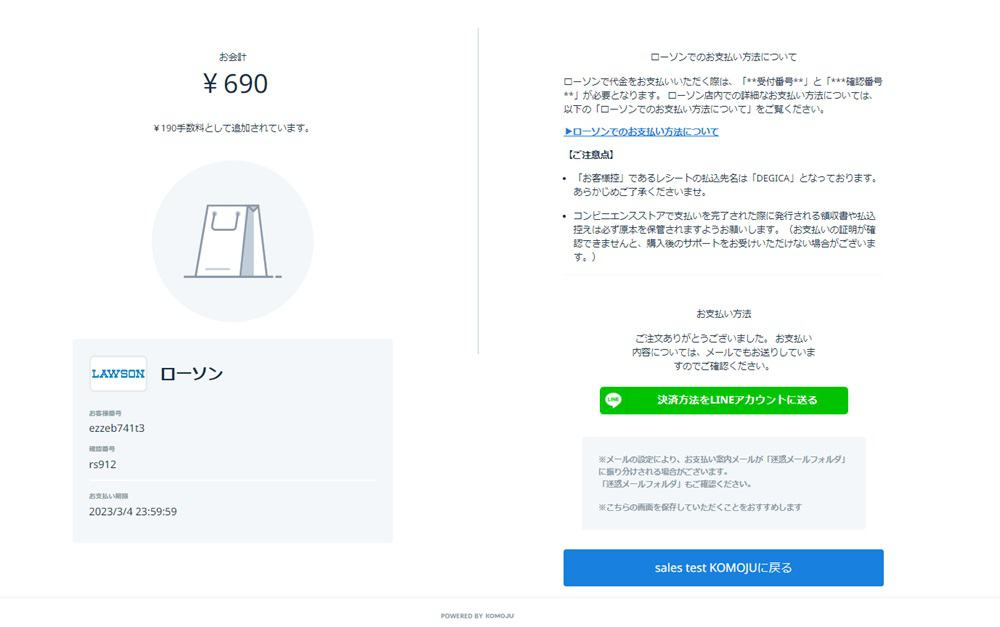

After receiving confirmation, customers typically have a seven-day window to visit a nearby convenience store, present the confirmation order, and complete the payment. Some stores may have specific caps on the amount customers pay in one transaction. However, the standard limit for a single konbini payment transaction is set at 300,000 yen by default. Buyers can usually get around this by splitting payments. Note that customers are also required to cover a convenience store transaction fee of 190 yen.

Read the latest whitepaper about an essential Japanese local payment method, Konbini Payments.

Benefits of Convenience Store Payments for eCommerce Businesses

Integrating convenience store payments provides eCommerce businesses in Japan with payment flexibility, breaking through to the country’s cash-only preference. Regardless of location, customers can conveniently complete transactions at nearby convenience stores, which operate 24/7. They no longer need to wait at home for pay-on-delivery options. This streamlines the purchasing process, boosting customer satisfaction.

Introducing convenience store payments offers benefits such as:

- New Customer Acquisition: Attracts new customers by providing a widely accepted and accessible payment option through convenience stores.

- Immediate Payment Notification: Enables prompt monitoring of payment notifications, ensuring real-time awareness of transactions.

- Reduced Uncollected Payments: Minimizes the risk of uncollected payments, contributing to a more secure and reliable payment process.

Expand opportunities for sales

Introducing convenience store payments opens avenues for new customer acquisition. Relying solely on credit card payments excludes users without credit cards, resulting in missed opportunities for sellers.

Buyers without credit cards can make online purchases by incorporating convenience store payments, expanding an eCommerce business’ customer base and fostering new acquisitions.

Instant confirmation of payment notification

A notable benefit of convenience store payments is the almost instant confirmation of payment notifications. Unlike some payment methods that might encounter processing delays, konbini payments provide businesses with real-time notifications of completed transactions. This improves operational efficiency and establishes a reliable system for promptly tracking and managing orders.

For example, compared to bank transfers, which may take some time to confirm and potentially cause delays, convenience store payment ensures confirmation within minutes to an hour after completion. This quick turnaround streamlines the transition until the product is shipped.

Convenience store payment processing is typically swift, ensuring a quick and hassle-free experience for merchants and customers. Merchants can expect instantaneous confirmation, with funds processed by KOMOJU being disbursed either at the end of the month or every Friday (for merchants who opt for weekly payouts).

Reduced risk of uncollected payments and product cancellations

Integrating convenience store payments helps mitigate the risk of uncollected payments. When using credit cards, there’s a substantial risk of cancellations due to issues like invalid cards or fraudulent activities.

If an order is canceled post-shipment, retrieving the product can be time-consuming. Opting for convenience store payments ensures definite collection upon completion, minimizing the risk of uncollected payments.

Drawbacks of Convenience Store Payments for eCommerce Businesses

While there are several benefits to introducing convenience store payment options on your e-commerce site, there are caveats, including:

Inconvenience for Customers: Purchasers are obligated to visit a convenience store.

Time-Consuming Processes: The implementation and review of the system can be time-consuming.

Profitability and Accessibility: Depending on the target demographics, trends and location, convenience store payments alone may not be beneficial.

The Buyer needs to go to a convenience store

Paying at a convenience store involves physically going to the store to pay. While this is straightforward if there’s a convenience store nearby, it becomes problematic in suburban or rural areas where such stores might be scarce. The absence of nearby convenience stores can hinder some users from utilizing this payment method.

System installation and screening process can be time-consuming

A dedicated system must be set up to enable convenience store payments on your e-commerce site. Establishing partnerships with individual convenience stores involves negotiations, screening, and the additional effort of managing deposits post-implementation.

A Payment service provide company can assist you in navigating the installation process and negotiations. By entering into a contract through a Payment service provide company, you can delegate handling various procedures, including introducing convenience store payments. KOMOJU offers convenience store payments and a range of other methods, such as PayPay online payment, deferred payment, and bank transfer.

Currently, KOMOJU accepts Konbini payments from these six convenience stores:

- Seven Eleven

- Family Mart

- Mini Stop

- Lawson

- Daily Yamazaki

- Seicomart

Accepting Konbini payment alone may not be profitable

For most e-commerce payments in Japan, many users lean toward credit card transactions. Moreover, your target demographic may not have comfortable access to convenience stores for payment. Therefore, if the sole payment option on your e-commerce site is convenience store payment, you might struggle to generate optimal sales profits. Depending on your site’s scale, it could be beneficial to incorporate both credit card and convenience store payment methods. This approach allows you to gauge which payment method resonates more with your customers and can help optimize your overall sales strategy.

Steps to Accept Konbini Payments

Implementing konbini payment involves expenses like ① initial costs, ② monthly system usage fees, and ③ payment fees incurred per transaction. You might have the option to decide whether the business operator or the purchaser covers ③. Using a merchant payment service provider such as KOMOJU eliminates costs associated with ① and ②, making the introduction of convenience store payments hassle-free.

The process of implementing convenience store payments may differ based on the payment service provider you choose, but the general procedure typically follows this flow:

1. Apply for convenience store payment

Begin by applying for the convenience store payment system through the selected Payment service provide company. Many payment processing companies offer online application forms on their official websites. Following the application submission, the Payment service provide company will provide detailed information about the convenience store payment process within a few days.

2. Prepare and submit the required documents

Documentation is required to verify the eCommerce business’s information and business details. Komoju facilitates this process by compiling and submitting the necessary documents to finalize a convenience store payment contract. KOMOJU members have the flexibility to submit documents either by sending PDF files via email or by mailing physical copies.

3. Screening by the Payment service provide company

Upon submission, the Payment service provide company will review the necessary documents according to screening criteria, which may vary depending on the provider. Typically, the assessment will include the following details:

- Type of product

- Quantity of goods

- Shipping source

Certain restrictions apply, with “information products” deemed ineligible for convenience store payments. Additionally, products conflicting with public order and morals are not qualified for this payment method.

Sometimes, convenience store payment cannot be utilized if the item’s value exceeds 300,000 yen. Moreover, this payment option is frequently unavailable when the shipping source is located overseas.

4. Integration and setup of payment system

After the Payment service provide company completes the examination, they will install and configure a system to integrate convenience store payment options into your e-commerce site. In most instances, the payment service provider will manage the setup on your behalf. However, some providers may require installing and setting up the system independently.

Upon successfully installing the payment system, you can offer convenience store payments for your customers.

How Customers Pay at Convenience Stores

Convenience store payments primarily utilize two methods.

The Payment Slip Method

The payment slip method requires making a payment at a convenience store using a slip delivered to the buyer’s home. This slip contains a barcode that can be scanned at the convenience store, enabling cash payment.

The delivery timing varies, and the payment slip may arrive before or, in rare cases, after receiving the product. However, the customer should receive the slip within a few days after placing the order.

After completing the payment at a convenience store, the information is transmitted to the affiliated payment processing company, which transfers the sales amount to the merchant. In Japan, many people prefer receiving payment slips for utilities such as electricity, water, taxes, etc. This straightforward method is especially favored by users over 40 who may not be accustomed to online payments.

The Payment Number Method

The payment number method is a “paperless method.” This confirmation number is sent to the buyer’s registered email address or phone number. For example, Amazon Japan sends customers who opt for convenience store payment an 11-digit Pay ID number via email.

The buyer uses a terminal machine at the convenience store to enter the payment number, generating an application ticket for cashier payment. After presenting the application ticket at the cash register and completing the payment, the Payment service provide company receives a payment completion notification. The payment is then transferred from the agency to the merchant.

The payment number method has two advantages. It enables quick payments by notifying buyers of a dedicated number and facilitating immediate transactions. It also eliminates the need for issuing or mailing payment slips, reducing the risk of errors.

Typically preferred by users in their 20s and 30s who are familiar with smartphones and those regularly using convenience store terminals, this method streamlines the process with a received dedicated number via email or SMS.

The Customer’s Process

Here’s an overview of how konbini payment in Japan typically works for the buyer/customer:

1. Payment Selection: When making a purchase or settling a bill online in Japan, customers often encounter the option to choose konbini payment (コンビニ決済 or konbini kessai, meaning “convenience store settlement”) during the checkout process.

2. Payment Confirmation: Customers will receive either a payment slip delivered to their home or a digital payment number via email, depending on their chosen payment options. In both cases, a purchase confirmation or transaction summary is typically emailed to customers.

3. Visit a Convenience Store (Konbini): Equipped with either the payment slip (with barcode) or the payment number, the customer heads to a nearby convenience store. If presenting the pay slip, they can easily show it to the cashier at the register.

However, if using a payment number, the customer must utilize a terminal machine, input the number (or QR code if applicable), print the payment slip, and then present it at the register, where they can complete the transaction with cash.

4. Payment Confirmation and Options: When the konbini payment is complete, customers typically receive a confirmation receipt from the convenience store’s machine. This receipt is proof of the transaction and includes details such as the payment amount, transaction ID, and a timestamp.

5. Transaction Completion: The online transaction is complete, with the payment settled at the convenience store. The customer should also receive a confirmation email for their records.

Summary

Konbini payment provides a unique and widely embraced solution in cash-dependent Japan, allowing customers to make online purchases and settle bills in cash at nearby convenience stores. By incorporating konbini payments into your business, you reach a substantial portion of the Japanese population that prefers cash transactions or lacks credit cards. This inclusivity expands your customer base and presents a payment option that aligns with Japan’s cultural norms.

But when implementing Konbini payments, opting for a trusted Payment service provide company to handle the myriad procedures on your behalf adds peace of mind. By choosing KOMOJU, you eliminate costs associated with initial expenses and monthly system usage fees. You will also have the support of a strategic partner to help your business thrive in the Japanese market.

We help businesses accept payments online.