We help businesses accept payments online.

From the functional minimalism of Uniqlo to the avant-garde edge of Comme de Garçons, Japan continues to shape global fashion culture. Adding to this richness, the market is also welcoming of global brands covering fast-fashion giants, to luxury labels, and cutting edge niche segments.

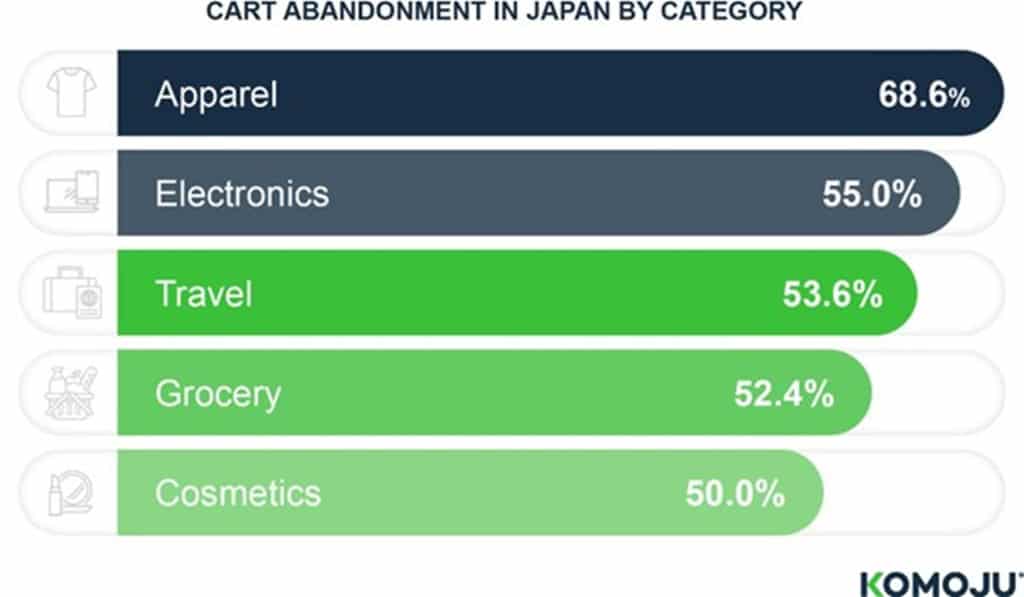

Despite strong market potential, Japan’s fashion eCommerce sector presents a critical challenge: cart abandonment. With rates exceeding 68%, fashion leads all industries in incomplete online purchases nationwide. The primary culprit is checkout friction— shoppers encountering unexpected fees, a lack of preferred payment options, or confusing final steps that undermine shopper confidence.

This article dives into the unique purchase behavior of fashion consumers—especially at checkout moment—and demonstrates how offering localized payment methods can improve conversions and brand success in Japan’s fashion eCommerce market. We’ll explore shifting consumer preferences, the rise of alternative payment options, and practical ways brands can adapt to Japan’s evolving digital landscape. Insights from local payment gateway KOMOJU and a real-world example illustrate how localization can drive success.

Want to improve your conversions in Japan’s fashion eCommerce market?

Explore KOMOJU’s local payment solutions today

Japan's Payment Landscape: Complex, but Full of Opportunity

To understand Japan’s local shopping and payment preferences, we first need to explore its unique and evolving payment culture—shaped by tradition, innovation, and a national push toward digital transformation.

According to a recent Ministry of Economy, Trade and Industry report, Japan’s cashless payment rate reached a record 42.8% in 2024, a sharp rise from just 13.2% in 2010.

This growth is supported by government-led initiatives, aimed at Japan’s ambitious goal of 80% cashless adoption by 2030. The growing preference for fast, frictionless payments, particularly among mobile-first younger generations, is accelerating the change in consumer behavior and putting this target within reach.

Key Payment Methods

While credit cards still dominate (accounting for over 80% of cashless payments in Japan), alternative payment methods (APMs) are rapidly gaining traction.

For fashion retailers, success in Japan means offering a diverse, localized mix of trusted options:

Credit cards & Debit cards

Still the primary method of payment for most Japanese consumers. International brands like VISA, Mastercard, and American Express are widely accepted, along with domestic options like JCB, and China-based Union Pay.

PayPay

PayPay is Japan’s leading digital wallet with more than 70 million users and is widely accepted, offering a user-friendly, mobile-first experience.

Rakuten Pay

Rakuten Pay is part of the broader Rakuten ecosystem, and appeals to regular online shoppers and loyal users who earn and spend Rakuten Points.

Konbini Payments (Convenience Store Payments)

With over 56,000 stores nationwide, convenience stores are a part of daily life in Japan. Konbini payments allow customers to pay for online purchases in person at local stores, making them ideal for those that prefer to use cash, or don’t have credit cards or bank accounts.

Paidy (Buy Now, Pay Later)

Paidy offers flexible BNPL options to shoppers —often in three interest-free installments—without needing a credit card.

Apple Pay / Google Pay

As Japan’s contactless infrastructure improves, mobile wallets are more frequently used. They offer convenience for tech-savvy users who prefer tap-to-pay functionality and fast mobile checkouts.

To truly convert shoppers, however, brands must also understand how fashion consumers behave at online checkouts.

Consumer Behaviour in the Fashion Industry

The Rise of BNPL & The Psychology of Fashion Buyers

In the fashion industry, Buy Now, Pay Later (BNPL) options are gaining users, particularly among younger shoppers and first-time buyers. According to Dazed Digital, BNPL services like Klarna are changing how fashion consumers shop globally, offering flexibility without requiring a credit card.

In Japan, this trend is reflected by the rapid rise of Paidy, the country’s leading BNPL provider with over 20 million app downloads. Japan’s BNPL market is projected to reach $20.1 billion USD in 2025, and is expected to grow at a compound annual growth rate of 23.7%, reaching over $58 billion USD by 2030.

Fashion purchases are often driven by trends, emotions, and impulse, making BNPL services a natural fit for this market. Research also suggests that BNPL can boost spending by over 6% in categories like fashion, where convenience and immediacy strongly influence purchase decisions.

The Points System Drives Repeat Fashion Purchases

Loyalty points systems are deeply embedded in everyday life in Japan. Consumers regularly earn, save and spend points on almost any type of purchase, not just with loyalty cards but also via integrated digital wallets like Rakuten Pay. These points can be used across a wide network of retailers—including major fashion platforms such as ZOZOTOWN, UNIQLO, and Rakuten Fashion.

By integrating points-based incentives, fashion brands encourage repeat purchases and build long-term customer loyalty.

Consumer Expectations for One-Tap Checkout

With mobile shopping on the rise, younger consumers—especially Millennials and Gen Z— have clear expectations for a seamless, mobile-first shopping experience that includes:

- Fast, mobile-optimized User Experience (UX)

- Streamlined checkout with no redirects, high transparency, and no hidden fees

- Availability of trusted local payment methods

- A secure and familiar payment gateways

For global fashion retailers expanding into Japan, aligning with these expectations can provide a competitive edge, helping build trust, and boost both conversions and customer loyalty.

But understanding Japan’s payment ecosystem is just the beginning. To truly win over fashion-savvy consumers, we also need to examine why cart abandonment is so high in this sector—and what to do about it.

Understanding Fashion Consumers

Why Cart Abandonment is Highest in Fashion eCommerce

Fashion eCommerce has the highest global cart abandonment rate across all online transactions, with nearly 9 out of 10 fashion eCommerce shoppers not completing their purchases. But this isn’t random behaviour. Fashion consumers behaves differently from other online consumers, and there are several reasons behind their hesitancy:

Uncertainty about Sizing & Fit

Shoppers will add items to their cart while still unsure if the size, cut, or fit will suit them, especially with new or international brands. This causes them to hesitate until they can confirm that they are buying the right size..

Delayed Shopping Mentality: Style Browsing = Digital Window Shopping

Fashion is aspirational, and generally, people frequently browse the latest styles or “window shop” while building a mental wish list. They are often “just looking” with the intention to ”maybe” buy later, especially when on mobile platforms.

Checkout Friction

Fashion consumers who shop online tend to be younger, mobile-first, and expect a frictionless checkout with their preferred payment methods.

If familiar local options like PayPay, Rakuten Pay, or Paidy aren’t available, they are more likely to abandon their carts.

The upshot, it is critical for fashion brands, especially those selling across borders, to offer local payment options.

Learn how KOMOJU helps eliminate friction and meet shoppers where they are!

A Case Study in Payment Localization: Daniel Wellington in Japan

Background

Daniel Wellington, a Swedish brand known for its minimalist watch and accessory designs, has been active in Japan since 2013. With a strong global presence, the brand recognized early on that local expectations around payments could significantly impact customer experience and retention.

In 2023, Daniel Wellington migrated its eCommerce operations to Shopify and partnered with KOMOJU to better meet the expectations of Japanese shoppers.

Payment Solutions & Implementation

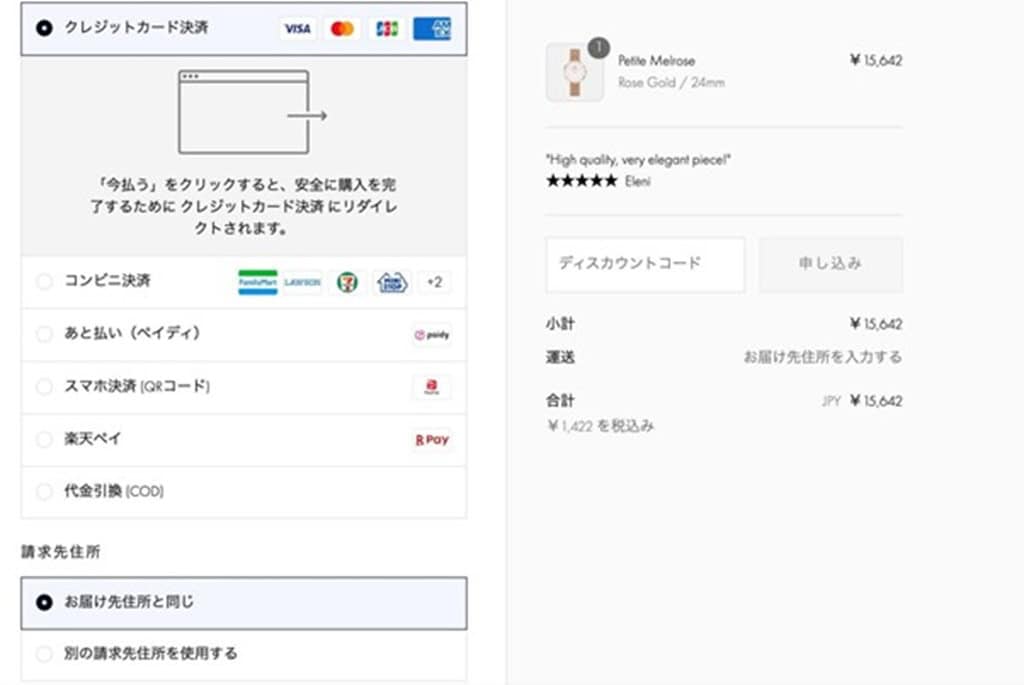

Understanding that fashion shoppers in Japan expect familiar, smooth checkout experiences, KOMOJU used their expertise to help Daniel Wellington implement a range of local payment methods, including: PayPay, Rakuten Pay, Konbini payments, and Paidy.

The Results

The results were immediate and measurable: while credit cards still made up 61% of transactions, a significant 39% of Japanese customers chose alternative payment methods, highlighting a clear demand for trusted local options. These included QR-code* wallets, cash-at-convenience-store payments, and Buy Now, Pay Later services, all optimized through KOMOJU’s Shopify integration.

The implementation process was smooth and didn’t require any custom development. Daniel Wellington reported that KOMOJU’s plug-in setup, combined with localized UX and responsive support, made it easy to go live quickly and test customer flows in advance.

What Other Brands Can Learn

This approach didn’t just improve conversion rates—it deepened trust and built loyalty among mobile-first, value-conscious shoppers. Other global fashion brands entering Japan can learn from Daniel Wellington’s experience: payment localization isn’t a technical upgrade, it’s a growth strategy.

> Ready to localize your payment experience? Partner with KOMOJU today!

What’s Next in Fashion Payments: Key Trends to Watch in Japan

Daniel Wellington’s success shows how local payments can drive growth. But to stay competitive, fashion brands must also keep pace with Japan’s rapidly evolving digital landscape. Here are some trends shaping the future of payments:

Digital Yen Rollout

Japan’s central bank is currently piloting a digital currency. While still in its early testing stages, a Digital Yen could transform how consumers pay, especially for fashion, where speed and simplicity matter.

Greater QR Wallet Compatibility

Digital wallets such as PayPay and Rakuten Pay are moving toward greater interoperability, both domestically and with platforms across Southeast Asia and beyond, enabling consumers to use familiar payment methods more seamlessly.

Omnichannel Loyalty Integration

Loyalty programs are evolving. Now, rewards and points can be linked across online and offline platforms, offering a seamless experience whether customers shop in-store, via app, or on desktop. This omnichannel approach encourages repeat purchases and increases brand loyalty across platforms.

AI-Powered Checkout Experiences

Brands are beginning to use AI to personalize the checkout experience, offer smarter payment suggestions, detect friction points, and tailor offers in real time. The end result, less checkout friction and higher conversion rates.

Meet Japanese Customers Where They Are

For global fashion merchandisers, Japan is a vibrant market full of opportunity—with style-conscious consumers who are open to global brands that understand their tastes and shopping behaviors.

To thrive in Japan’s eCommerce fashion market, brands must go beyond great products. They also need to provide seamless, localized payment experiences. From digital wallets to BNPL and Konbini payments, offering trusted, local options builds trust, reduces friction, and turns browsers into loyal buyers.

Ready to localize and convert more shoppers in Japan? Partner with KOMOJU for fast, flexible, and fully localized payment solutions.

*QR Code is a registered trademark of DENSO WAVE INCORPORATED in Japan and in other countries.

We help businesses accept payments online.