We help businesses accept payments online.

Japan is famous for being a land of contradictions. It seamlessly blends innovation with preserving tradition. The same is true for its payment methods.

There are frequent criticisms of the nation’s commitment to paper, especially its adamant use of fax machines and a seemingly entrenched reliance on cash. However, Japan was a trailblazer in digital payments.

Pioneering mobile payments in 2004 with the introduction of FeliCa chips embedded in cell phones, Japan laid the foundation for what we now know as a mobile wallet.

Notably, Japan stands out as the leading global player in mobile commerce and boasts the distinction of being the fourth-largest e-commerce market worldwide. However, despite these facts, many businesses in Japan continue to adhere strictly to cash-only transactions. This persistent trend exists despite the government’s push to incorporate digital forms of payment.

Despite holdouts, times are changing. Due to government push and evolving demographics, Japan’s e-commerce market users are anticipated to rise to 66.9 million by 2028, over half its projected population of 121 million.

This article will examine payment methods in Japan. As we explore the primary payment methods used in Japan today, we’ll unravel the dynamics of a country balancing traditional cash transactions with the forefront of digital advancements.

Japanese Payment Market Overview

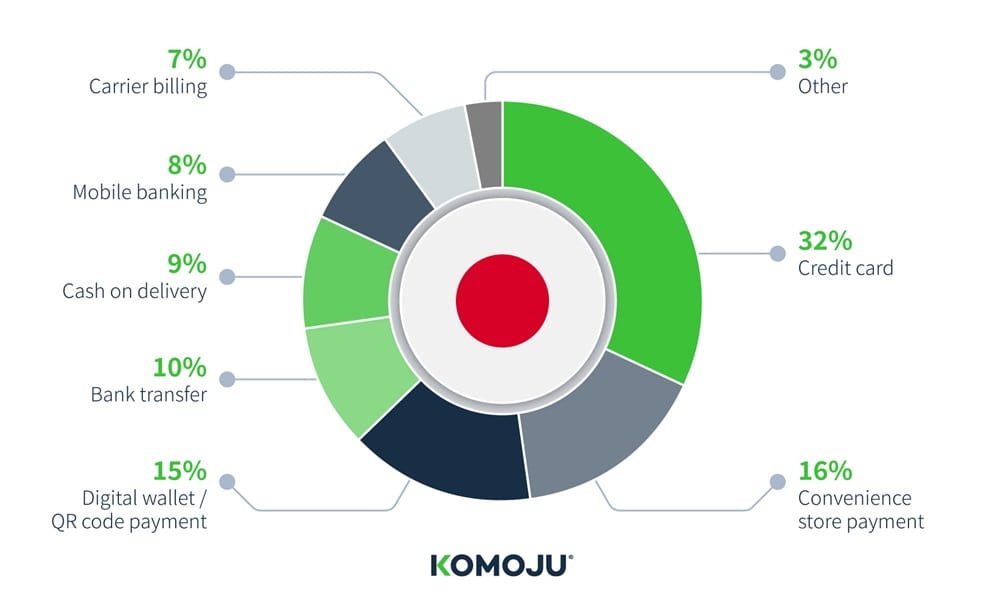

As reported by Nikkei Asia, electronic payment methods experienced significant growth in Japan, reaching 111 trillion yen ($838 billion) in 2022. This constitutes one-third of the country’s total consumption—a noteworthy 17% annual increase and surpassing 100 trillion yen for the first time.

Credit cards were the top choice, experiencing a 16% increase to 93.7 trillion yen. Debit card payments also saw a rise, increasing by 19% to 3.2 trillion yen. QR code payments showed significant growth, surging by 50% to 7.9 trillion yen, while e-money saw a more modest uptick of 2%. These trends highlight Japan’s slow shift to electronic payment methods.

Nevertheless, Japan’s e-commerce market is far below Western or other Asian countries such as China, South Korea, and Singapore, where digital payments account for more than 60% of the market.

However, the shift towards embracing cashless payments is set to grow. The demand for touchless shopping, spurred by the COVID-19 pandemic, has played a substantial role. The government actively encourages this transition through campaigns, incentives, and funding.

With the reopening of Japan’s borders, there was also an increase in spending. In response, companies installed more touchless payment terminals. By December 2022, Japan had over seven million prepaid e-money terminals, nearly triple that of five years earlier.

Credit Cards & Debit Cards

Credit cards are Japan’s most widely used form of cashless payments, accounting for 30.4 percent of 2022’s private final consumption expenditure. Surprisingly, despite the reluctance among the older demographic toward cashless payment options, surveys indicate that 90 percent of consumers in their 60s use credit cards.

As of 2023, Japanese credit card companies issued 308.6 million cards. However, cash and bank transfers remain the dominant mode of transactions, constituting around 70% of the total, according to Jeff Galvin, the senior partner at McKinsey’s Tokyo office for The Banker.

Getting a Japanese credit card as a foreigner is possible, but the process can be tedious and depends on factors like visa type, stay duration, and income. The payment structure is also distinct, requiring the complete settlement of the balance in the following month. However, you can pay in installments (you might be asked to specify how many at the cashier) or set up revolving payments yourself, which accrue interest.

Residents with bank accounts in Japan can apply for a debit card, but you may have to select payment options for online shopping when setting up your card. Seven Bank is a Japanese financial institution with ATMs in 7-Eleven stores, and PayPay is a mobile payment service in Japan for cashless transactions via smartphones. Seven Bank offers traditional banking, while PayPay specializes in electronic payments. However, both offer debit card services.

Additionally, many foreigners choose English-friendly alternatives like Revolut and Wise, as they offer versatile banking solutions for local and international payment methods and debit cards that are usable in Japan.

Major credit card brands in Japan

JCB

The Japan Credit Bureau (JCB) ranks among the country’s largest issuers as a major credit card company headquartered in Japan. JCB cards are widely accepted both domestically and internationally.

Visa

Visa cards, issued by banks and financial organizations worldwide, are widely accepted in Japan, allowing users to make purchases, payments, and withdrawals at banks and ATMs.

Mastercard

Mastercard, like Visa, is a widely recognized payment option in Japan. Issued by international and local banks, Mastercard cards are accepted throughout the country.

American Express

Although American Express may not be as universally accepted as Visa or Mastercard, it is still recognized by many major businesses, hotels, and restaurants in Japan.

UnionPay

UnionPay, a Chinese payment network, does not have widespread acceptance in Japan—approximately 50% of merchants, according to the UnionPay website. Still, UnionPay is accepted for cash withdrawals at most bank ATMs and ATMs in 7-Eleven and Lawson stores.

Cash

Cash is king in Japan. Due to several cultural factors, physical currency remains a prevalent and widely accepted form of local payment.

Firstly, the country’s well-earned reputation for safety and minimal theft is more than hearsay—hard data support it. In Japan, thefts are remarkably low, with an incidence rate of 1.2 per 100,000 people, starkly contrasting to countries with similar populations, such as France (43.8) and Germany (43.2).

High-profile security breaches have made consumers wary of transitioning to digital payments. In January 2021, Japan Post Bank withdrew its Visa-backed prepaid Mijica card after hacks, resulting in a 53 million yen ($374,846) compensation payout. Similarly, Seven-Eleven Japan faced challenges with its 7-Pay app, shutting it down just three months after its launch in 2019, prompted by hundreds of instances of unauthorized use and fraudulent transactions.

Japan’s unique demographic composition also challenges the digital payment landscape. Per Asahi, an estimated 36.23 million people in Japan are aged 65 or older, and 10% of the population is 80 or older. This demographic in the country has been slower to adopt digital payment methods.

While tourist hot spots and trendy locations are more likely to have cashless payment options, most family-run businesses and local restaurants will only accept cash. Even if a restaurant takes credit cards, they commonly limit it to dinner hours, typically after 5 pm. The reasons could vary—from avoiding credit card fees to a sense of comfort and tradition.

As a fifth-generation owner of a Tokyo ramen restaurant told Al Jazeera, “Change is not necessary because we are comfortable with what we have.”

Nevertheless, Japan is advancing towards a cashless society. The Japanese government has been promoting the adoption of cashless payments among retail stores and consumers through point reward programs. In December 2023, a government panel of experts under the Finance Ministry urged Japan to move towards digital yen.

Konbini payment

In Japan, “konbini” refers to convenience stores. In contrast to the snack-and beverage-centric nature of convenience stores in the West, Japanese konbini are versatile institutions. Convenience stores offer various services, including ATMs, purchasing concert tickets and prepaid cards, printing and copying documents, and even dry cleaning.

Convenience stores in Japan also allow customers to pay bills and make online purchases at stores with cash. Customers receive a payment code or receipt and present it at the counter for cash transactions.

Konbini payment is Japan’s second most utilized online payment method, with over 20% of digital shoppers having either completed or indicated their intention to finalize online purchases. More than 56,000 convenience stores across Japan, contributing nearly 8 percent of Japan’s total retail sales.

The “Big Three” convenience store brands are 7-Eleven, Lawson, and FamilyMart.

Bank Transfer

Most residents in Japan use bank transfers (furikomi in Japanese) to pay rent and bills by automatic withdrawal or manual bank transfer every month.

Most banks in Japan close at 3 pm, which can be very inconvenient for most people. If someone needs to make a bank transfer after regular banking hours, they’ll need to use a bank ATM on their own after the tellers have closed for the day. Bank ATMs are usually available until midnight. However, convenience store ATMs are typically available 24 hours.

It is important to note that transfers made before 3 pm on a business day will be processed on the same day. However, transfers initiated after 3 pm or on a weekend will be deposited the following business day.

Usually, a bank account, bank book, or bank card is needed to make a bank transfer. However, it is possible to make a transfer without an account with cash at ATMs. Regardless of whether you have an account, the biggest caveat is navigating the menu, which is likely only available in Japanese. Transfer fees between the same bank are usually under 400 yen, but transfers to other banks will be doubled.

International transfers are called remittance, which transfers funds from a Japanese bank to a beneficiary account in a foreign bank. Remittance fees are expensive and are not a recommended international payment option. Fees can be anywhere from 2,000 to 7,500 yen. Inexpensive options for international transfers include Wise, Revolut, and Seven Bank, which offers an international transfer service through Western Union.

Digital Wallet

Digital wallets are rising in Japan. In April 2018, the Ministry of Economy, Trade and Industry coined the “Cashless Vision” to increase cashless transactions to 40% by 2025 and eventually reach 80%.

Starting from April 2023, employees in Japan could opt to receive their wages via e-wallets (if offered by their companies).

However, embracing digital wallets in Japan is not without challenges. Some popular options like LINE Pay and PayPay pose difficulties for foreigners, mainly due to app instructions being exclusively in Japanese.

Personal details, such as the lack of a middle name option in LINE Pay, can cause compatibility problems with bank account information. This hurdle extends to elderly users, who may find the process daunting and fear disclosing their bank details.

Despite these initial barriers, once set up, digital wallets prove to be incredibly useful. The growing appeal is attributed to their speed, convenience, and the ability to bypass frequent ATM visits.

Popular Digital wallet brands in Japan

LINE Pay

LINEPay is part of LINE, the massively popular messaging application. LINE users can request and send money to contacts within their LINE app, pay utility bills, make mobile payments online or in stores, complete wire transfers, and more. According to a report by Boku, a mobile payments FinTech, LINE Pay controls 38.1 % of the market.

Rakuten Pay

Rakuten Pay, provided by Rakuten, Inc., makes up 25.8 % of the market and uses the slogan “friendly, convenient and secure transactions.” The primary benefit of using Rakuten Pay is the ability for users to earn points that can be utilized for in-store purchases or other Rakuten services. Rakuten also allows in-store QR payments.

PayPay

PayPay, a product of LY Corporation, was formed through a merger of Z Holdings, SoftBank Group, Line Corporation, and Yahoo! Japan. In 2022, PayPay Corporation reported surpassing 50 million users, with the significant growth potentially influenced by the Japanese government’s introduction of a 20,000 yen cashback campaign. PayPay is also the most common QR code payment service in Japan.

Apple Pay

One notable benefit of using Apple Pay in Japan is that users can link their Suica, PASMO, or ICOCA cards to the Apple Wallet app, allowing for convenient travel on public transportation and in-store store purchases. Japan’s prepaid IC cards for public transportation extend their usability to convenience stores, shops, restaurants, and grocery stores.

Merpay

Mercari, by Mercari, Inc., is a Japanese e-commerce platform for buying and selling new or used goods. Merpay is a mobile wallet that is connected to the Mercari app. Mecari userscan add money to their Merpay wallet using funds from a bank account or earnings from sales. As of 2022, Merpay was accepted in 1.35 million stores in Japan.

auPay

Mobile carrier KDDI Corporation’s AuPay is an e-wallet and a prepaid card system. Despite AU being the second-largest mobile carrier in Japan, AuPay commands a 15.5% market share in the e-wallet market. The leading provider’s e-wallet, NTT Docomo’s d Barai, holds a market share below 3.1%.

Carrier Billing

Mobile carrier billings are payment services that allow customers to pay for products via their monthly mobile phone bill. Mobile carriers usually offer a points reward system with these services.

Users can make digital purchases, such as mobile apps, in-app content, games, subscriptions, and more. Once the purchase is authorized, the amount is reflected on their monthly phone bill. Alternatively, users can opt to have the amount deducted from their prepaid mobile balance if sufficient funds are available.

Major mobile phone carriers in Japan

NTT Docomo:

As of March 2023, NTT Docomo, Inc. dominated the Japanese mobile phone subscription market, holding the largest share at 41.6%. The company reported around 87.5 million mobile phone subscriptions for the fiscal year 2022.

KDDI Corporation (au)

KDDI’s mobile subscriptions of au in Japan reached about 64.23 million in 2023.

SoftBank Corp.

SoftBank is a major telecommunications and internet corporation in Japan affiliated with Yahoo! and PayPay.

Rakuten Mobile

Rakuten Mobile is a relatively newer entrant in the Japanese market, but it has gained attention for its virtualized mobile network. Its disruptive pricing models and connectivity with other Rakuten services make it a popular carrier.

LINE Mobile

LINE offers mobile services through LINE Mobile. It provides various plans and features that leverage the app’s existing user base.

Summary

Digital wallets are rapidly becoming a leading payment option in Japan, driven by convenience and the widespread integration of technologies. This surge in popularity is propelled by the ease with which users can make secure and swift transactions, whether for everyday purchases, online shopping, or public transportation.

The Japanese government’s proactive measures, including incentives and funding, further fuel the adoption of digital currency—a concerted effort that reflects a broader societal shift towards cashless transactions. As digital currency becomes essential to Japan’s payment ecosystem, businesses entering the Japanese market can leverage this trend for strategic growth.

However, as this article demonstrates, the digital currency market in Japan is still emerging, and multiple alternatives are available. If you’re contemplating entering your business into the Japanese market, KOMOJU provides seamless integrations with diverse payment methods, allowing you to effortlessly set expense options for Japanese customers and promote your business effectively within Japan.

We help businesses accept payments online.