We help businesses accept payments online.

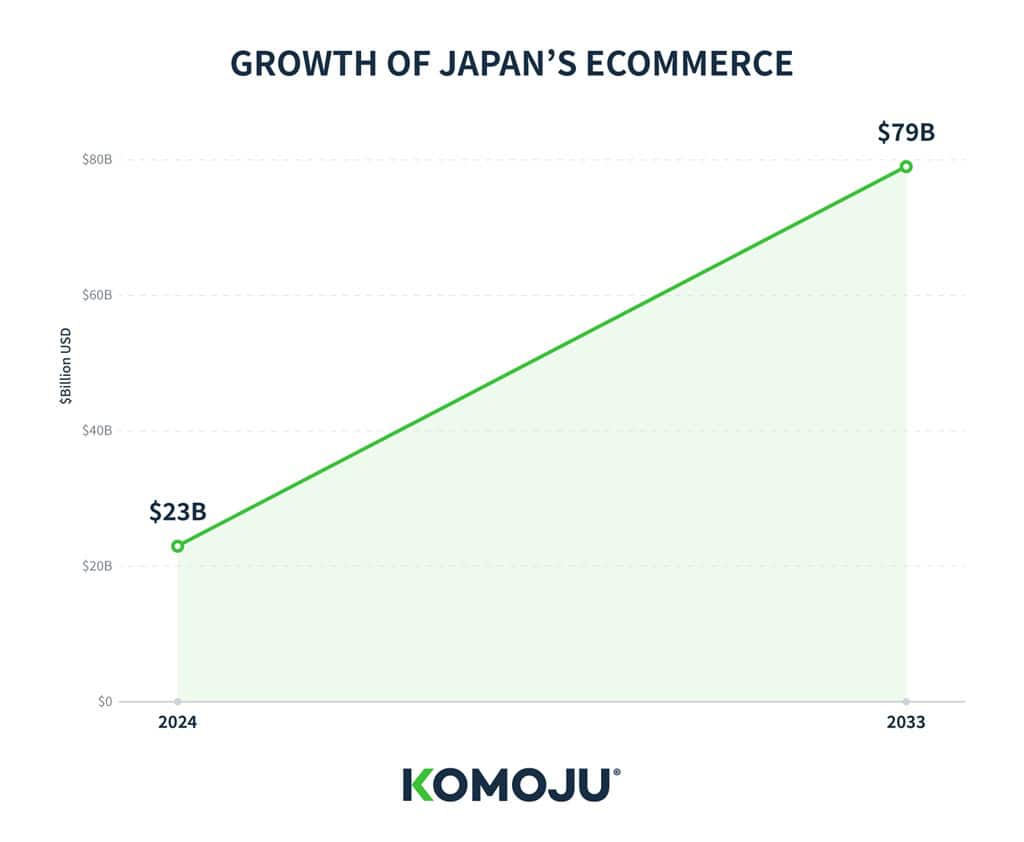

Japan has the fourth-largest eCommerce market globally. It is valued at $23 billion USD, and projected to reach $79.9 billion USD by 2033. (Spherical Insights). Growth is driven by convenience, high internet penetration, and the widespread adoption of digital payments.

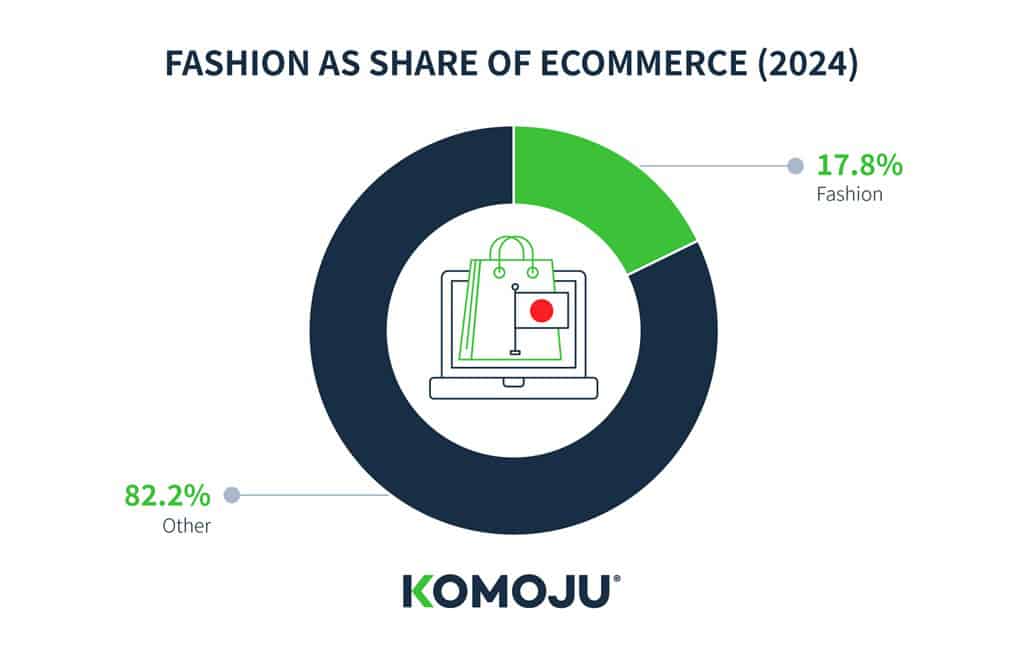

Fashion, a sector that is also experiencing rapid growth and evolving consumer behaviors, accounts for 17.8% of this market. Online fashion shopping behavior in Japan is influenced by age, lifestyle, and cultural values. While there are opportunities for international brands; success requires understanding the different demographics and their unique shopping habits and payment preferences.

This article explores Japan’s online fashion market; who shops online, how they shop, and their preferred payment methods. It will also demonstrate how international brands can effectively engage with different consumer segments, and how partnering with a trusted payment gateway like KOMOJU ensures brands offer the right mix of payment options to reach every customer group.

Demographic Breakdown & Shopper Segments

Overview of Japan's Online Fashion Shopper Segments

Japan’s online fashion shoppers can be grouped by age, lifestyle, and values. Understanding each group’s unique expectations and purchasing behaviors enables merchants to tailor their products, marketing strategies, and payment options.

For effective targeting, a good first step is to look at the broader demographic trends (age, gender, location, and technology) that shape the market as a whole.

Macro Trends: Age, Gender, and Location

Age Distribution

While online shopping is usually driven by younger shoppers, Japan has strong participation across all age groups. In fact, there is higher engagement among older shoppers, so brands need to tailor their products and marketing to each life stage, in order not to miss out on any opportunities.

Gender Distribution

While the average online shopper spends ¥200,000 ($1,300 USD) annually, women spend slightly more than men. Digital fluency is also high in this group, with 93% of women aged 40–49 having shopped online in the past year. This makes women a key demographic to focus on for refined and targeted online fashion strategies.

Urban vs. Regional Behavior

Urban shoppers in major cities like Tokyo and Osaka tend to have higher disposable incomes, shop online more frequently, and are quicker to adopt social trends through social media. In contrast, regional consumers generally spend less, prefer local retailers, and adopt trends at a slower pace. To effectively reach different regional markets, brands need to tailor their messaging and offers, focusing on value and localization.

Mobile Commerce

It’s also important to note that over 50% of eCommerce traffic comes from smartphones, especially among younger shoppers; therefore, mobile-first strategies are necessary.

Cross-channel (OMO) → Offline-to-online integration

OMO, or “Online Merges with Offline” is a significant retail trend that goes beyond Online-to-Offline (O2O), and fully integrates online and offline experiences into a single, seamless customer journey. This bridges online orders and offline settlement and also encourages users to buy online and offline with the same brand.

Based on these macro trends, we can group Japanese online shoppers into four distinct segments: Luxury Seekers, Minimalists, Trend-Focused Shoppers, and Budget-Savvy Buyers.

Luxury Seekers (40s–50s, with younger professionals aspiring)

In Japan, there is a segment of consumers that came of age during the 1980s–1990s economic boom, when luxury goods represented status. Today, many of them, now in their 40s and 50s, value heritage, refinement, and lasting quality, favoring brands such as LVMH, Kering, and Japanese icons like Comme des Garçons, Issey Miyake, Yohji Yamamoto, and Sacai.

Purchasing Power: They typically spend at least ¥1,000,000 ($6,500 USD) on fashion annually, reflecting both their disposable income and brand loyalty. Japan’s luxury fashion market reflects this demand, valued at $6.5 billion USD in 2024, according to a report by the IMARC Group it is projected to reach $10.7 billion USD by 2033.

Implications for brands: To engage with this segment, international merchants must emphasize premium positioning, trustworthiness, and provide seamless service.

Minimalists (30s/40s)

Minimalists are pragmatic, style-conscious consumers usually in their 30s and 40s. They grew up in a period of economic stability and prioritize simplicity, quality, and versatility over trends. They also tend to favor mid-tier brands, private labels, and contemporary overseas designers like Jil Sander and Theory.

Spending & Habits: Known for consistency, they make measured and thoughtful purchases. Despite this,they generally spend more per transaction than younger shoppers. According to a report by the Engagement Lab, consumers in their 30s–40s are far more likely to spend ¥5,000–¥10,000 ($33–65 USD) or even ¥10,000–¥20,000 ($65–130 USD) per order, compared to younger shoppers (16–30) who more often spend under ¥2,000 ($13 USD) per purchase. This reflects their preference for quality, versatile pieces over fast-fashion novelty.

For Brands: To capture this segment, international brands should emphasize high quality, versatility, and curated collections that resonate with their mindset of practicality and value. Because Minimalists often browse online but confirm purchases in-store (and vice versa), seamless OMO experiences—such as inventory visibility and cross-channel returns—are key. Also important is providing clear product information, reliable delivery, and flexible payment methods.

Trend-Focused Shoppers (Teens and 20s)

This group values novelty, digital engagement, and self-expression, following fast-fashion and micro-trends from social media, influencers, and peers, seeking social connection while staying current with social trends.

Spending & Habits: Purchase frequency is high in this group, with 76% of women aged 20–29 shopping online in the past year. Purchases are driven by trends and social influence rather than long-term brand loyalty or high-value items.

For Brands: To engage with this segment, international brands should prioritize mobile-first, and roll out visually engaging shopping experiences integrated with social media. It’s also important to leverage influencer partnerships and social content that resonates with Gen Z aesthetics and values.

Budget-Savvy Buyers (All ages, value-conscious shoppers)

Budget-savvy buyers are a broad segment that spans multiple age groups. Often shopping at UNIQLO, Shimamura, and other mass-market retailers, they balance affordability without sacrificing style or functionality.

Spending & Habits: Annual spending is less than ¥50,000 ($320 USD), lower than other segments, but with a substantial volume of purchases. They actively shop online, often looking for promotions and seasonal discounts.

For Brands: To engage this segment, international merchants should focus on value-driven offerings, accessible pricing, and frequent promotions. Cost-conscious yet fashion-aware, brands can capture this segment by making it easy to browse, compare, and purchase without friction. OMO plays a role here too—cross-channel campaigns like app coupons redeemable in-store or Konbini payment options tied to online orders work well with this group.

Payment Preferences by Demographic

In online fashion shopping, payment methods vary across demographic segments and are influenced by differences in trust, digital adoption, and purchasing behavior. Understanding these patterns help international businesses provide seamless shopping experiences and maximize conversions.

Luxury Seekers

Preferred Payments: Credit cards, convenience store payments, barcode payments.

Behaviour: Often making high-value purchases, this group relies on credit cards for security and reliability, though about 12.4% of online shoppers still use cash-on-delivery for added flexibility.

What brands need to know: Emphasize reliability, trust, and seamless checkout for premium transactions.

Minimalists (30s/40s)

Preferred Payments: Buy Now, Pay Later (BNPL), (Paidy) is growing in this sector.

Behaviour: Minimalists prioritize practicality and predictable transactions. Credit cards provide secure, reliable payments, while BNPL offers added flexibility for managing purchases without compromising their preference for curated, long-lasting items.

BNPL adoption in Japan is expanding rapidly, projected to grow from $20.8B USD in 2023 to $58.3B USD by 2030 (CAGR 23.7%), signaling rising demand for flexible payments.

Trend-Focused Shoppers (Teens/20s)

Preferred Payments: Digital wallets (PayPay, Rakuten Pay, auPay, MerPay); occasional cash.

Digitally native and mobile-first, this segment favors fast, app-based payments that seamlessly integrate with social media-driven shopping. They are primarily driven by convenience, speed, and ease of use, with cash used occasionally for smaller purchases,

For Brands: Offer secure, efficient payment options with optional flexibility to match their practical yet curated shopping habits.

Budget-Savvy Buyers

Preferred Payments: Credit cards, digital wallets, convenience store payments, barcode payments.

Budget-savvy shoppers actively compare prices and look for promotions. Credit cards are used strategically for points and paying in installments, while digital wallets and QR-code* payments appeal for the rebates and promotions. Convenience store payments are preferred for those who prefer cash-based budgeting.

For Brands: Across Japan’s online fashion market credit cards remain the most trusted payment method, while digital wallets, BNPL, and mobile payments are growing rapidly, especially among younger shoppers. Businesses need to offer multiple, secure, and convenient payment options tailored to different customer segments to maximize conversions, build trust, and encourage loyalty.

Increasingly, these differences are also shaped by OMO (online–merge–offline) strategies, where consumers expect payment methods and promotions to carry seamlessly across online platforms, physical stores, and convenience outlets.

Platform & Channel Behavior

In 2025, Japan’s fashion eCommerce landscape is shaped by a diverse array of platforms catering to various consumer segments. Understanding where customers shop, and how they prefer to pay, is critical for successful market entry.

Major Fashion eCommerce Platforms

ZOZOTOWN

ZOZOTOWN is Japan’s largest fashion eCommerce mall, featuring over 9,000 brands and more than 1 million items. It offers trend-driven fashion, fast-fashion labels, influencer-driven campaigns, app-based digital wallet payments

Target Audience & Key Insights: ZOZOTOWN is particularly favored among younger consumers (Trend-Focused Shoppers (Teens/20s),) and minimalists seeking trendy and exclusive fashion items. Its mobile-first approach and social media integration make it ideal for younger, digitally native shoppers.

Rakuten Fashion

Rakuten provides a wide range of premium fashion products and mid-tier brands. Known for its loyalty program, Rakuten Super Points, incentivizes repeat purchases. It is a trusted marketplace that has approximately 544 million monthly visits.

Target Audience & Key Insights:

Rakuten Fashion benefits from strong brand recognition and a reputation for reliability, appealing to shoppers who prioritize authenticity and convenience. Integration with Rakuten points and loyalty programs encourages repeat purchases from luxury seekers and minimalists.

Amazon Japan

Amazon’s fashion segment is integrated within its broader eCommerce platform, offering convenience and a vast selection.

Target Audience & Key Insights:

It appeals to a broad audience covering all four shopping segments: Luxury Seekers, Minimalists, Trend-Focused, and Budget-Savvy Buyers. It is very appealing to consumers who prioritize efficiency and fast delivery.

Key Features include its extensive catalog, fast shipping, competitive pricing, multiple payment options,u]

including credit cards, digital wallets, and COD.

SHEIN Japan

SHEIN is a Chinese fast-fashion giant that is popular among Japanese consumers, especially younger shoppers, due to its affordable pricing and rapidly updated inventory.

Target Audience & Key Insights:

SHEIN offers affordable, fast-fashion products, social commerce integration (Instagram, TikTok), app payments, and captures micro-trends and social shopping habits. It appeals to shoppers seeking novelty, affordability, and immediate gratification, with a strong social media presence that enhances engagement and repeat purchases.

Instagram & TikTok Shops

Social commerce combines influencer-driven marketing, mobile-first checkout, and digital wallets. These platforms target younger trend-focused shoppers and those who quickly adopt trends. Quick, seamless checkout within the apps leverages impulse buying.

Case Studies: Localized Brands in Japan

The following case studies illustrate how two international brands adapted their products, user experiences, and payment strategies for Japan’s unique market segments. Each example highlights how tailoring offerings—and leveraging KOMOJU for flexible, mobile-friendly payments—can drive engagement and conversion.

Daniel Wellington – Localizing Payment Options for Japanese Fashion Shoppers

Daniel Wellington is a Swedish watch and accessory brand known for minimalist, elegant designs and premium craftsmanship.

Its products appeal to consumers seeking timeless, versatile pieces that balance style and functionality. Since launching in Japan in 2013, Daniel Wellington has grown a loyal following through both offline stores and online channels, emphasizing quality, reliability, and a seamless shopping experience.

Target Segment

Minimalists (30s–40s):

Primary audience. Values simplicity, quality, and versatile fashion that can be integrated into everyday wear.

Luxury Seekers (40s–50s, aspirational buyers):

Secondary audience. Attracted to refined, premium products and reputable brands.

Limited Reach Among Younger Shoppers

Trend-Focused Shoppers (teens/20s) are a small audience that occasionally purchases through social media exposure and influencer marketing

Platform & Payment Strategy:

To meet diverse Japanese consumer expectations, Daniel Wellington migrated its eCommerce to Shopify and partnered with KOMOJU in 2023 to offer localized payment options.

Preferred Platforms:

Shopify (main online store), supported by social media channels for promotion.

Payment Methods:

Credit Cards (61% of transactions) – secure, reliable for higher-value purchases.

Digital Wallets (PayPay, Rakuten Pay)

Favored by tech-savvy, mobile-first shoppers.

Konbini (convenience store) Payments

Preferred by Minimalists and aspirational buyers who value cash flexibility.

Buy Now, Pay Later (Paidy)

Increasingly popular among younger, flexible-spending consumers.

- 39% of Japanese customers selected alternative payment methods beyond credit cards, demonstrating the demand for localized checkout experiences.

- Seamless KOMOJU integration allowed Daniel Wellington to go live without custom development, improving conversion and loyalty.

- Localization of payments strengthened trust with mobile-first, value-conscious shoppers, particularly Minimalists and aspirational Luxury Seekers.

Key Takeaways for Brands Entering Japan

- Payment localization is a growth strategy, not just a technical upgrade.

- Offering multiple payment options (cards, wallets, konbini, BNPL) ensures accessibility for different segments.

Understanding shopper segments and aligning platforms and payment methods increases conversions, loyalty, and long-term brand success in Japan.

SHEIN – Engaging Trend-Focused Shoppers in Japan

SHEIN is a global fast-fashion eCommerce brand known for its ultra-affordable, trend-driven apparel and rapid product turnover.

Since entering Japan, SHEIN has captured attention among younger shoppers through social media-driven marketing, influencer collaborations, and mobile-first shopping experiences.

Target Segment

Trend-Focused Shoppers (Teens/20s):

Primary audience. Values novelty, affordability, and social influence. Purchases are often impulse-driven and guided by social media trends.

Budget-Savvy Buyers:

Secondary audience. While price-sensitive, some make occasional purchases when promotions align with their preferences.

Limited Reach Among Older Shoppers:

Minimalists (30s/40s) and Luxury Seekers (40s–50s): Small appeal. These groups prioritize quality, durability, and brand prestige over fast-fashion novelty, making them less likely to shop regularly at SHEIN.

Platform & Shopping Strategy:

SHEIN leverages social media (Instagram, TikTok) and mobile apps to engage consumers. Flash sales, frequent catalog updates, and influencer promotions drive urgency and impulse purchases. While the brand focuses on younger, trend-sensitive shoppers, some budget-conscious consumers occasionally make purchases when discounts or promotions are offered.

Results & Insights:

Social commerce integration and mobile-first experiences have enabled SHEIN to capture attention and repeat purchases among its target audience.

Trend-driven merchandising and fast product turnover appeal to novelty-seeking consumers, but older and premium-focused segments remain largely untapped.

Insights from the Case Studies

- Localized products, UX, and payment options are crucial for engaging each segment.

- Mobile-first and flexible payment strategies drive conversions, especially for Trend-Focused and tech-savvy shoppers.

- Listening to customer feedback and adapting quickly builds trust and loyalty in Japan’s competitive market.

Merchant Takeaways

Japan’s eCommerce fashion market is highly competitive, and for international merchants entering the country, success depends on segmenting and understanding that different consumer groups have different shopping behaviors and payment preferences.

To effectively target customers and increase sales, brands must tailor the shopping experience to each demographic segment, while also providing flexibility in payment options.

Offering a seamless and localized shopping experience can significantly reduce cart abandonment and increase conversions.

Key takeaways for merchants include

Payment Flexibility Reduces Cart Abandonment

At 89%, Japan has notably high cart abandonment rates. A significant factor contributing to this is the lack of preferred payment methods.

Providing mobile-first & social commerce experiences

It’s critical to provide mobile-first and app-based payment options for younger and trend-driven audiences.

Offering the right payment method for each segment

Understanding shopper segments and aligning platforms and payment methods increases conversions, loyalty, and long-term brand success in Japan.

Providing multiple payment methods across platforms ensures accessibility for different segments, and provides seamless customer experiences.

Credit cards are dominant, but digital wallets, BNPL, and Konbini payments are essential for younger and budget-savvy segments.

Platform choice matters

Rakuten & Amazon appeal to Luxury Seekers and Minimalists; ZOZOTOWN, SHEIN, and social media shops can reach younger, trend-focused shoppers.

Get the Payments Right

Merchants need to build trust, reduce friction, and increase conversions in Japan by localizing payments, prioritizing mobile-first experiences, and aligning platform and messaging with segment-specific values. Payment localization is a growth strategy, not just a technical upgrade.

Find the right partner

Partnering with a payment gateway like KOMOJU enables merchants to offer seamless payment experiences and increase conversions.

Conclusion

Japan’s online fashion market is diverse, dynamic, and highly segmented. To successfully turn browsers into buyers, international merchants must do more than offer the right products—they need to also have the appropriate payment methods.

Flexible, localized payment methods reduce friction, build consumer trust, and ensure purchases are completed seamlessly. Partnering with a gateway like KOMOJU allows merchants to support cards, digital wallets, and Konbini payments, bridging the gap between global brands and Japanese consumers.

Success in Japan’s fashion eCommerce market requires a holistic approach: combining demographic insight, platform and payment optimization, and culturally informed marketing. With KOMOJU’s seamless payment infrastructure, international brands can confidently enter the market, meet consumer expectations, and reach the full spectrum of Japanese online shoppers.

Partner with KOMOJU to reach every Japanese shopper segment with tailored payments!

*QR Code is a registered trademark of DENSO WAVE INCORPORATED in Japan and in other countries.

We help businesses accept payments online.