We help businesses accept payments online.

In an increasingly digitized world, the concept of carrying a bulky wallet stuffed with cash and cards is becoming a thing of the past. Instead, people are opting for the digital wallet, a sleek and efficient solution that allows users to store payment information securely on their smartphones or other electronic devices.

Japan has embraced digital wallets with open arms. In this article, we’ll explore what digital wallets are, how they work, the different types available, and delve into some of the best digital wallet options specifically tailored for the Japanese market.

What is a Digital Wallet?

At its core, a digital wallet is a virtual container that securely stores payment information, such as credit card details, bank account information, and even cryptocurrency. Think of it as a digital version of your physical wallet but with added convenience and security features.

Key components of a digital wallet include the software application or platform that facilitates transactions and the underlying technology that ensures security. Digital wallets typically leverage technologies such as Near Field Communication (NFC), QR codes, and tokenization to enable seamless and secure transactions.

In Japan, the adoption of digital wallets has been steadily increasing, fueled by a combination of factors, including widespread smartphone usage, a tech-savvy population, and a culture that values convenience and efficiency in financial transactions.

How Does a Digital Wallet Work?

The digital wallet, often referred to as an e-wallet, is a virtual storage space for various types of payment methods and sensitive financial information. Its operation is akin to a physical wallet, but in a digital realm.

Here’s a breakdown of how it works and its typical features:

1. Storage of Payment Information

Users can store multiple payment methods, such as credit cards, debit cards, bank account details, and even cryptocurrency, securely within the digital wallet.

2. Transaction Authorization

When making a purchase, the digital wallet acts as an intermediary between the user and the merchant. The user authorizes transactions by inputting a secure PIN, using biometric authentication (such as fingerprint or facial recognition), or simply tapping their device on a contactless payment terminal.

3. Integration with Payment Systems

Digital wallets integrate with various payment systems and technologies to facilitate transactions. These may include Near Field Communication (NFC), which enables contactless payments, QR codes for scanning, and tokenization for enhanced security.

4. Convenience Features

Digital wallets offer convenience features such as transaction history tracking, expense categorization, and budget management tools. Some wallets also provide loyalty program integration, allowing users to earn rewards or cashback on their purchases.

5. Security Measures

To ensure the safety of users’ sensitive information, digital wallets employ robust security measures such as encryption, multi-factor authentication, and device-specific tokens. These measures help protect against fraud and unauthorized access to users’ accounts.

6. Peer-to-Peer Payments

Many digital wallets allow users to send money to friends and family members directly from their wallet balance. This feature is particularly useful for splitting bills, paying back loans, or sending gifts.

7. Online and Offline Use

Digital wallets can be used for both online and offline transactions. Users can make purchases at physical stores by tapping their smartphone on contactless payment terminals or scan QR codes. Similarly, they can also use their digital wallet for online shopping by selecting it as a payment method during checkout.

Digital Wallet Types

In Japan, digital wallets come in various types, catering to diverse consumer needs. While Closed digital wallets are confined to a specific company’s ecosystem, offering convenience within a limited network, Semi-open options provide flexibility to transact both within and outside the issuing company’s platform. In the meanwhile, Open wallets offer versatility, allowing users to make purchases across a wide network of merchants and platforms with ease. Each type offers unique benefits, catering to different preferences and lifestyles in the Japanese market.

Closed

Closed digital wallets are typically operated by a single company or organization and can only be used to make purchases within their ecosystem. Examples include mobile payment apps offered by retailers or transportation companies.

For example, PayPay is a closed digital wallet operated by PayPay Corporation, a joint venture between SoftBank and Yahoo Japan. Users can load funds onto their PayPay account and use the app to make purchases at various merchants across Japan. However, PayPay funds cannot be used outside of the PayPay ecosystem or transferred to other digital wallets. It is primarily used for transactions within the PayPay platform.

Semi-Open

Semi-open digital wallets allow users to make purchases both within and outside of the issuing company’s ecosystem. While users can use these wallets at a wider range of merchants, they may still be limited in terms of interoperability with other platforms.

Take Rakuten Pay as an example. Provided by Rakuten, Inc., it is a semi-open digital wallet that allows users to make purchases both within and outside of the Rakuten ecosystem. While users can use Rakuten Pay at a wide range of merchants, including partner stores and online retailers, its interoperability may be limited compared to fully open digital wallets. Rakuten Pay primarily caters to transactions within the Rakuten ecosystem but also offers some flexibility for purchases outside of it.

Open

Open digital wallets are the most versatile, allowing users to make purchases across a wide network of merchants and platforms. These wallets often support multiple payment methods and offer greater flexibility and convenience to users.

For instance, LINE Pay, offered by LINE Corporation, is an open digital wallet that provides users with the flexibility to make purchases across a wide network of merchants and platforms in Japan. Users can link various payment methods, including credit cards and bank accounts, to their LINE Pay account and use it to make transactions both online and offline. LINE Pay supports multiple payment methods and is accepted at numerous retailers, offering users greater convenience and flexibility in their transactions across different platforms and merchants.

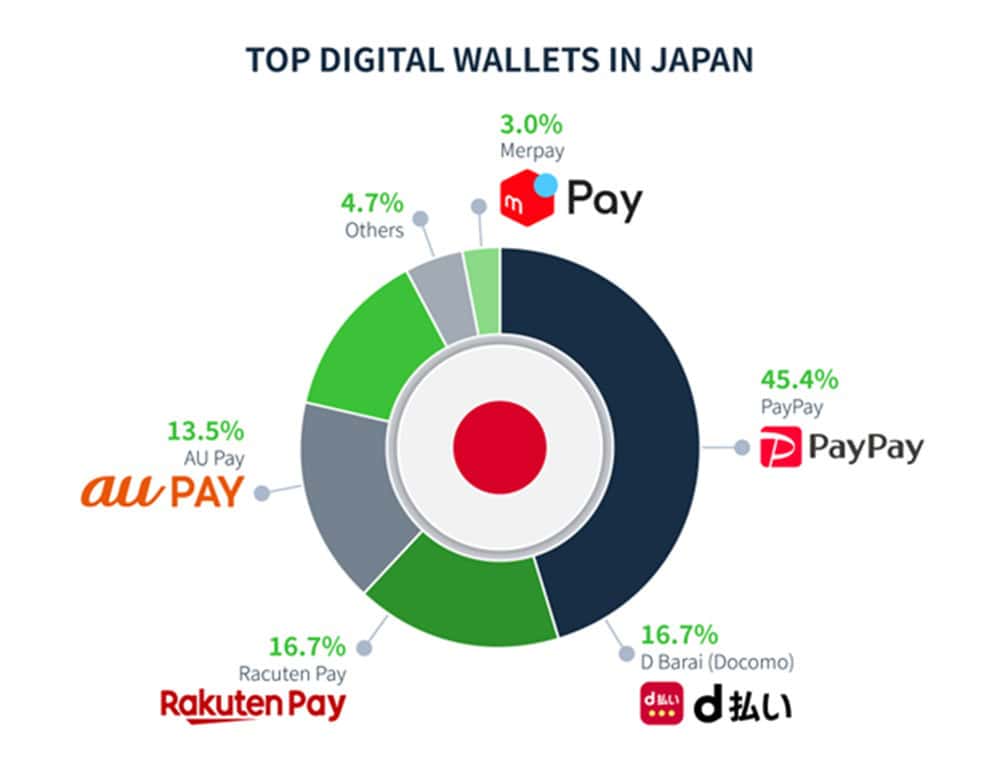

Top Digital Wallets in Japan

Now, let’s take a closer look at some of the top digital wallet options available in Japan:

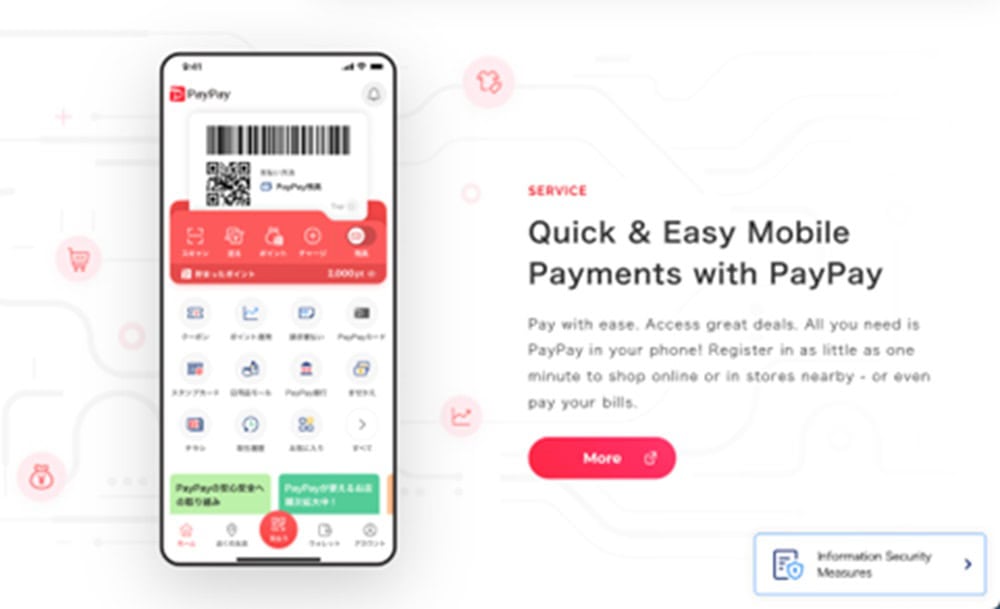

Paypay

Paypay (not to be confused with PayPal) is a popular digital wallet app in Japan, offering users a convenient and secure way to make payments both online and offline. Developed by a joint venture between SoftBank and Yahoo Japan, PayPay allows users to link their bank accounts or credit cards to their accounts and use the app to make purchases at thousands of merchants across the country.

One of PayPay’s key features is its ease of use, allowing users to make payments with just a few taps on their smartphone. Users can simply scan a QR code or tap their device on a contactless payment terminal to authorize transactions. Additionally, PayPay offers various promotions and rewards to users, including cash-back incentives and discounts at participating merchants.

PayPay also provides users with features such as transaction history tracking, budget management tools, and the ability to split bills with friends and family. The app prioritizes security, employing encryption and other measures to protect users’ sensitive information.

dBarai

dBarai is yet another digital wallet service in Japan operated by the NTT Docomo group. It offers users a convenient and secure platform to make payments both online and offline. With dBarai, users can link their bank accounts or credit cards to their accounts and use the app to make purchases at various merchants across the country.

The app provides users with features such as transaction tracking, budget management tools, and loyalty program integration. It prioritizes security with encryption and other protective measures to safeguard users’ financial information. Although anyone in Japan can use the app, the biggest benefits are reaped by the NTT Docomo mobile service users, who get to use their accumulated dPoints to pay their bills, including their mobile one.

As with all previous digital wallets, dBarai also aims to streamline the payment process and enhance the overall user experience in the evolving landscape of digital payments in Japan.

Rakuten Pay

RakutenPay, a prominent digital wallet in Japan, is an integral part of the Rakuten ecosystem, one of the country’s largest e-commerce platforms. Rakuten Pay offers users a convenient and secure way to make payments both online and offline. Users can link their bank accounts or credit cards to their Rakuten Pay account and utilize the app to make purchases at various merchants.

The ease of use is a significant advantage of Rakuten Pay; users can make transactions by scanning a QR code or tapping their device on a contactless payment terminal. Moreover, Rakuten Pay frequently offers incentives such as cashback rewards and discounts, enhancing its appeal among consumers.

In addition to its primary payment function, Rakuten Pay provides users with features like transaction tracking, budget management tools, and the ability to accumulate Rakuten Super Points, which can be redeemed for discounts on future transactions. Security is also a top priority for Rakuten Pay, with robust encryption and other protective measures in place to safeguard users’ financial information.

auPAY

auPAY is a prominent digital wallet in Japan, primarily utilized by mobile carrier customers. It offers a seamless and secure method for making payments both online and offline. Users can link their bank accounts or credit cards to their auPAY account and use the app to make purchases at various merchants, including convenience stores, restaurants, and online retailers.

The convenience of auPAY lies in its ease of use; users can simply scan a QR code or tap their device on a contactless payment terminal to authorize transactions. Additionally, auPAY often offers promotions and discounts to users, enhancing its appeal.

Beyond its basic payment functionality, auPAY provides users with features such as transaction tracking, budget management tools, and the ability to earn rewards points. It prioritizes security, employing encryption and other measures to protect users’ sensitive information.

LINE Pay

LINE Pay is another popular digital wallet service, offered by LINE, the widely used messaging app in Japan. It provides users with a convenient and secure platform to make payments both online and offline. Users can link their bank accounts or credit cards to their LINE Pay account and utilize the app to make purchases at various merchants, including restaurants, convenience stores, and online retailers.

The simplicity of LINE Pay is a key feature; users can make transactions by scanning a QR code or tapping their device on a contactless payment terminal. Additionally, LINE Pay offers various incentives such as cashback rewards and discounts to enhance the user experience.

Aside from its primary payment function, LINE Pay offers additional features such as peer-to-peer money transfers, bill splitting, and loyalty program integration. Users can also earn LINE Points for making purchases, which can be redeemed for various rewards within the LINE ecosystem. Security is a top priority for LINE Pay, with advanced encryption and other security measures implemented to protect users’ financial information.

Merpay

Merpay is a digital wallet service provided by Mercari, Japan’s leading online marketplace. It offers users a convenient and secure platform to make payments both online and offline. Users can link their bank accounts or credit cards to their MerPay account and utilize the app to make purchases at various merchants, including retailers, restaurants, and convenience stores.

MerPay stands out for its simplicity; users can make transactions by scanning a QR code or tapping their device on a contactless payment terminal. Additionally, MerPay offers incentives such as cashback rewards and discounts to enhance the user experience.

Beyond its primary payment function, MerPay offers additional features such as transaction tracking, budget management tools, and the ability to earn MerPay points for making purchases. These points can be redeemed for discounts on future transactions within the Mercari ecosystem. Security is also a priority for MerPay, with advanced encryption and other security measures implemented to protect users’ financial information.

Apple Pay

Apple Pay revolutionizes the way users make payments by transforming their iPhones, Apple Watches, or iPads into digital wallets. It offers a secure and convenient platform for making purchases both online and in stores. Users can add their credit or debit cards to Apple Pay and use their devices to make payments at contactless payment terminals by simply tapping or holding them near the terminal.

One of Apple Pay’s key features is its ease of use; transactions can be authorized with Touch ID, Face ID, or a passcode, providing users with a seamless and secure payment experience. Additionally, Apple Pay prioritizes user privacy and security, utilizing features such as tokenization and biometric authentication to protect users’ sensitive information.

Beyond its primary payment function, Apple Pay offers additional features such as loyalty program integration and peer-to-peer payments through the Messages app. Users can also benefit from special offers and discounts from participating merchants

Are Digital Wallets Safe to Use?

Digital wallets have become increasingly popular for their convenience and efficiency in managing finances and making transactions. However, many users may have concerns about the safety and security of using digital wallets to manage their sensitive financial information. While there are inherent risks associated with any form of online payment, reputable digital wallet providers implement robust security measures to mitigate these risks and protect users’ financial data.

Risks Associated with Digital Wallets

But before diving head first into the world of digital wallets, it’s essential to acknowledge that, like any financial tool, they come with inherent risks. Understanding these risks can help users navigate the digital landscape more securely.

Here are some common risks associated with digital wallets:

1. Unauthorized Access

Hackers may attempt to gain unauthorized access to users’ digital wallet accounts to steal sensitive information or make unauthorized transactions.

2. Identity Theft

Users’ personal and financial information stored in digital wallets may be at risk of being stolen and used for identity theft or fraud.

3. Data Breaches

Digital wallet platforms may be vulnerable to data breaches, resulting in the exposure of users’ sensitive information to malicious actors.

4. Phishing Attacks

Users may fall victim to phishing attacks, where they receive fraudulent emails or messages attempting to trick them into disclosing their digital wallet credentials.

Security Measures Implemented by Digital Wallet Providers

In the realm of digital wallets, both in Japan and globally, security is paramount. Fortunately, most platforms employ robust security measures to safeguard users’ financial information and provide peace of mind.

Here are some key security features commonly found in digital wallets:

1. Encryption

Digital wallet platforms utilize advanced encryption algorithms to encrypt users’ sensitive information, making it unreadable to unauthorized parties.

2. Tokenization

Many digital wallet providers employ tokenization technology, which replaces users’ actual payment information with unique tokens, reducing the risk of exposure in the event of a data breach.

3. Multi-Factor Authentication (MFA)

MFA adds an extra layer of security by requiring users to provide multiple forms of verification, such as a password, fingerprint, or one-time code, to access their digital wallet accounts.

4. Biometric Authentication

Some digital wallet apps offer biometric authentication options, such as fingerprint or facial recognition, to verify users’ identities and authorize transactions securely.

5. Transaction Monitoring

Digital wallet platforms often employ sophisticated fraud detection systems to monitor users’ transaction activities and identify any suspicious or fraudulent behavior.

Choosing a Reputable Provider

To ensure maximum safety when using digital wallets, users should opt for reputable and well-established providers with a proven track record of implementing strong security measures and protecting users’ financial data. It’s essential to research and review the security features and policies of digital wallet platforms before entrusting them with sensitive information.

In conclusion, while there are inherent risks associated with using digital wallets, most platforms offer robust security measures to safeguard users’ financial information and mitigate the risks. By choosing reputable providers and following best practices for security, users can enjoy the convenience of digital wallets with peace of mind.

Pros & Cons of Digital Wallets in Japan

Pros

- Convenience: Digital wallets streamline the payment process, allowing users to make purchases with just a few taps on their smartphone.

- Security: Digital wallets use encryption and other security measures to protect users’ payment information, reducing the risk of fraud.

- Rewards and Discounts: Many digital wallet platforms offer rewards programs or discounts for using their services, providing additional incentives for users.

- Expense Tracking: Some digital wallets offer features that allow users to track their spending and manage their finances more effectively.

- Interoperability: Open digital wallets can be used at a wide range of merchants and platforms, offering greater flexibility to users.

Cons

- Limited Acceptance: While digital wallets are becoming more widespread, there are still some merchants and regions where they may not be accepted.

- Dependence on Technology: Digital wallets rely on smartphones or other electronic devices, so users may encounter difficulties if their device malfunctions or runs out of battery.

- Security Risks: Despite security measures, digital wallets are not immune to cyber threats, and users may be at risk of fraud or unauthorized access to their accounts.

- Privacy Concerns: Some users may have concerns about the collection and use of their personal data by digital wallet providers and other third parties.

- Compatibility Issues: Users may encounter compatibility issues if their device or operating system is not supported by a particular digital wallet platform

Summary

Digital wallets have revolutionized the way we make payments, offering convenience, security, and flexibility to users. In Japan, where technological innovation is embraced, digital wallets have quickly gained popularity, with a wide range of options available to consumers.

While there are risks associated with using digital wallets, choosing reputable providers and following best practices can help mitigate these risks and ensure a smooth and secure payment experience.

FAQs

To set up a digital wallet, you’ll need to download the corresponding app from the app store and follow the instructions to create an account and link your payment information.

Most digital wallet providers offer their services for free, but some may charge fees for certain transactions or services. Be sure to check the terms and conditions of the digital wallet provider for details on any applicable fees.

While digital wallets offer many benefits, some users may prefer traditional payment methods or have concerns about security and privacy. Ultimately, the decision to use a digital wallet depends on individual preferences and needs.

The terms “digital wallet” and “e-wallet” are often used interchangeably and refer to the same concept: a virtual container for storing payment information. However, some may use the term “e-wallet” to refer specifically to electronic wallets used for online transactions.

When choosing a digital wallet, consider factors such as security features, compatibility with your devices, acceptance at merchants you frequent, and any rewards or incentives offered by the provider. Researching different options and reading reviews can also help you make an informed decision.

Conclusion

In the end, digital wallets offer a convenient and secure way to make payments in an increasingly cashless society. With a variety of options available in Japan, consumers have the flexibility to choose the digital wallet that best suits their needs and preferences. By understanding how digital wallets work and following best practices for security, users can enjoy the benefits of this innovative payment solution with confidence.

We help businesses accept payments online.