We help businesses accept payments online.

Generating over $22 billion USD annually, Japan is the world’s third-largest and most advanced video gaming market. It is also highly digital, with 90% of revenue coming from digital sales vs 10% in-person.

Despite its tech-savvy consumer base, over 40% of users avoid credit cards, preferring prepaid including BitCash, digital wallets, convenience store payments, and carrier billing.

For developers on platforms like Steam, Wargaming, or Blizzard, succeeding in Japan requires more than translation, it demands payment localization. This guide explores Japan’s preferred gaming payment methods and how payment service provider KOMOJU, helps global publishers integrate them seamlessly and in compliance with local regulations.

We also draw parallels with South Korea, another major market with similar infrastructure but distinct user behavior, to show how businesses can scale their strategy regionally.

Overview of the Video Gaming Market in Japan

Japan has played a significant role in shaping the global gaming industry. The country has always been at the forefront of innovation, dating back to the early days of arcades and home consoles by companies like Nintendo, SEGA, and Sony, as well as the rise of mobile and online gaming.

Today, Japan has the third-largest video gaming market in the world, generating over $22 billion annually. But beyond its size, Japan’s digital ecosystem is also highly mature, with an urbanized, mobile-savvy population. Digital video game purchases lead the market, which makes entry both lucrative and complex for international publishers.

Top PC and Mobile Game Platforms

Mobile

Mobile video gaming is especially popular, driven by titles like Monster Strike, Fate/Grand Order, and Puzzle & Dragons. These games rely heavily on microtransactions, small, virtual purchases of items or services often found in apps or video games. Therefore, it’s essential to have smooth in-app purchase processes and offer local payment options.

PC

On the PC side, platforms like Steam, Wargaming.net, and Battle.net are very popular among advanced video gamers. Steam, in particular, has gained traction by offering:

- Localized interfaces

- Regional pricing

- Support for prepaid methods like BitCash and gift cards

These features have a direct impact on conversion and retention rates.

Growth of Digital Distribution

More than 90% of video game revenue in Japan now comes from digital sales. This number is driven by mobile app stores, downloadable content (DLC), and online platforms, and the shift has been accelerated by:

- Subscription models (e.g., PlayStation Plus, Xbox Game Pass)

- DLC and gacha mechanics

- Frequent live updates and events, which keep players engaged and spending

For publishers, user experience doesn’t end with playing the game—the payment flow is part of the product.

Therefore, to fully leverage the potential of the Japanese video gaming market, it’s important to localize and support trusted payment methods.

Unique Payment Culture in Japan

Consumer Trust in Cash and Prepaid Options

Despite its reputation for technology and innovation, cash is still the most accepted payment method in Japan. Approximately 60% of transactions in Japan are paid by cash. This behavior is due to a combination of cultural, societal, and demographic factors.

One of the reasons so many people are comfortable with cash is because of Japan’s reputation for having low crime rates. Because of this, people generally feel safe carrying cash, reducing the urgency for digital payment methods.

There have also been security concerns in the past, which have made some consumers wary of online transactions, not wanting to risk being victims of data breaches and online fraud.

Mobile Wallet Usage vs. Credit Cards

Since 2018, the Japanese government has been making efforts to create a more cashless society, aiming for 40% cashless payments by 2025, intending to eventually reach 80%. As a result, there has been accelerated growth in digital and mobile payment solutions.

Mobile wallets, or digital wallets, are becoming increasingly used, especially among younger consumers. Offering both convenience and enhanced security features like biometric authentication, they allow users to store bank cards and prepaid accounts on their smart devices. In Japan, PayPay, MerPay, Rakuten Pay, and Apple Pay are leading digital wallets.

However, credit cards are still the most widely used form of cashless payments in Japan, being used 83.5% of the time. They give shoppers credit and loyalty rewards and are widely accepted in both online and physical stores.

When it comes to consumer behavior, mobile wallets offer flexibility and speed in payments, while credit cards are used for larger purchases or recurring transactions.

Why Localization Matters for Monetization

Regardless of the payment method, localization (the process of adapting content, products, payment options, and customer experiences to meet the unique expectations of a local audience) is still important for international businesses entering Japan.

In a country where consumer behavior is shaped by tradition, customs, and language, localization is essential for building consumer trust and brand loyalty.

Key benefits of localization include:

- Expanded market reach: Businesses can connect with a broader audience by meeting local expectations.

- Increased customer engagement: Customers are more likely to engage with a brand when it offers familiar payment options and culturally relevant experiences.

- Higher conversion rates: Localization leads to increased customer satisfaction, which increases the likelihood of purchasing.

- Enhanced brand reputation: Brands can build trust and credibility with Japanese consumers by showing an understanding of the local culture.

Understanding Japan’s unique payment culture and consumer preferences and tailoring the shopping experience accordingly helps build long-term customer relationships and enables international companies to increase their monetization opportunities.

Frequently Used Payment Methods Among Japanese Video Gamers

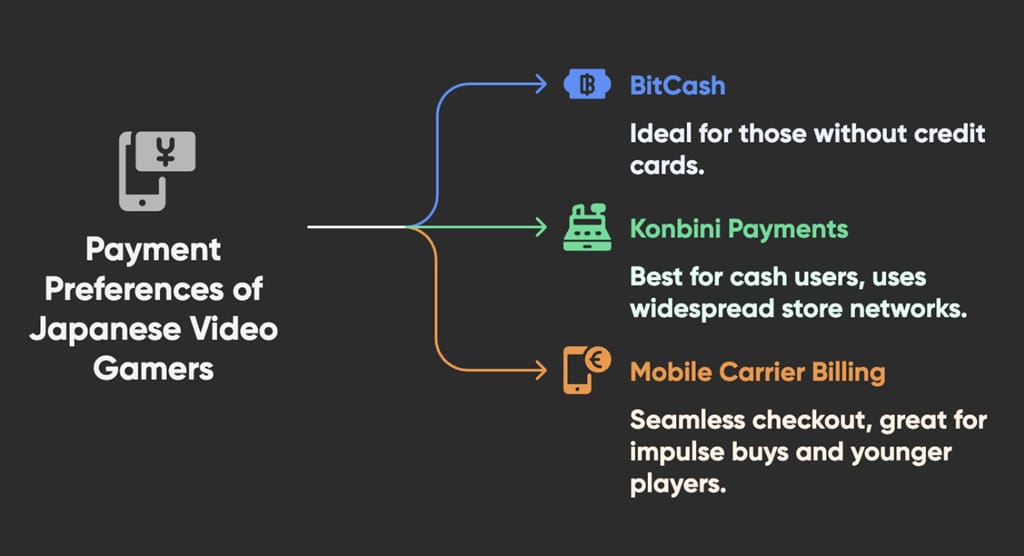

Japan’s video gamers use a variety of payment methods, based on the need for privacy, convenience, and compatibility with local infrastructure. As a result the payment ecosystem is a diverse mix of traditional and digital payment options.

For global platforms entering the Japanese market, understanding and adapting to these preferences is essential.

Prepaid Wallets

Prepaid wallets are a widely accepted solution for Japanese gamers purchasing downloadable content, virtual currency, or games from digital storefronts. They offer privacy, ease-of-use, and appeal to younger users and those without credit cards.

Here’s a breakdown of the top three prepaid wallets in Japan:

WebMoney

One of Japan’s oldest and most widely used prepaid solutions, webmoney is accepted across a large number of game platforms and digital services. It consistently holds the largest market share among prepaid options.

Bitcash

BitCash is popular among younger users and is especially trusted for anonymous online payments. Its unique use of “character-based” codes makes it visually appealing and secure. It is commonly accepted on platforms like Steam, DMM, and PlayStation Store.

NetCash

NetCash is used for games, anime, and other digital content. Its simple code system supports anonymity and it’s easy to purchase at convenience stores. While not as widely used as WebMoney or BitCash, it remains a trusted choice, especially for mobile games, niche platforms, and younger users.

Convenience store (Konbini) payments

Convenience Store (Konbini) Payments allow consumers to pay for online purchases or bills in cash at major convenience store chains like 7-Eleven, Lawson, FamilyMart, Ministop, Sunkus, Circle K, and Daily Yamazaki.

Leveraging the widespread Convenience Store network and catering to a cash-centric culture in Japan, they are convenient for customers who don’t own credit or debit cards or prefer to use cash.

For video game publishers, offering Konbini payment options allows them to reach a broader audience, especially among younger players and those who don’t want to share their payment info online.

Mobile Carrier Billing

Carrier billing is a payment method that allows customers to charge purchases directly to their phone bill, eliminating the need to enter credit card or bank account information.

In Japan, Docomo is a major provider, while Boku provides global coverage for developers and platforms. Transactions are approved by the merchant using the customer’s phone carrier’s ID and password, and charges appear on their monthly phone bill.

Mobile carrier billing is frequently used for app store purchases, in-game content, and subscription services. Because it is a seamless checkout experience, it is especially accessible for younger players or those without access to cards and is also great for impulse buys.

Digital Wallets

Digital wallets have been embraced in Japan as part of the country’s initiatives to make Japan a cashless society. This mobile-first payment solution provides fast and secure payments, which increasingly influences video gamer spending behavior. Key stats:

PayPay leads the market with roughly 65 million registered users—almost half of Japan’s population—offering seamless QR payments online and in-store.

Other major players include LINE Pay, MerPay, Rakuten Pay, au PAY, and d払い, each serving tens of millions monthly.

Digital wallets are deeply integrated with loyalty systems and saved cards, encouraging frequent micro transactions and boosting average spend among video gamers.

How video gamers top up accounts on Steam, Blizzard

While global developers offer a wide range of payment methods, success in Japan requires localization. Japanese video gamers tend to prefer prepaid and cash-based solutions, which are shaped by the country’s infrastructure and cultural preferences.

Global platforms like Steam and Blizzard succeed in Japan by supporting these trusted, local methods:

Steam, for example, offers a wide selection of Japan-friendly payment options through integrations like KOMOJU, including:

- BitCash – Prepaid digital codes are commonly used by users who don’t have bank accounts, especially teenagers.

- Konbini (Convenience Store) Payments – after generating a payment slip online, users pay in cash at stores like 7-Eleven, Lawson, or FamilyMart.

- Carrier Billing – Allows purchases to be charged directly to mobile bills through providers like Docomo.

- Local Credit Cards & Wallets – Including services like PayPay, are available through localized gateways like KOMOJU.

Blizzard’s Battle.net also supports a variety of local options:

- Japanese credit/debit cards

- Prepaid cards and gift cards

- Regional payment aggregators

Both platforms reduce friction and boost conversion by integrating with local gateways that offer these preferred payment methods.

Why It Matters for Developers

Even experienced, engaged players may abandon purchases if they can’t pay the way they’re used to. Supporting familiar options builds trust, lowers checkout friction, and increases conversion, especially in a cash-first society like Japan.

Case Study: How KOMOJU Helped Steam Localize Payments and Accelerate Growth in Japan

DEGICA, which offers the online payment system “KOMOJU” , started as a video game publishing company that published Steam’s RPG Maker, a popular Japanese software. This established relationship positioned KOMOJU to further support Steam in localizing its platform for Japanese users, with a primary focus on providing tailored payment solutions.

The Challenge: Why Steam Needed a Payment Partner

When Steam, one of the world’s largest PC gaming platforms, first entered the Japanese market, engaging with local gamers proved to be challenging. Several factors created friction during the checkout process:

Language Barriers

The interface was in English, which made it difficult for users to navigate.

Currency confusion

Prices were displayed in USD, not Japanese yen, which confused users about what the actual cost was.

Limited Payment Options

Credit cards were the primary payment method. However, many Japanese users preferred cash or did not have access to bank accounts or credit cards.

Lack of local customer support

All inquiries were answered in English and during U.S. hours, making it difficult for users to get help when needed.

Despite Steam’s global success, these barriers affected its ability to gain the trust of Japanese users and complete transactions. Steam needed a local partner with deep knowledge of Japan’s payment ecosystem and user preferences.

Key Integrations:

The Solution: KOMOJU’s Localized Payment Integration

With expertise in localizing global platforms for Japanese users, KOMOJU played a key role in Steam’s 2014 expansion into Japan by offering familiar and trusted payment solutions.

Key solutions implemented:

KOMOJU as a Payment Gateway

Steam integrated KOMOJU to support trusted Japanese payment methods, including:

- Konbini (convenience store) payments

- Prepaid e-money (BitCash, WebMoney, NetCash

- Digital wallets (e.g PayPay, Rakuten Pay)

- Carrier billing via major mobile carriers

In August 2014, konbini payments were enabled through KOMOJU, allowing users to pay in cash at convenience stores—one of Japan’s most trusted and familiar channels. This was especially effective in building trust with first-time or younger users.

In September 2014, support for domestic credit cards followed, further reducing checkout friction and aligning with local preferences

Currency Localization

Steam began displaying prices in the Japanese yen, removing the confusion caused by exchange rates.

Local Customer Support

To increase user trust and improve service, email and phone support in Japanese was introduced.

Community Engagement

Steam and KOMOJU launched “PRO Steamer,” a Japanese-language support hub to guide new users and provide updates.

These changes were powered by KOMOJU’s developer-friendly infrastructure and deep expertise in the Japanese market.

The Results: User Growth and Developer Momentum in Japan

The impact of KOMOJU’s integration was immediate and significant:

Massive user adoption

By 2016, Japan had the largest increase in Steam users worldwide.

Increase in Japanese video game developers

With fewer barriers to entry, more developers embraced Steam as a platform to reach global audiences.

Improved conversion rates

By offering familiar and trusted payment methods, checkout friction was reduced, resulting in fewer abandoned carts.

Partnering with KOMOJU allowed Steam to turn Japan from a niche market into a significant growth market that was fully localized and user-friendly.

Partnering with KOMOJU allowed Steam to turn Japan from a niche market into a significant growth market that was fully localized and user-friendly. The collaboration demonstrated how local payment infrastructure can directly impact user acquisition and engagement in international markets.

South Korea Comparison: Similar Trends & Lessons

If you’re building a payment strategy for Japan, South Korea is worth considering in your expansion goals. Both countries have strong digital infrastructure, high consumer spending on games and entertainment, and loyal user bases.

Frequently used Payment Methods in Korea

In South Korea, Kakao Pay and Naver Pay lead the digital payment space followed by PayCo and Toss, and are deeply integrated into users’ everyday lives. For example, Kakao Pay, through its connection with KakaoTalk, the nation’s top messaging app, has over 37 million monthly active users.

These services reflect trends seen in Japan with BitCash and Konbini-based payment options, which also focus on offering convenience, privacy, and mobile-first design.

Video Gamer Behavior - S.Korea vs. Japan

S.Korean video gamers tend to prefer PC and mobile video games and are known for making frequent in-game purchases, especially in competitive or socially connected environments. Japanese video gamers, while also active on mobile, show a stronger preference for console-based video games and tend to trust prepaid options rather than directly linking their credit cards.

These behavioral differences highlight the importance of localization and tailoring monetization strategies to each market’s unique habits and expectations.

Steam Gift Cards in Both Regions

Steam Gift Cards are a common solution in both Japan and Korea. They provide a low-friction, prepaid option for users without credit cards or for those who prefer to remain anonymous. In both markets, they serve as a bridge between digital content and local payment behavior.

South Korea is not only a valuable point of comparison, but it also presents a compelling growth opportunity for developers and eCommerce businesses already exploring Asia. With platforms like KOMOJU supporting localized payment methods in both Japan and South Korea, regional expansion may be more seamless than you think.

Why Localization Matters for Global Video Game Publishers

Players don’t abandon video games—they abandon checkouts. Even the most engaged players will hesitate if the payment flow is unfamiliar or doesn’t feel smooth.

In markets like Japan and South Korea, how users pay is just as important as what they’re paying for. That’s why platforms like Steam and Blizzard partner with KOMOJU to offer localized, trusted payment options like Konbini, BitCash, PayPay, Kakao Pay, and Naver Pay and others

This results in higher consumer trust, lower drop-off rates, and increased conversions.

How to Get Started with KOMOJU

KOMOJU connects global publishers to the most trusted local methods with a single integration, and no local entity is required.

By partnering with KOMOJU, you’ll get:

- Access to Japan’s top payment rails

- Assurance that you are complying with local regulations (tax, currency, reporting)

- Customer and technical support in both English and Japanese

- Real-time analytics

Ready to go live? Contact KOMOJU to get started.

FAQ: Payment Methods in Video Gaming in Japan

Japanese gamers commonly use:

- Convenience (konbini) store payments (e.g., 7-Eleven, Lawson, FamilyMart)

- Prepaid Wallets (BitCash, NetCash, WebMoney)

- Carrier billing (for mobile games and app stores)

Many Japanese consumers prefer prepaid or cash-based methods due to:

- Greater privacy and anonymity

- Easier budget control

- Concerns about security

- A cultural tendency to avoid debt

BitCash is a prepaid e-money system. Video gamers can:

- Purchase it from a convenience store

- Receive a 16-character code

- Use that code to pay for games on platforms like Steam and Blizzard

KOMOJU helps publishers localize their payment offerings. Supported methods include:

- BitCash

- PayPay

- Konbini payments

- Carrier billing

- Korean payment methods like Kakao Pay and Naver Pay

Yes. Korean gamers often use:

- Kakao Pay and Naver Pay

- Top-up cards from convenience stores like GS25 or CU

- Carrier billing via SK Telecom, KT, and LG U+

They can integrate with KOMOJU, which provides:

- One-stop access to local Japanese and South Korea payment methods

- Currency and regulatory compliance

- Easy refunds and local customer support to the end-user

We help businesses accept payments online.