We help businesses accept payments online.

If you’ve plateaued in your local market, you can either stagnate or expand internationally.

As the single largest eCommerce market in the world by far, China is the obvious candidate for consideration.

China’s eCommerce market size makes sense, as the country accounts for 17.72% of the world population, second only to India.

But did you know that China currently spends $79 billion on cross-border eCommerce buying from US-based merchants?

Chinese people perceive brands from the West to be of high quality.

If you’re based in the West, particularly in the US, China eCommerce is a potential goldmine.

We’ve done the research; below is everything you need to know to seize the opportunity.

China eCommerce Market Overview

Market Size

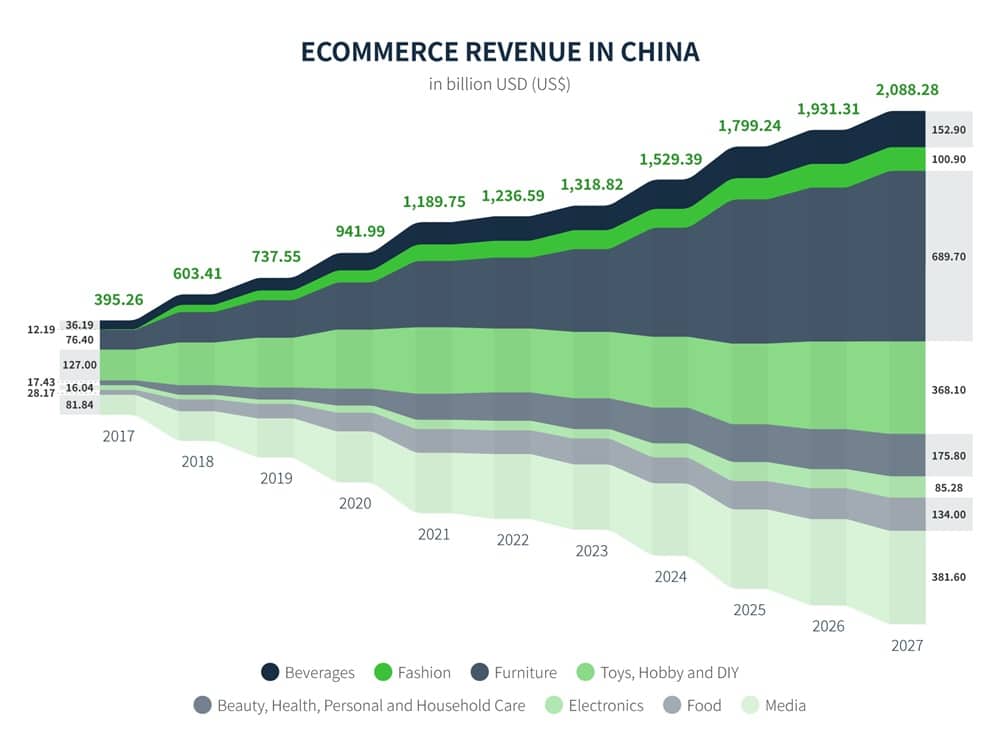

At a projected volume of $1,319 billion in 2023, China’s eCommerce market towers over the rest of the world.

This is despite the fact that consumer confidence was at a historical low in 2022 and China is just recovering from the aftermath of Covid outbreaks.

The removal of Covid policies and measures is regenerating the country to pre-pandemic levels after the slow start in 2023. Below is a list of factors contributing to the long-term outlook in China eCommerce:

- The disposable income of Chinese citizens per capita has been rising over the years

- Low-tier cities are showing an increasing interest in eCommerce

- Internet and mobile penetration continues to rise and mobile commerce is booming

- Social commerce which blends social media and eCommerce is gaining traction

- The nation is making efforts to increase domestic demand and regulate eCommerce

- Shanghai has explicitly included the Metaverse in its Five-Year Plan, and many eCommerce giants are already testing the waters with exclusive brand experiences

Growth Rate

Between 2023-2027, China eCommerce market is expected to grow by 12.17% annually and reach $2,088 billion by 2027.

Here is the bigger picture that puts the current slow eCommerce growth rate into perspective:

The imported cross-border eCommerce has maintained an annual growth rate of 20% and is a major growth engine for China’s consumer market, giving the country every reason to continue making it easier for foreign brands to sell in China online.

It’s a good moment to break into the market to stay ahead of the curve with all the recent innovations and developments and cement your position in the world’s biggest online market.

Demographics

The population of China is 1.42 billion people with a median age of 39.

Here are some characteristics of your typical Chinese consumer:

- Likes a good deal and low prices but as long as they don’t come with a quality decrease

- Is brand-conscious due to the community-oriented culture where participating in the norms and keeping face are important

- Is willing to pay a higher price for a brand name to maintain social status and guarantee quality

- Likes brands that have a heritage and strong brand position, such as Chanel or Louis Vuitton

- Expects communication and marketing via locally popular social media like WeChat, Douyin, and Weibo

- Searches online via Baidu, the Chinese version of Google that doesn’t show results from brands that don’t cater to the Chinese audience, at least in terms of language

- Trusts Key Opinion Leaders (KOLs) and social media reviews more than advertisements to inform their shopping decisions

- Is very active and engaged online

Popular Product Category

The top ten product categories in China eCommerce in 2023 are as follows:

- Clothing – 52%

- Shoes – 47%

- Food and beverages – 35%

- Bags and accessories – 29%

- Cosmetics and body care – 28%

- Consumer electronics – 26%

- Sports and outdoor products – 24%

- Accessories – 22%

- Books, movies, music, and games – 20%

- Bags and luggage – 18%

Additionally, most categories of high-quality or even luxury products, particularly those sold at discounted prices or exclusively on a Chinese platform have a good chance of becoming popular in this country.

But whether you find your category on this list or not, you need to know the relevant laws and regulations before you can offer your product to the Chinese market online.

Chinese eCommerce Laws

The eCommerce Law (ECL) exists to protect consumer rights, provide a healthy environment for eCommerce growth, and ensure all businesses have fair opportunities.

Depending on your business and distribution model, this law might require you to obtain a business license or register with local tax authorities.

Aside from learning about the regulations that directly apply to you, it’s also important to know the rules for eCommerce marketplaces to protect your business.

The ECL’s anti-monopoly regulation specifically prohibits the restriction or limitation of competition by dominant platforms.

Alibaba, which has the highest share of Chinese eCommerce, got fined with an administrative penalty of 10,182 million Yuan in 2021 for abusing its dominant position by forbidding merchants on its marketplace from doing business on competitor sites.

Having a legal professional examine these regulations is the best way to ensure you’re getting the most out of your expansion to China and staying on the right side of their law.

Top Chinese eCommerce Platforms

Chinese eCommerce market used to be based primarily on consumer-to-consumer selling, but business-to-consumer (B2C) gradually became the dominating selling model over the years.

This is especially true for B2C eCommerce platforms. There are several reasons why:

- Quick and centralized search results: Customers are searching within their favorite platforms rather than via search engines to save time

- Higher security and vetted products: Platforms verify featured brands to comply with the Chinese eCommerce Law and maintain their reputation, giving consumers an additional sense of security

- Relevant results and deals: Searching within a platform narrows the query results to more relevant products, and gives consumers an opportunity to compare items from similar categories to find the best deals all in one place

- Payment convenience: The increasing use of smartphones and the need for cashless payments through We Chat Pay or Alipay are making B2C eCommerce convenient to Chinese consumers

The blend of social media and eCommerce on platforms like WeChat and Douyin is a new eCommerce trend that’s projected to change the scene regarding dominant platforms and marketplaces.

Below are the platforms that currently dominate the space and can help you break into the market.

Taobao

Taobao is an eCommerce platform owned by Alibaba. It’s similar to Ebay.com but with more fixed prices and fewer auctions.

Taobao is one of the most visited websites in the world with over 370 million registered users.

Anyone with a Chinese ID can open a Taobao store, which means it’s both a B2C and C2C platform.

Alibaba recently launched a Metaverse live streaming channel called TaoLive City where users can have an immersive experience walking around and browsing through affiliated stores.

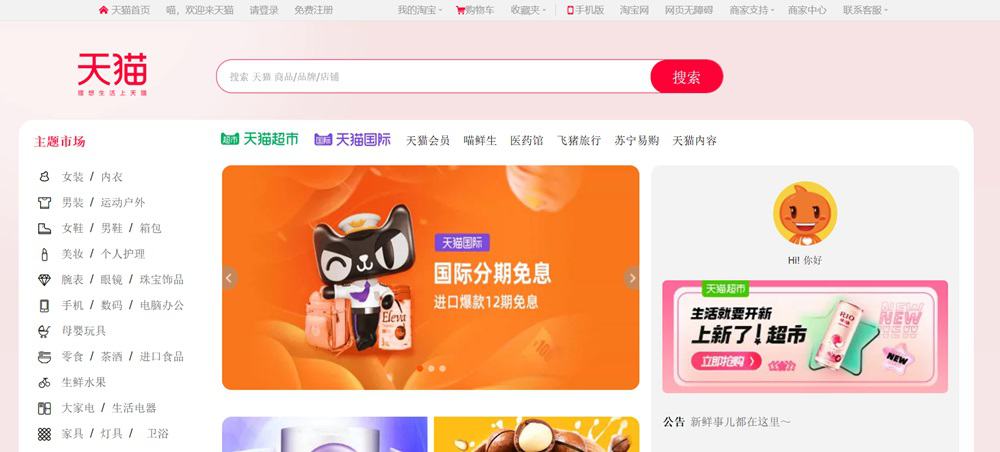

TMall

TMall, previously Taobao Mall, is Alibaba’s dedicated B2C platform and one of the most visited B2C marketplaces in China.

It’s a subset of Taobao, but also a popular and important platform on its own.

However, even though they both have their own apps, consumers favor Taobao because this app includes TMall in its search results anyway.

One key difference between the two is that only verified businesses can sell on TMall, which ensures a higher quality standard for customers.

Alibaba favors TMall, which is why most of Taobao traffic, and by extension, revenue goes to this platform.

This is reflected in the unique perks of the platform as selling on TMall exclusively allows you to apply to high-profile promotional events and get even more traffic.

JD Jingdong

JD operates on a different business model compared to Alibaba and is one of Alibaba’s biggest competitors.

Instead of hosting entire stores on a third-party marketplace model alone, JD takes on its own selective inventory. It essentially buys the items it deems to be high-quality and in demand and sells them.

The products include every major category like electronics, home furnishing, food and beverages, fashion, jewelry, and cosmetics.

The combination of first-party and third-party models allows JD to maintain tighter quality control. However, it’s a capital-intensive approach, so the platform operates at lower margins.

JD’s marketplace sells locally and offers JD Worldwide which helps foreign businesses reach the Chinese eCommerce market.

The platform has grown in light of Alibaba’s recent fine for locking merchants into exclusive partnerships, but both platforms face significant competition from Pinduoduo and other rapidly growing competitors.

PDD Pinduoduo

Pinduoduo is a Chinese eCommerce rising star.

It came out of nowhere in 2015 as an online agriculture retailer, but today it’s a third-party platform selling a variety of product categories, second only to Alibaba.

This platform transformed China eCommerce with three strong points:

- Rock-bottom prices thanks to working directly with manufacturers without commission

- Social eCommerce model that offers deals for groups of customers shopping together

- Gamification increases engagement and pulls more traffic

Pinduoduo encourages customers to share purchases with friends and family via social platforms, WeChat or QQ (the most popular chat apps in China), and QR codes to get a discount.

This way, manufacturers get bulk orders, and consumers get items at even lower prices.

Pinduoduo also has a daily check-in mechanism that rewards users who open the app each day with points they can deduct from their next purchase, further helping with engagement.

Another way the platform drives impressive traffic is by allowing customers to choose an item they would like to get for free, triggering a 24-hour timer.

The customer has to send the link to friends and they in turn have to click on it, each click lowering the price. If enough of them do it before the time runs out, the item is free.

The platform reached nearly 900 million active buyers and 131 billion Yuan ($18.9 billion) in revenue in 2022.

It’s a great option for businesses expanding to China because Pinduoduo has a “no commission” policy and only requires you to pay a 0.6% service fee to the payment function supplier.

This is because they mainly make money through advertising, allowing them to maintain low prices for everyone involved.

PDD also owns Temu and is currently expanding overseas due to its wild success in China eCommerce.

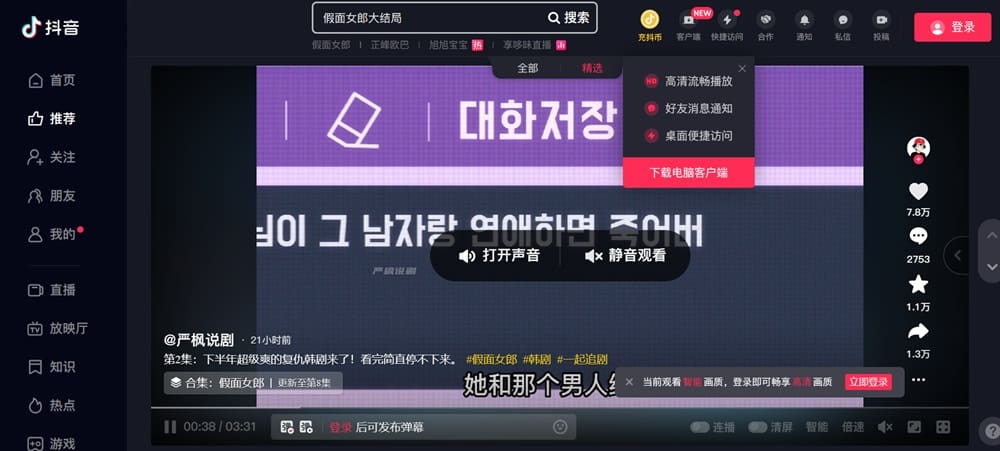

Douyin

Douyin is the original, local version of TikTok intended for shopping, owned by the same Beijing-based company called ByteDance.

However, because of some key differences between the two like their censorship rules, only Douyin is available in China.

Today, it’s one of the most popular social media platforms in the country, right behind WeChat.

The biggest reason behind this status is live streaming.

Live streaming sales are a multibillion-dollar industry in China and a trend that’s expected to grow.

Much like Taobao, Douyin is capitalizing on this trend with in-app sales.

In the past, customers would discover a brand or product on Douyin and then go to Taobao to buy it. Today, they don’t have to leave the app or even the video they’re watching.

Brands can register Douyin accounts and start selling directly to an audience of 730 million monthly active users.

The platform has useful features like geo-location tagging, in-video search, mini programs, and brand-official hashtag challenges.

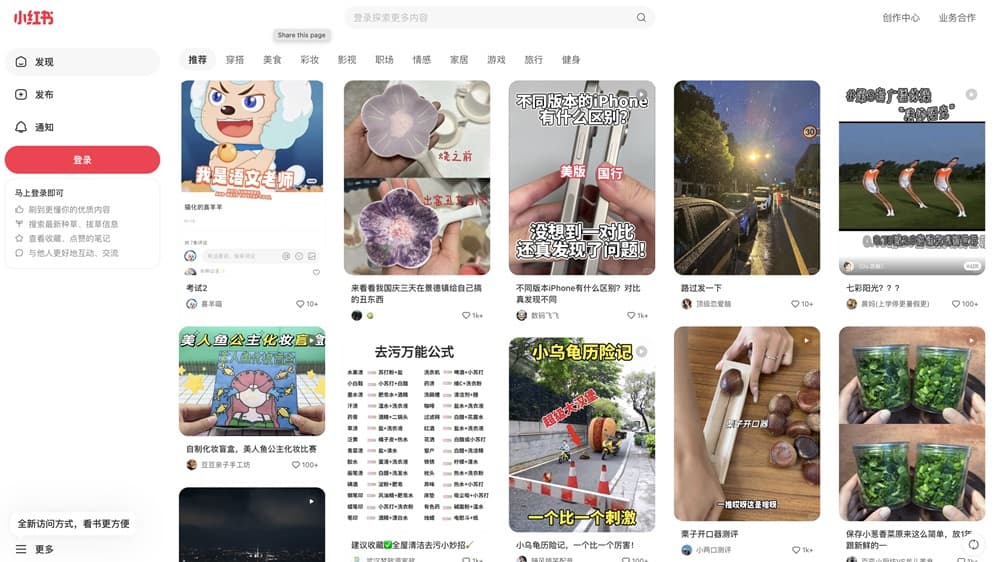

XiaoHongShu

XiaoHongShu (RedBook) is essentially a combination of Instagram and Pinterest with added eCommerce features, focused on selling beauty and lifestyle products.

This platform allows users to create blogs, post reviews, and create short videos, much like a regular social media platform.

Users can browse through other people’s experiences, get outfit inspiration, and then buy the same items on the spot, without leaving the app.

The idea is to facilitate a community and engage users in a way that’s similar to their everyday social media experience.

VIP.com

VIP Shop is one of the biggest flash sale websites in the world. There are two versions of VIP Shop: VIP International and VIP.com.

Both are based in China, but VIP.com sells specifically to this market.

The platform specializes in selling high-quality brand items at discounted prices that beat TMall and JD.

It’s rapidly expanding due to its affordability and convenience for merchants and customers alike:

- Merchants get a brand awareness boost, expand their reach, and in the case of cross-border eCommerce, open the door to the China eCommerce market

- Customers get desired items at top prices and they can pay via WeChat wallet, a popular option

VIP.com has a high number of engaged customers and a stable rate of repeat customer orders mainly from Greater China.

Suning

Suning started as an air conditioning franchise business in 1990 and grew into one of the top three B2C retail platforms in China.

It operates offline and online and its stores are dispersed across China. This allows the marketplace to offer same-day delivery and relatively low product prices, making it a popular consumer choice.

You’re more likely to be welcomed at Suning if you have an established brand, have a presence at JD, TMall or another Chinese platform, and sell preferred product categories such as electronics, books, home essentials, or infant care items.

Suning is currently recovering from a crisis period in 2021 and their revenue hasn’t been close to reaching its previous standard.

However, the company has strategies in place to get back on track in the following years and remain one of the biggest players in the Chinese eCommerce market.

Case Studies of Companies Succeeding in China eCommerce

Below are some brands that expanded to China online and their entire strategies, including but not limited to the platforms we just discussed.

1. Brasserie De Monaco

A high-end beer brand Brasserie De Monaco found its way into the Chinese market online.

However, they initially faced a hurdle: Chinese people gravitate towards brands they know.

To facilitate a brand presence accessible to China, you have to be searchable on Baidu, their version of Google. But Baidu’s “Great Firewall” cuts off websites that don’t have information written in Chinese, aren’t featured in Chinese news, and don’t use the right local platforms.

Brasserie De Monaco had to find a way to become visible to Chinese online consumers who were otherwise primed for top-of-the-line luxury beer brands.

They climbed that wall with a comprehensive strategy, including:

- Website optimization in Chinese, with Chinese backlinks

- Marketing on WeChat and Weibo, leveraging the Chinese belief that Monaco is a wealthy paradise and positioning their beer as high-end

- Partnering with Key Opinion Leaders in the lifestyle niche who are seen as credible and already have a large following base, which helped generate buzz

- Producing PR material for Chinese E-Media to be featured in the news, receive credible backlinks, and increase search engine ranking on Baidu

As a result, the brand established a customer base with 3000 followers on Weibo and 1000 fans on WeChat, driving consumer traffic to their site.

2. LVMH / Dior

Dior made multiple digital promotion attempts in China since 2015.

A fair few campaigns missed the mark in this market, but Dior learned from them and adjusted its course.

The company started marketing in China on popular apps like WeChat, Douyin, and Bilibili to localize its brand. They opened a TMall store in June 2020, right before the Chinese online shopping carnival with a limited selection of products and was positively received.

Following the success, Dior made a WeChat online festival promotion in time for Singles Day (November 11th) that included a series of limited-edition products created specifically for the event.

At the same time, LVMH (the collection of over 70 luxury brands including Dior) decided to launch a Chinese version of their eCommerce website 24S, and open their door to the Chinese market online.

They engaged consumers who wanted quality at top prices by giving them a 30% discount on orders exceeding $3,500 (23,000 Yuan) and offering a 12-month payment plan, as well as offering payment via AliPay.

This level of localization in China is the reason the luxury group is seeing a year-on-year revenue increase in China, only temporarily halted in 2022 due to strict Covid measures.

The beautiful thing about the company’s cross-border eCommerce strategy is the steady profit growth despite regional problems. While China’s contribution was muted in 2022, American and European markets saved the day.

In turn, now that these countries are facing a slower year, China’s recovery along with the growth in Southeast Asia, Japan, and the Middle East is more than making up for it in 2023.

Tips to Succeed in Online Selling to China

1. Start working on brand awareness

The first step to brand awareness is Baidu, the Chinese search engine equivalent to Google.

Baidu doesn’t link to the websites it deems irrelevant or inappropriate for the Chinese audience, which likely includes your site. To become discoverable, you need to meet certain requirements and get local validation:

- Have a website in Chinese

- Prepare PR material for Chinese news

- Sell products from popular categories that Chinese consumers might search for

- Consider eCommerce marketplaces that welcome foreigners like TMall and Pinduoduo

- Offer community discounts or rewards for inviting friends to generate buzz

- Partner with KOLs and virtual influencers

Showing you care enough to accommodate your Chinese audience’s needs and fit into their lives is the way to earn their trust. Word spreads fast after that initial hurdle.

2. Position yourself in places where your target audience spends their time online

To use your marketing budget wisely, you need to know what works locally.

Typically, what works in China doesn’t overlap with Western standards.

Metaverse is one of the only exceptions.

The Metaverse Spend Value in China is expected to reach $457,241.9 million by 2030 with an annual growth rate of 35.8%.

Alibaba, ByteDance, Tencent, and other giant companies are already investing in the space and working on their immersive experience offerings for customers.

In most other cases, your international strategy wouldn’t yield positive results in China.

Using TikTok to increase your reach is a good example of what not to do in China because the platform doesn’t exist there.

On the other hand, modifying your approach to focus on avenues popular in China gives you access to an already engaged audience. These avenues may be:

- China’s version of a globally popular platform, like Douyin (the local and original TikTok)

- Exclusive to China, or not as popular elsewhere, like Weibo

- Geared towards a specific audience, like Bilibili (a streaming platform popular with China’s Generation Z)

For best results, remember to tailor the approach to your target audience, not just any Chinese consumer.

3. Make the logistics smooth and convenient

Smooth logistics extend from having a fast and functional website and user interface to offering payment options that Chinese people expect.

Focus on removing traction. Identify any moment in the buyer journey that could make a person drop out of your sales funnel.

Here are some frustrating scenarios you need to prevent:

- Slow-loading website

- Poor navigation so people can’t find what they’re looking for quickly

- Items are frequently out of stock, even worse if the website doesn’t show it

- Lack of expected payment options

- Prices in USD instead of Chinese Yuan

- Complicated or unclear shipping procedure

- Inadequate, unresponsive, or English-only customer support

These mistakes may seem minor, but they’re enough to show your Chinese audience this site isn’t really for them.

4. Unlock Chinese payment methods

The three payment methods that dominate in China are:

- UnionPay – the largest card network in the world with more than 7.5 billion cards issued globally

- AliPay – the most popular online wallet in China which holds over 55% of the market share in mainland China

- WeChat Pay – another popular online wallet with a 38% market share in China

These are the payment methods that your audience in China expects and trusts. Offering at least some of them is essential to a positive customer experience.

You can easily integrate local payments with a payment provider such as KOMOJU.

Get Your Share of The World’s Largest eCommerce Market

Extending your eCommerce business to China prolongs your high sales points from Black Friday to Chinese New Year and gives you access to the biggest online market all year long.

That’s assuming you manage to reach and cater to the audience in ways they expect:

- Have a website version and customer service in their language

- Show up in Chinese news, on their search engines, and on the local social media

- Sell or at least market on their trusted platforms

- Appeal to their interest in quality and status symbols

- Make the logistics a non-issue

Learning about Chinese payment methods and enabling them ensures Chinese people have a smooth experience shopping from your company.

If you’d like help, sign up for KOMOJU to bridge payment gaps and access the global market.

We help businesses accept payments online.